- •Bitvavo is a Netherlands-based exchange founded in 2018.

- •The platform supports over 390+ cryptocurrencies, mostly paired with EUR.

- •Bitvavo only offers spot trading, with no futures or margin options.

- •Standard trading fees are 0.15% maker and 0.25% taker.

- •Deposits via SEPA and iDEAL are free, while cards and PayPal incur fees.

- •KYC is mandatory, with a €25,000 daily withdrawal limit under basic verification.

- •Bitvavo Earn allows staking and lending on 70+ assets with weekly payouts.

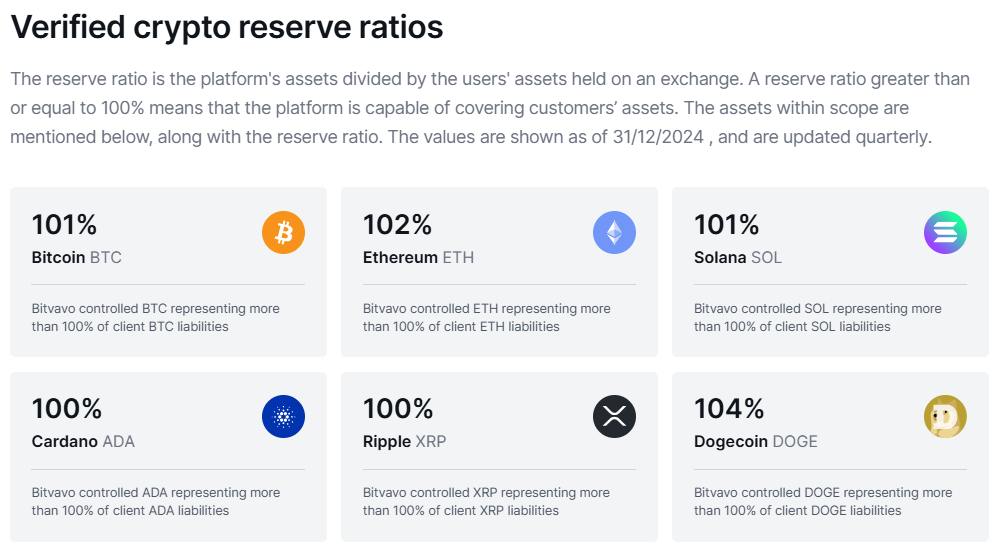

- •Security includes cold storage, 2FA, proof-of-reserves, and insurance up to $755M.

Crypto adoption in Europe is on the rise, with traders and long-term investors alike searching for reliable platforms that balance ease of use with regulatory trust. Among the names that keep surfacing is Bitvavo, a Netherlands-based exchange that has quickly gained attention for its mix of accessibility and compliance. But there’s more to choosing an exchange than just reputation. This Bitvavo review breaks down its fees, available services, security measures, and customer support, giving you the information needed to evaluate whether it aligns with your trading goals.

| Stats | Bitvavo |

|---|---|

| 🚀 Founded | 2018 |

| 🌐 Headquarters | Amsterdam |

| 🔎 Founder | Mark Nuvelstijn |

| 👤 Active Users | 4M+ |

| 🪙 Supported Cryptos | 390+ |

| 🔁 Spot Fees (maker/taker) | 0.15% / 0.25% |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.8/5 |

| 💰 Bonus | $10 (Claim Now) |

Bitvavo Overview

Founded in 2018 and headquartered in Amsterdam, Bitvavo has positioned itself as one of Europe’s most recognized cryptocurrency exchanges. Led by CEO and co-founder Mark Nuvelstijn, the platform was built with a clear mission: to make digital assets accessible to everyone through transparency, ease of use, and regulatory trust. This mission is reflected in its straightforward interface, support for over 390 cryptocurrencies, and a fee structure designed to remain predictable for users.

Bitvavo is regulated in the Netherlands and operates under strict European compliance standards, giving it a high safety rating within the region. The exchange serves more than 4 million users, with coverage limited primarily to European countries, and does not operate in the United States, Canada, or a wide list of restricted jurisdictions.

Unlike global competitors that prioritize high-volume derivatives trading, Bitvavo keeps its focus on spot markets, providing only buy, sell, and staking services. Daily spot volume averages around $120 million, highlighting its role as a regional player rather than a global derivatives hub.

In terms of features, Bitvavo supports deposits in euros via SEPA, along with credit and debit cards, while withdrawals are crypto-only. All users must complete KYC verification before trading, with withdrawal limits of up to €25,000 per day at Level 1 verification. While professional traders may find the lack of futures, options, or margin trading restrictive, the exchange appeals strongly to retail users looking for a regulated, user-friendly gateway into the crypto market.

