Binance is the largest crypto derivatives exchange, regularly reaching a daily trading volume of over $30 billion. In this guide, we will show you everything you need to know about Binance futures trading.

For a broad overview of the exchange, you can read our full Binance review.

Opening a Binance Futures Account

You need to have a Binance account before you can open a Binance Futures account. For Binance sign up, go to Binance and click the “Register” button on your screen.

After this, you will need to put in your email address and create a secured password. If you have one, put your referral ID into the box designated for it. Click on “Create Account” to proceed.

Binance will send you a verification mail; complete your registration by following the instructions in the mail.

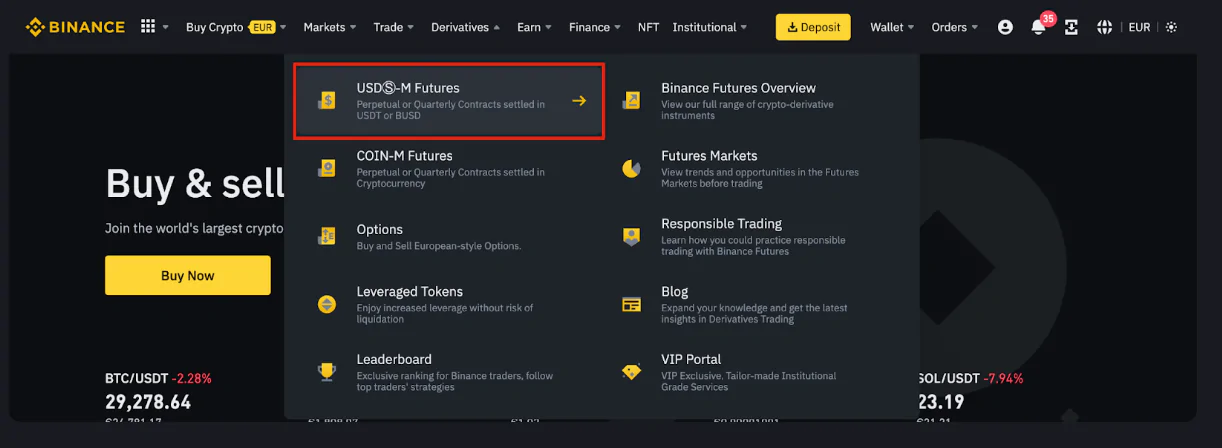

With your regular Binance account in place, you are ready to create your futures account. Sign in to your Binance account, locate the “USD(S)-M Futures,” and click on it.

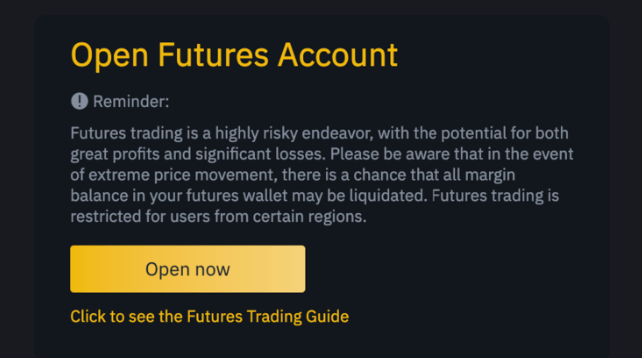

Next, you’ll see an “Open now” button; click on it to activate your Binance Futures account. With these steps, you can now trade Binance futures.

