• Paxos stated that it accidentally minted excess PYUSD while running an internal transfer.

• The stablecoin issuer quickly reacted to the situation by burning the surplus tokens.

• Paxos confirmed it had corrected the technical glitch, and no customer funds were affected.

Paxos claims it accidentally minted excess PayPal USD (PYUSD), the official stablecoin of the PayPal network, following a glitch during an internal transfer. The firm stated that it has identified and burned the surplus funds, reaffirming to customers the safety of their funds.

PayPal Confirms Excess PYUSD Minting

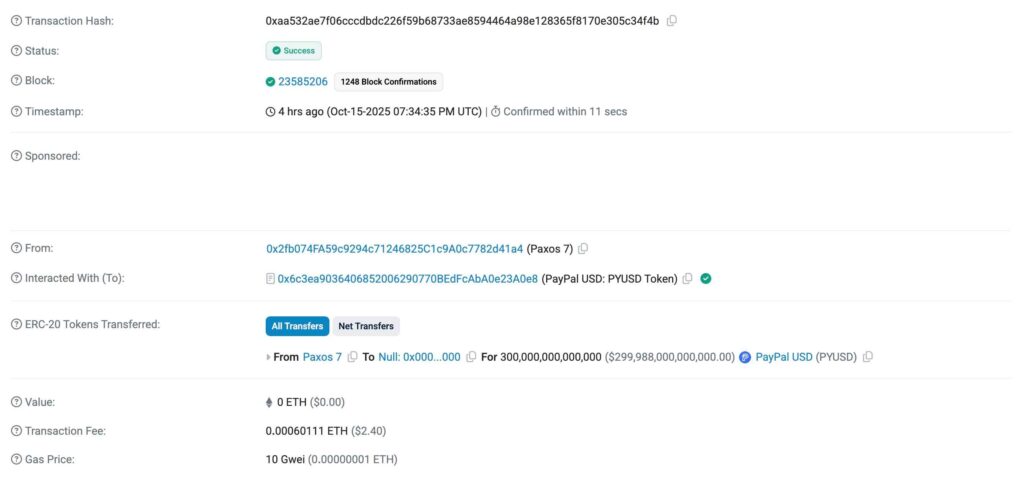

Stablecoin issuer Paxos revealed in an X post on Wednesday that it accidentally printed surplus PYUSD while performing an internal transfer. The firm claims the action was caused by a technical error, which led to the printing of $300 trillion worth of the Ethereum-based stablecoin. The incident occurred at about 3:12 PM ET, and the excess tokens were fully burned about 20 minutes later, according to on-chain data.

Paxos confirmed that the event had no effect on customer funds and that the error has been solved. The excess minting ranks among the largest errors ever recorded in crypto, an amount comparable to the entire global debt, and far exceeding the total cryptocurrency market cap and the roughly $2.4 trillion currently in global circulation.

A Wider Call For Caution

Stablecoin issuers typically retain greater control over such technical errors, which makes these incidents less damaging than irreversible mistakes, such as sending Bitcoin (BTC) to an incorrect wallet address.

Regardless, the episode underscores the importance of caution when dealing with fiat-pegged digital tokens. Stablecoins are designed to maintain a 1:1 value with their fiat counterparts and be fully backed by reserves. Still, events such as this often raise questions among market participants about the transparency and safety of fiat-pegged assets.

In 2019, Tether had also mistakenly minted around $5 billion in USDT before correcting the error. Such mistakes aren’t unique to crypto. In traditional finance, firms have also fallen victim to fat-finger blunders. Last year, Citigroup accidentally credited a client with about $81 trillion before discovering and reversing the error within hours.

PYUSD’s Growth Amid a Fast-Paced Stablecoin Market

PayPal rolled out PYUSD on August 7, 2023, as a US dollar-pegged stablecoin operating on the Ethereum network. Each PYUSD token is backed by a reserve of dollar deposits, short-term Treasuries, and cash equivalents, ensuring a 1:1 parity with the US dollar. The stablecoin has amassed a market cap of $2.64 billion and a daily trading volume of $294 million, according to CoinGecko data.

While PYUSD’s presence in the broader stablecoin market remains relatively modest, it’s gaining meaningful traction among corporate users. A recent EY-Parthenon survey revealed that 36% of the firms polled currently use PYUSD, giving it an edge over Ethena’s USDe and Sky Protocol’s USDS, both of which command larger market capitalizations.

In a separate development this week, PayPal unveiled PayPal Links, a new feature that will allow users to send and receive Bitcoin, Ethereum, and PYUSD in peer-to-peer transfers. The rollout will begin in the US, with global expansion expected to follow in the coming months.