Day trading crypto has become a popular way to make money in recent years. Cryptocurrency is an exciting and volatile asset class, offering the potential for significant returns – but how much capital do you need to start day trading crypto?

In this article, we’ll look at How much money to start day trading crypto, how to build a portfolio of cryptocurrencies, how to manage risk when day trading crypto, and the pros and cons of starting out with a small or large amount of money for day trading crypto. So let’s dive in!

1. What is day trading Crypto?

Before answering the question of how much money to start day trading crypto, you must know what day trading is.

Day trading is the daily trading of cryptos, securities (stocks, bonds, etc.) or commodities. In other words, you hold securities until the price you want to sell, and you sell at that price. One thing to note is that day trade is risky and variable. However, if you can continue for a few months, you may be able to make a lot of money.

If you are interested in day trading cryptocurrencies, you should first evaluate your risk tolerance. If you’re used to the potential volatility in the market, start trading. However, if you are unable to cope with large price swings, avoid day trading altogether.

Once your risk tolerance has been determined, then look for an account with a brokerage firm that can do day trading. Many online brokerage firms offer this type of trading, so check them out before you register. Once you’ve opened an account and deposited some funds, the next step is to find the right cryptocurrency for the trade.

In cryptocurrency, Day trading involves buying and selling digital coins on an exchange over a short period of time. Traders will buy low and sell high, or vice versa, in order to make a profit from the difference between the prices. Day traders usually open and close multiple positions every day with the aim of making quick profits based on price fluctuations in the market. Furthermore, they often use technical analysis to determine how the price of a coin will move in the future.

How day trading crypto works: Day trading cryptocurrency works just like day trading any other asset class. You open a position, set your risk parameters, and then wait for the price to move in your favor. You can also use technical indicators and chart patterns to help identify potential entry and exit points in the market. Once you’ve made a profit or hit your stop loss limit, you close the position and either pocket your gains or move on to another trade.

2. How day trading crypto has become popular

Day trading crypto has become popular in recent years due to its amazing gains, high volatility and potential for significant returns. Cryptocurrency is an exciting asset class, offering investors the chance to make quick profits or losses in a very short amount of time. Furthermore, with so many different coins available on the market, there are plenty of opportunities for day traders to take advantage of. Additionally, many online brokerages are now offering day trading accounts specifically for cryptocurrencies. This has made it much easier for people to start trading cryptocurrencies without needing to understand how the underlying technology works.

3. How much money do you need to start day trading crypto

If you want to start day trading Crypto, How much money to start day trading crypto is the most important question. The amount of money you need to start day trading crypto depends on how much risk you are willing to take. If you want to make a profit, starting with a small capital base is best, and then growing your portfolio as you gain more experience in the market.

For example, if you are starting out with $2,000, you may want to invest in 5–10 different coins and then wait for the prices to move. Alternatively, if you have a larger capital base of $20,000, you can diversify your portfolio more by investing in 20–30 different coins. However, this is a passive form of trading. If you want to actively trade we recommend going another route.

Example: Day trading with $50,000

For example, if you have $50,000 to start day trading crypto, you can set your risk parameters and aim for a return on investment of 6% per month. This means that after one month of trading, you could be looking at a profit of $3000, which is a very smart earning. However, it is important to remember that trading is not a stable income. So, some months you earn more, and some months less than 6% ROI. So, please don’t expect to get the same profits each month.

It is also important to remember that you can start day trading Crypto with any amount, even when it is just $100. As you become better at trading, your profits will also grow, as trading is exponential in theory. To conclude, day trading crypto can be a great way to make money from the ever-volatile cryptocurrency market. But in order to make a somewhat decent income, $50,000 is the bare minimum you should have.

Caution: Don’t take 6% profit as a hard and fast rule. This can vary depending on your trading strategy, how well you manage the volatility of the crypto market and how much risk you are willing to take.

