- •Regulated South Korean exchange operating under the FIU with full KRW banking integration.

- •Supports over 396+ cryptocurrencies, no futures or leverage.

- •KRW deposits are free, but KRW withdrawals cost 1,000 KRW.

- •Security measures include ISMS certification, 2FA, and cold storage, though the exchange lacks proof of reserves.

- •Interface favors Korean users, and some English translations remain incomplete, affecting accessibility for global traders.

- •Best suited for South Korean investors seeking a compliant, fiat-integrated trading environment with local support.

Investors and traders across Asia are leveling up fast. With Korea pushing stablecoin initiatives and even global figures like Eric Trump praising the government’s forward steps, the local crypto scene is buzzing. But when innovation rises, so do scams, regulations, and confusion.

Bithumb, a leading South Korean cryptocurrency exchange, has built a solid foothold in Asia with strong KRW integration and strict regulatory alignment. Through this Bithumb review, we’ll explore its offerings, customer support, and security standards, helping you make an informed decision before you trade or invest.

| Stats | Bithumb |

|---|---|

| 🚀 Founded | 2014 |

| 🌐 Headquarters | Seoul, South Korea |

| 🔎 Founder | Lee Jung-hoon |

| 👤 Active Users | 8M+ |

| 🪙 Spot Cryptos | 396+ |

| 🪙 Futures Contracts | N/A |

| 🔁 Spot Fees (maker/taker) | 0.04% / 0.25% |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.1/5 |

Bithumb Overview

Founded in 2014 by Lee Jung-hoon and headquartered in Seoul, South Korea, Bithumb is one of Asia’s most established cryptocurrency exchanges. With over 8 million registered users and a 24-hour spot trading volume exceeding $1.5 billion, it continues to hold a strong presence in Korea’s regulated crypto landscape.

Bithumb is fully regulated under South Korea’s Financial Intelligence Unit (FIU) and operates within the country’s real-name banking system, which ties user accounts directly with verified bank details, a standard that significantly strengthens compliance and security. Its KRW (Korean Won) fiat on-ramps make it a preferred choice among local investors looking for smooth deposits and withdrawals through domestic bank partners.

In terms of trading options, Bithumb currently supports 396+ cryptocurrencies on its spot market, but offers no futures or leveraged products. However, the exchange compensates for this with extra tools like its Forecast feature, which uses a regression-based model to provide possible market outcomes; not revolutionary, but a useful indicator for short-term traders.

For passive and semi-active investors, Bithumb also includes staking programs and automated bot trading, making it suitable for users who prefer steady returns or algorithmic strategies. That said, its taker fee of 0.25% and maker fee of 0.04% are on the higher side compared to global competitors, and the platform’s services are mainly optimized for South Korean users, with limited international accessibility.

With more than 700 employees, a solid safety record, and strong domestic regulatory alignment, Bithumb has evolved into a trusted gateway for South Korean traders, though it remains less appealing to advanced global traders seeking futures, margin, or cross-market options.

Bithumb Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Strong regulatory compliance in South Korea | ❌ No futures or margin trading |

| ✅ Supports KRW deposits and withdrawals | ❌ Limited global accessibility |

| ✅ Deep liquidity and tight spreads | ❌ Past security breaches and low Cer.live rating |

| ✅ User-friendly mobile app with bank integration | ❌ No proof of reserves |

| ✅ Auto and bot trading options available | ❌ Interface issues for non-Korean users |

