- • Deepcoin is a centralized exchange founded in 2018 with over 10 million users worldwide.

- • Offers both spot and futures trading, with leverage up to 125x and unique indicator order types.

- • Trading fees are flat at 0.1% for spot and 0.02%/0.06% for futures, with no tiered discounts.

- • Supports on-chain crypto deposits and withdrawals only, but allows crypto purchases via multiple fiat options.

- • Security includes cold storage, 2FA, multi-signature wallets, and COBO custody, though no Proof of Reserves is provided.

- • Customer support is available via live chat, email, and Telegram, though user reviews are mixed.

Picking the right exchange can feel overwhelming, especially when every platform promises something different. For some, the deciding factor is how strict the KYC process is. Others care more about fees, trading platforms, or whether there are extra products and services that add value. And then there’s the question of customer support, which can make or break the experience when things go wrong. This Deepcoin review walks through all of those points, giving you a clear sense of what the exchange offers so you can decide if it fits your style of trading.

| Stats | Deepcoin |

|---|---|

| 🚀 Founded | 2018 |

| 🌐 Headquarters | Singapore |

| 🔎 Founder | Ego Huang |

| 👤 Active Users | 2M+ |

| 🪙 Spot Cryptos | 341+ |

| 🪙 Futures Contracts | 401+ |

| 🔁 Spot Fees (maker/taker) | 0.1% / 0.1% |

| 🔁 Futures Fees (maker/taker) | 0.04% / 0.06% |

| 📈 Max Leverage | 125x |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.1 / 5 |

Deepcoin Overview

Deepcoin is a centralized exchange launched in 2018 by Ego Huang, serving more than 10 million users across 30+ supported countries. Headquartered in Singapore, the platform has steadily positioned itself as a global player by focusing on product innovation and compliance. Its stated mission is to deliver secure and optimized trading solutions, while the vision centers on making digital asset trading more efficient and accessible worldwide.

The exchange offers both spot and derivatives markets, with a daily spot trading volume of around $762 million. Traders can access over 341+ cryptocurrencies for spot and 401+ contracts for futures, with leverage reaching up to 125x. Spot fees are fixed at 0.10% maker and taker, while futures trading comes in slightly lower at 0.040% maker and 0.060% taker.

Deepcoin requires KYC verification, with withdrawal limits of up to 10 BTC per day for users who complete advanced verification. Fiat deposits are supported in multiple currencies, including USD, AED, and ARS, through cards, bank transfers, or crypto.

On the service side, Deepcoin provides features like copy trading, bot trading, demo accounts, and staking options. Customer support is available 24/7 via live chat and email, though user ratings suggest room for improvement.

Overall, Deepcoin sits in a competitive space, appealing to traders who value high leverage and diverse contracts, but also raising questions about liquidity depth, restrictions in certain regions, and long-term safety.

Deepcoin Pros and Cons

| 👍 Deepcoin Pros | 👎 Deepcoin Cons |

|---|---|

| ✅ 341+ spot pairs and 401+ futures contracts | ❌ No proof of reserves |

| ✅ Unique indicator and combo indicator orders | ❌ Liquidity can be thin |

| ✅ API, copy trading, bots, demo, and convert | ❌ No discounts for high-volume traders |

| ✅ Mobile support | |

| ✅ Mobile app on iOS and Android |

Deepcoin KYC and Sign-up

Signing up on Deepcoin is straightforward. You’ll need a valid email address and a strong password to get started. Since KYC is compulsory on this exchange, you must complete the advanced identity verification process to unlock full access to Deepcoin’s products and services. This step is also necessary if you want to benefit from the higher daily deposit and withdrawal limit of up to 10 BTC.

