- •Stablecoins are reshaping competition by pressuring banks to share deposit yields fairly.

- •Stripe CEO Patrick Collison believes depositors deserve market-level returns on savings.

- •The GENIUS Act restricts yield-sharing today, but stablecoin growth may soon override it.

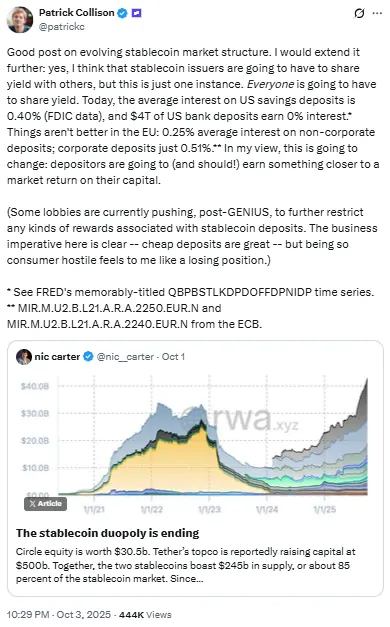

The growing tension between traditional finance and blockchain innovation is once again in the spotlight. Stripe CEO Patrick Collison believes stablecoins will force everyone share yield, reshaping how banks and financial institutions reward depositors. His comments come as the line between digital assets and conventional savings grows increasingly blurred, with stablecoin adoption accelerating across global markets.

Stablecoins, digital assets pegged to fiat currencies like the U.S. dollar or euro, have quietly become a backbone of modern finance. Their ability to move funds globally within seconds, without intermediaries, is pushing traditional banks to rethink how they treat customer deposits. According to Collison, this evolution will soon make it unsustainable for banks to continue offering near-zero interest on savings when on-chain alternatives are offering better returns.

Stablecoins Are Redefining the Yield Game

Responding to a post by venture capitalist Nic Carter on X, Collison highlighted that the average interest rate on U.S. savings deposits stands at just 0.40%, while European deposits average around 0.25%. “Depositors are going to, and should, earn something closer to a market return on their capital”, he wrote. His argument reflects a growing belief that yield-bearing stablecoins could introduce market competition that traditional banks have long avoided.

This shift is partially tied to recent regulatory developments. The U.S. GENIUS stablecoin bill, passed in 2023, laid the groundwork for a regulated stablecoin ecosystem but explicitly prohibited issuers from offering yields. Critics, including Collison, see this as a direct result of banking lobby pressure, a move designed to protect cheap deposit bases rather than consumers. “Cheap deposits are great, but being so consumer-hostile feels like a losing position”, he noted.

Meanwhile, the rise of tokenized assets and yield-bearing stablecoins has captured investor attention. Some protocols now offer stablecoins that automatically distribute yield generated from underlying assets, bridging the gap between DeFi innovation and traditional banking expectations. This dynamic has led many in the crypto sector to predict that all currencies, including dollars, euros, and yen, will eventually exist in stablecoin form.

See also: U.S. Senate Passes GENIUS Act in Landmark Stablecoin Vote

Banks Struggle to Match Market Pressure

While Collison’s remarks reflect a forward-looking stance, many banks remain resistant to change. U.S. lawmakers and financial institutions have argued that allowing stablecoins to offer yield would erode their market share. Senator Kirsten Gillibrand voiced this concern at the DC Blockchain Summit, questioning whether stablecoin issuers should be allowed to pay interest at all.

However, the numbers suggest that banks may have little choice but to adapt. With trillions in deposits currently earning near-zero returns, depositors may begin migrating toward blockchain-based alternatives that provide higher yields and faster access to funds. The GENIUS Act temporarily limits how far this shift can go, but technological and market forces are already setting the stage for broader transformation.

As digital payments become increasingly borderless and user-friendly, the frictionless experience of stablecoins continues to attract both retail and institutional interest. Platforms integrating decentralized finance protocols, such as Crypto.com’s recent move to add Morpho for stablecoin lending, are further demonstrating how accessible and competitive blockchain-based yield systems can be.

The Shift That Could Reshape Global Finance

Patrick Collison’s statement that stablecoins will force everyone share yield highlights more than just a market adjustment, it signals a systemic change in how capital flows between consumers, banks, and digital platforms. While regulatory hurdles remain, the underlying trend points toward a world where yield distribution becomes a baseline expectation rather than a privilege tied to specific institutions.

If stablecoins continue gaining ground, the banking sector may soon face its most significant challenge yet: competing not just on trust or convenience, but on fairness and transparency in rewarding customer deposits. And in that world, yield may finally belong to everyone, not just the banks.