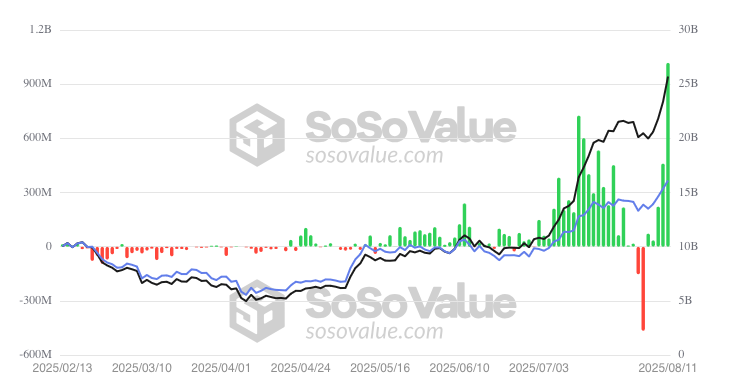

- •Spot Ethereum ETFs recorded a $1.01B net inflow on August 11, 2025, their largest single-day inflow to date, led by BlackRock and Fidelity.

- •Ethereum ETFs now hold $25.71B in assets, representing 4.77% of ETH’s market cap, as institutional demand shifts from Bitcoin to Ethereum.

- •Over 50% of ETH issued since the Merge has been bought by ETFs, highlighting their growing role in absorbing new supply.

Spot Ethereum ETFs posted their highest single-day net inflow on August 11, 2025, totaling $1.01 billion. Data from SoSoValue shows that the surge was driven primarily by BlackRock’s iShares Ethereum Trust ETF (ETHA) with $640 million and Fidelity’s Ethereum Fund (FETH) with $277 million. Grayscale’s Ethereum Trust added another $80 million.

This marked the first time daily net inflows for Ethereum ETFs crossed the $1 billion threshold since their launch, signaling heightened interest from both institutional and retail investors. The milestone comes after a period of steady gains, with Ethereum up about 45% in the past 30 days, trading around $4,300.

Institutional Momentum and Market Impact

Ethereum ETFs now hold an estimated $25.71 billion in net assets, representing 4.77% of ETH’s market capitalization. The increased demand has also shifted attention away from Bitcoin ETFs, which recorded $178 million in daily inflows on the same day and are seeing monthly net outflows in August.

The ETF record flow was accompanied by a surge in trading volume, with Ethereum ETF turnover reaching $2.725 billion on the day, according to Coin World. Large investment firms, including BlackRock and Bit Digital, have reportedly increased their ETH exposure, with some shifting strategy to prioritize Ethereum over Bitcoin during the current market cycle.

Drivers Behind the Record Flow

Several factors contributed to the ETH ETF record flow. Analysts point to Ethereum’s transition to proof-of-stake in 2022, which improved scalability and energy efficiency, making the network more appealing to long-term investors. Staked ETH across the network recently surpassed $150 billion, further reflecting confidence in its ecosystem.

Ethereum also maintains a dominant position in tokenized assets, with roughly 58% market share. On-chain data indicates a nine-year low in ETH held on exchanges, 15.28 million ETH, suggesting more investors are moving holdings into long-term storage. Additionally, over 50% of ETH issued since the Merge has been purchased by ETFs, indicating these products are absorbing a significant portion of new supply.

Also read: Top 5 Ethereum Staking Trends

Mixed Reactions from Industry Leaders

While the inflows have been viewed as a sign of maturity for Ethereum’s role in traditional finance, some industry figures have urged caution. Ethereum co-founder Vitalik Buterin warned that the trend of corporations adding ETH to their treasuries could lead to an “overleveraged game” if not managed carefully.

Market analysts remain divided on short-term price direction. Some see the current momentum as part of a long-term growth cycle, while others caution that the recent rally could prompt short-term profit-taking.

Closing Outlook

The ETH ETF record flow underscores Ethereum’s growing acceptance as a core asset in regulated investment products. With sustained institutional demand, high trading volumes, and expanding corporate interest, Ethereum’s position in the broader financial market continues to strengthen. However, as noted by Buterin and other market observers, the long-term stability of this growth will depend on measured adoption and prudent risk management.

If the current pace of inflows persists, spot Ethereum ETFs may remain a central driver in bridging traditional finance with blockchain-based assets, further embedding ETH into the portfolios of mainstream investors.