| ✅ Reliable staking for Korean users |

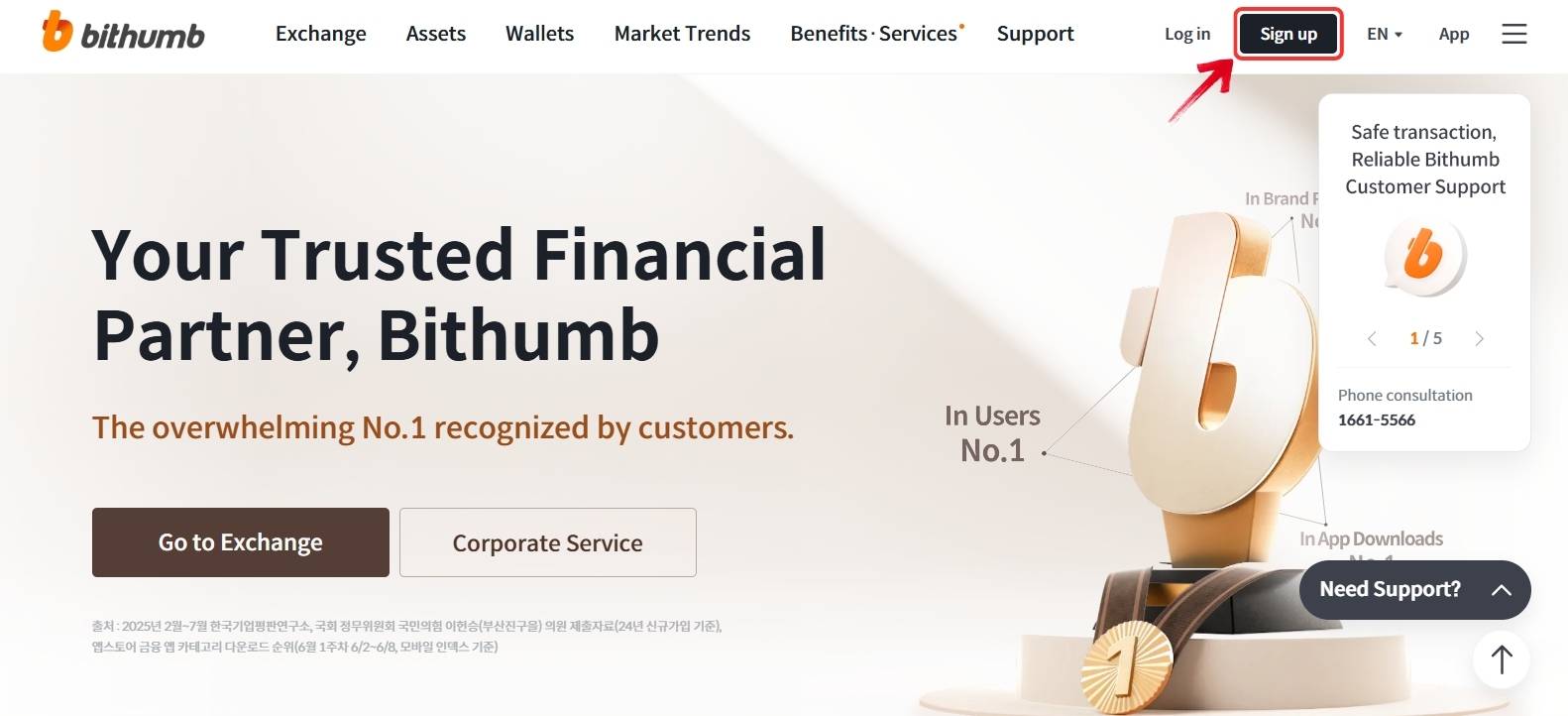

Bithumb KYC and Sign-up

Bithumb fully complies with South Korea’s regulatory framework, which requires identity verification for all users. While you can start by signing up with your email account, you’ll need to complete KYC verification before trading or making any withdrawals.

The process is straightforward; users are asked to submit a national ID and a live selfie for identity confirmation. In most cases, verification takes under five minutes, though in rare cases, it may extend up to three business days.

This strict verification aligns with the country’s real-name banking system, ensuring transparency and reducing the risk of fraud or unauthorized transactions. Although this adds an extra step for new users, it ultimately strengthens the exchange’s security and trustworthiness.

Before you start the verification process, it’s important to check whether Bithumb’s services are available in your region. Some countries are restricted under compliance laws, so it’s always smart to confirm before signing up. You can use our free Bithumb Country Checker to instantly see if your location is supported.

🌍 Free Bithumb Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Bithumb does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Bithumb country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