Bitvavo Pros & Cons

| 👍 Bitvavo Pros | 👎 Bitvavo Cons |

|---|---|

| ✅ MiCA licensed as of June 2025 | ❌ No futures, margin, or derivatives trading |

| ✅ User-friendly interface for beginners | ❌ Limited to European countries; not available globally |

| ✅ Offers both Flex and Fixed staking | ❌ Higher taker fees compared to tier-one exchanges |

| ✅ Free deposits via SEPA and iDEAL | ❌ Daily withdrawal limit capped at €25,000 |

| ✅ Staking and Earn options with weekly payouts | |

| ✅ Proof-of-reserves audits and $755M insurance coverage |

Bitvavo Sign-up and KYC

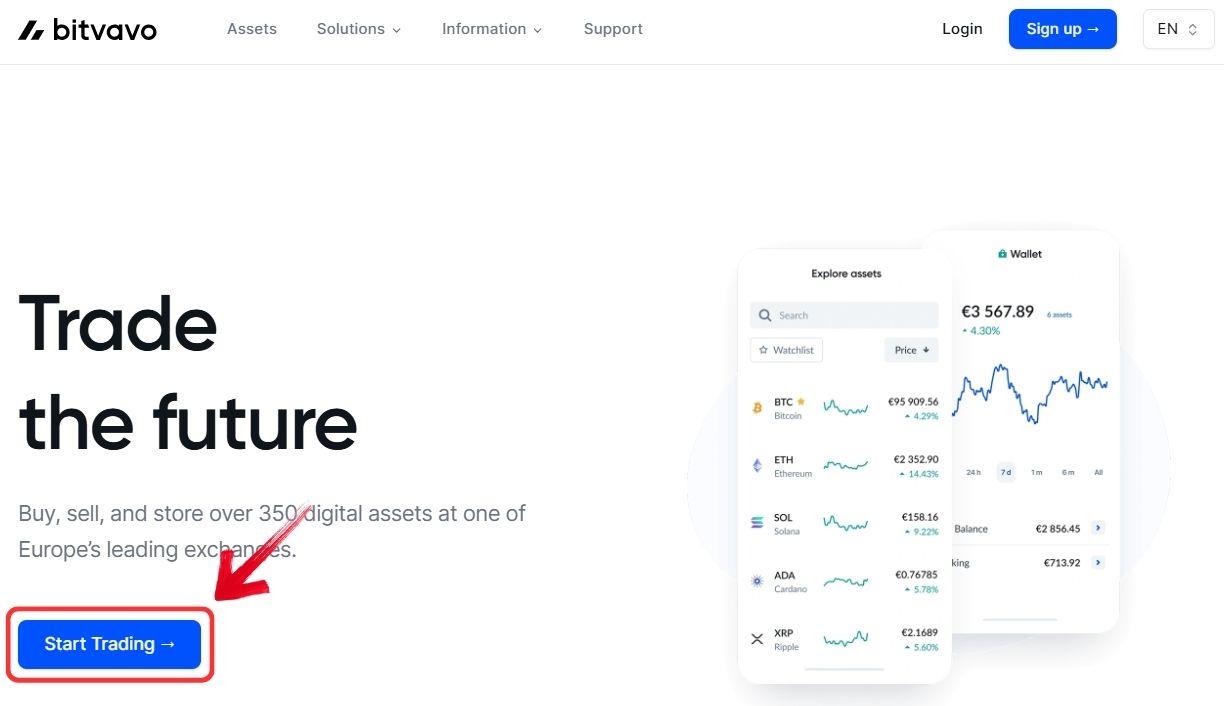

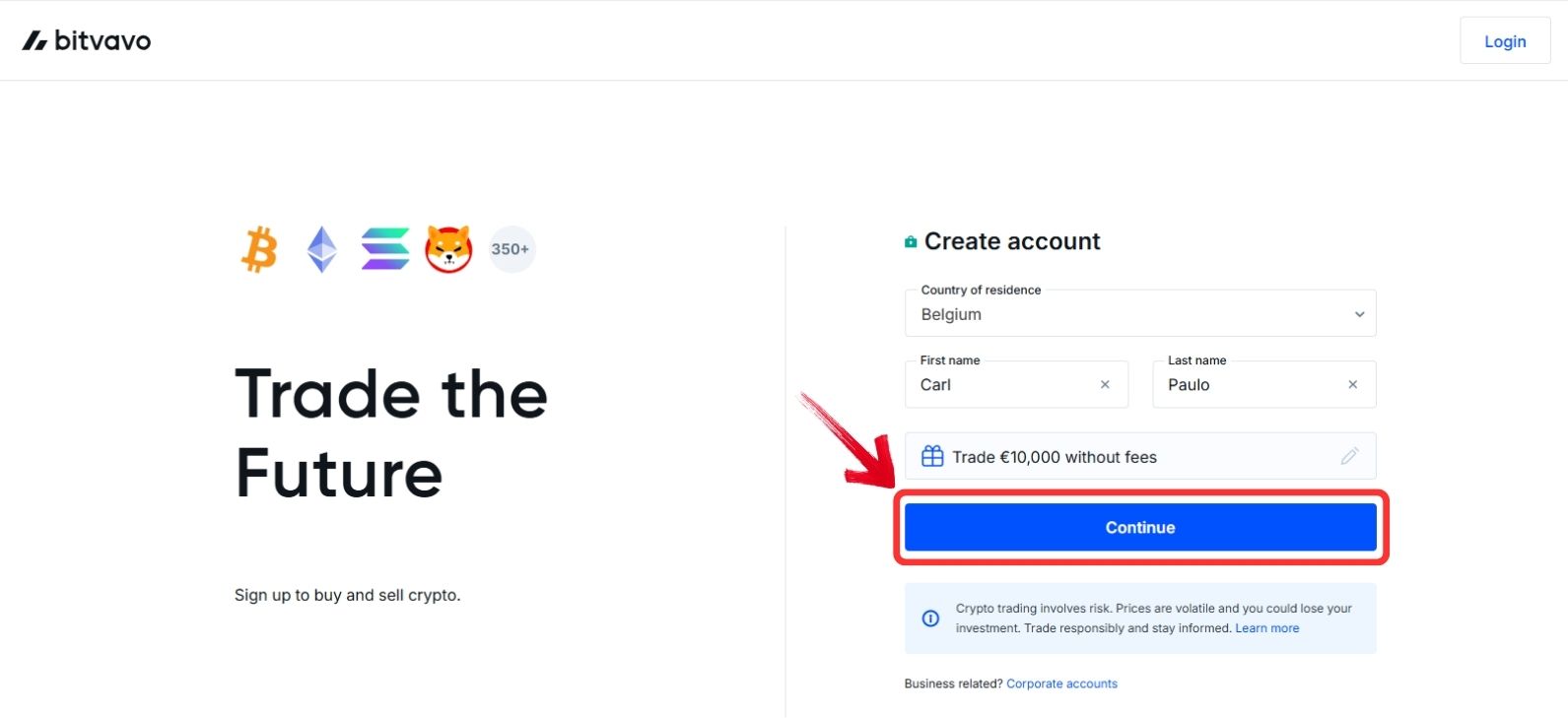

Bitvavo’s sign-up process is simple. You must first specify your country of residence, as the platform is only available throughout Europe. From there, you register with your name and email address, followed by completing identity verification with a national ID.

Basic KYC unlocks account access with a daily withdrawal limit of €25,000, while higher limits are available through advanced verification levels. To get started with Bitvavo, follow these steps:

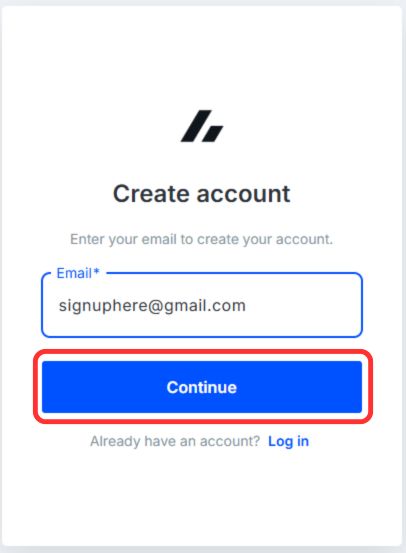

Step 1: Visit the official Bitvavo website through your preferred browser and click on the “Start Trading” button.

Step 2: On the sign-up page, select your country of residence and enter your full name. Then click “Continue”.