As a general rule for actual day trading, you should never risk more than 1% to 5% of your capital on any single trade, although it is best to aim for a risk of 1% to 2%. By following this strategy, you can ensure that any losses are manageable and that your trading is always conducted responsibly.

By understanding the risks and benefits of day trading, you can make the most out of your investment in the cryptocurrency market.

Many crypto exchanges, such as MEXC and Binance, can help you start day trading crypto. They provide easy-to-use platforms that are suitable for both beginner and experienced traders. Furthermore, these exchanges also provide useful tools such as price charts, orderbooks, advanced order types and technical indicators to help you make informed trading decisions.

Ultimately, how much money to start day trading crypto depends on how much risk you are willing to take and how diversified you want your portfolio to be. On top of that, especially as a beginner you should take it slow. Most people lose money in trading because they have unrealistic expecations. Trading is not a get rich quich scheme but rather a way to build up capital in a slow but consistent manner.

So, after how much money to start day trading Crypto is discussed, the next question is which strategies to use for day trading crypto.

4. Strategies for day trading crypto

When how much money to start day trading crypto is discussed, the next important factor is choosing the right strategy. Day trading crypto involves taking advantage of market volatility and exploiting price movements in order to make profits. You can use several strategies for day trading cryptocurrencies, such as scalping, Algorithmic trading, Range Trading, Swing trading, and Arbitrage.

Scalping

Scalping is one of the popular strategies for day trading crypto. It involves quickly opening and closing positions in order to make small profits from fleeting price movements. Scalping is considered to be one of the most aggressive strategies and requires a lot of knowledge and experience to master.

Day traders use Scalping strategies to build up small wins dozens of times and hundreds of times, not to win big wins. Scalping is the fastest-moving trading strategy because Scalpers use large amounts of liquidity to take advantage of short, small price fluctuations.

The timeline can take minutes, seconds, or even hours. Traders are trying to make a profit by taking advantage of the increase in trading volume by keeping track of current news and future events that may trigger price movements. Scalping is one of the best cryptocurrency day trade strategies, as traders can set up bots to make frequent and high-intensity trades according to technical indicators and signals.

Swing trading

Usually, swing trades hold their positions over at least one or more trading sessions, but usually in a few days, weeks or even months. This is a common period; some transactions may last more than a few months, but traders can still consider it a swing trade. Swing trades can also reach their target during a single trading session, a rare consequence of very volatile conditions.

A swing trade aims to capture most of the potential big price movements. Some traders are looking for more volatile cryptos or stocks, while others prefer more stable ones. In any case, swing trading is the process of identifying where the asset price may move next in the bigger picture, holding positions, and gaining a large portion of the profits if the move is realized. Compared to scalping, swing traders take way fewer trades which also means that you do not have to spend as much time on the charts. This can be great, especially for people that work a fulltime job and have a family but still want to start trading.

Range trading

Range trading is another popular day trading strategy for cryptocurrencies. It involves taking advantage of the volatile nature of crypto prices and buying or selling when they reach an upper or lower range of prices, often determined by support and resistance.

The goal of range trading is to capitalize on the natural cycles in the markets, buying low and selling high when prices reach an extreme level. Range traders use technical analysis to identify support and resistance levels that they can take advantage of when executing their trades.