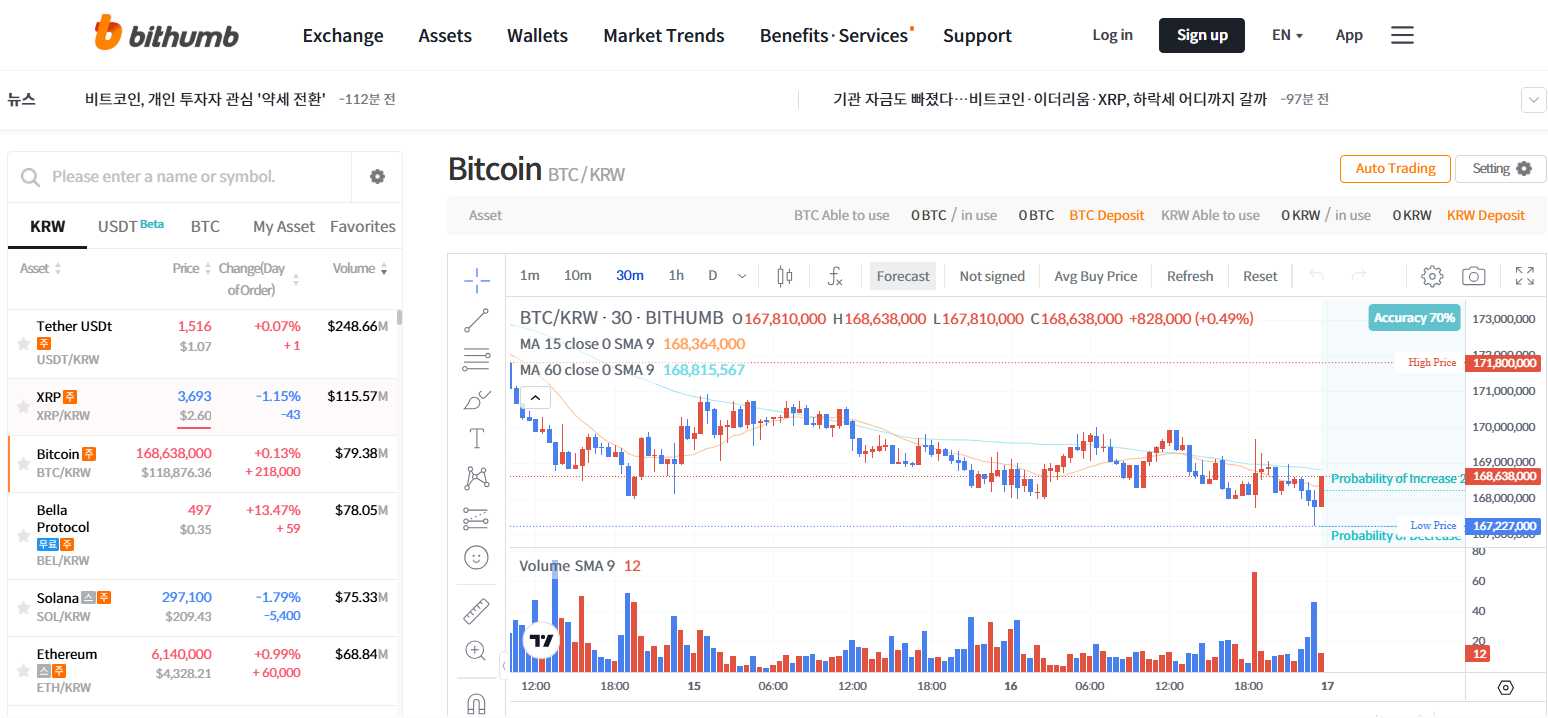

Bithumb Trading

Bithumb currently offers only spot trading, with more than 396 cryptocurrencies available, most paired with KRW (Korean Won). The maker fee stands at 0.04%, while the taker fee is 0.25%, which is slightly higher than what international users might expect on global exchanges.

For foreign traders, the interface can feel confusing at first. Even though an English version is available, several terms and buttons remain in Korean, and the layout differs from typical global exchanges. Still, it includes all core elements such as TradingView-integrated charts, order books, and basic trading tools.

An interesting extra is the price comparison tool, which shows how asset prices on Bithumb differ from other top exchanges like Binance and Gate.io, a handy feature for domestic traders tracking global spreads. Liquidity is strong, and spreads remain tight, making execution quick even on high-volume pairs.

Bithumb also features a Forecast tool, which applies a regression model to extrapolate short-term price movements directly on the chart, not groundbreaking, but useful for quick insights. Order types are limited to Limit and Market orders, with Stop-Limit and Stop-Market options for added control.

Bithumb Deposit and Withdrawal Methods

Bithumb supports KRW deposits and withdrawals through its partnered local banks in South Korea, offering quick and secure transfers under the country’s real-name banking system.

For digital assets, users can deposit and withdraw a wide range of cryptocurrencies directly from their wallets, with no deposit fees and variable withdrawal costs based on network conditions.

Bithumb Fees

Now, let’s look at the fees Bithumb charges its users, not only for trading but also for deposits and withdrawals.