Funding your Binance Futures Account

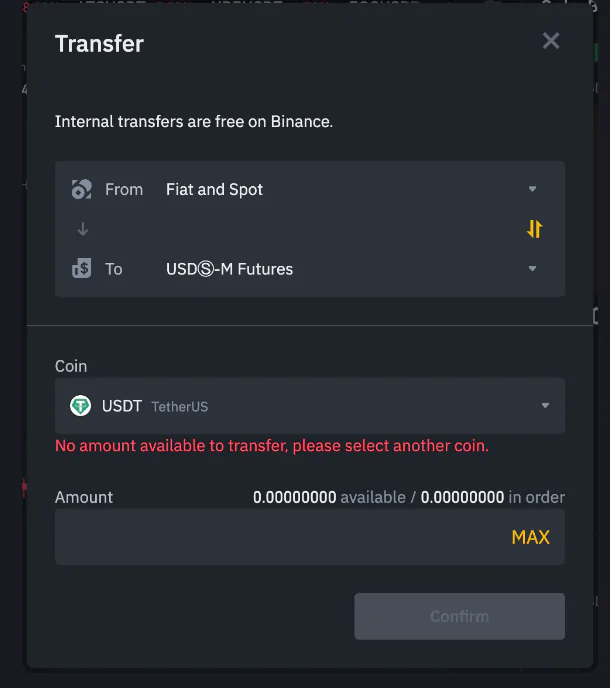

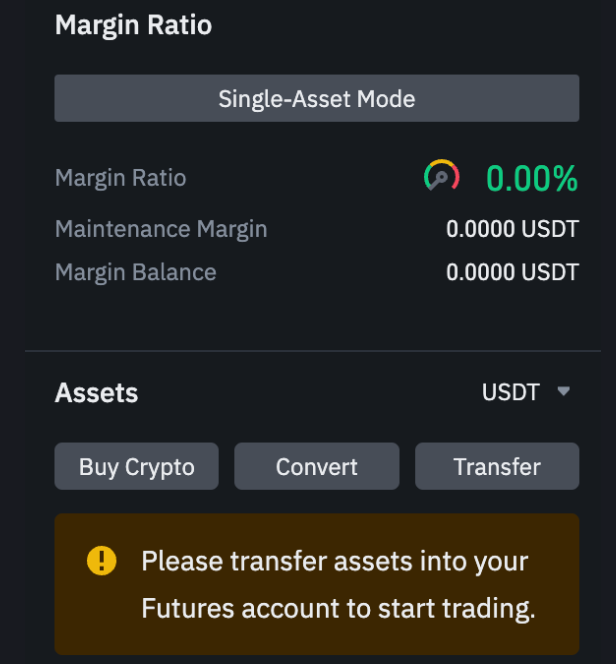

Funding your Futures account is quite easy. However, you must have funds in your Binance account as this is what you’ll transfer. Note also that it does not matter what wallet the fund is -Funding, Margin, Fiat and Spot, Margin, or options – you can transfer safely. Follow these steps to fund your Futures wallet.

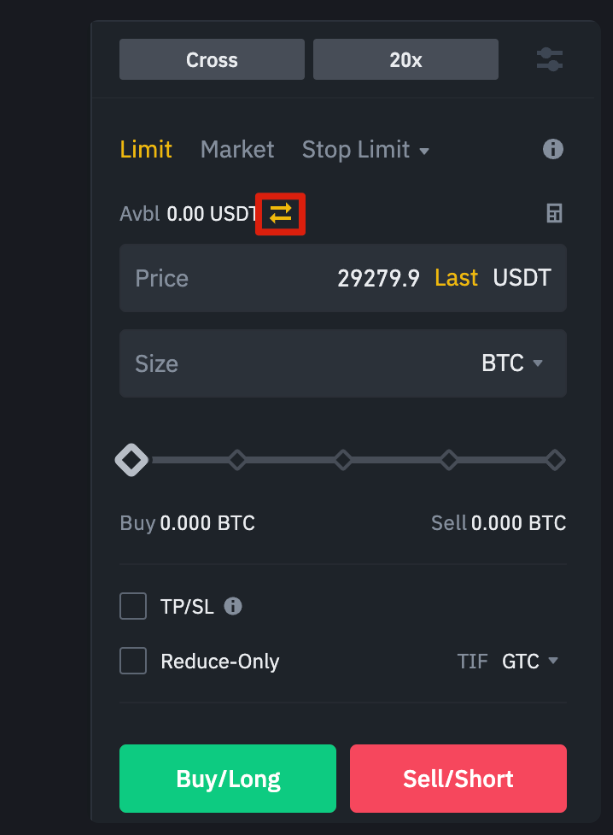

- Navigate to the right side of the Binance Futures page and click on the “transfer” icon.

