- CoinCatch allows trading without KYC, with daily withdrawal limits up to 50,000 USDT.

- Offers 240+ USDT-margined futures contracts with leverage up to 200x.

- Spot trading fees are low and flat at 0.10% for both maker and taker.

- Interface is clean, beginner-friendly, and powered by TradingView.

- Copy trading is available but still lacks high-quality, consistent traders.

- P2P feature exists but has limited merchant activity and low liquidity.

- No fiat deposits or withdrawals, crypto-only for all transfers.

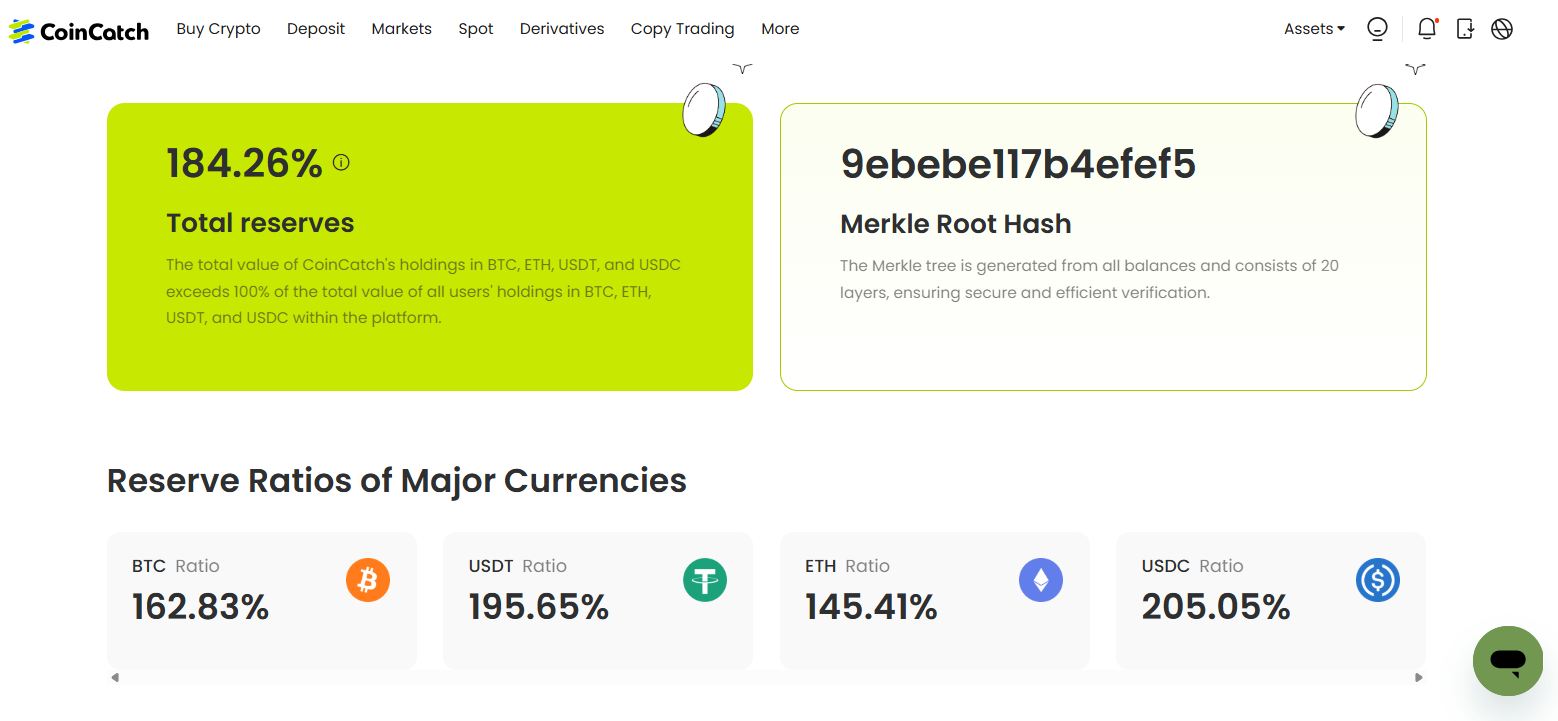

- Security features include 2FA, anti-phishing codes, fund password, and proof of reserves.

- One of the few Non-KYC exchanges available for U.S. based crypto users.

- Supports 279+ assets on spot, catering well to altcoin-focused traders.

Every now and then, you might run into issues with your current exchange. It could be high fees, limited availability in your country, or simply a lack of convenience. When that happens, moving your assets to a different crypto platform becomes a practical option. But with so many exchanges available, finding the right fit isn’t always straightforward. CoinCatch, a relatively new name now listed on CoinMarketCap and CoinGecko, is one of the platforms gaining quiet attention, and worth a closer look.

In this CoinCatch Exchange Review, we’ll take a closer look to help you decide whether it offers the tools, features, and flexibility you’re looking for in a crypto exchange.

| Stats | CoinCatch |

|---|---|

| 🚀 Founded | 2022 |

| 🌐 Headquarters | British Virgin Islands |

| 🔎 Founder | Iris A. |

| 👤 Active Users | 1M+ |

| 🪙 Spot Cryptos | 279+ |

| 🪙 Futures Contracts | 242+ |

| 🔁 Spot Fees (maker/taker) | 0.10%/0.10% |

| 🔁 Futures Fees (maker/taker) | 0.02%/0.06% |

| 📈 Max Leverage | 200X |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.4/5 |

| 💰 Bonus | $5,125 (Claim Now) |

CoinCatch Overview

CoinCatch is a relatively new player in the crypto exchange space, launched in October 2022 and registered in the British Virgin Islands. It’s now listed on platforms like CoinMarketCap and CoinGecko, and while still building its reputation, it’s started to draw attention, particularly from traders looking for low-friction access to crypto markets.

The platform offers both spot and derivatives trading, but most of its activity leans toward futures. Daily futures volume reportedly crosses $20B+, while spot trading volume remains more modest at around $49M+. So if you’re someone who primarily trades futures, CoinCatch might feel more aligned with your needs.

On the features front, you’ll find the basics: a web trading platform, mobile app, copy trading, P2P options, and some automated tools like grid bots and auto-invest. Nothing groundbreaking, but enough to get started or manage ongoing strategies.