Trading Fees

Bithumb follows a straightforward fee model across its trading markets. The standard maker fee is 0.04%, while the taker fee is 0.25%, placing it within the typical range for Korean exchanges. These rates apply to KRW, USDT, and BTC markets, with occasional zero-fee promotions available for Bitcoin pairs during special campaigns.

To reward active users, Bithumb operates a tiered membership system with six levels; White, Blue, Green, Purple, Orange, and Black. Each tier offers incremental benefits such as trading point bonuses and maker rewards, providing small but meaningful incentives for consistent traders. Users in the highest “Black” tier can earn up to a 0.02% total trading fee discount, making it the most rewarding level within Bithumb’s membership program.

Spot Fees

0.10% Maker

0.20% Taker

Deposits and Withdrawals Fees

Bithumb keeps its funding structure simple and transparent. KRW deposits are completely free, allowing local users to move funds without any added cost. For KRW withdrawals, the exchange charges a flat fee of 1,000 KRW per transaction.

When it comes to cryptocurrencies, deposits are free aside from the standard network gas fees, which depend on each blockchain. However, crypto withdrawal fees vary by asset, as they’re adjusted according to network conditions and token-specific costs.

Bithumb Products and Services

Every exchange today offers more than just trading, they aim to create broader opportunities for users, catering to different goals and trading styles. Let’s take a closer look at what Bithumb offers its users beyond the standard spot trading platform.

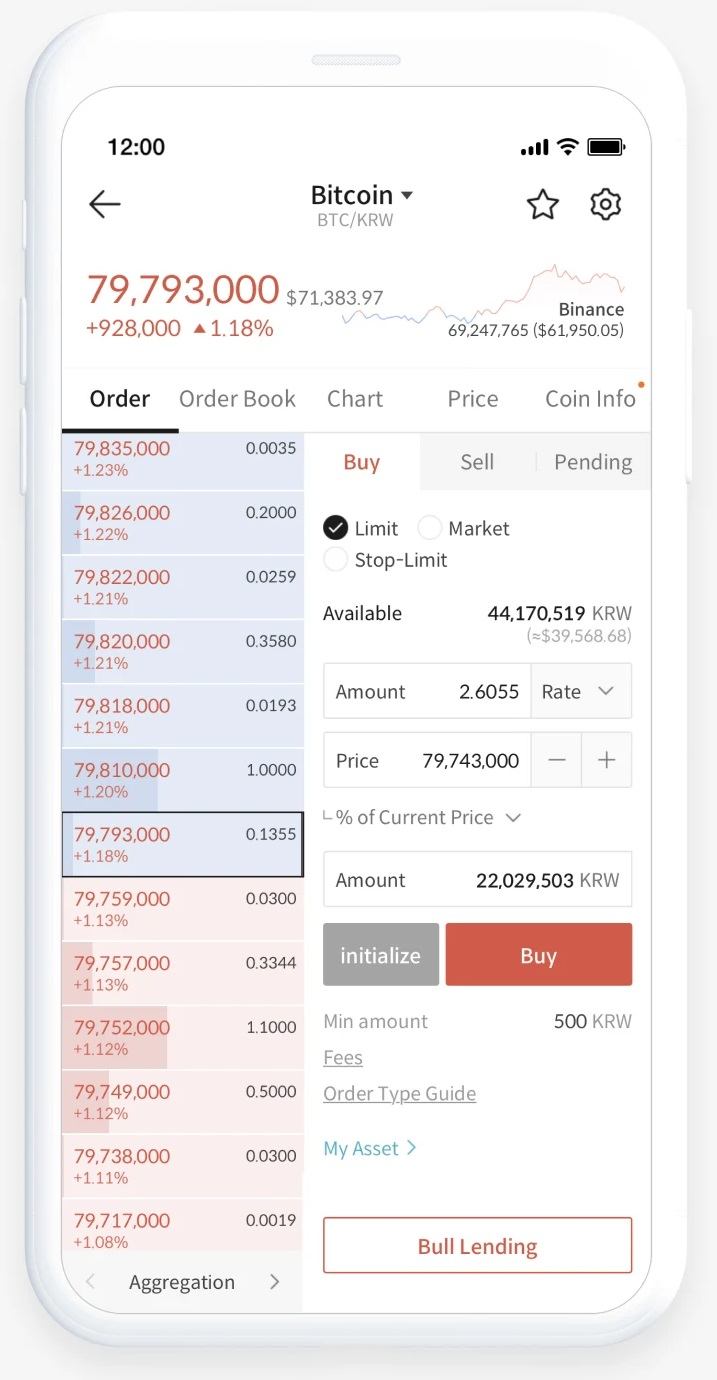

Mobile App

Bithumb’s mobile app is available on both iOS and Android, carrying an average rating of 3.5 stars. It allows users to trade on the go, monitor prices, and manage portfolios in real time. The app holds multiple security certifications including ISMS, ISO27001, and BS10012, ensuring compliance with Korean data standards.

