- •Kadena announced it will cease all business operations immediately, citing unfavorable market conditions.

- •The KDA token plunged over 50% within hours of the announcement, reflecting shaken investor confidence.

- •Despite the company’s closure, the Kadena blockchain will continue running through miners and community governance.

The blockchain firm Kadena has announced it will cease all business operations immediately, citing market conditions as the main reason for its shutdown. The news, shared through an official statement on X, has sent shockwaves through the crypto community and caused a significant drop in its native token, KDA, making Kadena winds down operations the focal point of current blockchain discussions.

The announcement marks an abrupt end to one of the most ambitious proof-of-work Layer 1 projects launched in recent years. The Kadena team stated that while its organization will dissolve, the blockchain itself will continue to operate independently through miners and community governance. The company has also retained a small internal team to manage the transition and handle operational queries during the wind-down phase.

Kadena’s Shutdown and Token Fallout

According to the official statement, Kadena’s business entity will halt all active maintenance and development immediately. The team emphasized that the Kadena blockchain is not owned or operated by the company, but by independent miners and developers who will continue maintaining network functionality.

Shortly after the announcement, Kadena’s KDA token dropped sharply, falling nearly 60% within 90 minutes, from around $0.21 to $0.12, according to DefiLlama and CoinMarketCap data. At the time of writing, KDA trades near $0.11, down over 50% on the day.

Founded in 2016 by Stuart Popejoy and Will Martino, both former JPMorgan and SEC executives, Kadena was built as a “blockchain for business”, aiming to bring institutional-grade scalability to decentralized systems. The project raised roughly $15 million over multiple funding rounds and once reached a market valuation close to $4 billion during its 2021 peak, when KDA traded above $27.

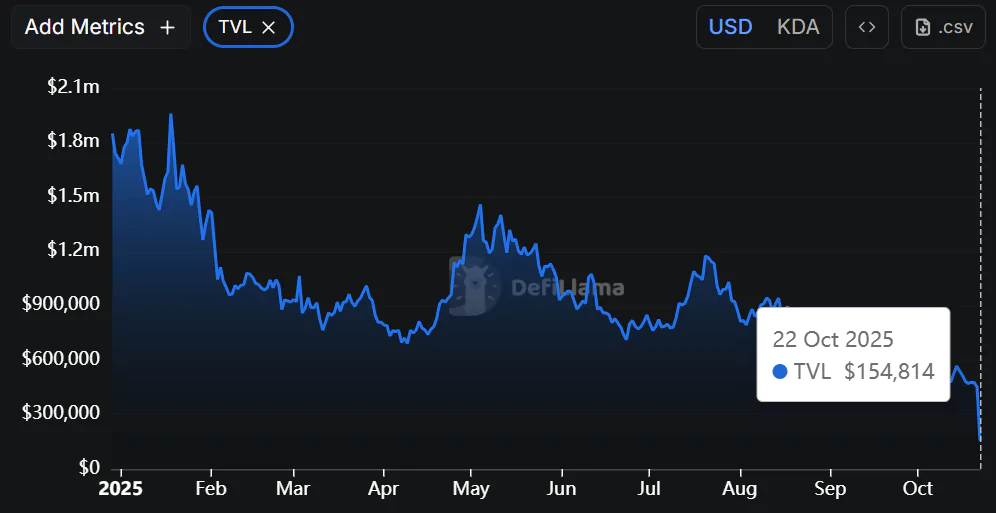

However, the long-term sustainability of smaller Layer 1 blockchains has become increasingly challenging in a competitive landscape dominated by Ethereum, Solana, and Avalanche. Despite several network updates and ecosystem expansions, Kadena’s user base and total value locked (TVL) saw a steep decline in 2025; a drop of nearly 60% within the last quarter, per DefiLlama data.

Network to Continue Under Community Governance

In its statement, Kadena clarified that while the company will dissolve, the network will remain operational through decentralization. Miners will continue to validate transactions, and smart contract maintainers will govern protocols independently.

To ensure smooth network continuity, Kadena said it would release a new binary update that removes organizational dependencies and allows node operators to keep the chain running without company oversight. The team encouraged all node operators to upgrade promptly.

Regarding the KDA token, Kadena confirmed that 566 million KDA will remain available for mining rewards until 2139, while 83.7 million KDA are scheduled to unlock gradually until November 2029. The remaining core team plans to work with the community to establish a transition framework for governance and future protocol maintenance.

The announcement also noted that all employee contracts are being closed, with a minimal staff retained solely for operational and legal winding-down duties. Kadena expressed gratitude toward its partners, contributors, and community members for their support throughout its development journey.

Also read: Coinbase Expands On-chain Reach with $375 Million Echo Acquisition

What’s Next for Kadena’s Legacy?

Kadena’s closure underscores the shifting realities of blockchain competition, especially for proof-of-work chains striving for relevance in a market leaning toward energy-efficient models. While the company’s exit represents a significant moment for its followers, the Kadena blockchain itself will continue functioning as an open, miner-operated network.

Whether the community can sustain the project’s development and governance remains uncertain, but Kadena’s decentralized foundation leaves the door open for future evolution under new leadership. For now, Kadena winds down operations remains one of 2025’s most defining events in the crypto landscape, a reminder that innovation alone does not guarantee longevity in the blockchain space.

- Kadena Official Announcement on X – (Oct 21, 2025)

- The Block – Kadena winds down operations, KDA token drops 60% – (Oct 21, 2025)