BingX is known to be one of the best non-KYC crypto exchanges in 2024. That means BingX does not require KYC. You can deposit, trade, and withdraw on BingX without having to verify your identity.

However, there are still some rules and limits that apply to unverified users of the BingX crypto exchange. In this guide, we will share everything you need to know about BingX KYC requirements, withdrawal limits, and security.

You can learn more about the platform in our full BingX review.

Is BingX safe to use without KYC?

BingX was launched in 2017 and has always been a reliable crypto exchange for users, even without KYC verification, without any data breaches, hacks, or exploits. Over 5 million users across 120 countries trust the platform. You can easily deposit cryptocurrencies to your BingX account, trade, and then withdraw your profits. The BingX exchange has not been hacked, and customer funds remain safe as of 2024. Therefore, BingX appears to be a safe and reliable crypto exchange to use without KYC verification.

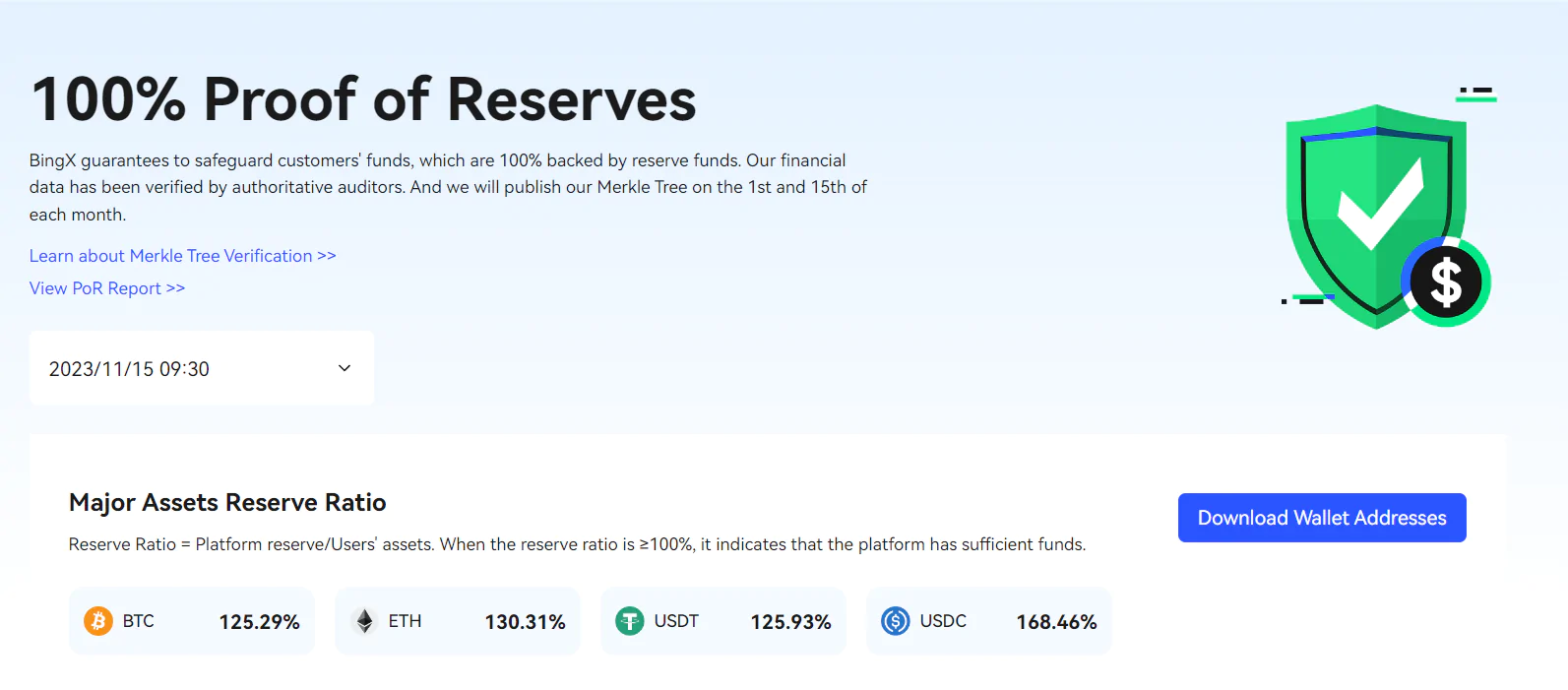

Aside from being regulated by major authorities, BingX even provides 100% proof of reserves. That means all customer funds are backed 1:1 by BingX. You can even check out the BingX live proof reserves.