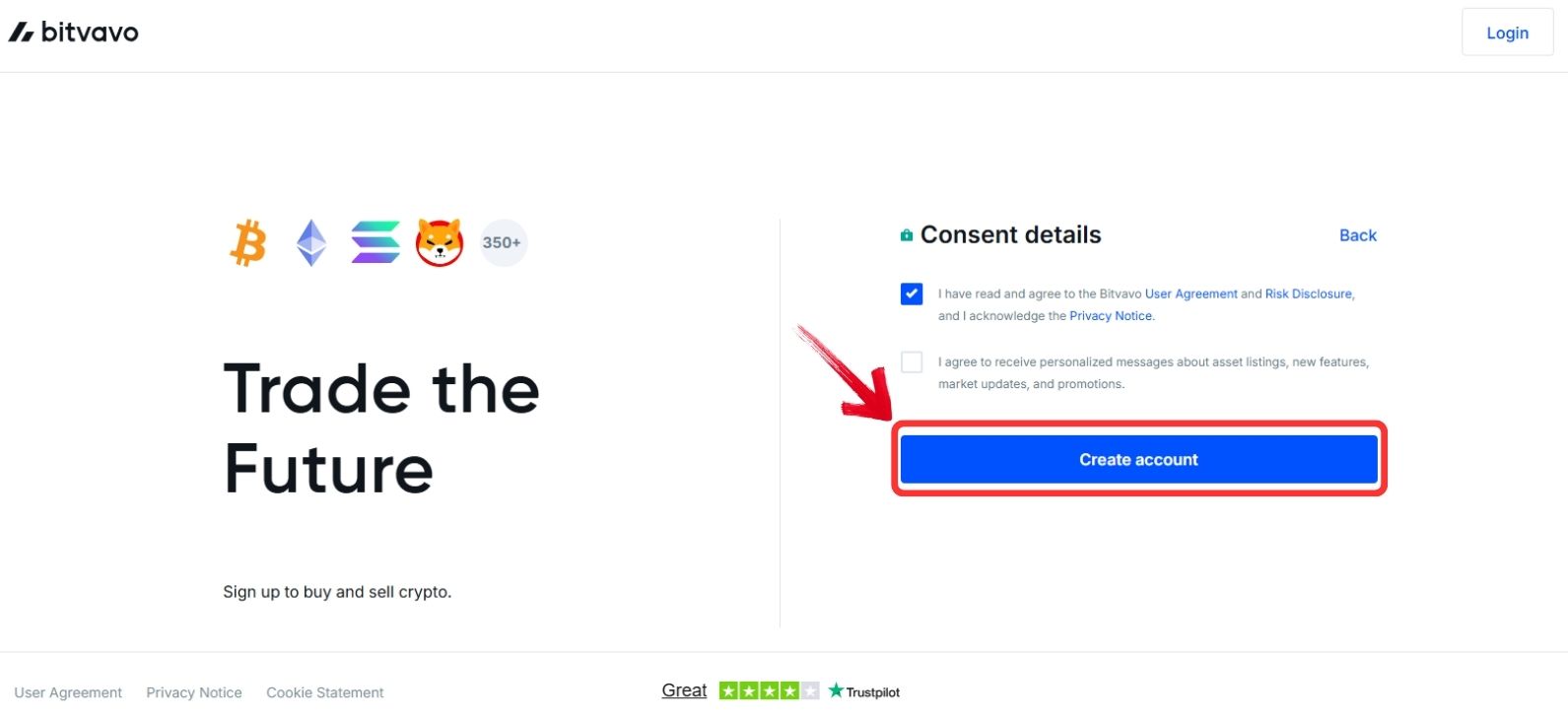

Step 3: Tick the box to accept the Terms and Conditions, and click “Create Account”.

Step 4: Enter your email address, which will be used for your Bitvavo account, and click “Continue”.

Step 5: Check your inbox for a 6-digit verification code, enter it on the website, and set up a strong password.

Step 6: Once your account is created, complete the KYC process using your national ID to fully activate your account and begin trading on Bitvavo.

With Basic Verification, Bitvavo sets a daily withdrawal limit of €25,000. There are no additional verification levels beyond this. Before registering, it’s important to confirm whether Bitvavo is available in your country. In compliance with FATF regulations, the exchange restricts users from several regions, including the United States and Canada. To avoid any sign-up issues, you can use our Bitvavo Country Checker tool to verify accessibility in your area.

🌍 Free Bitvavo Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Bitvavo does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Bitvavo country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Bitvavo Trading