Arbitrage trading

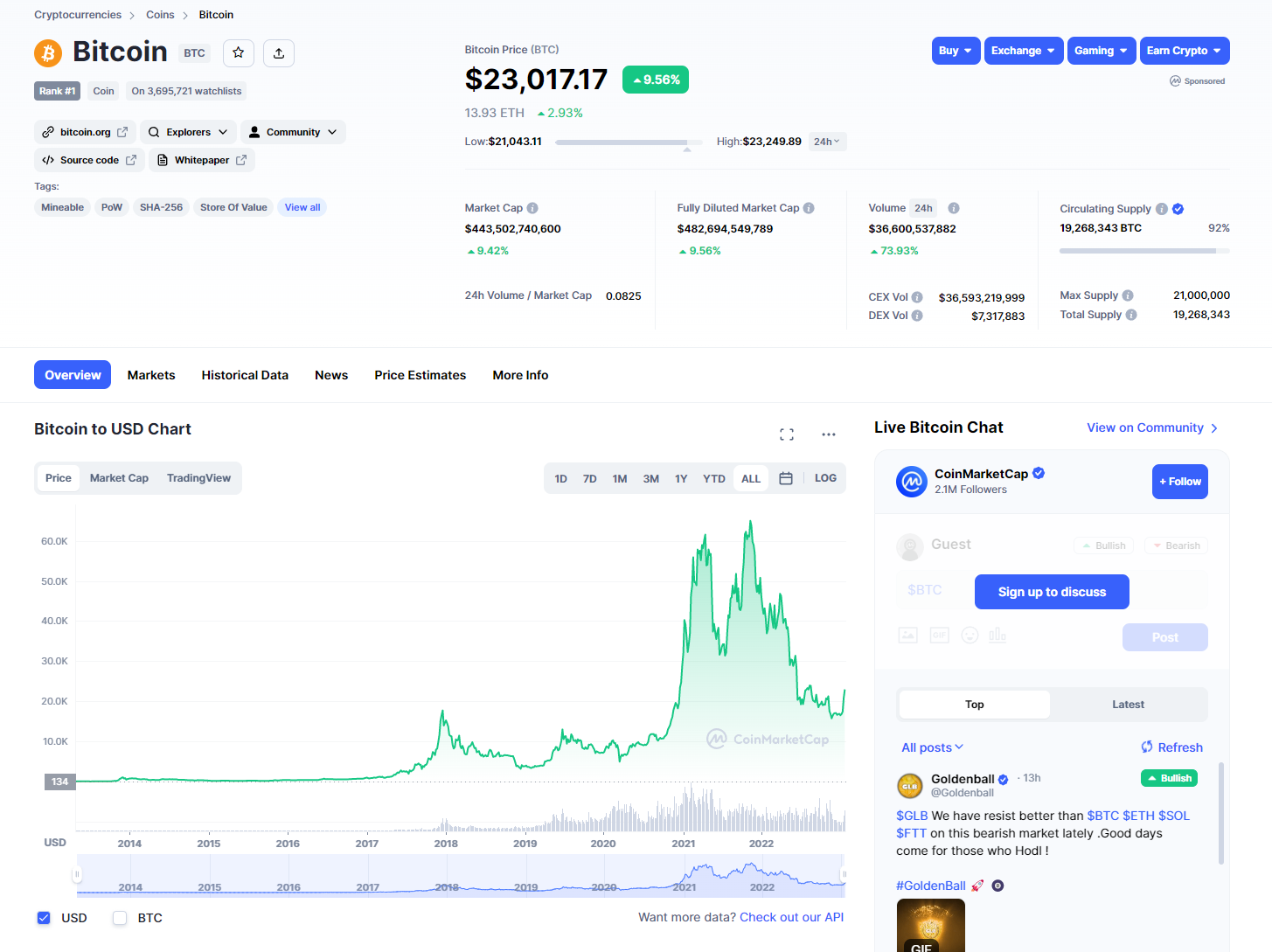

For day-trading Crypto, Arbitrage is another popular strategy. It involves taking advantage of price discrepancies between different markets to make a profit. For example, suppose one exchange is offering Bitcoin at $7000 while another exchange is offering it at $7100 (Please remember that this is just a hypothetical example and not an indication of the actual Bitcoin price). In that case, an arbitrage trader can take advantage of this discrepancy by buying the cheaper BTC on one exchange and then selling it on the other.

This type of trade requires a keen eye and fast reflexes, as the prices can change quickly. Arbitrage trading is considered to be one of the most profitable strategies for day trading crypto. Also, it is important to note that arbitrage trading usually requires a lot more capital than regular trading, as you try to capitalize on even the slightest inefficiency in the market, like a 0.5% difference.