- Next, you set the amount you want to transfer and specify the wallet you are transferring from. Click on “Confirm.”

With these steps, the amount you set will immediately go to your Futures wallet.

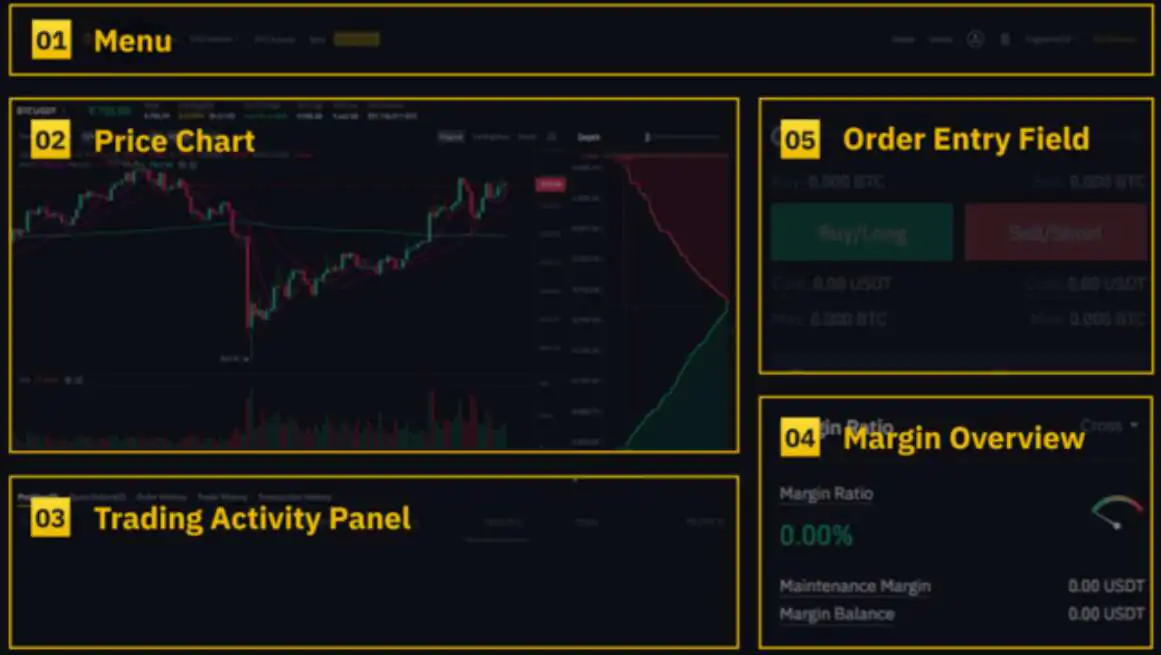

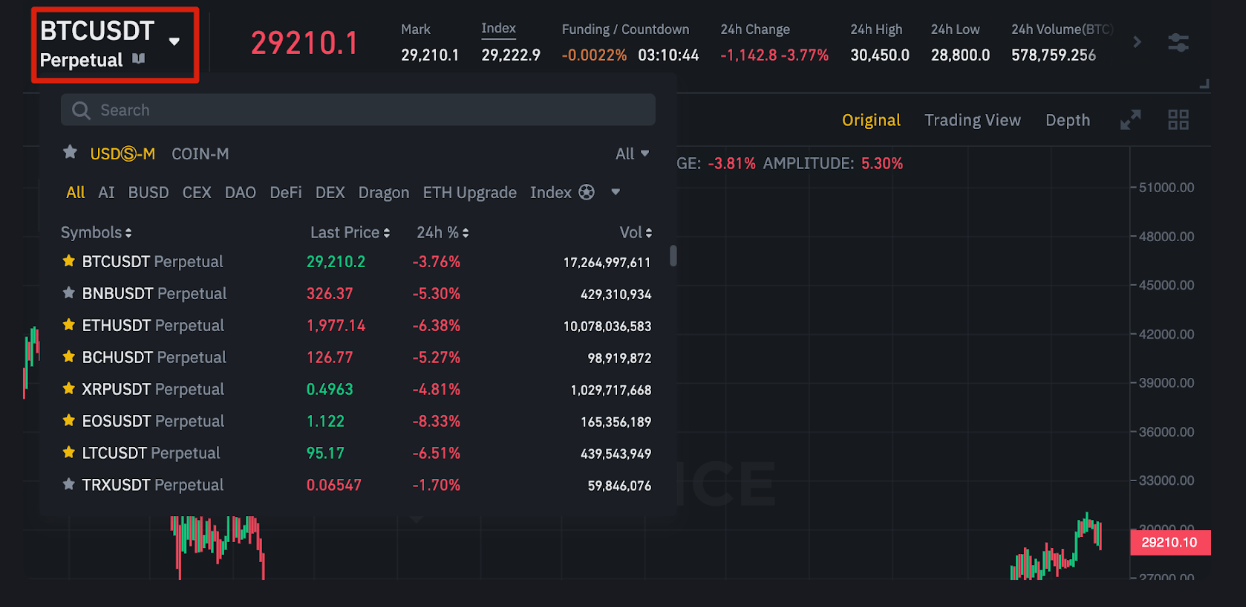

Understanding the Binance Futures Interface

1. Menu: The “Menu” area is where you will find links to other pages available on Binance – Options, COIN-M Futures, Strategy Trading, and Activities. There’s also the “Information” tab, where you will find links to the FAQ section and market data like funding rate, index price, etc.

