- •China’s cybersecurity agency accuses the U.S. of seizing 127K BTC originally stolen from LuBian mining pool in 2020.

- •Arkham traced the hacked coins to wallets later tagged as U.S. government-controlled, linking the theft and DOJ seizure.

- •The U.S. denies wrongdoing, calling the bitcoin seizure part of its fraud and money-laundering investigation into Chen Zhi’s Prince Group.

In a recent development, China’s cybersecurity authority, National Computer Virus Emergency Response Center (CVERC), has accused the U.S. government of seizing approximately 127,000 bitcoin in connection with a 2020 hack of the LuBian mining pool. The claim centres on a substantial flow of crypto assets and alleges involvement of a “state-level hacking organisation”. China frames this as more than a routine law-enforcement action, and the dispute adds a new element to U.S.– China tensions in the digital-asset space.

The 2020 LuBian Hack and Subsequent Bitcoin Flows

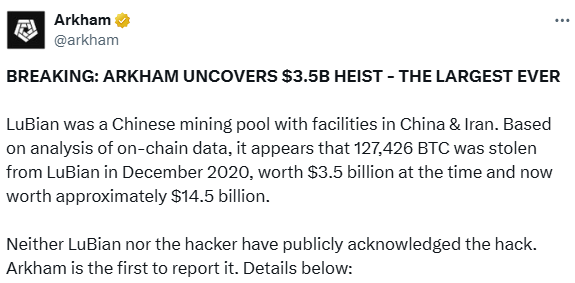

Blockchain intelligence firm Arkham was the first to publicly uncover the LuBian hack in 2024, calling it “the largest crypto theft ever recorded”. On-chain analysis revealed that about 127,426 BTC were drained from LuBian’s wallets in late December 2020. Arkham’s research suggested the mining pool’s private keys may have been compromised due to a flaw in its pseudorandom number generator, leaving the wallets open to brute-force attacks.

The firm later traced the movement of the stolen coins and tagged the destination wallets as U.S. government-controlled, aligning with the Department of Justice’s 2025 forfeiture claim. This connection between the 2020 hack and the later seizure became a central element in China’s accusation that the same entity might have been involved in both events.

According to the Global Times report, the LuBian mining pool was targeted on 29 December 2020, when hackers exploited a system flaw and drained around 127,272.07 BTC (then valued at roughly US $3.5 billion) from wallets tied to the operation.

Between December 2020 and June 2024 the funds reportedly remained largely dormant, with minimal “dust” transactions. In mid-2024 the stash was moved to new wallet addresses which blockchain analytics firm Arkham Intelligence later tagged as U.S. government-controlled.

On 14 October 2025 the United States Department of Justice (DOJ) announced criminal charges against Chen Zhi, founder of Prince Group, and asserted that approximately 127,271 BTC (worth around US $15 billion at current value) were subject to forfeiture.

Related news: US Seizes $15 Billion BTC, Boosts Reserves to $36 Billion

China’s allegations and U.S. Response

In its technical analysis, CVERC characterises the situation as a “typical case of ‘thieves falling out’” and alleges that the U.S. government’s seizure of the coins may effectively have been the culmination of a hacking operation, rather than a conventional law-enforcement forfeiture.

The report states that the origin of the coins traces to LuBian’s wallets and that the pattern of the transfer (a long dormancy followed by movement to U.S.-tagged wallets) diverges from standard criminal-proceeds behaviour.

The U.S. side maintains the seizure was legitimate and tied to fraud, money-laundering and forced-labour investigations related to Chen Zhi and the Prince Group, rather than a covert hacking operation. This clash in narrative introduces a geopolitical dimension to what otherwise would be a blockchain-forensics case.

What This Means For Crypto and Policy

Whether or not the core allegation, i.e., that the U.S. effectively “stole” the 127 K BTC from LuBian via hacking, is substantiated, the dispute underscores that large movements of bitcoin now carry not only financial but also diplomatic implications. For crypto market participants, the sheer scale of the assets and the national-security framing may influence perceptions of risk, regulation and cross-border enforcement.

As governments worldwide expand their focus on digital-asset oversight, this incident may serve as a precedent for how state-level agencies approach wallet tracing, blockchain attribution and asset forfeiture. At the same time, the claim by China may prompt other jurisdictions to scrutinise large-scale crypto seizures more closely, especially when they interface with mining-pool vulnerabilities, key-generation weaknesses and prolonged dormancy of large sums.

In practical terms, operators in the mining and wallet-generation ecosystem may revisit their security protocols, private-key generation practices and incident-response readiness in light of what CVERC identifies as a “systemic risk”.

Also read: US and China Ease Trade Tensions on Trump’s Asia Diplomacy Tour

A Turning Point for Crypto Geopolitics

The allegation that the U.S. may have effectively appropriated 127 K BTC via the 2020 LuBian hack marks a notable shift in how digital-asset disputes are being framed. Crypto is no longer just a matter of markets or technology, it is increasingly a terrain of state-level strategy, forensic debate and legal contestation.

As the narratives from China and the U.S. continue to diverge, the incident stands as a reminder that wallet addresses and blockchain flows may increasingly carry diplomatic weight. Crypto professionals, regulators and observers would be wise to monitor how enforcement, attribution and cross-border coordination evolve in the wake of this case.

- Global Times – China’s CVERC accuses U.S. of stealing 127K BTC through LuBian hack – (Nov 9, 2025)

- CoinDesk – China accuses U.S. of stealing 127K BTC in high-profile crypto hack – (Nov 11, 2025)

- Arkham Intelligence – On-chain analysis reveals 2020 LuBian hack and BTC movement – (Nov 2024)

- U.S. Department of Justice – Chairman of Prince Group indicted and 127K BTC forfeited – (Oct 14, 2025)