Algorithmic trading

Algorithmic trading is a type of day trading strategy that uses computer algorithms to make trading decisions. It uses advanced computer programs to analyze the market and make decisions in order to buy or sell securities. Algorithmic trading uses complex algorithms that are designed to recognize small price movements and execute trades within milliseconds.

This allows traders to take advantage of even the smallest changes in the market and make money quickly. Algorithmic trading is a highly sophisticated strategy requiring advanced knowledge of how to program algorithms and how the markets work.

In the answer of how much money to start day trading crypto, it is important to consider which strategy is more suited for your profile. When starting out, it is best, to begin with a small amount of capital and focus on one strategy that you are confident in. This will help you to build your confidence in the market and avoid losses from taking large risks. With that said, the amount of capital needed to start day trading crypto will depend on how active you plan to be and how much risk you are willing to take.

5. The importance of Technical analysis in day trading

Technical analysis is an important approach that day traders use to make informed trading decisions. It involves analyzing historical price charts of a given asset in order to identify patterns and trends that can be used to predict how the asset will behave in the future.

Technical analysis is a skill that takes time to develop, but it can be extremely valuable for day traders looking to identify profitable trades. By studying price charts, you can gain insights into how an asset has behaved in the past and how it may behave in the future. This is particularly useful when day trading crypto, as cryptocurrencies tend to be highly volatile and require careful analysis in order to make profitable trades. Technical analysis can also be used to identify areas of support and resistance, which can provide clues into where an asset’s price may go next. By combining technical analysis with fundamental research on a given cryptocurrency, you can develop a comprehensive trading strategy that will maximize your profits.

There are many analysis tools for crypto currencies. Here is a list of great websites that can help your crypto currency analysis:

6. What to look out for when day trading crypto?

When day trading crypto, it is important to pay attention to the following factors:

News events: Always monitor the most important events and news releases, such as FOMC, CPI or PPI. You can keep track of those dates on ForexFactory.

Low fees: Fees can quickly eat away at your profits, so choosing an exchange with low fees is important. For example, MEXC is the only exchange with 0% maker fees. Also, Binance generally has very competitive trading fees but is unfortunately restricted in many countries.

Volume and liquidity: High volume and liquidity are essential for successful day trading. You want to ensure the exchange has enough liquidity to fill your trades quickly and at the best available price.

Long and short positions: Day trading doesn’t just mean buying and holding. You can also make money when the price goes down (short positions) as well as when it goes up (long positions). The easiest way to do this is on the futures market.

So it is important to understand how these strategies work and how they can be used to increase profits. By paying attention to these factors, you can make sure that your day trading crypto strategy is as profitable as possible.

7. Pros and cons of Day trading crypto

Before you start, understanding the pros and cons of day trading crypto is important.

| 👍 Day trading crypto Pros | 👎 Day trading crypto Cons |

|---|---|

| ✅ Day trading crypto can be very profitable, especially in a bull market | ❌ Trading crypto is risky, and prices can fluctuate quickly, leading to large losses if trades are not managed correctly |

| ✅ With the right strategies and risk management techniques, losses can be minimized | ❌ Cryptocurrency markets can be highly volatile, making it difficult to accurately predict how prices will move |

| ✅ A variety of strategies are available to traders, allowing them to choose how they want to make money | ❌ Finding reliable sources of information about the cryptocurrency markets can be difficult. (Tip: To get updated information about the crypto world, please visit cryptowinrate.com) |

| ✅ It can provide a great source of income with the potential for high returns | ❌ Day trading crypto requires substantial capital, which may not be accessible to all traders |

| ✅ Day trading can be done in a relatively short amount of time, allowing traders to quickly capitalize on market movements | ❌ Crypto trading is largely unregulated and illegal in some countries like China |

8. Future of day trading crypto

Day trading crypto is becoming an increasingly popular way to make money. With the right strategies and risk management techniques, traders can capitalize on volatile market movements and potentially generate large profits. As the cryptocurrency markets continue to mature, more traders may be drawn to this industry, leading to increased liquidity and more profitable opportunities.