One thing that does stand out is its no-KYC policy, allowing withdrawals of up to $50,000 per day without requiring ID verification. That’s higher than most no-KYC exchanges, which tend to cap much lower. If you do decide to verify, your limits increase significantly.

CoinCatch also markets itself as a social trading-friendly platform, aiming to let KOLs (key opinion leaders) share strategies directly with followers. While that direction is still developing, it does show an interest in building community-led features down the line.

In short, CoinCatch is still in its early stages, but if you’re looking for a no-KYC platform focused on futures with just enough tools to get by, it’s worth keeping on your radar, especially since it’s available in the United States without the need for a KYC. That alone puts it in a small group of platforms still offering accessible trading options to U.S.-based users.

CoinCatch Pros and Cons

| 👍 Coincatch Pros | 👎 Coincatch Cons |

|---|---|

| ✅ Fast and reliable trading execution | ❌ No fiat deposits or card payments |

| ✅ Simple, user-friendly mobile and web platform | ❌ Flat fee structure (0.25%) not ideal for high-volume traders |

| ✅ 200x leverage on futures, 180+ contracts | ❌ Copy trading still lacks top-tier trader variety |

| ✅ Available in the U.S. with no KYC | |

| ✅ Proof of reserves with excess backing for major assets |

CoinCatch KYC and Sign-up

Getting started on CoinCatch is quick and uncomplicated. You don’t need to go through identity checks or upload documents, just register with your email, set a password, and you’re in. The platform doesn’t ask for KYC by default, so you can deposit crypto, place trades, and even withdraw funds right after signing up.

That said, the exchange does have tiered limits. Without KYC, you can withdraw up to 50,000 USDT daily, which is relatively high compared to most no-KYC platforms. If you’re looking to move larger sums or access certain features, you’ll need to complete verification, which involves submitting standard personal documents like ID and proof of address.

For most users, though, the default access is enough to get going without friction. The process is smooth, fast, and doesn’t force you to give up privacy unless you choose to.

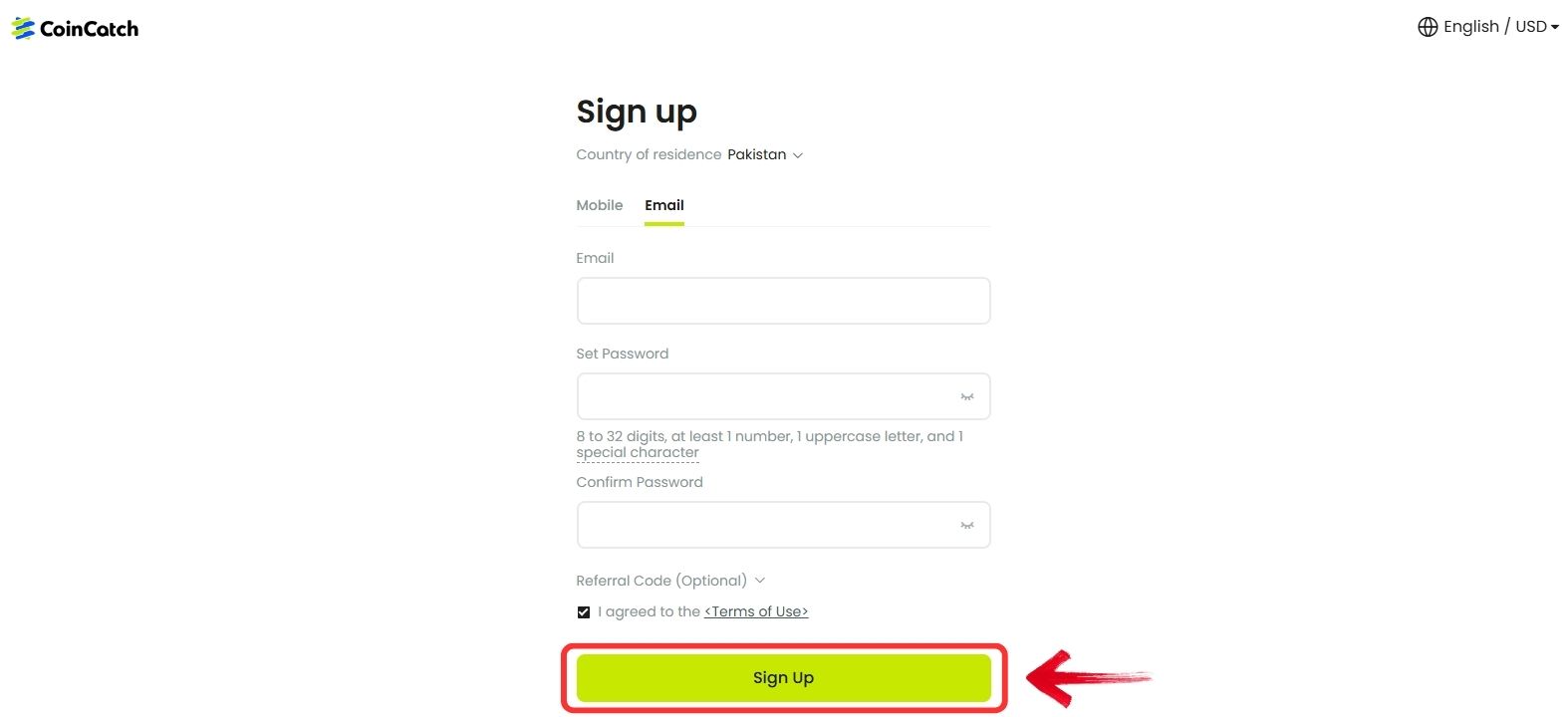

Step 1: You will need your browser if you’re using your PC for this, and navigate to the CoinCatch official website.

Step 2: On the CoinCatch homepage, click on the “Sign Up” button to create a new account.

Step 3: On the sign-up page, simply enter your email credentials and click on the “Sign Up” button.