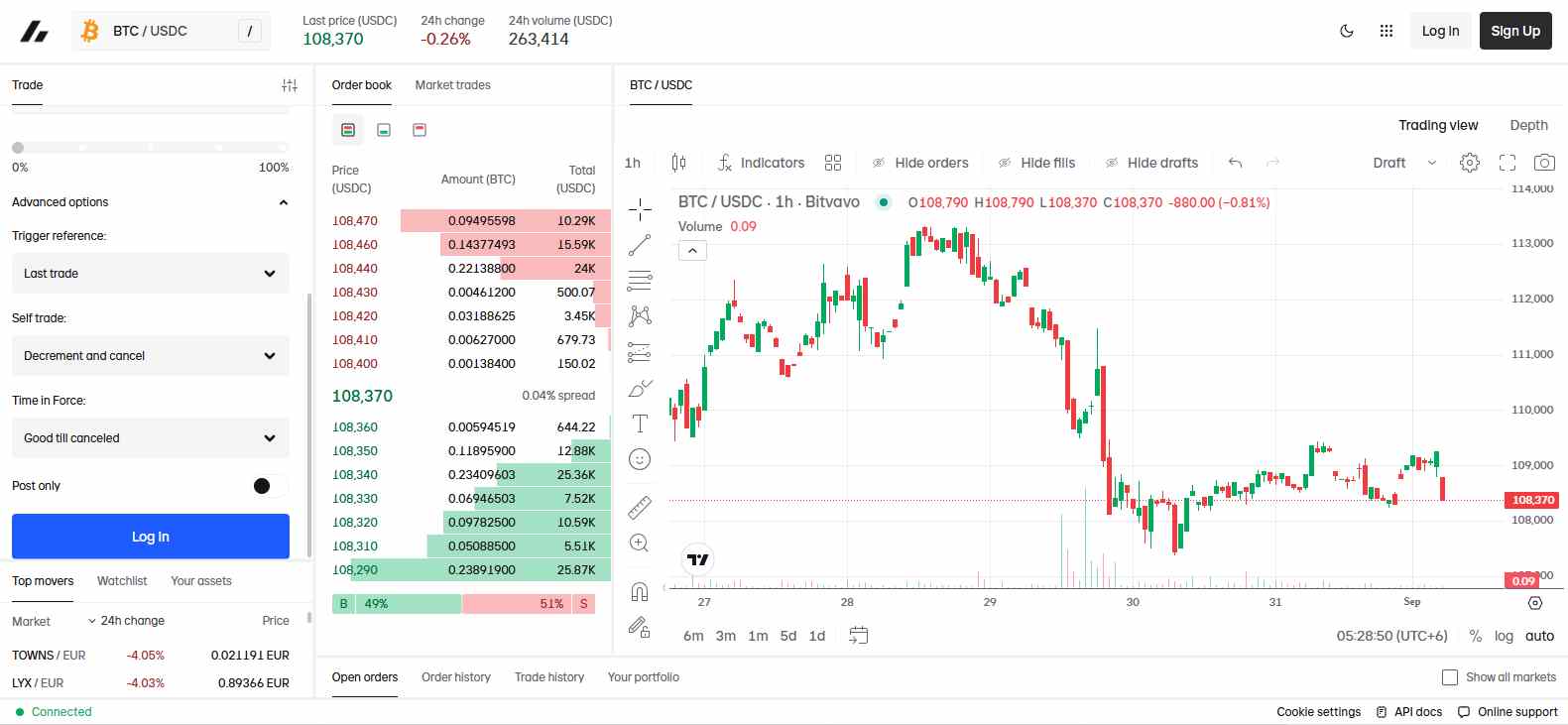

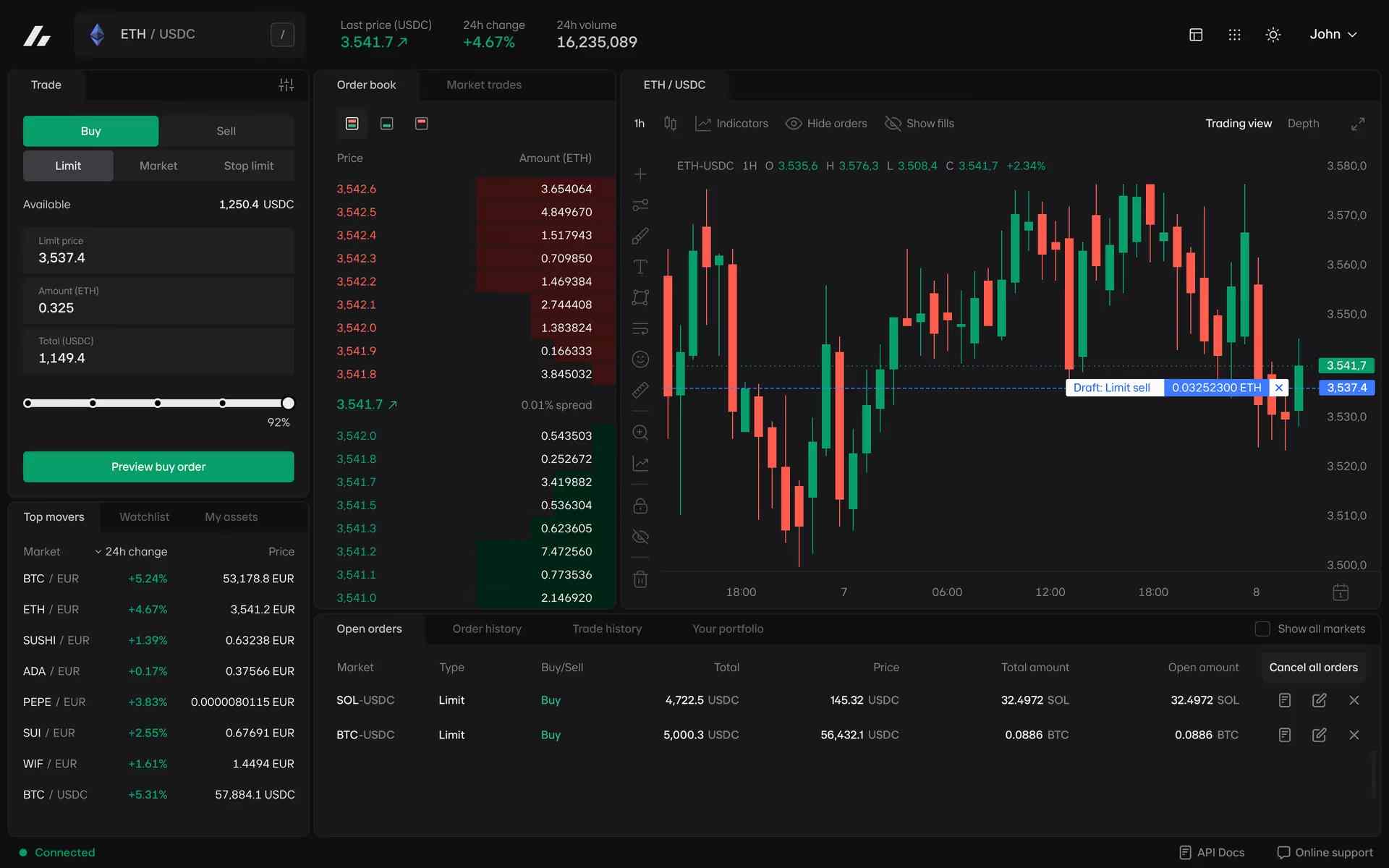

Bitvavo’s trading section is available under Pro Mode, where the platform currently offers only spot trading. The layout is slightly different from what many traders may be used to: trading tools are positioned on the left and charts on the right, creating a design that may feel crowded for experienced users coming from other exchanges. For beginners, however, this layout can quickly become the standard. Charts are powered by TradingView, giving access to familiar tools and indicators that support a wide range of strategies.

The order book is broad, but what stands out most is the range of order types. Standard options like Limit, Market, and Stop Limit are placed at the top for ease of access, while advanced settings are neatly tucked below. These include features such as Trigger, Self-Trade Prevention, and Time in Force, offering traders more control without overwhelming newcomers.

In terms of markets, Bitvavo provides access to over 390 cryptocurrencies. Spot maker fees are competitive at 0.15%, though taker fees at 0.25% are higher compared to many tier-one exchanges. Since Bitvavo is tailored for the European market, most trading pairs are listed against EUR, with an additional selection of 11 USDC pairs available for those preferring a stablecoin base.