While it supports several languages, some non-Korean users have reported interface and translation issues. Interestingly, the app also connects with major Korean banks like Samsung Securities, NH Nonghyup, and KB Kookmin Bank, allowing users to view crypto prices and account status directly from their banking apps.

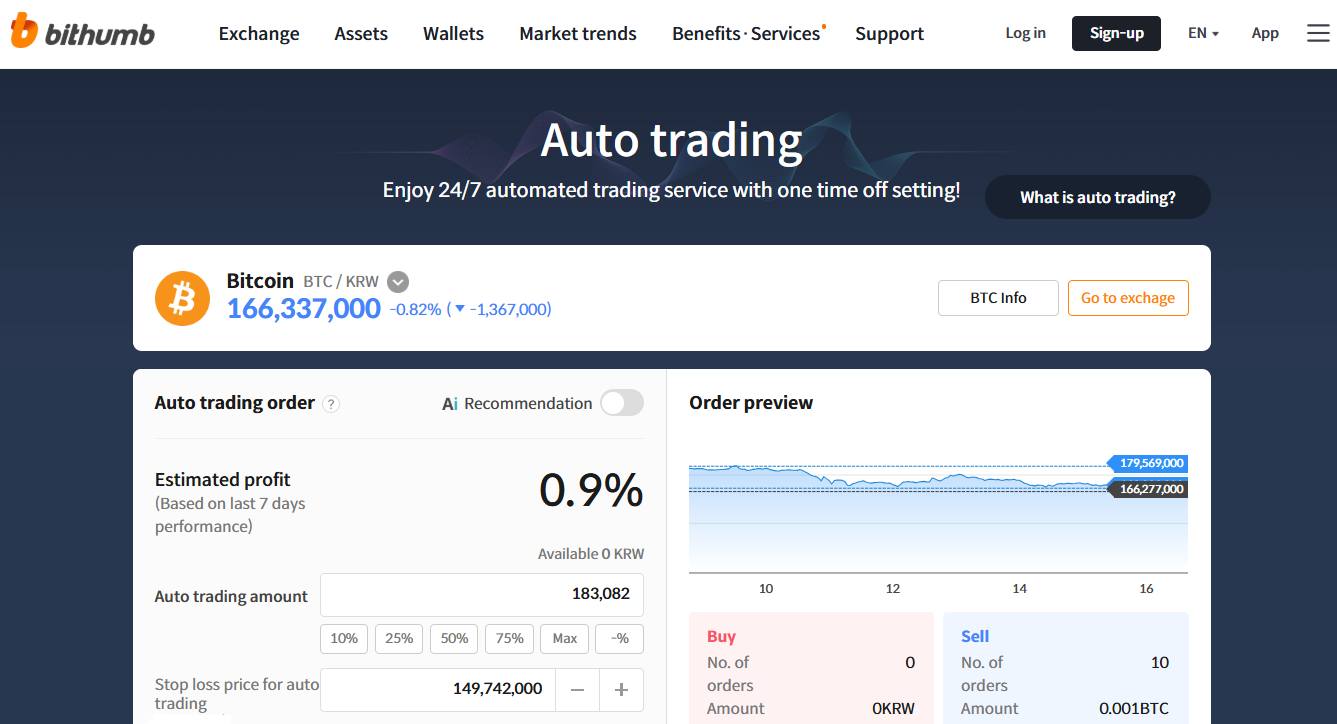

Auto Trading

Bithumb features an auto-trading service powered by Crom Innovation’s ANW Algorithm Trading Engine. Users can set their preferences and risk parameters, after which the algorithm executes trades automatically. The system includes built-in safeguards, pausing executions if profits or losses hit preset limits.