BingX Withdrawal Limits

While BingX allows users to deposit and withdraw funds without KYC verification, there are some limitations that no-KYC users must be aware of. First and foremost, every BingX user must bind Google Authentator, email, and phone verification before being able to withdraw funds. After these security measures are taken, you can withdraw funds.

Below, you will find the daily withdrawal limits for all verification levels.

- No KYC: $50,000

- Level 1 KYC: $5,000,000

That means if you are unverified on BingX, you can withdraw funds worth $50,000 every 24 hours. If you want to withdraw $5,000,000 per day, you must verify your identity with the KYC process.

| Period | No KYC | KYC 1 |

|---|---|---|

| Daily Crypto Limit | $50,000 | $5,000,000 |

| Monthly Crypto Limit | $150,000 | $150,000,000 |

BingX KYC Requirements

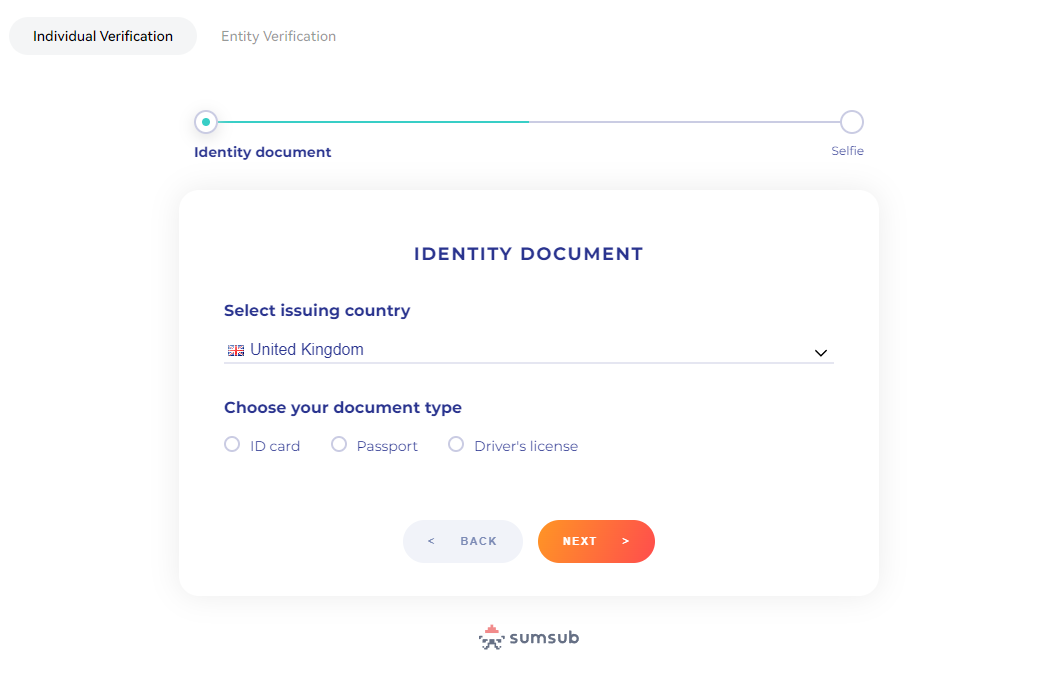

If you want to verify your identity on KYC, you must provide personal details, including a government-issued ID, Passport or Driver’s License, and a live selfie. That means your device must have a webcam that you can use for facial recognition. The BingX KYC process is managed by a third-party verification program called sumsub.

Lastly, note that you must reside in a country supported by BingX. If you are in a restricted area, such as the United States, you can not use BingX.

Is BingX legit?

BingX is a legit crypto exchange licensed in several regions. The BingX Group is an international digital services financial institution with a focus on crypto products. For more information about BingX, refer to the BingX website or contact the official BingX compliance team at compliance@bingx.com.

BingX US LIMITED is registered as a Money Services Business (MSB) under the Financial Crimes Enforcement Network (FinCEN) of the US Department of Treasury with approval to engage in FX activities. (Registration No.: C4809450; License No.: 31000204096551)

BINGX CA LIMITED is registered as a Money Services Business (MSB) under the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) in both FX Dealing as well as Dealing in Virtual Currencies. (Registration No.: 1350703-3; License No.: M21534025)

BINGX GLOBAL PTY LTD is registered as a Digital Currency Exchange (DCE) provider under the Australian Transactions and Reports Analysis Centre (AUSTRAC). (Registration No.: 644804571; License No.: 100725677-001)

BINGX EU UAB is a registered financial service company in Lithuania, a member of the European Union, and is recognized and regulated by the Financial Crime Investigation Service (FSIC) as a digital currency exchange. (Registration No.: 305995741, license no: 4400-1839-5132)

If you want to learn more about BingX, you can read our comprehensive BingX review.