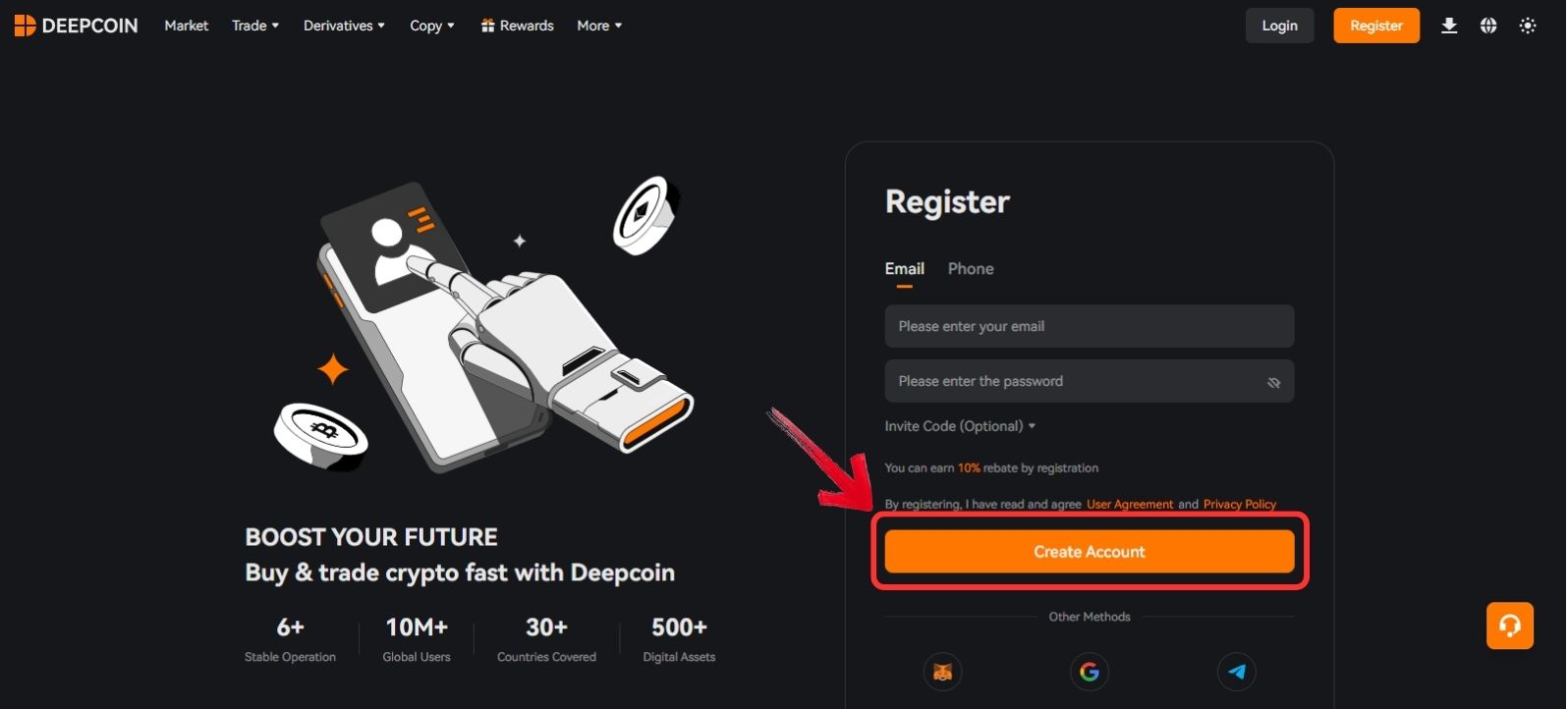

Step 1: Open your browser, go to the official Deepcoin website, and click on the “Register” button at the top of the page.

Step 2: Provide your email address and set a strong password for your new account, then select “Create Account”. If you prefer, you can also sign up using your phone number.

Step 3: Check your inbox for the 4-digit verification code sent by Deepcoin and enter it to confirm your email address.

Before signing up, it’s important to confirm whether Deepcoin is available in your region. Because the exchange complies with AML and CFT regulations that follow FATF recommendations, its services are restricted in certain countries. To avoid issues later, you can use our Deepcoin Country Checker to verify accessibility in your location before creating an account.

🌍 Free Deepcoin Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Deepcoin does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Deepcoin country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Deepcoin Trading