Bitvavo Deposit and Withdrawal Methods

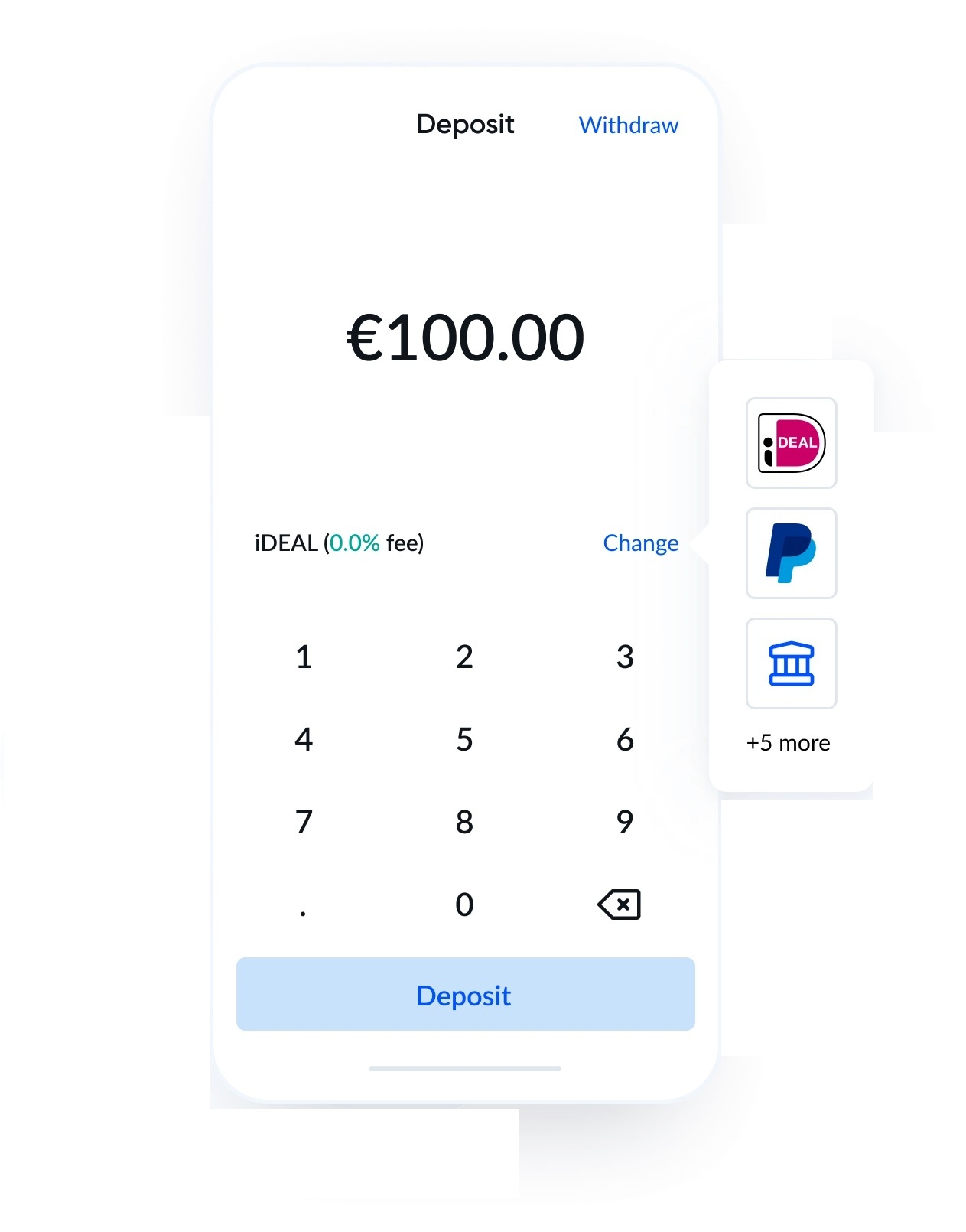

Bitvavo offers both fiat on- and off-ramp options, making it easy to move funds in and out of the platform. Through integrated third-party providers, users can purchase crypto instantly with a credit or debit card. SEPA transfers are also supported, allowing direct bank transfers in euros. Since EUR is the only supported fiat currency, options are somewhat limited.

On the withdrawal side, funds from selling crypto can be sent straight to a linked bank account. In addition, crypto deposits and withdrawals are fully supported across the listed assets.

Bitvavo Fees

Trading costs are always an important consideration when selecting an exchange. Here’s a breakdown of Bitvavo’s fee structure.

Trading Fees

Bitvavo applies a standard spot trading fee of 0.15% for makers and 0.25% for takers, based on a tiered structure. For high-volume traders, these fees can be significantly reduced. In Category A, for example, users with a 30-day trading volume above €500 million pay as little as 0.00% maker and 0.01% taker. Other categories apply mainly to stablecoin pairs, each with its own adjusted tiers.

Spot Fees

0.15% Maker

0.25% Taker

Deposits and Withdrawals

When it comes to deposits, costs vary depending on the payment method. SEPA and iDeal transfers are free of charge, while options such as credit cards and PayPal carry fees starting at around 1% or higher.

On the crypto side, deposits are free, but withdrawals include a charge from Bitvavo that also covers network miner fees. These vary depending on the token being transferred.

Bitvavo Products and Services

An exchange isn’t only about trading tools. Many users also look for additional services such as staking and passive income options. Let’s take a closer look at what Bitvavo offers beyond trading.

Bitvavo Trading

Bitvavo is limited to spot trading but supports over 390 cryptocurrencies paired with EUR, giving traders a wide range of markets to explore. The trading platform is designed with advanced tools, allowing users to perform detailed chart analysis powered by TradingView. Multiple order types, including market, limit, and stop-limit orders, provide flexibility for both beginners and more active traders. The order book offers transparent insights into market depth, while additional settings such as trigger and time-in-force help refine trading strategies. Together, these features make Bitvavo’s spot platform suitable for users who value both simplicity and analytical tools.