Accessible directly from the KRW Market, it requires no additional app or API setup. This service currently advertises returns of up to 0.9% on BTC, though actual outcomes depend on market movement and user settings.

Bot Trading

Bithumb doesn’t offer its own native trading bot. Instead, it partners with third-party providers such as Karbot and Arbitrage Trading platforms. These integrations let users automate strategies, rebalance portfolios, and capture small market inefficiencies without coding knowledge.

Lending

Bithumb has transitioned its lending services into a “Coin Lending Plus” model, focusing on managing liquidity internally rather than facilitating peer-to-peer loans. This shift was made to strengthen regulatory compliance and operational control following guidelines from Korean financial authorities. However, the platform recently received a warning from DAXA (September 2025) for allegedly breaching credit extension regulations, highlighting that lending still remains a closely monitored area in South Korea.

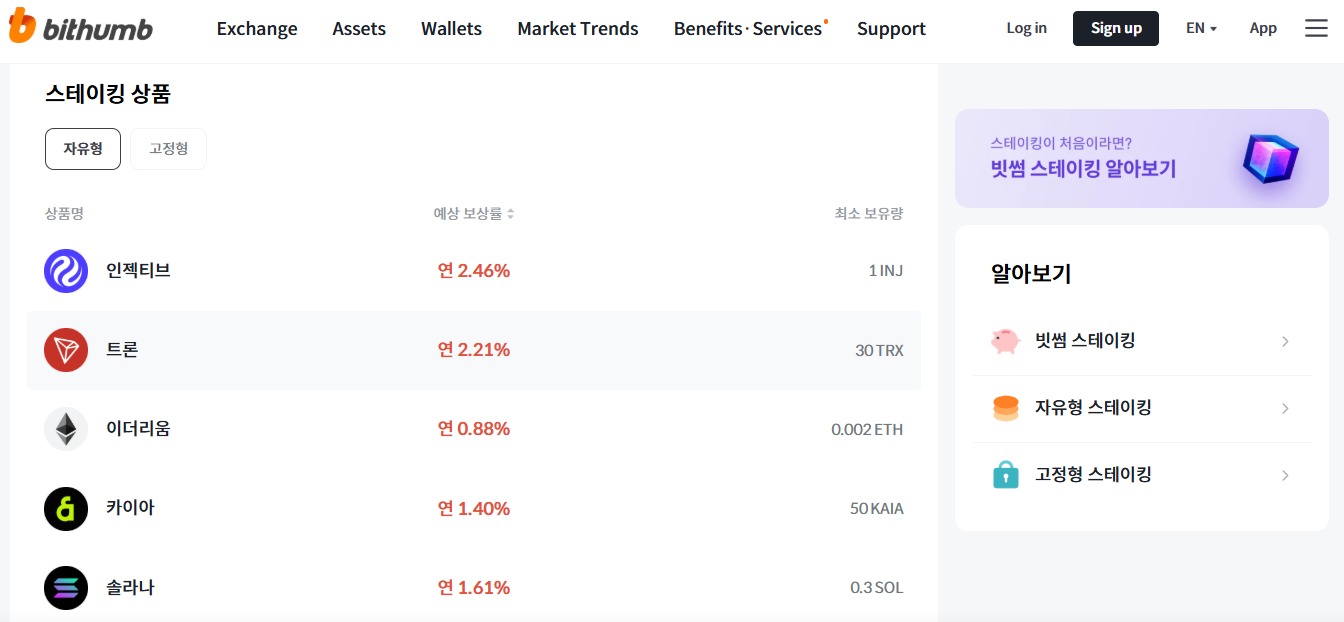

Staking

Bithumb’s staking program is available exclusively for Korean users. Even in its English version, most staking details are displayed in Korean, which makes navigation tricky for global users. It supports both fixed and flexible staking across 16+ digital assets, offering APYs of up to 2.46%. Locked assets are used solely for on-chain staking, meaning funds remain transparent and traceable through blockchain activity.

Bithumb Security

Bithumb employs several security protocols, including two-factor authentication (2FA), cold wallet storage for the majority of user assets, and compliance with South Korea’s ISMS (Information Security Management System) standards. Despite these measures, the exchange has a history of major security breaches, with incidents in 2017, 2018, and 2019 resulting in the loss of millions in assets such as EOS and Ripple (XRP).