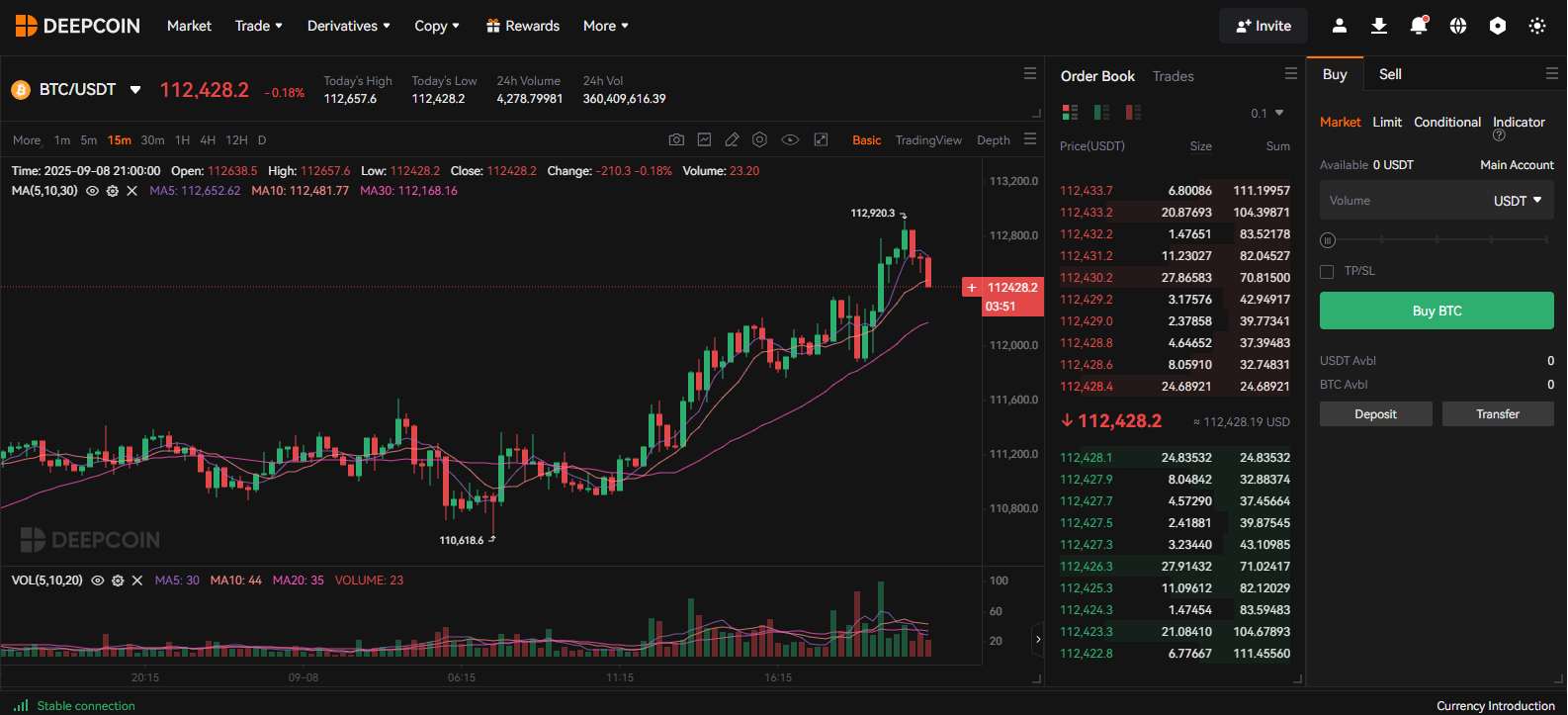

When it comes to any exchange, the real test is the trading platform itself. Deepcoin gives users access to both Spot and Futures markets, each designed with flexibility in mind. The interface allows you to drag and drop panels into your preferred layout, and you can toggle between the basic in-house chart or switch with a single click to the integrated TradingView chart. This integration unlocks advanced charting tools and indicators that many traders rely on.