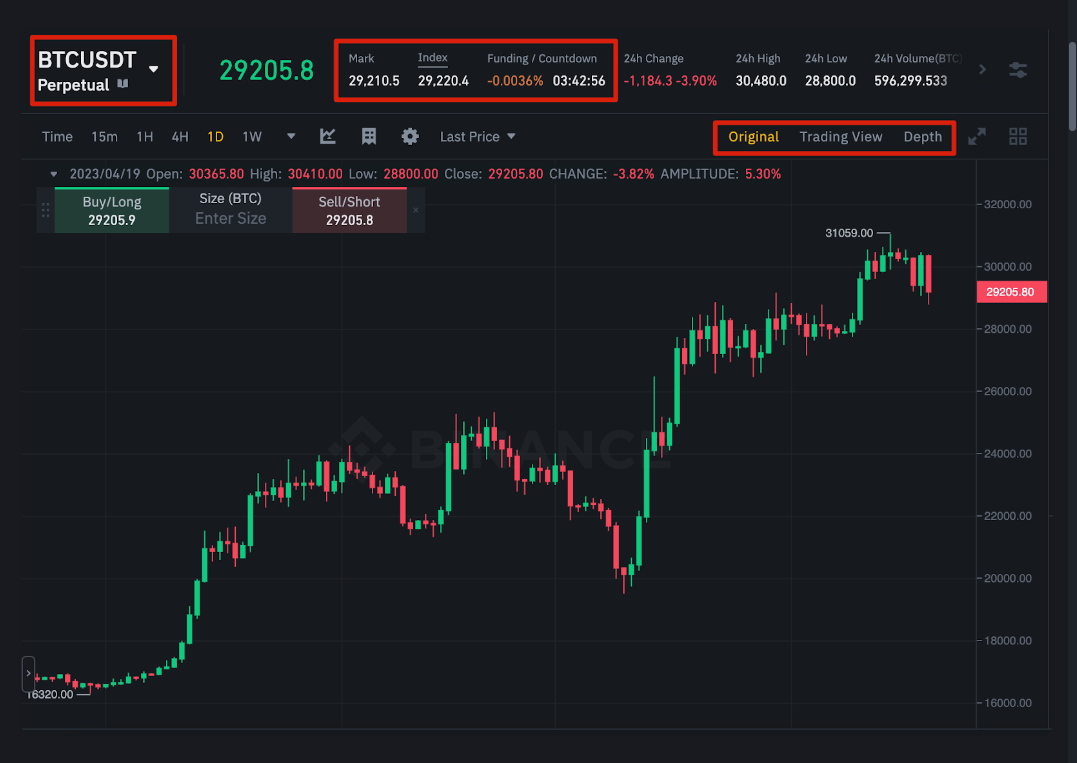

2. Price Chart section: There are a number of things you can do here:

- You can pick a contract by hovering your mouse on the contract’s name.

- You can check the Mark Price.

- You can also check the expected funding rate and time till the next round of funding.

- You can see your current chart. The interface allows you to toggle between the original and the integrated TradingView chart. Click the “Depth” button to get a live display of the current order book depth.

- You can view the order book data and adjust its accuracy via the dropdown menu

- Finally, you can view a live feed of past trades on the platform

3. Trading Activity Panel: This panel allows you to actively watch your futures trading. There are various tabs in this panel, and you can switch between them to see the current status of your position, currently open and previously executed orders, and even transaction history.

4. Margin Overview section: Here, you can view your available assets, transfer, and purchase crypto. You will also find information about the current contract and your positions in this section.

Note: You can transfer funds between your Futures wallet and the rest of the Binance ecosystem by simply clicking on “Transfer.”