Mobile App

The Bitvavo mobile app delivers an intuitive design that mirrors the essentials of its web platform. Users can manage their accounts with ease, from deposits and withdrawals to identity verification and staking, all directly from their devices. Available on both iOS and Android, the app provides a smooth trading experience for everyday users. While advanced traders may find some professional tools missing, the app remains a reliable way to access and manage crypto portfolios on the go.

Earn

Bitvavo Earn offers the potential to earn returns of up to 30% through staking and lending services. Staking is provided by Bitvavo B.V., while lending is managed by Bitvavo Custody B.V., though both currently operate outside the MiCA regulatory scope. Users can choose flexible staking options with weekly payouts, covering more than 70 supported assets. This service is aimed at those seeking passive income opportunities while maintaining the convenience of managing their investments directly within the Bitvavo platform.

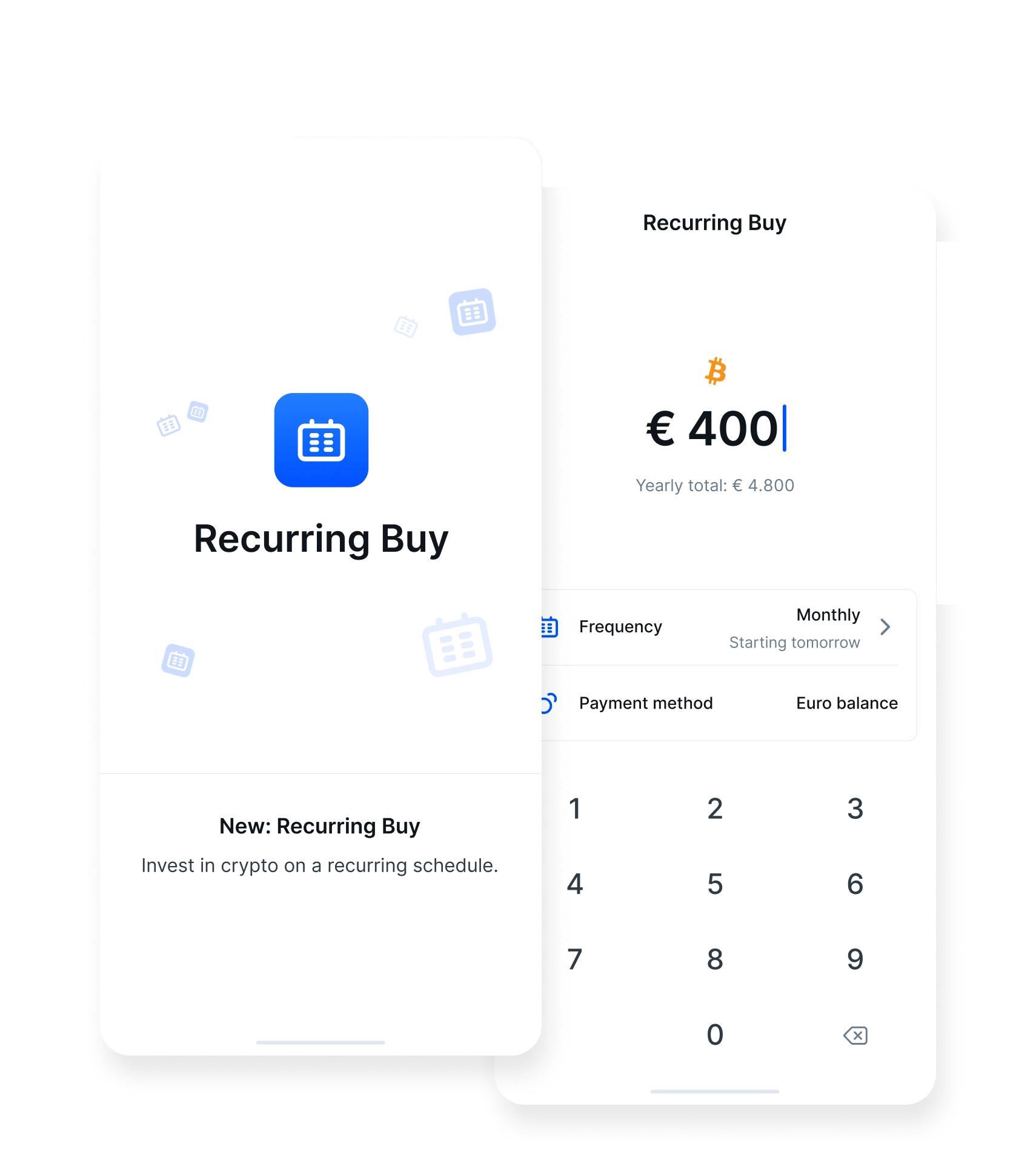

Recurring Buy (DCA)

Bitvavo offers a Recurring Buy feature that enables users to invest in crypto on a set schedule, removing the pressure of timing the market. Purchases can be customized by adjusting the amount, frequency, or skipping transactions when needed. This approach follows the principle of Dollar-Cost Averaging (DCA), allowing investors to spread out purchases over time and reduce the impact of market volatility while building their portfolio steadily.

