- •Regulatory clarity has removed major uncertainty and reopened the path for adoption.

- •Execution is critical, Ripple and XRPL must turn products and partnerships into real utility.

- •Price outlook is wide, with projections from $3.50 to $38 by 2030, depending on adoption and momentum.

XRP price prediction has gained fresh focus after Ripple settled its SEC case for 125 million dollars. The deal ended years of uncertainty, fueled an 11% rally, and reopened doors for relistings and institutional use. The question now is simple: can XRP

Loading...

hit 5 or even 10 dollars? In this guide, we’ll explore the drivers that matter. Markets may be unpredictable, but patterns shaped by news and adoption give direction. With legal clarity back in place, the real debate is how far XRP can scale in the coming years.

Historical Pattern: Volatility, Consolidation, and Continued Development

XRP’s journey has always been defined by volatility, but also by resilience. Since launching in 2013 at just $0.00589, it has seen some of the sharpest cycles in crypto. The 2017 bull run took XRP up an unbelievable 64,000% to $3.84, only for it to fall 96% to $0.25. The SEC lawsuit in 2020 added more pressure, sending it down to $0.20. Yet, every collapse was followed by recovery. In 2021, XRP surged 875% to $1.95 before another pullback.

More recently, it rallied from $0.58 in late 2024 to $3.65 by July 2025, and has held above $2.00 for over 200 straight days, a first in its 12-year history. This kind of consistency points to maturity, supported by regulatory clarity, institutional flows, and ongoing ledger upgrades. Despite the turbulence, XRP has consistently managed to stay within the top three cryptos by market cap, underscoring its long-term strength.

Ripple (XRP)

New TokenToken Symbol

XRP

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

What’s Really Moving XRP: The Fundamental Drivers

XRP’s recent performance isn’t just about speculation; it’s being shaped by some very real fundamentals. With the SEC battle behind it, Ripple has entered a new phase where regulation, adoption, and ecosystem development play a larger role in price movements.

Bullish Catalysts

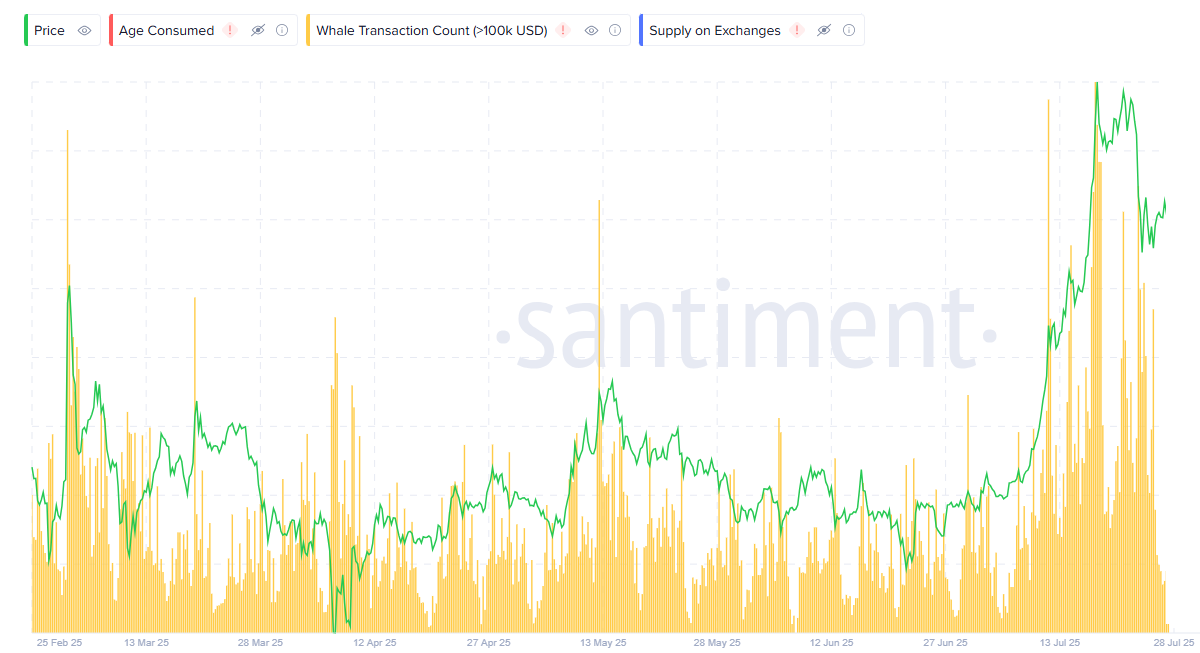

Regulatory clarity in the U.S. has been the single biggest driver. With appeals dismissed in 2025, XRP now enjoys a status few altcoins can claim: institutional confidence. Whale accumulation, highlighted in Santiment’s data, reinforces this trend and shows conviction among large holders. Ripple’s launch of RLUSD, a compliant U.S.-backed stablecoin, further expands ecosystem activity, bringing in more transaction volume onto the XRP Ledger.