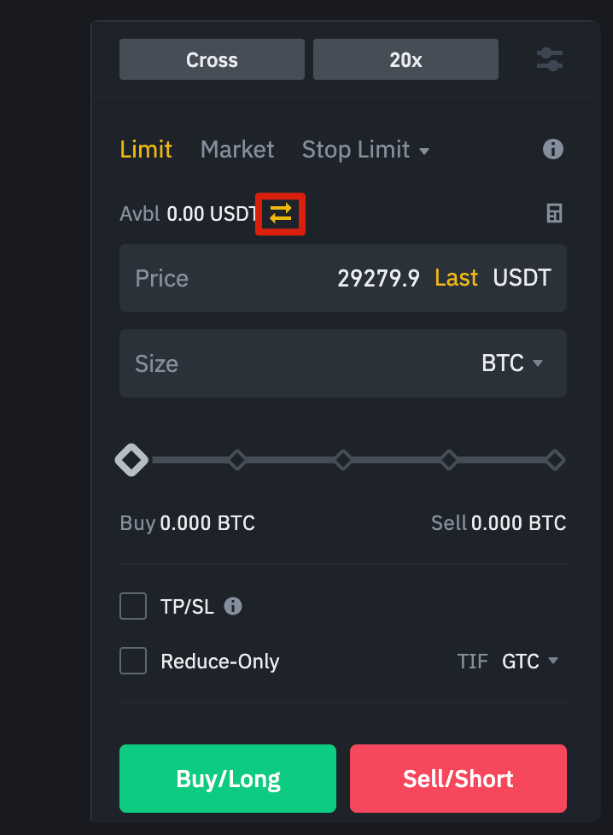

5. Order Entry field: Your Buy/Long and Sell/Short orders go into the Order Entry field

Binance USDT-M vs Coin-M Futures

Traders on Binance can use the platform’s wide range of cryptocurrency derivatives. These derivatives include, among others, COIN-margined and USDT-margined futures. Because each of these has characteristics peculiar to it, they offer different merits and demerits, which in turn influence your trading strategies.

COIN-Margined Contracts:

Pros:

Settlement in Crypto: COIN-margined contracts are denominated and settled in the underlying cryptocurrency; hence, there is no need to use stablecoins as collateral. Miners and long-term investors especially find this beneficial.

Long-Term Holding Benefits: Holding COIN-margined contracts when the market is on the upside allows investors to put profits directly into their long-term crypto holdings, taking advantage of rising prices,

Hedge Without Converting: With COIN-margined futures, miners and long-term investors can hedge positions without having to convert their holdings into USDT. This helps them to dodge compromised market prices.