Institutional Services

Bitvavo provides institutions with deep euro liquidity, fast execution, and a compliant framework for cryptocurrency trading. Built on institutional-grade security, the platform is tailored to meet the needs of professional clients under the EU’s unified regulations. Services include advanced asset protection, real-time risk monitoring, and low-latency APIs for automated trading. Institutions also benefit from seamless SEPA funding, the ability to manage multiple accounts, and access to a secure infrastructure that combines simplicity, reliability, and compliance across European markets.

Affiliate Program

Bitvavo offers an affiliate program that allows partners to earn a commission starting at 15% on all trading fees generated by their referrals. The program is available across 27 European countries, giving affiliates broad reach and the opportunity for unlimited earnings. Signing up is straightforward: register for the program, share your unique referral link, and earn commissions as referred users trade. With its simple structure and attractive payouts, Bitvavo’s affiliate program provides a practical way to monetize networks.

Bitvavo Learn

Bitvavo Learn is an educational platform designed to guide users from beginner to advanced levels in digital assets and blockchain technology. It offers structured tracks, practical tips, and in-depth lessons that cover everything from the basics of cryptocurrency to expert-level insights into blockchain systems. The content is designed to simplify complex topics, making it accessible for new investors while still providing valuable detail for experienced traders. This initiative supports Bitvavo’s mission of improving accessibility through knowledge and education.

Bitvavo Security

Security is at the core of Bitvavo’s operations, with strict measures in place to safeguard both user funds and personal data. Accounts can be protected through two-factor authentication, anti-phishing codes, device management, and withdrawal address whitelisting. The majority of assets are stored offline in multi-signature cold wallets, supported by leading custodial partners and insured up to $755 million.

Bitvavo also operates under a dedicated payments foundation to keep user funds separate and protected in case of insolvency. On the infrastructure side, certified data centers, advanced monitoring, and regular third-party audits ensure ongoing resilience.

With continuous employee screening, penetration testing, and proof-of-reserves attestations, Bitvavo maintains a transparent and compliant framework for asset security within the European market.

Bitvavo Customer Support

Bitvavo provides multiple ways for users to connect with its support team. Live chat is available directly on the website during business hours (10:00–20:00 weekdays and 10:00–16:00 weekends) for quick assistance. For more complex queries, users can email support@bitvavo.com

, where responses are typically provided within one business day. To help speed up resolution, it’s recommended to include account details and screenshots when reaching out.

Beyond direct support, Bitvavo offers a Support page with FAQs and guides, a Bitvavo Learn platform for educational resources, and a regularly updated Blog covering news and platform updates. While response times may vary, Bitvavo’s structured support options provide users with clear and reliable channels for addressing questions and concerns.

Bitvavo Alternatives

Bitvavo is a European-focused exchange, but if it’s not available in your region or you need different features, consider these:

- Coinbase: Coinbase is a user-friendly exchange with a wider range of supported countries.

- Bitunix: If you’re looking for a no-KYC exchange, Bitunix is a good option with a user-friendly platform.

| Feature | Bitvavo | Coinbase | Bitunix |

|---|---|---|---|

| Established | 2018 | 2012 | 2022 |

| Spot Fees (Maker/Taker) | 0.15% / 0.25% | 0.40% / 0.60% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | N/A | 0.050% / 0.050% | 0.020% / 0.060% |

| Max Leverage | None | 10x | 125x |

| KYC Required | Yes | Yes | No |

| Supported Cryptos (Spot) | 390+ | 297+ | 317+ |

| Futures Contracts | None | 164+ | 218+ |

| 24h Volume | $137.07M+ | $1.42B+ | $573.01M+ |

| 24h Futures Volume | N/A | $3,13B+ | $3.21B+ |

| Trading Bonus | $10 | None | $5,500 |

| Key Features | • EU regulated exchange • SEPA transfers • Beginner friendly |

• Most trusted US exchange • Easy to use interface • Strong regulatory compliance |

• No KYC required • High leverage (125x) • Multiple fiat options |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Bitvavo positions itself as a regulated, Europe-focused exchange built around accessibility, transparency, and security. It offers a strong selection of over 390 cryptocurrencies, competitive spot fees, and added features like staking, recurring buy, and an educational platform. At the same time, it is limited to spot trading, supports only EUR as fiat, and requires full KYC.

For beginners and retail investors within Europe, it serves as a safe and straightforward entry point into crypto. More advanced traders, however, may find its lack of futures, margin, and broader global access restrictive. Ultimately, whether Bitvavo is the right fit depends on your location, trading needs, and preference for a regulated environment.

FAQs

1. Is Bitvavo safe to use?

Yes, Bitvavo is safe to use. The platform employs various security measures, including two-factor authentication (2FA), to ensure the safety of user accounts.

2. Can you store cryptocurrencies at Bitvavo?

Yes, you can store cryptocurrencies at Bitvavo. The platform provides users with unique wallet addresses for each supported cryptocurrency.

3. What is the minimum deposit required at Bitvavo?

The minimum deposit at Bitvavo is €5.

4. Can I deposit funds using a credit card?

No, it is not currently possible to deposit funds to Bitvavo using a credit card.

5. Is Bitvavo regulated?

Yes. Bitvavo is headquartered in Amsterdam and operates under Dutch and EU regulations, including AMLD5 and GDPR.