The platform has since faced multiple regulatory investigations and fines for past security lapses and management issues. According to Cer.live, Bithumb currently holds a DDD security rating, indicating a relatively low trust score. The exchange also lacks ISO 27001 certification and has not published any proof of reserves, leaving transparency around asset backing unclear.

Bithumb Customer Support

Bithumb provides strong customer support for South Korean users, offering multiple contact channels including a responsive live chat bot, KakaoTalk chat support, and a detailed help center filled with guides and FAQs. The platform’s official blog also serves as a useful resource for navigating new features and updates. Domestically, Bithumb maintains a high complaint resolution rate, reflecting its emphasis on user satisfaction and regulatory compliance.

For international users, however, support options are more limited. The live chat and KakaoTalk services are exclusive to Korean users, while global traders are restricted to email support. Although responses are professional, delays and translation gaps can make the experience slower and less convenient for non-Korean customers.

Bithumb Alternatives

Bithumb is a popular exchange in South Korea, but if you’re looking for alternatives, consider these:

1. Upbit: Upbit is a leading South Korean exchange known for its strong regulatory compliance, and deep liquidity. It supports KRW trading pairs, offers a clean interface, and is fully licensed under Korea’s financial authorities.

2. Coinbase: Coinbase is a user-friendly exchange with a wider range of supported countries and cryptocurrencies.

3. BloFin: If you need a no-KYC option with a good selection of cryptocurrencies and fiat deposit options, BloFin is worth checking out.

| Feature | Bithumb | Upbit | Coinbase | BloFin |

|---|---|---|---|---|

| Established | 2014 | 2017 | 2012 | 2019 |

| Spot Fees (Maker/Taker) | 0.04% / 0.25% | 0.05% / 0.05% | 0.40% / 0.60% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | None | None | 0.05% / 0.05% | 0.02% / 0.06% |

| Max Leverage | None | None | 10x | 150x |

| KYC Required | Yes | Yes | Yes | No |

| Supported Cryptos (Spot) | 396+ | 152+ | 297+ | 564+ |

| 24h Spot Volume | $1.25B+ | $2.14B+ | $3.65B+ | $603.04M+ |

| 24h Futures Volume | None | None | $522.44M+ | $1.03B+ |

| Trading Bonus | None | None | None | None |

| Key Features | • Established since 2014 • Supports KRW deposits • 396+ cryptocurrencies |

• Fully licensed in Korea • KRW pairs • Clean and simple interface |

• No KYC required • High leverage (150x) • $9.73B futures volume |

• No KYC • Easy to use interface • Strong compliance |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Bithumb stands out as one of South Korea’s most established crypto exchanges, offering strong regulatory alignment, KRW support, and a secure trading environment built for local users. Its smooth integration with domestic banks and government compliance gives it an edge for traders who prioritize safety and convenience over advanced trading features.

That said, Bithumb’s limited global accessibility, lack of futures trading, and interface challenges for non-Korean speakers can make it less appealing to international users. The absence of proof of reserves and its history of security incidents are also factors worth considering for those seeking full transparency.

If you’re exploring more options suited to your needs, check out our full list of top crypto exchanges for South Korean users to compare features, fees, and user experiences in detail.

FAQs

1. Is Bithumb safe to use?

Bithumb follows strong security protocols like 2FA and cold wallet storage, and it’s certified under ISMS in South Korea. However, the exchange has experienced multiple hacks in the past and does not publish proof of reserves, so users should remain cautious and enable all available security measures.

2. Does Bithumb require KYC verification?

Yes. Bithumb requires full KYC verification before users can start trading or withdrawing funds. You’ll need to provide a national ID and a live selfie, and the process usually takes just a few minutes to complete.

3. Can international users register on Bithumb?

Bithumb primarily serves South Korean users, and many of its services — including KRW deposits and KakaoTalk support — are limited to domestic accounts. Some international users can still sign up, but functionality may be restricted depending on regional compliance rules.

4. Does Bithumb offer futures or margin trading?

No. Bithumb currently provides only spot trading with over 396 cryptocurrencies available. It does not support futures, margin, or derivatives trading at this time.

5. What are Bithumb’s trading fees?

Bithumb charges a maker fee of 0.04% and a taker fee of 0.25%, consistent across KRW, USDT, and BTC markets. Higher membership tiers can unlock up to 0.02% in fee discounts, depending on activity level.

6. Where Is Bithumb Located?

Bithumb is originally from South Korea. The company was founded there in 2014. Bithumb Global is now present in some other countries.