Cons:

Expose to Price Volatility: Traders must put tight risk control measures in place because of the underlying collateral’s exposure to price volatility. Cryptocurrencies often experience high volatility, requiring quick reactions to hedge against downside risks.

Non-Linear Payout Structure: COIN-margined futures show a non-linear payout structure, where changes in the price of the underlying asset may not proportionately translate to profits or losses in BTC terms.

USDT-Margined Contracts:

Pros:

Stablecoin Settlement: USDT-margined contracts provide a stable and easily calculatable fiat value for profits and losses because the contracts are settled in USDT.

Flexibility and Reduced Fees: A universal settlement currency like USDT offers flexibility across various futures contracts, eliminating the need to buy underlying coins and reducing fees associated with conversions.

Mitigating Volatility Risk: During high market volatility, USDT-margined contracts can help to reduce the risk of huge price swings, thereby providing a more stable trading environment.

Cons:

Allocation to USDT: Using USDT-margined contracts requires traders to allocate a significant portion of their portfolio in USDT, which unfortunately does not appreciate in value and, hence, is a turn-off for some cryptocurrency investors.

How to Adjust Your Leverage

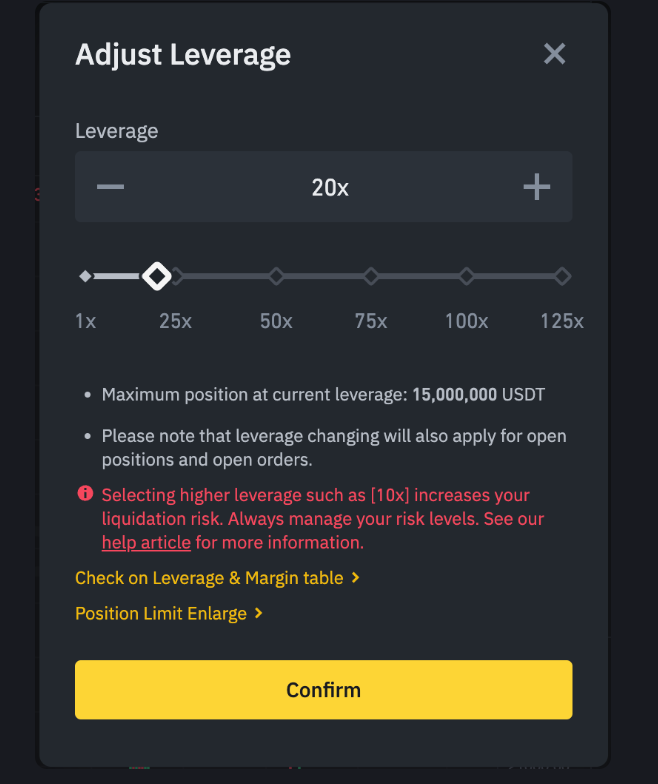

To modify your leverage on Binance Futures, navigate to the upper left corner:

- Hover over the existing contract (normally BTCUSDT).

- Access the “Order Entry” segment, and select your current leverage (usually 20x).

- Adjust the leverage by moving the slider or inputting a specific value, then click “Confirm”

It’s crucial to note that larger positions mean reduced leverage, while smaller positions allow for increased leverage. Opting for higher leverage heightens the risk of liquidation. Traders must conscientiously evaluate leverage amounts, considering the associated risks.

Cross Vs Isolated Margin

Understanding the difference between Cross and Isolated margins is very important when trading Binance futures. Cross margin uses up your account balance to back up all your open positions, affording you a better approach to risk management. Cross margin allows for more flexibility and the potential to withstand larger market fluctuations. Still, it also implies that profits or losses from one position affect the margin of your entire accounting, exposing you to a higher risk level.

Isolated margin, on the other hand, takes a different approach. It allocates only a specific amount of margin for each open position, creating a distinct separation of risk between trades. In essence, this implies that losses in one position do not directly affect your account balance or the margin in the other positions.