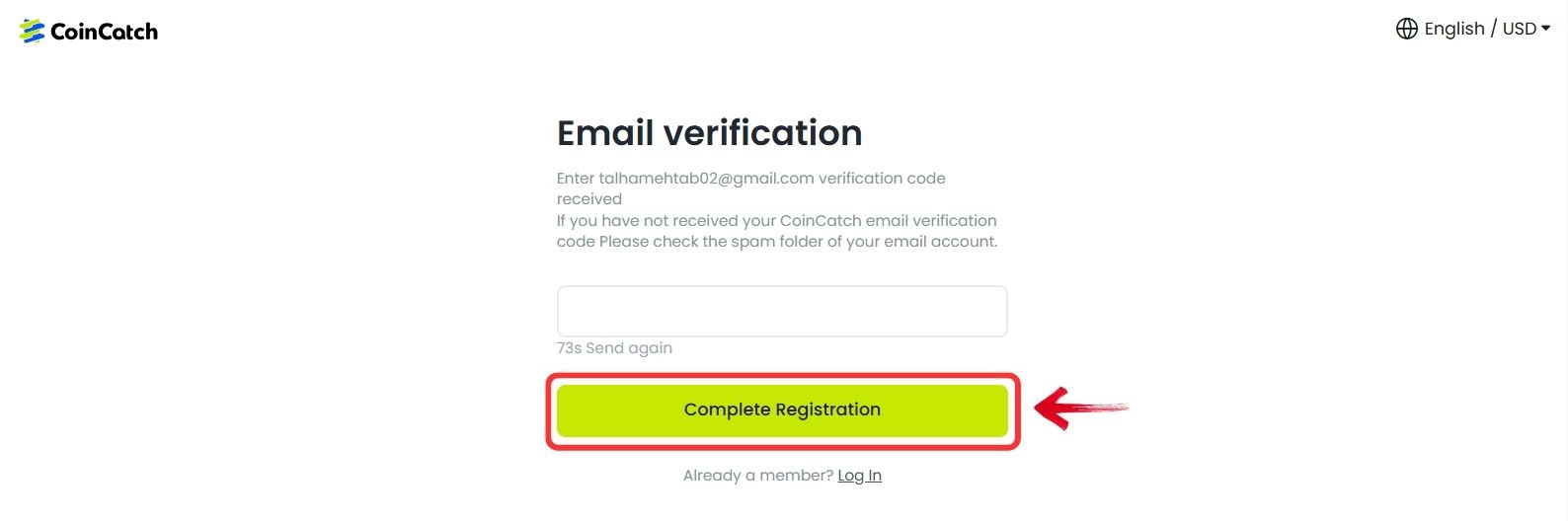

Step 4: Your account has been created, but in order to use it, you’ll need to verify your email. Simply paste the code you received from CoinCatch in your email and click on “Complete Registration”.

You can now start your trading journey on CoinCatch. But before proceeding, be aware that not all regions are eligible. So before signing up, make sure CoinCatch’s services are available in your region using our Country Checker tool, which will also suggest alternatives if your country is not supported.

🌍 Free CoinCatch Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, CoinCatch does not support every country. To ensure that you are eligible to register on the exchange, you can use our free CoinCatch country checker.

Simply type your country and see if you can use the platform or if your country is restricted.

CoinCatch Trading

Trading is the core function of any crypto exchange, but just having a trading feature isn’t enough. There are multiple layers that define how good (or limiting) that experience really is. We’re talking about trading fees, the number of listed assets, available volume (which often hints at liquidity and volatility), supported order types, and of course, the platform interface itself. So, let’s take a closer look at CoinCatch’s trading setup and break down what it really offers, starting with spot, then moving to derivatives.