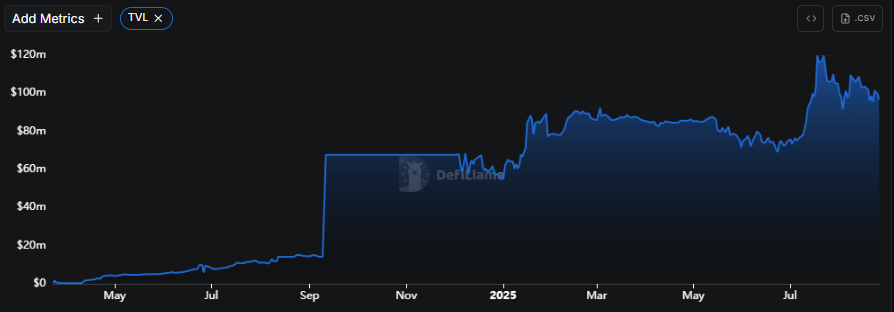

While stablecoins don’t replace XRP, they increase XRPL activity, where XRP is still the settlement token and fee asset. Meanwhile, ETFs and enterprise adoption via On-Demand Liquidity deepen XRP’s role in cross-border payments, a market worth trillions annually. The rising TVL on DeFiLlama shows how Ripple’s ecosystem is gradually anchoring itself in the broader digital finance landscape.

Bearish Pressures

But challenges remain. The XRPL’s Automated Market Maker (AMM) and DeFi features are still in their infancy. Liquidity is thin, and building trust takes time. XRP has also repeatedly failed to push beyond the $3 barrier with conviction, raising questions about sustained buying interest. Stablecoin expansion, while positive for ecosystem growth, could also compete with XRP’s original function as a bridge asset if institutions lean too heavily on RLUSD for stability. Lastly, macro uncertainty and risk-off sentiment in crypto could limit upside momentum, even with strong fundamentals.

Technical Analysis: XRP’s Mid-2025 Setup

Current Price and Market Position

As of mid-August 2025, XRP trades around $3.02, holding its ground at a critical psychological threshold. Every move above $3.00 sparks momentum, while dips below invite caution. With a $179 billion market cap, XRP remains firmly the third-largest cryptocurrency, proof of its staying power despite volatility. Trading volumes have surged, including a $33 million spike as it first crossed the $3.00 barrier.

Technical Setup

Momentum indicators lean bullish but call for patience. XRP trades above both its 50-day EMA ($2.76) and 200-day MA, showing long-term strength. The RSI near 61 signals room to climb before overbought levels. Chart formations add to the optimism: a descending triangle suggests continuation potential, and a cup-and-handle pattern points to a breakout if $3.35 is cleared. Key resistance sits at $3.30–$3.40, with immediate support around $2.85–$2.80.

XRP Live Technical Summary

Market Sentiment

Institutional conviction is strong. Santiment data shows mid-tier whales accumulating even as larger holders take profits, a sign of confidence in XRP’s long-term outlook. Retail sentiment is less stable. Social media conversations reflect FUD during corrections, while the crypto Fear & Greed Index sat at 48 in August, a neutral reading that captures the current tug-of-war between caution and optimism.

Price Outlook

In the near term, a clean breakout above $3.35 could propel XRP toward $3.70–$3.80 by mid-September. If momentum holds, medium-term targets range between $5.00 and $5.50, while bullish extremes stretch to $7–$8 by 2026. On the downside, a break below $2.80 risks a slide toward $2.70 or deeper. For now, the path of least resistance remains upward, but execution on adoption and liquidity will decide how far this rally can extend.

Short-Term Outlook for 2025

Technically, XRP remains in an uptrend, but momentum has cooled with price now trading around $2.92, below the former $3.10 support. The next test is whether bulls can defend the $2.85–$2.80 zone, which has become the immediate floor.

- Bear case: Failure to hold above $2.85 could open a slide toward $2.70 or lower, especially if broader market sentiment weakens.

- Base case: Stabilization around current levels and renewed ETF inflows could support a climb back toward $3.60–$3.80.

- Bull case: A decisive breakout above $3.35–$3.56 with strong volume would flip momentum and create room for a run at $5.00–$5.50.

Even with those scenarios, traders should expect turbulence. XRP has already posted weekly swings of 10% or more in 2025, a reminder that progress comes with volatility attached.

Read more: How to Buy XRP Tokens

Future Outlook and XRP Price Predictions

XRP’s future outlook is characterized by a high degree of optimism driven by regulatory clarity and increasing institutional adoption, but projections for its future price vary widely.

| Year | Bear Case | Base Case | Bull Case |

|---|---|---|---|

| 2026 | $3.50 | $5.20 | $9.00 |

| 2027 | $4.60 | $7.10 | $14.50 |

| 2028 | $5.80 | $10.20 | $21.00 |

| 2029 | $7.30 | $13.80 | $28.50 |

| 2030 | $9.00 | $17.50 | $38.00 |

Bottom Line

XRP has moved beyond the question of survival. The challenge now is execution, whether Ripple and the XRPL can transform regulatory clarity, institutional partnerships, and product innovation into adoption that truly scales. How well that execution unfolds will decide if XRP finally breaks into a sustained growth cycle that secures its role in the future of global finance, or if it risks stalling once again at the resistance levels that have defined its past.

FAQs

1. What was the impact of the SEC lawsuit resolution?

It brought regulatory clarity, restored institutional confidence, and drove new investor interest.

2. Is XRP a good long-term investment?

It has strong fundamentals but remains volatile; suitability depends on risk tolerance.

3. Can XRP hit $5 by end of 2025?

Possible if ETF approvals and institutional adoption continue to build momentum.

4. What is RLUSD and how does it support XRP’s ecosystem?

RLUSD is Ripple’s stablecoin, helping drive network demand and supporting DeFi on the XRP Ledger.