The one traders pick between cross and isolated margin usually depends on their trading strategy and risk tolerance.

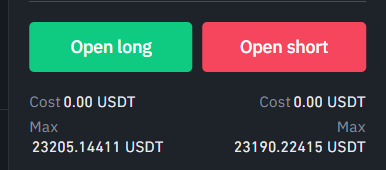

Binance Long vs Short explained

Long and short positions on Binance denote the directional outlook a trader holds for an asset’s price movement. Going long signifies an expectation of a price increase, while going short involves a bet on a price decrease.

When a trader goes long on Binance, they are purchasing an asset with the anticipation that its value will rise. For instance, if one goes long on Bitcoin at $50,000 and the price increases to $60,000, a profit is realized from the $10,000 upswing.

Conversely, going short on Binance entails selling an asset, with the foresight of its price declining. Should a trader short Bitcoin at $50,000 and its price drops to $40,000, a profit is generated from the $10,000 descent. Long and short positions on Binance offer traders the flexibility to capitalize on both upward and downward market movements based on their market predictions.

Binance Hedge Mode vs One Way mode

Hedge Mode in Binance Futures allows you to simultaneously hold both long and short positions for the same trading pair, providing a way to hedge against fluctuations in the market and reduce risks. This strategy is particularly useful during periods of market uncertainty.

One-Way Mode, on the other hand, takes a more simplified approach. It allows you to hold only one of long or short positions at any given time for a particular trading pair. This straightforward strategy is ideal for traders who prefer a more traditional and linear trading strategy without simultaneous long and short exposure.

Understanding Binance Futures Order Types

Limit Order

A limit order refers to an order with a specific limit price placed on the order book. With a limit order in place, the trade will execute only if the market price hits your set limit price. With limit orders, you can buy at lower prices or sell at higher prices than the current market price.

Market Order

Market order allows you to buy or sell at the best price based on what the market is saying. A market order will execute against the limit orders you previously placed on the order book. Note that placing a market order will cost some fees as a market taker.

Stop-Limit Order

- Comprises a stop price and a limit price.

- The stop price triggers the limit order, immediately placing it on the order book.

- The stop and limit prices can vary, offering flexibility.

- Effective for enhancing the chances of order fulfillment after reaching the stop price.

Stop Market Order

- It is similar to a stop-limit order but triggers a market order upon reaching the stop price.

Take-profit Limit Order

- Involves a trigger price and a limit price, added to the order book.

- Exclusively used to reduce open positions, manage risk, and secure profits at predetermined levels.

- Works well in tandem with other order types, providing enhanced control over positions.

Take-Profit Market Order

- It functions like a take-profit limit order but triggers a market order instead.

Trailing Stop Order

- Facilitates profit locking while limiting potential losses on open positions.

- For long positions, the trailing stop moves with the price increase.

- In the case of price decrease, the trailing stop halts, and if the price moves a specific percentage in the opposite direction, a sell order is issued.

- Similar principles apply to short positions, with the trailing stop moving down with market decline.

- The activation price triggers the trailing stop, which is customizable at the bottom of the order entry field.

- The callback rate determines the percentage by which the trailing stop follows the price, issuing buy or sell orders based on market movement.