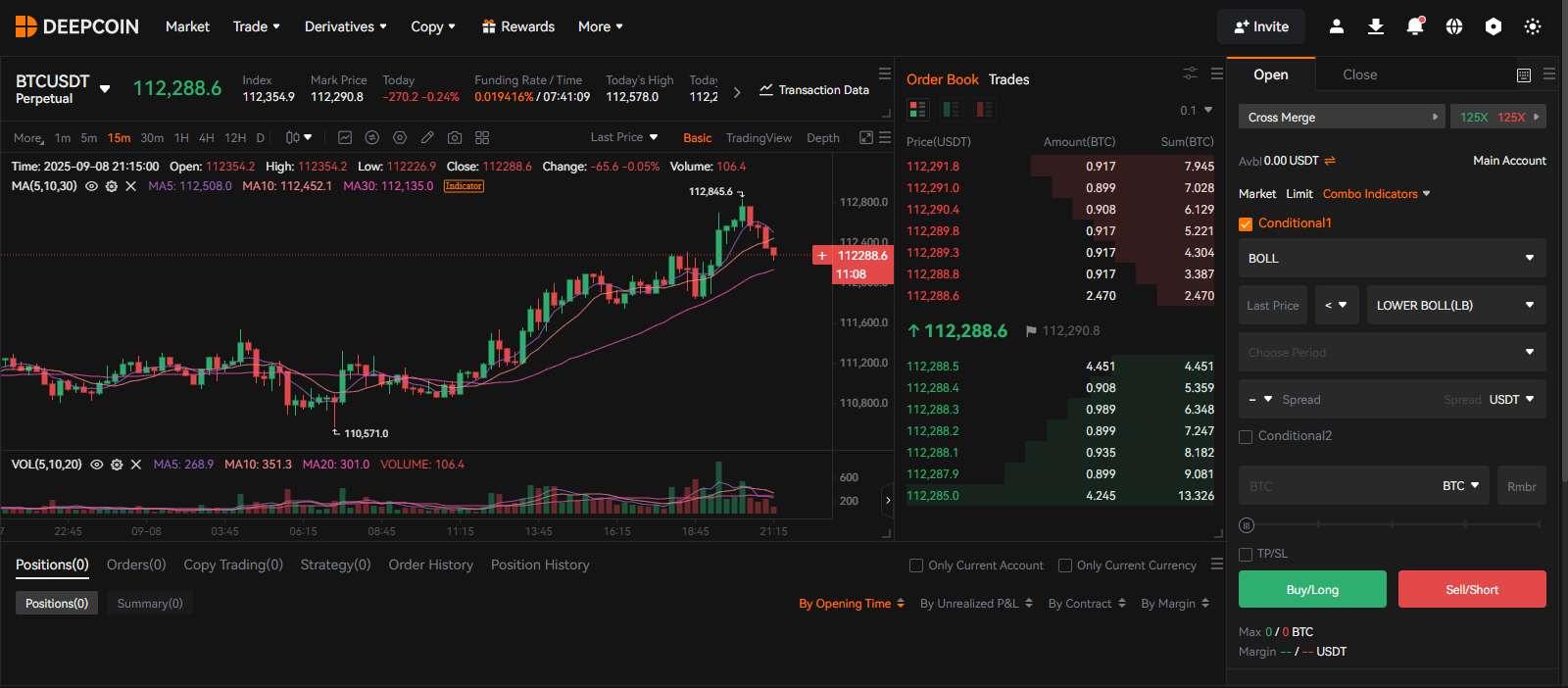

On the order side, Deepcoin goes beyond the standard market, limit, and conditional orders. It introduces Indicator Orders, which let you automate entries or exits based on popular indicators like BOLL (Bollinger Bands) and MA (Moving Average). For spot trading, only one indicator order can be used alongside the basic order types. Futures trading, however, expands the toolkit by adding more conditional options and even Combo Indicator Orders. This allows traders to combine strategies, such as pairing MA with RSI, for direct execution without having to set up manual alerts, a feature particularly useful for swing traders, day traders, and those managing larger positions.

That said, there’s one drawback worth noting: liquidity can feel thin at times, and the order book isn’t always as deep as what you’d find on top-tier exchanges. For active traders, this could affect execution during high volatility.

Spot Trading

Deepcoin’s spot market gives access to over 341+ trading pairs, covering a wide range of cryptocurrencies. Trading fees are set at 0.1% for both makers and takers, which keeps them at the lower end of the industry average. The interface is smooth and intuitive, making it suitable for both beginners exploring their first trades and advanced users managing larger portfolios. For high-frequency traders, Deepcoin also supports API trading, allowing for automated strategies and faster execution.

Derivatives Trading

On the derivatives side, Deepcoin offers more than 401+ USDT-margined perpetual contracts, along with 7+ inverse perpetuals for those who prefer trading against other assets. Leverage goes up to 125x, giving traders flexibility to scale positions according to risk appetite. The futures interface also puts key metrics, such as funding rates, 24h highs and lows, and trading volume, right at the top of the chart. This setup ensures that critical market data is always visible while executing trades, a feature many professional traders value.

Deepcoin Deposits and Withdrawals Methods

Deepcoin does not support fiat deposits or withdrawals. Instead, all funding is handled through on-chain crypto transactions. The exchange supports a wide range of major blockchain networks, including Ethereum, the Bitcoin Lightning Network, Solana, and more, giving users flexibility when moving funds in and out of the platform.

Deepcoin Fees

Deepcoin keeps its pricing simple with a flat fee model and no tiered discounts based on trading volume.