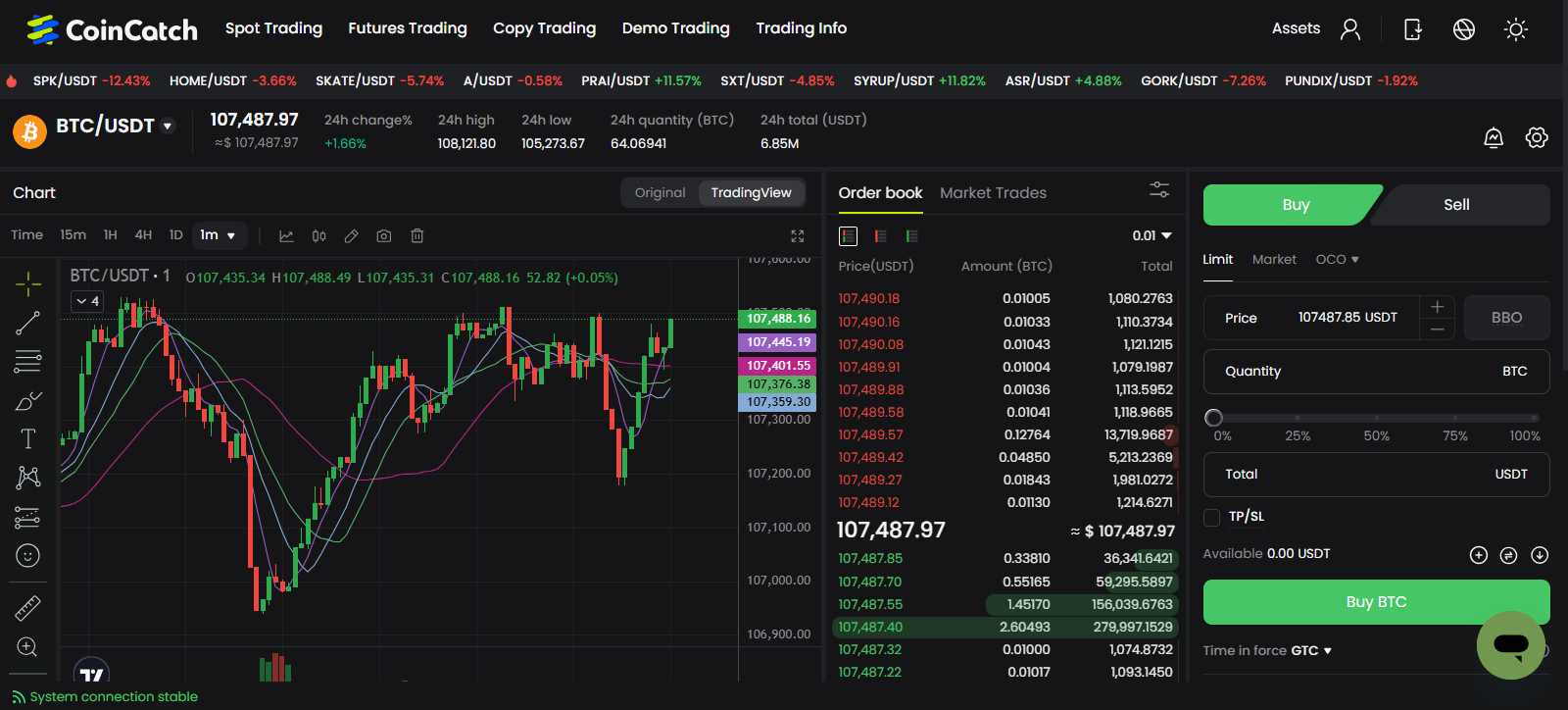

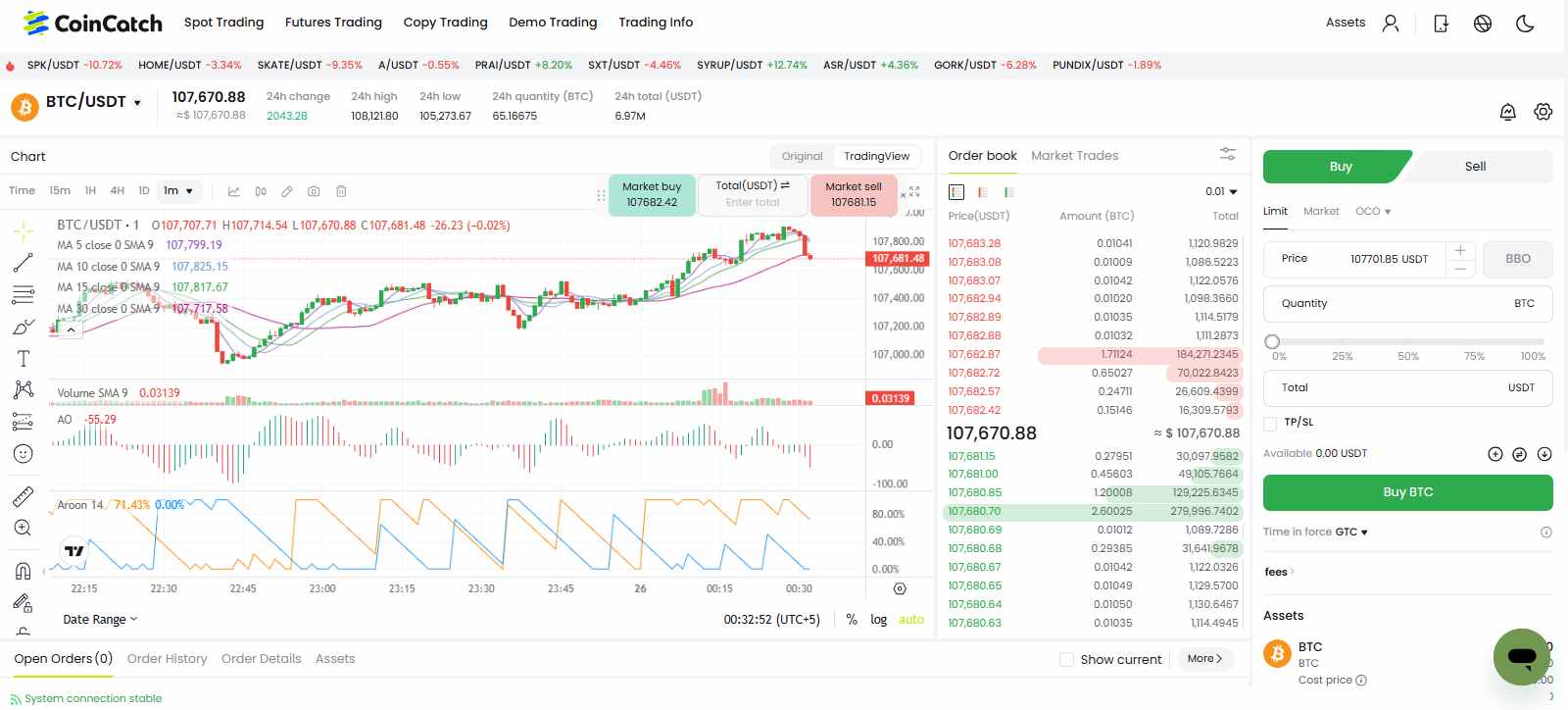

Spot Trading

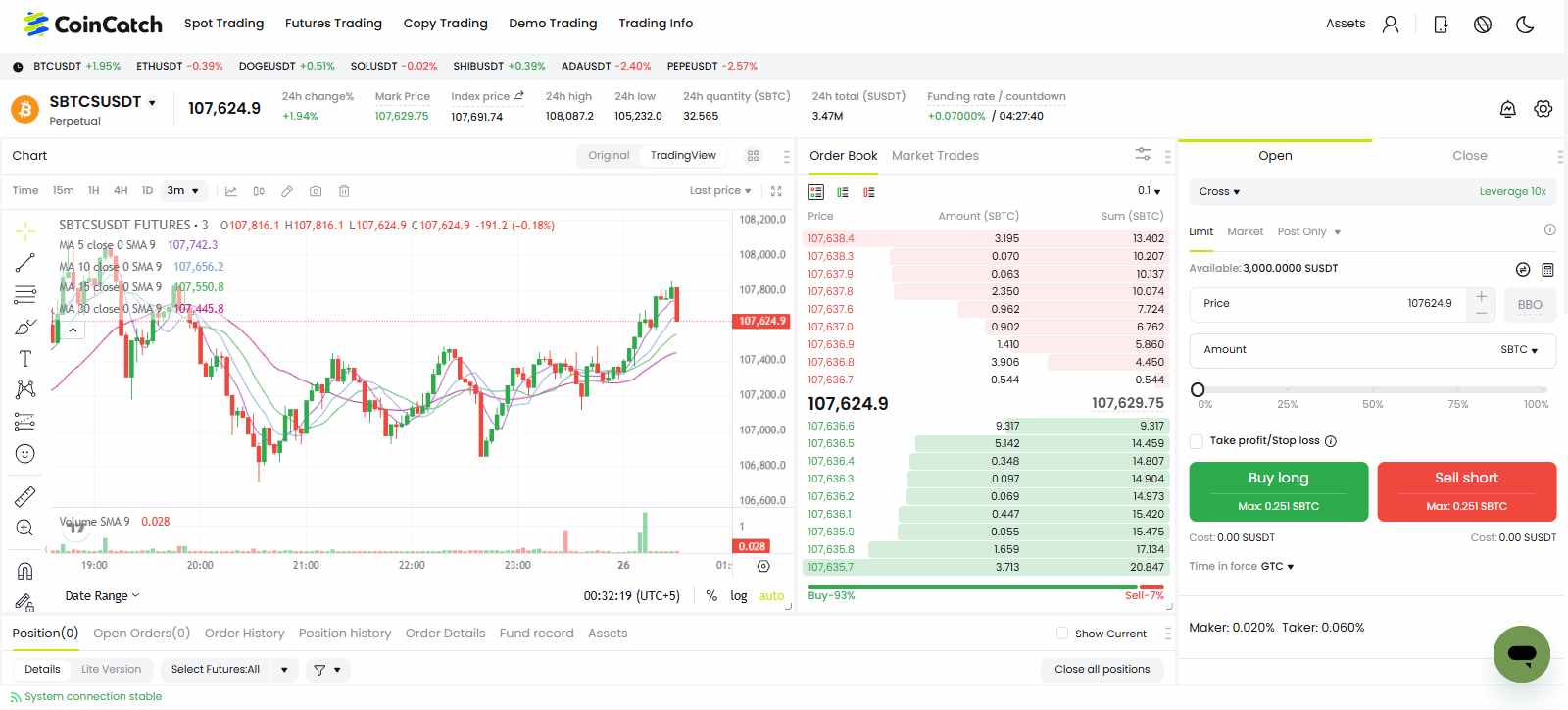

CoinCatch offers a clean, user-friendly spot trading interface, similar to what you’d find on larger, well-established exchanges. Integrated TradingView charts bring full-spectrum charting tools, indicators, and strategy execution right into the platform. You’ll also find a real-time order book and market trades feed, helping you stay on top of liquidity and momentum.

The platform supports over 279 assets, spanning major coins and a healthy selection of altcoins. You get essential order types, market and limit, plus advanced options like OCO, trailing stop, and TP/SL, giving you control over trade execution.

In terms of functionality, the platform supports basic order types like limit and market, along with more advanced options such as OCO (One-Cancels-the-Other), trailing stop, and take profit/stop loss (TP/SL) settings. This range of order types adds flexibility for traders who want more control over their entries and exits.

The fee structure is straightforward, 0.10% for both maker and taker, making it one of the more affordable options in the market. It also avoids the complexity of tiered models, which some users might appreciate. With a reported user base of over 1 million and a daily spot volume of around $49 million, CoinCatch offers a decent level of liquidity for everyday trading needs.

