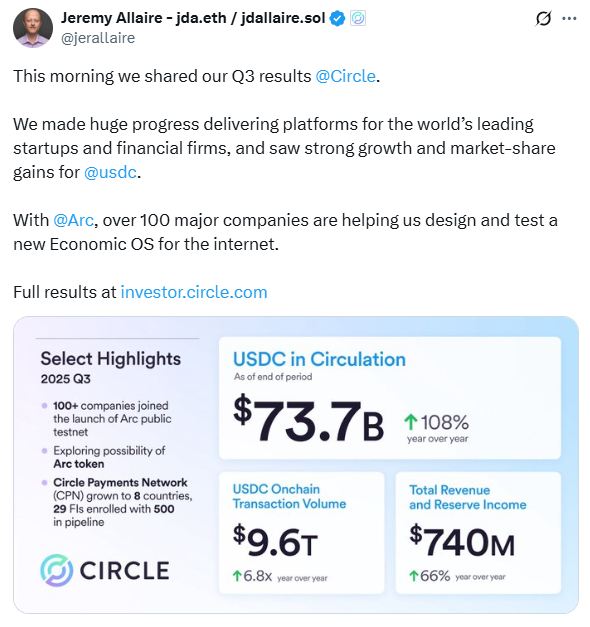

- •Circle reported $740 million in Q3 revenue, up 66% year-over-year, fueled by strong USDC growth.

- •The company plans to issue a native token for the Arc Network as part of its broader on-chain finance expansion.

- •Circle launched its Arc public testnet and introduced USYC, a tokenized money market fund live on Arc.

Circle revealed $740 million in Q3 revenue, marking a 66% rise year-over-year driven by USDC adoption and expanding blockchain initiatives, including plans for a native token on its Arc Network.

Circle Records a Boost in Q3 Performance

Circle Internet Group revealed a strong quarter in a report released on Wednesday, with its total revenue and reserve income reaching $740 million in the third quarter of 2025, a 66% increase from the same period last year. The company’s Net income rose to $214 million, up 202% year-over-year, while adjusted EBITDA climbed 78% to $166 million.

The surge was driven by the accelerating adoption of USDC, which saw its circulation more than double to $73.7 billion, reflecting a 108% increase from a year earlier.

Circle’s CEO Jeremy Allaire described the quarter as one that showcased the company’s growing role in the digital economy. He emphasized that as digital dollars become more integrated with internet-based systems, Circle’s infrastructure is positioning global finance for greater trust, transparency, and speed.

The company’s average USDC in circulation climbed 97% to $67.8 billion, boosting reserve income to $711 million, even as declining interest rates slightly reduced returns on reserve assets.

Related read: Circle is Exploring Reversible Stablecoin Transactions to Tackle Crypto Fraud

Arc Testnet and USYC Lead DeFi Innovation

Alongside its financial report, Circle stated that it is focused on building what Allaire refers to as the “Economic OS for the internet” which is to be as the future of on-chain finance through its Arc Network, a Layer-1 blockchain designed to power payments, capital markets, and foreign exchange on-chain.

The Arc public testnet launched on October 28 with more than 100 financial and technology institutions joining at the outset. Alongside the launch, Circle introduced USYC, its tokenized money market fund, now live on Arc Testnet.

USYC, which has reportedly grown more than 200% since June, reaching about $1 billion in assets under management by early November enables instant redemptions at scale into USDC. It also provides access to short-duration US Treasury yields, can be used as collateral for trading or structured products, and operates as an ERC-20 token for seamless integration.

Circle also revealed that it is exploring the creation of a native token for the Arc network, which would serve to align the interests of participants and drive broader adoption and growth across the ecosystem. Allaire noted that the enthusiasm from industry partners for Arc’s testnet highlights growing momentum around open, programmable financial systems.

Circle Expands Global Ecosystem

Parallel to its blockchain development, Circle has continued expanding its Circle Payments Network, which now operates across eight countries. The network has enrolled 29 financial institutions, with 55 under review and 500 more in the pipeline. Transaction volumes have risen to an annualized $3.4 billion since the network’s launch in May, signaling early traction in Circle’s bid to connect traditional banking with digital asset rails. The company’s tokenized money market fund, USYC, also grew more than 200 percent since June, reaching about $1 billion in assets under management by early November.

While shares dipped slightly after the report, largely due to market expectations of lower interest rates, investor sentiment toward Circle remains positive. The company’s expanding ecosystem, rising stablecoin circulation, and the early promise of the Arc Network reinforce its reputation as one of the central players shaping the future of digital finance.

With USDC adoption accelerating and its infrastructure projects gaining global traction, Circle continues to cement its place at the intersection of stablecoin innovation and the evolving on-chain economy.

- Circle Pressroom – Circle Reports Third Quarter 2025 Results – (Nov 12, 2025)