Trading Fees

For spot trading, the fee is fixed at 0.1% maker and 0.1% taker. Futures trading comes in lower, with 0.02% maker and 0.06% taker fees. Unlike many exchanges, Deepcoin does not offer volume-based discounts or token-based reductions, keeping the structure straightforward but less flexible for very high-volume traders.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.02% Maker

0.06% Taker

Deposits and Withdrawals Fees

Deposits and withdrawals on Deepcoin incur only the standard blockchain network fees, with no extra charges from the exchange itself. The actual cost depends on the network chosen, whether it’s Ethereum, Solana, Bitcoin Lightning, or others.

Deepcoin Products and Services

Deepcoin keeps its product range limited, mainly targeting active traders interested in spot, derivatives, and basic automated strategies.

Deepcoin Trading

Deepcoin supports both spot and futures trading, giving users flexibility in how they approach the markets. The platform also provides API trading, which appeals to high-frequency traders looking for faster execution and automated strategies.

The interface itself is smooth and customizable, but one of its standout features is the Indicator Order type. With this, users can automate trades based on technical signals such as moving averages or Bollinger Bands, making it easier to follow strategies without manual alerts.

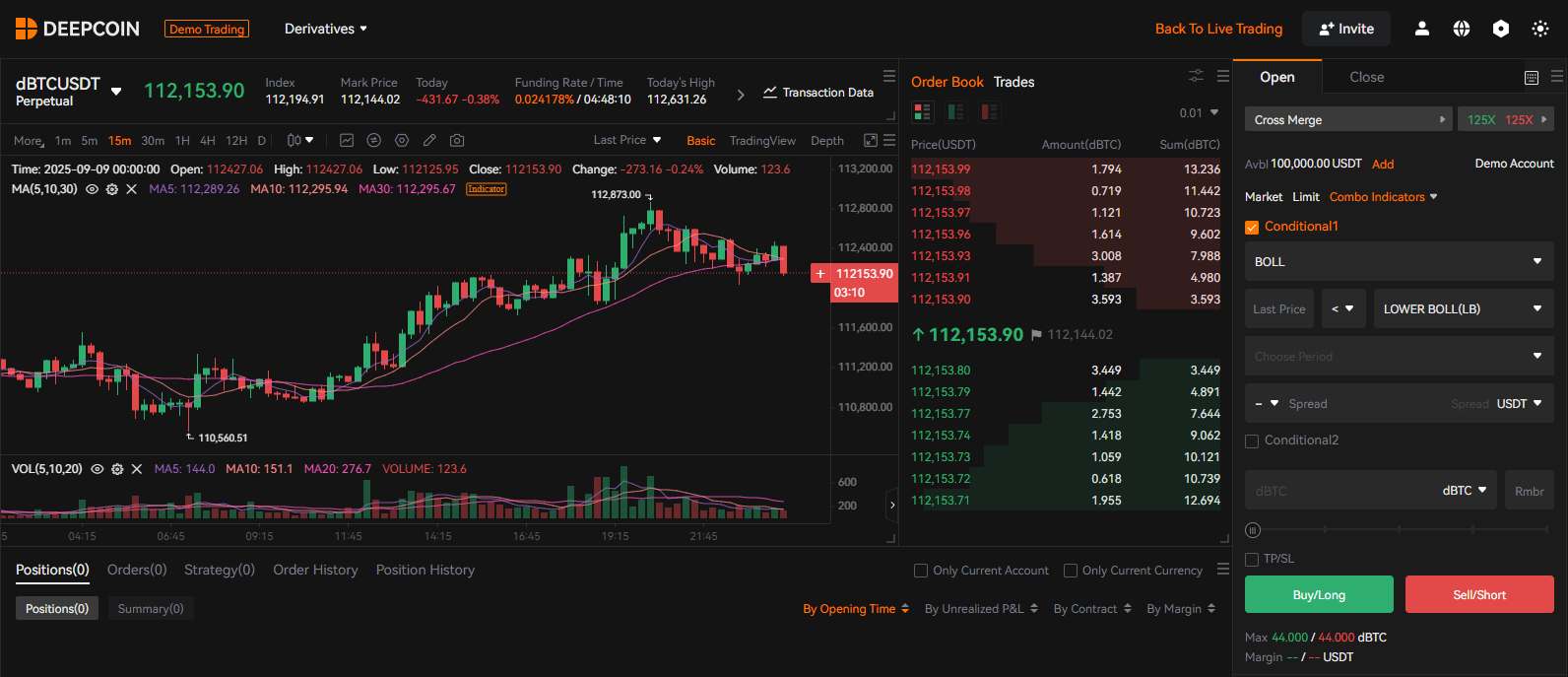

Spot markets offer over 341+ pairs, while the derivatives side includes 401+ contracts with leverage up to 125x. For those not ready to commit real funds, Deepcoin also offers a demo trading account, preloaded with a 100,000 USDT trial balance. This allows beginners to practice derivatives trading and test strategies in a risk-free environment, while advanced traders can fine-tune systems before deploying them live.

Mobile App

Deepcoin’s mobile app is available for both iOS and Android devices. It carries nearly all the features of the desktop platform, including spot, futures, copy trading, and access to indicator orders. The layout is designed for quick navigation, ensuring traders can manage positions and check charts on the go. User ratings average around 4.1, reflecting a solid experience but also leaving room for improvement, particularly in terms of performance and occasional connection delays during high-volume trading hours.

Copy Trading