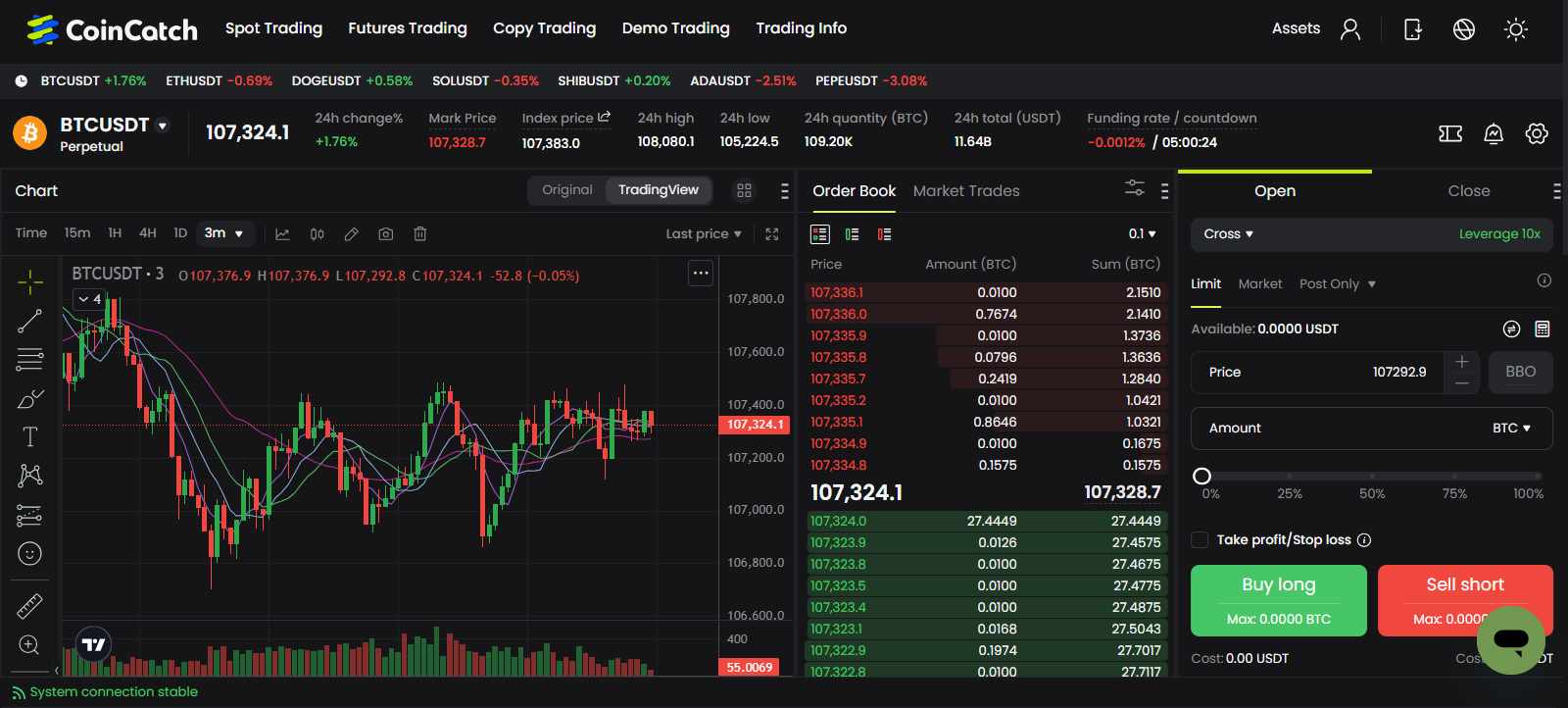

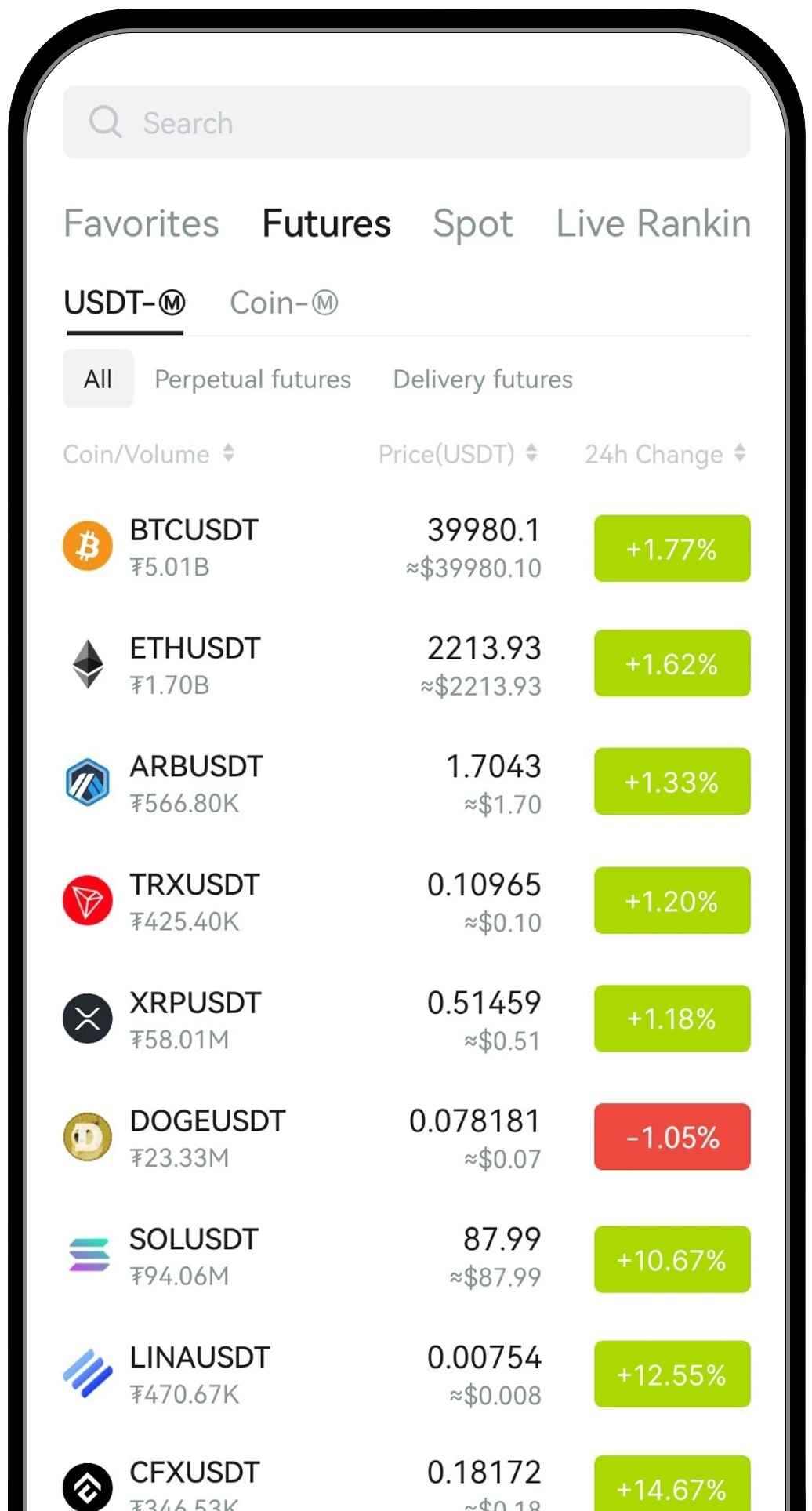

Futures Trading

CoinCatch’s Futures platform shares the same clean interface as its spot section, making it easy to navigate. It supports USDT-margined perpetual contracts with access to over 240+ trading pairs and leverage up to 200x.

Fees are competitive at 0.02% maker and 0.06% taker, which is fairly standard for futures platforms. Traders also get access to advanced order types like scaled orders, post-only, trigger, and trailing stop, offering more control in fast-moving markets.

CoinCatch Fees

When evaluating a crypto exchange, fees play a central role, not just in trading, but also in how you move assets in and out. So, having a quick look at the platform’s fee structure is essential, as even small charges can directly impact your overall returns. CoinCatch keeps things relatively straightforward, with flat trading fees and clear withdrawal terms. Let’s take a closer look at how its trading fees stack up, and what you’ll be paying when depositing or withdrawing funds.

Trading Fees

Unlike many top exchanges that use tiered pricing or require token holdings to unlock lower fees, CoinCatch keeps things straightforward. Spot trading fees are fixed at 0.10% for both makers and takers, simple, transparent, and among the more competitive rates out there.

For futures trading, fees are set at 0.02% for makers and 0.06% for takers, which aligns with what most derivatives-first platforms offer. No hidden conditions or confusing fee schedules, just flat rates across the board.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.02%% Maker

0.06% Taker

Deposits and Withdrawals

CoinCatch doesn’t offer any fiat on-ramps or off-ramps, meaning you won’t find support for bank transfers, card payments, or direct crypto purchases on the platform. All deposits and withdrawals are handled exclusively through crypto networks.

It supports most major chains, including Ethereum, Bitcoin, and Solana, as well as several Layer 2 and alternative networks like Arbitrum, Avalanche C-Chain, and more. This ensures flexibility for users who already hold crypto, but it also means you’ll need to use another platform if you’re starting with fiat.

CoinCatch Products and Services

CoinCatch offers a focused set of trading features aimed at both individual traders and privacy-focused users, making it a practical option for crypto futures and altcoin access. Here’s a closer look at what the platform provides:

Trading Platform

The core trading interface on CoinCatch is simple and functional, offering a TradingView-powered layout with all the necessary tools, from charting to order management. It delivers a familiar experience for anyone who has used other major exchanges, making it easy to switch over without a learning curve.

