• Ripple secured $500 million in new equity funding, raising its valuation to $40 billion.

• The company’s streak of Wall Street and global partnerships is set to strategically expand Ripple’s reach in institutional finance.

• The fund, past acquisitions, and regulatory growth are set to solidify Ripple’s position in the future of crypto.

Ripple’s $500 million funding round lifts its valuation to $40 billion. The move deepens partnerships with Wall Street and global fintech firms. It also positions Ripple’s ecosystem as a leading force shaping the future of crypto finance.

Ripple’s $500M Funding Lifts Value

Ripple, the digital asset and infrastructure company behind the XRP cryptocurrency, announced today that it has raised $500 million in new funding. The investment increases Ripple’s valuation to $40 billion, up from about $35 billion after its earlier $1 billion tender offer this year.

The round was led by Fortress Investment Group and Citadel Securities, along with Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace. The move marks it among the biggest fintech investments of the year and reflects the growing institutional interest in blockchain infrastructure.

Ripple stated that accepting $500 million in new common equity highlights the strategic importance of working closely with financial partners whose expertise supports the company’s expanding suite of global products. The firm added that it is continuing what it calls a “record year of growth.”

The new partnerships deepen Ripple’s ecosystem in several ways. Fortress brings experience in digital asset custody that aligns with Ripple’s institutional storage systems. Citadel Securities’ strength in global liquidity complements Ripple’s cross-border payments and treasury management solutions. Meanwhile, Galaxy Digital and Pantera Capital provide crypto market expertise that strengthens Ripple’s push into prime brokerage and stablecoin services.

Expansion Through Acquisitions and Institutional Partnerships

Ripple continues to expand its reach through partnerships and acquisitions in 2025. Among its acquisitions are Rail, a stablecoin infrastructure platform, and GTreasury, an enterprise treasury management company that handles trillions in transaction volume.

Ripple also purchased Hidden Road, now operating as Ripple Prime, a trading and collateral platform that uses Ripple’s RLUSD stablecoin as collateral and processes over 60 million transactions daily. Each of these moves shows Ripple’s strategy of combining the efficiency of traditional finance with blockchain technology.

Building a Regulated Global Network

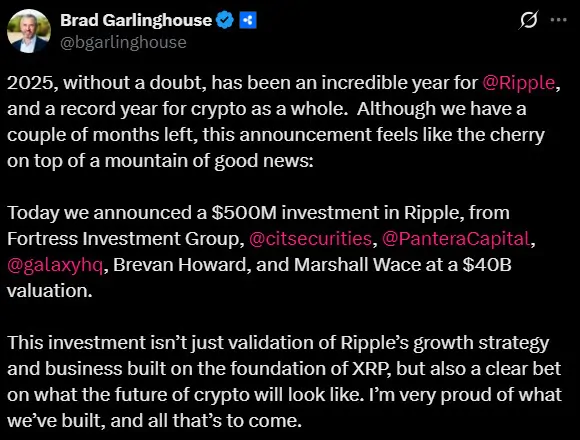

Ripple CEO Brad Garlinghouse commented on X that the funding reflects Ripple’s continued evolution. “This investment isn’t just validation of Ripple’s growth strategy and business built on the foundation of XRP, but also a clear bet on what the future of crypto will look like. I’m very proud of what we’ve built, and all that’s to come”, he said.

Beyond the US, the company is expanding a regulated global network by aligning with federally supervised American financial firms and working with global innovation hubs.

This direction is supported by the firm’s partnerships with Bahrain Fintech Bay, a hub that promotes financial innovation within Bahrain’s regulatory system, and by its license from the Dubai Financial Services Authority (DFSA).

Together with the GENIUS Act’s national stablecoin framework, these developments highlight Ripple’s growing advantage in a market that is increasingly open to blockchain adoption. Even with ongoing volatility in the crypto industry, Ripple’s strong balance sheet, widening partnerships, and focus on regulation show its determination to serve as a bridge between traditional finance and digital assets.