In addition, new technologies are being developed to help make trading easier and more secure. With the right tools and information, day trading crypto can be a great way to make money in the digital future. So, that’s why how much money to start day trading crypto is important for everyone.

By understanding how much money to start day trading Crypto with the right strategy, anyone can get started on their journey of making money by day trading with Crypto.

9. Summarizing how much money to start day trading crypto

In summary, how much money to start day trading crypto depends on the individual trader. To realistically make an average income from day trading, you should have at least $50,000 in capital and preferably more.

With the right strategies, risk management techniques, and access to reliable sources of information about the market, day trading crypto can be a profitable venture with the potential to generate significant returns. New technologies are also continuing to be developed to make trading easier, more secure, and more accessible. So how much money you need to start day trading crypto is up to you and how confident you feel in your abilities as a trader. We recommend not starting out with high amounts of money but instead practicing and working your way up until you feel like you have figured out how the markets work.

To wrap it up, the question “how much money to start day trading crypto” requires careful consideration and preparation. At the end of the day, it really depends on what you want. If you want to make this your fulltime job, you should have at least $50,000 available. Other people might just want to day trade on the side to make an extra income. You can do this with $10,000, $1,000, and even $100. If you want to do arbitrage trading, you would require a lot more capital to make gains as the price differences are minimal. Swing trading, on the other hand, can be done with less money compared to arbitrage trading. Ask yourself what you want to reach with day trading, which strategies you want to learn, and what your risk tolerance is.

For this purpose, the above information can help traders better understand how much money they need to start trading.

For more information about the crypto world, please visit our website CryptoWinrat.com. CryptoWinrat strives to bring you the very best trading platforms. We provide the best services to help traders maximize their profits while reducing risks in the crypto market.

For managing your risk, we developed a free position size calculator, which you can check out here. This amazing tool will calculate your required capital for a position and also calculates your maximum loss, based on your inputs. That way you never lose more than you are willing to lose!

You can also follow us on Twitter (@CryptoWinrate) or subscribe to our YouTube channel to learn about the crypto industry.

Thank you for your time! Have a great day!

10. Important FAQs

How much money do I need to start day trading crypto?

The amount of money you need to start day trading crypto depends on your risk tolerance and the strategies you plan to use. For most traders, a small initial investment is recommended until they gain experience in the markets. After that, they can gradually increase their capital as they become more familiar with how the markets work. To make a sustainable income, we recommend having at least $50,000 in your trading account.

Is Day trading crypto safe?

First of all there are no guarantees in trading. But day trading crypto can be safe if you understand how the markets work and how to manage risk. Knowing how much money you need to start day trading Crypto and building up a portfolio of cryptocurrencies can help reduce the risks associated with day trading.

Best Trading Platform to day trade crypto?

This really depends on your region. Some exchanges are restricted. Binance is a great option, but they are restricted in many countries such as the USA. A great alternative to Binance is MEXC Global which operates in most countries and has the lowest fees in the crypto market with 0% maker fees.

Is there any restriction on how much money I can invest in crypto?

Some crypto exchanges have a minimum deposit limit and a maximum trading limit. The amount of money traders can invest in Crypto depends on the exchange they are using and the regulations set by their country of residence. In some countries, there may be restrictions on how much money individuals or organizations can invest in Crypto. It is important to check your local laws and regulations before investing any funds into the crypto market.

What are the financial risks in day trading crypto?

The main financial risks in day trading crypto are volatility, fraud, and theft. Volatility is the amount of price movement that happens within a certain period, which can cause traders to incur losses if they don’t properly manage their risk. Fraud and theft can also occur as there are no regulatory standards in place for crypto trading.