Mobile App

CoinCatch’s mobile app mirrors the web platform in both design and features, making trading on the go smooth and responsive. One helpful addition is the integrated AI-powered chat support, which makes it easy to get basic assistance without leaving the app, a small touch that enhances user experience.

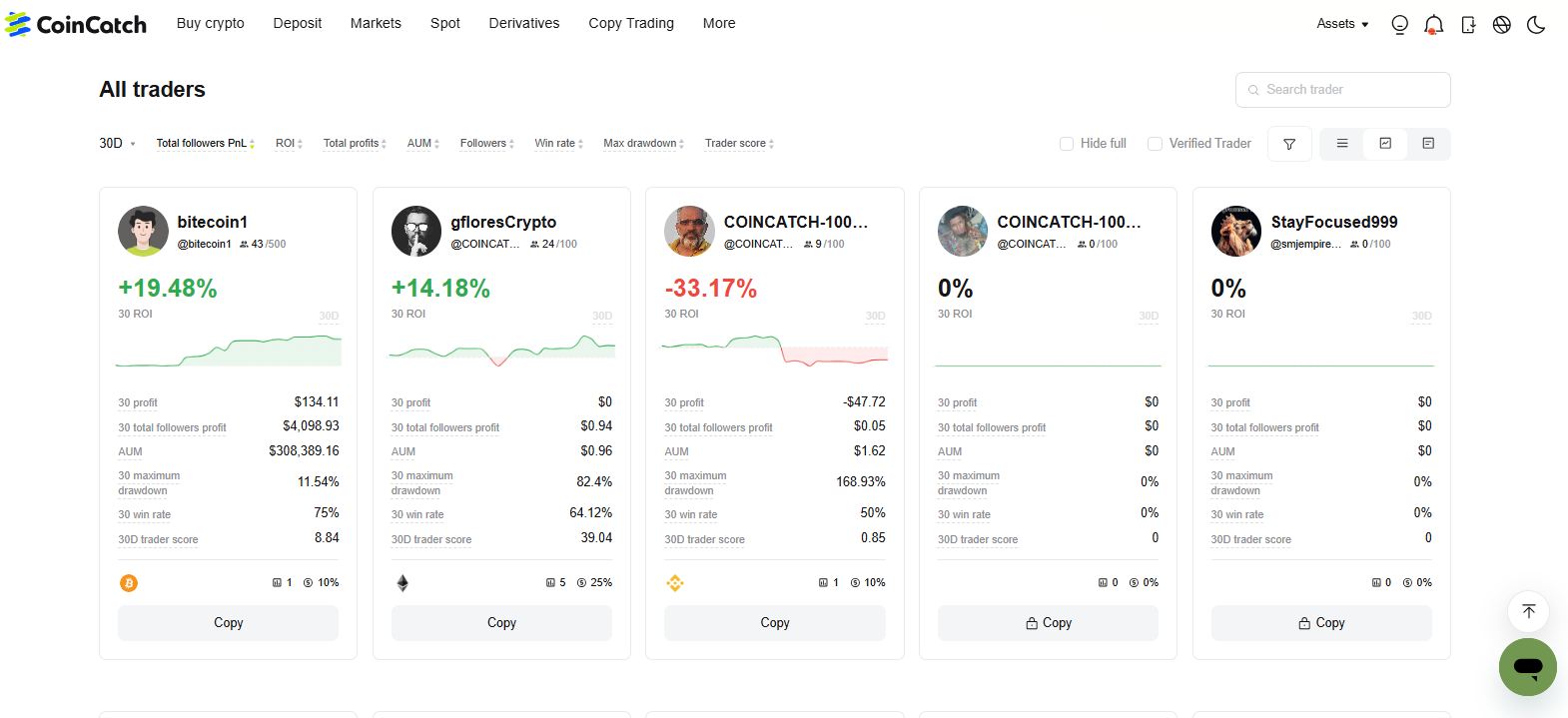

Copy Trading

The platform includes a built-in copy trading feature, allowing users to follow and mirror the strategies of more experienced traders. While the functionality is there, the current pool of signal providers is relatively limited, so users may find it difficult to identify consistently strong performers.