Deepcoin includes copy trading for spot, futures, and strategy-based trades. The system is easy to use, letting beginners follow experienced traders without needing deep market knowledge. Profits are shared, but the profit share fee is capped at 15%, making it fairly competitive. Fees for copy trading are the same as standard trading fees, so there are no additional charges. One limitation, however, is that the pool of top-performing traders is relatively small compared to leading copy-trading platforms.

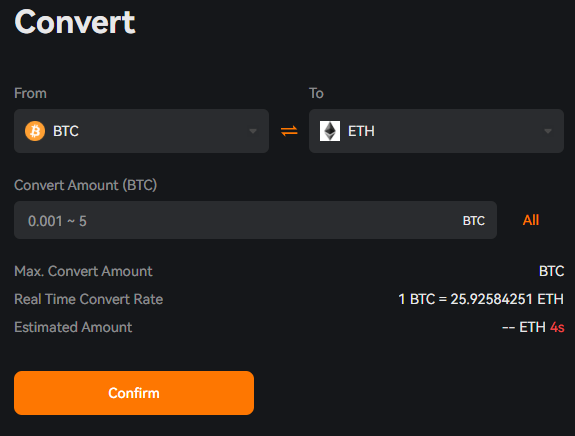

Convert

For quick swaps, Deepcoin offers an instant convert feature. This tool lets users exchange one cryptocurrency for another or convert crypto directly into supported fiat currencies without going through the trading interface. It’s designed for speed and simplicity, making it useful when you want to move funds quickly or avoid slippage. The convert function doesn’t require advanced trading knowledge, so even beginners can use it confidently to rebalance portfolios or cash out into stable assets instantly.

Affiliate Program

Deepcoin runs a structured VIP Affiliate Program, giving partners up to 30% commission on referred trading activity. Affiliates benefit from a dedicated account manager, 24/7 support, rising commission rates tied to volume, and access to tailored marketing materials. Applications are reviewed within 24 hours, after which affiliates receive a unique referral link through the affiliate center. With over 800 active affiliates across 20+ countries, the program offers global reach and real-time rebate tracking for transparent earnings.

Deepcoin Security

Deepcoin emphasizes asset protection with industry-standard safeguards, including cold storage, multi-signature wallets, two-factor authentication (2FA), SSL encryption, and email confirmations for withdrawals. Wallet infrastructure is supported by COBO custody, and the platform maintains an insurance fund to offset socialized losses in leveraged trading. Regular third-party audits add an additional layer of oversight.

From a compliance standpoint, Deepcoin is registered as a Money Services Business (MSB) with FinCEN, authorized in Canada, and regulated by the International Financial Commission (IFC). While this highlights efforts toward legitimacy, its regulatory presence remains somewhat complex and fragmented across jurisdictions.

A key limitation is that Deepcoin does not publish Proof of Reserves, which many exchanges now provide to demonstrate solvency and reassure users. Traders Union also gave Deepcoin a high-risk score of 2.13/10, citing mixed user feedback. Although the exchange has never suffered a hack, this combination may raise concerns for cautious investors.