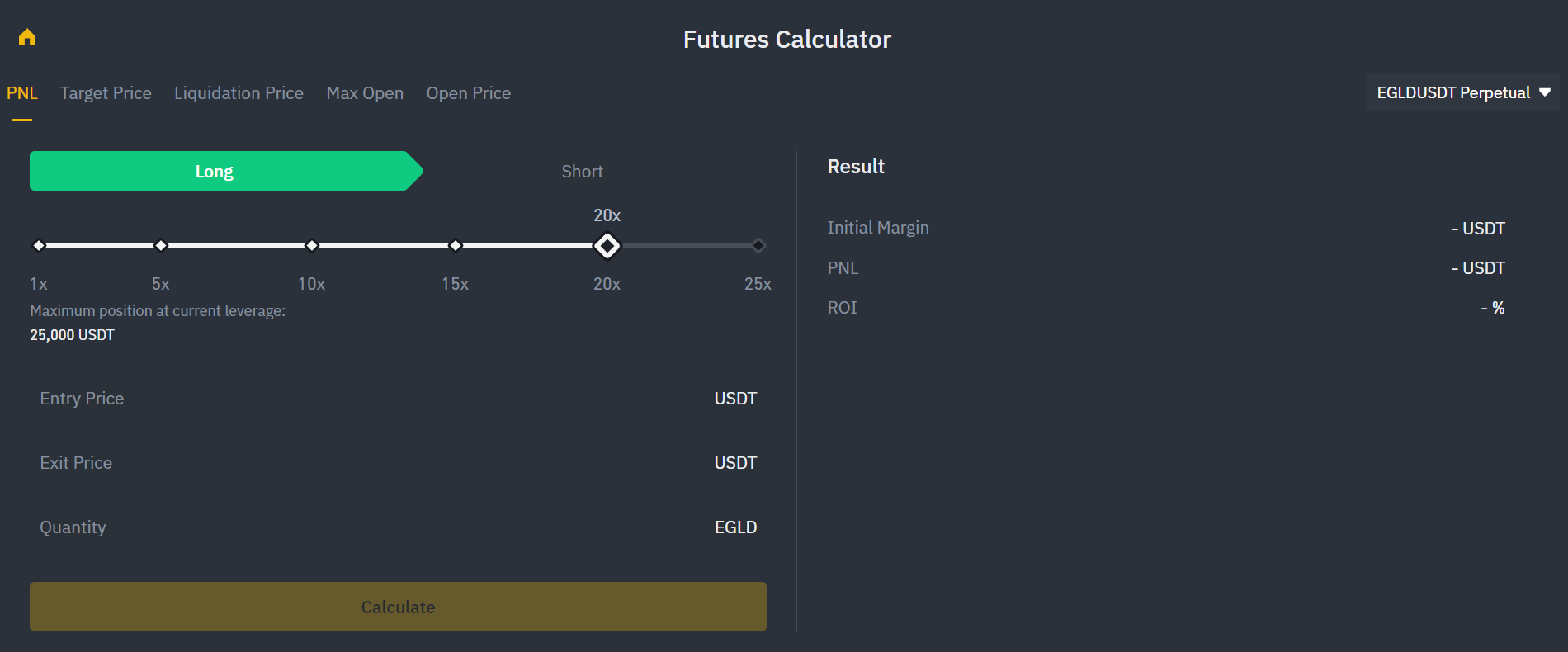

Using the Binance Futures Calculator

Accessing the Binance Futures Calculator is straightforward. Located at the top of the order entry field, this tool empowers you to predetermine values for both long and short positions. Simply manipulate the leverage slider within each tab to establish a foundation for your calculations.

There are three tabs within the calculator:

PNL: This tab facilitates the calculation of Initial Margin, Profit and Loss (PnL), and Return on Equity (ROE). Input your intended entry and exit prices and the position size to derive these metrics.

Target Price: In this tab, you can determine the exit price necessary to achieve your desired percentage return. It streamlines the process of strategizing your position exit.

Liquidation Price: Calculate your estimated liquidation price using this tab. Consider factors such as your wallet balance, intended entry price, and position size to gauge potential liquidation scenarios.

Efficiently utilize these tabs to enhance your decision-making process and optimize your trading strategies on the Binance Futures platform.

Bottom Line

Because of its complexity, there are a lot of risks involved in trading futures on Binance. It is imperative that you understand the derivatives (as explained above) for effective trading. Starting out, the Binance Futures platform could be a little intimidating and tricky to navigate. However, referring to our full Binance review will help you understand all you need.

Remember that as much as you can make money trading futures, occasional losses is inevitable as well because of the crypto’s high volatility

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)