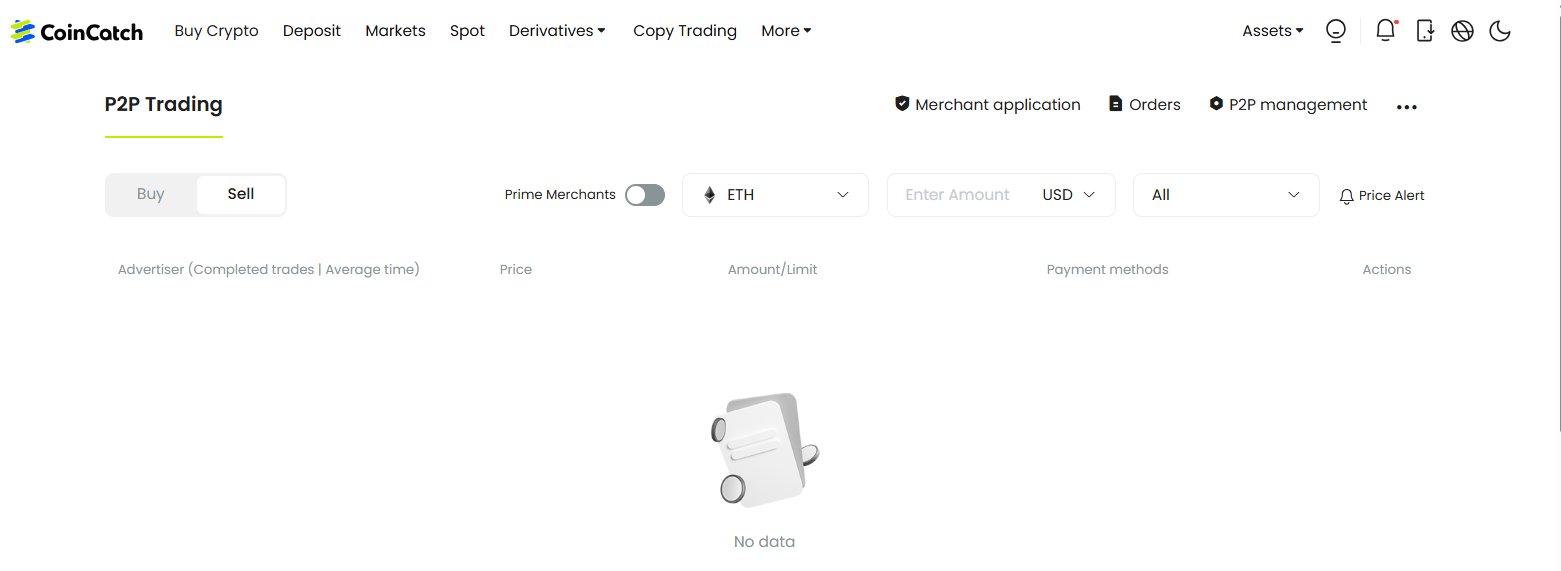

P2P Trading

CoinCatch technically offers P2P trading, but merchant availability is quite limited, especially compared to more established platforms. This makes it harder to find competitive offers or active listings, so the feature feels more underdeveloped than ready for regular use.

Demo Trading

The demo trading mode provides a risk-free environment for users to explore the platform and test out strategies without using real funds. It’s simple, easy to access, and a useful entry point for beginners who want to get familiar with market dynamics before jumping in.

Learn more: How to start demo trading on CoinCatch

CoinCatch Security

CoinCatch combines platform-level and user-level security measures to protect funds and data. On the backend, it uses multi-signature cold wallet storage, manual withdrawal approvals, and real-time monitoring systems to track suspicious activity. The exchange also offers proof of reserves, showing excess backing for major assets like BTC, ETH, USDT, and USDC.

For users, CoinCatch includes several important account-level protections: two-factor authentication (2FA), email confirmation codes for sensitive actions, anti-phishing code setup to detect spoofed emails, and a separate fund password required for withdrawals and trades. These layers make it harder for unauthorized access to succeed, provided users set them up properly.

While CoinCatch hasn’t yet been tested in high-profile attack scenarios, its security stack covers the essentials for a newer exchange.

CoinCatch Customer Service

CoinCatch provides 24/7 customer support through live chat and email, covering the core channels most users rely on. The mobile app also features an integrated AI-powered chatbot, which can help with basic platform queries and navigation without needing to wait for a human agent.

While response times are generally prompt, the depth of support can vary depending on the nature of your issue. For now, the platform handles routine questions and account-related concerns reasonably well, but users looking for in-depth technical help may find the support experience a bit limited.

CoinCatch Alternatives

CoinCatch is a newer exchange with a growing focus on altcoins and derivatives, but it may not be the right fit for everyone. If you’re exploring similar platforms, here are a few alternatives worth considering:

- Bitunix: A no-KYC exchange offering high leverage and a user-friendly interface, with decent altcoin coverage for futures traders.

- Blofin: Another no-KYC platform with support for a wide range of crypto assets, plus the added benefit of fiat deposit options for easier onboarding.

- MEXC: Known for its extensive selection of altcoins and competitive fees, MEXC is a strong option for spot traders looking for market depth and variety.

| Feature | CoinCatch | Bitunix | Blofin | MEXC |

|---|---|---|---|---|

| Established | 2022 | 2022 | 2019 | 2018 |

| Spot Fees (Maker/Taker) | 0.25% / 0.25% | 0.10% / 0.10% | 0.10% / 0.10% | 0.00% / 0.02% |

| Futures Fees (Maker/Taker) | 0.020% / 0.060% | 0.020% / 0.060% | 0.020% / 0.060% | 0.000% / 0.020% |

| Max Leverage | 100x | 125x | 150x | 200x |

| KYC Required | No | No | No | No |

| Supported Cryptos (Spot) | 212+ | 317+ | 394+ | 2,437+ |

| Futures Contracts | 156+ | 218+ | 329+ | 433+ |

| No KYC Withdrawal Limit | $20,000 | $10,000 | $20,000 | 30 BTC |

| 24h Futures Volume | $5.66B | $6.4B | $9.73B | $6.07B |

| Trading Bonus | $100 | $5,500 | $5,000 | $20,000 |

| Key Features | • Grid & Auto Invest bots • No KYC required • Demo trading available |

• Very user-friendly • No KYC required • Multiple fiat options |

• High leverage (150x) • Strong futures volume • Trading bots available |

• Largest coin selection • Zero-fee spot trading • Highest leverage (200x) |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

CoinCatch is still in its early stages, but it’s steadily gaining traction among traders looking for a no-KYC platform with futures support and altcoin variety. While it doesn’t offer groundbreaking innovation, it covers the essentials well, from a clean user interface to transparent fees and a growing list of supported assets.

The exchange is particularly suited for users who value privacy, straightforward trading, and access to high-leverage derivatives. However, limited fiat support, relatively lower liquidity on the spot side, and a still-developing ecosystem may be points to consider for long-term use.

Overall, CoinCatch is a solid option for those seeking a functional, no-KYC trading environment with room to grow.

FAQS

1. Is CoinCatch legit?

CoinCatch is an exchange located in the British Virgin Islands and fully registered in the United States and Canada, making it a legitimate platform for you to buy and sell or trade assets.

2. What are CoinCatch fees?

CoinCatch exchange fees are low and competitive when compared with other exchanges. Spot fees are 0.1% maker/taker, while futures trades attract 0.02% and 0.06% maker/taker.

3. Can you use CoinCatch without KYC?

Yes, CoinCatch allows users to trade and withdraw up to 50,000 USDT per day without completing KYC. Higher limits are available for verified accounts.

4. Does CoinCatch support U.S. users?

Yes, unlike many other exchanges, CoinCatch is accessible in the United States without requiring a VPN or identity verification.

5. Is CoinCatch safe to use?

CoinCatch follows standard security practices like multi-sig cold storage, proof of reserves, 2FA, anti-phishing codes, and fund passwords. While it hasn’t faced a major public security test yet, its current setup covers key risk areas.

6. Can I buy crypto with fiat on CoinCatch?

No, CoinCatch does not offer fiat on-ramps. You can only deposit and withdraw using supported crypto networks.