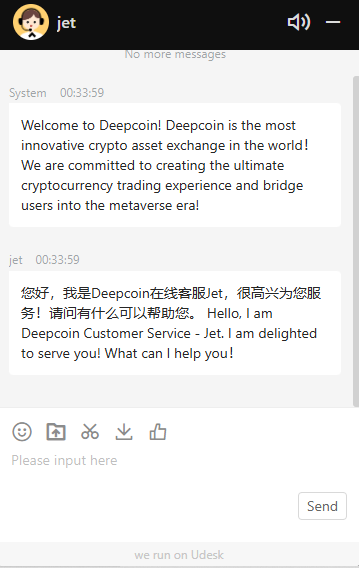

Deepcoin Customer Support

Deepcoin provides a Help Center with detailed user guides and FAQs, covering most of the basics around account setup, trading, and security. For more direct assistance, the platform offers online live chat support, where users can connect with real customer service representatives instead of automated bots. Response times can vary, but the availability of human support is a strong plus.

Beyond official channels, Deepcoin also maintains an active Telegram community, where traders can discuss market updates, share experiences, and get informal guidance. Overall, support options are accessible, though feedback on consistency remains mixed.

Deepcoin Alternative

Deepcoin is a decent choice with high leverage, but if you’re looking for alternatives, consider these:

- Bitunix: User-friendly no-KYC exchange with a good selection of altcoins and high leverage.

- BloFin: Another solid no-KYC option with a wide range of cryptocurrencies and competitive fees.

- Phemex: Known for its focus on futures trading and offers high leverage and a variety of trading tools.

| Feature | Deepcoin | Bitunix | BloFin | Phemex |

|---|---|---|---|---|

| Established | 2018 | 2022 | 2019 | 2019 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.060% | 0.020% / 0.060% | 0.020% / 0.060% | 0.010% / 0.060% |

| Max Leverage | 125x | 125x | 150x | 100x |

| KYC Required | Yes | No | No | No |

| Supported Cryptos (Spot) | 341+ | 541+ | 564+ | 536+ |

| Futures Contracts | 401+ | 400+ | 440+ | 440+ |

| No KYC Withdrawal Limit | None | $500,000 | $20,000 | $50,000 |

| 24h Futures Volume | $18.01B+ | $5.15B+ | $1.41B+ | $1.39B+ |

| Trading Bonus | None | $5,500 | $5,000 | $8,800 |

| Key Features | • High leverage (125x) • Multiple FIAT options • Indicator Order type |

• Very user-friendly • No KYC required • Multiple fiat options |

• High leverage (150x) • No KYC required • Large futures selection |

• Copy trading available • Grid/martingale bots • Low maker fees |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Deepcoin sits in an interesting spot within the exchange landscape. It offers smooth trading, advanced features like indicator orders, and leverage up to 125x, yet its liquidity and lack of Proof of Reserves may give some traders pause. Fees are simple and competitive, but without tiered discounts, heavy traders won’t find extra incentives. Security is solid on paper, though user reviews are divided.

If you’re weighing your options, think about what matters most; low fees, advanced tools, regulatory clarity, or customer support, before deciding whether Deepcoin aligns with your style and priorities.

FAQs

1. Is Deepcoin Safe?

Deepcoin uses standard security measures such as 2FA, cold storage, SSL encryption, and multi-signature wallets. The platform has never been hacked, and it also relies on COBO custody plus an insurance fund for leveraged trading losses.

2. Can you Buy Crypto on Deepcoin?

Yes, users can purchase Bitcoin and other cryptocurrencies with fiat payment methods such as credit/debit cards and bank transfers. Additionally, Deepcoin has a convert feature for instant swaps between assets.

3. Can you deposit fiat on Deepcoin?

Direct fiat deposits and withdrawals are not supported. Deepcoin only supports on-chain crypto deposits and withdrawals. Fiat payments are available only when purchasing crypto through third-party providers.

4. Is Deepcoin Registered and Licensed?

Deepcoin is registered as an MSB with FinCEN in the U.S. and holds FINTRAC certification in Canada. It also lists regulation by the International Financial Commission (IFC). However, its regulatory footprint is fragmented and less transparent compared to top-tier exchanges.

5. Can U.S. residents use Deepcoin?

No. Deepcoin restricts users in the United States along with several other regions (including Hong Kong, Cuba, Iran, North Korea, Syria, and Malaysia). The FAQ you shared incorrectly states otherwise.

6. What is the Maximum leverage on Deepcoin?

Deepcoin offers leverage up to 125x on derivatives, with more than 400 perpetual and inverse contracts. This is among the higher ranges available in centralized exchanges.