- •France says it may block crypto companies licensed in other EU countries if regulatory gaps under MiCA are not addressed.

- •France, Italy, and Austria are calling for the European Securities and Markets Authority (ESMA) to supervise major crypto firms.

- •The three countries also propose stricter MiCA rules, stronger cybersecurity oversight, and tighter control of activities outside the EU.

France says it may block crypto companies licensed in other EU countries, a move that could reshape how digital asset firms operate under the European Union’s MiCA framework. The country’s financial watchdog has raised concerns that some companies are seeking licenses in jurisdictions with more lenient standards, putting investors at risk. This step marks France’s strongest warning yet and highlights growing tension over how the EU’s first comprehensive crypto regulations are being enforced.

France’s Concerns Over MiCA Passporting

The Autorité des Marchés Financiers (AMF), France’s securities regulator, told Reuters that it is worried about regulatory shopping, where crypto companies seek out EU member states with lighter licensing requirements. Under MiCA, or Markets in Crypto-Assets Regulation, firms licensed in one EU country can “passport” their license to operate across the bloc.

Marie-Anne Barbat-Layani, AMF’s chair, said the regulator does not rule out refusing EU passports if it believes supervision is inadequate. She compared such a move to an “atomic weapon”, emphasizing that while legally complex and politically sensitive, it remains a tool available to France.

Push for Centralized Oversight

France has joined Italy and Austria in urging lawmakers to give supervisory power over major crypto firms to the European Securities and Markets Authority (ESMA), which is based in Paris. According to a position paper seen by Reuters, the three regulators believe centralized oversight would close supervision gaps and create a level playing field for companies across the EU.

In their joint statement, they argued that the first months of MiCA’s implementation have shown major differences in how national regulators apply the rules. ESMA head Verena Ross has previously said she would welcome greater authority, though some EU members remain cautious about transferring power away from national regulators.

Related read: Backpack EU Launches Business Operations With Derivatives Approved by CySEC

Specific Cases and Regulatory Gaps

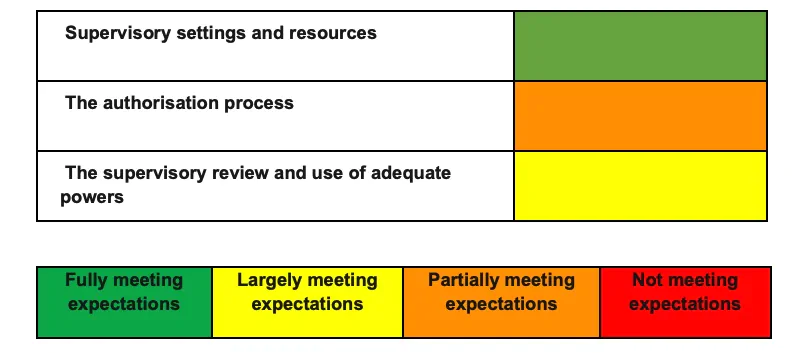

The discussion comes at a time when Malta’s licensing regime has drawn scrutiny. ESMA’s peer review earlier this year found that Malta’s regulator only partially met expectations when approving a crypto service provider’s license. The report recommended closer monitoring of authorization processes and faster adjustments to supervisory practices.

Luxembourg recently granted a MiCA license to Coinbase, while Malta approved Gemini. These examples underline how different EU states are moving at their own pace in granting licenses during MiCA’s transition period, raising questions about consistent investor protection.

Call for Stronger Rules

In addition to calling for ESMA oversight, France, Italy, and Austria have suggested revising MiCA to include stricter rules for activities outside the EU, enhanced cybersecurity requirements, and a review of how new token offerings are managed. These proposals aim to prevent regulatory arbitrage and strengthen investor trust in the European crypto market.

What This Could Mean for EU Crypto Regulation

France says it may block crypto companies licensed in other EU countries, but the step is described as a last resort. The country’s call for centralized oversight and tighter rules shows the EU’s crypto framework is still evolving. Whether this leads to stronger, more consistent regulation across the bloc will depend on how quickly lawmakers address the current gaps and align supervision standards.