As one of the leading crypto exchanges, BTSE brags a global user base exceeding 1.5 million. Offering 100x leverage options, the platform presents many opportunities for users to succeed in the crypto market. A standout feature is Copy Trading.

Explore our blog for a comprehensive guide on setting up and succeeding in Copy Trading on BTSE. Follow our easy steps to maximize your gains through this remarkable feature on the platform.

Let’s get started.

BTSE Copy Trading Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Real profits for participants with successful transactions | ❌ The primary challenge lies in market risk, posing a substantial threat |

| ✅ Learn from professional traders, gaining insights into their techniques | ❌ Success is dependent on the performance of chosen traders, introducing potential uncertainties |

| ✅ Experience minimal losses, typically limited to temporary deposit shortfalls | ❌ Potential losses if the strategies of copied traders are unsuccessful |

| ✅ Benefit from a range of trading strategies by copying multiple traders | ❌ Trading errors can intensify losses, limiting deposit flexibility |

| ✅ Engage in copy trading with minimal or no prior financial market experience |

BTSE Overview

Launched in March 2020 by Jonathan Leong and Brian Wong, BTSE, representing buy, trade, sell, and earn, has swiftly become a significant player in the crypto field. Based in the Western US, this platform provides secure trading services for institutions, retail users, and new traders.

With a selection of over 150 cryptocurrencies, including their native BTSE token, it has earned the trust of its 100,000 users across 70 countries, gaining its reputation as a reliable and comprehensive cryptocurrency exchange. If you want to know more details about this platform, check out our comprehensive BTSE review.

How to Copy Trade on BTSE

There are three types of copy trading on BTSE.

- Trading Leaderboard

- Futures Grid

- Spot DCA

Here is a comprehensive guide to help you engage in your preferred type of copy trading on BTSE.

Spot Leaderboard Copy Trading

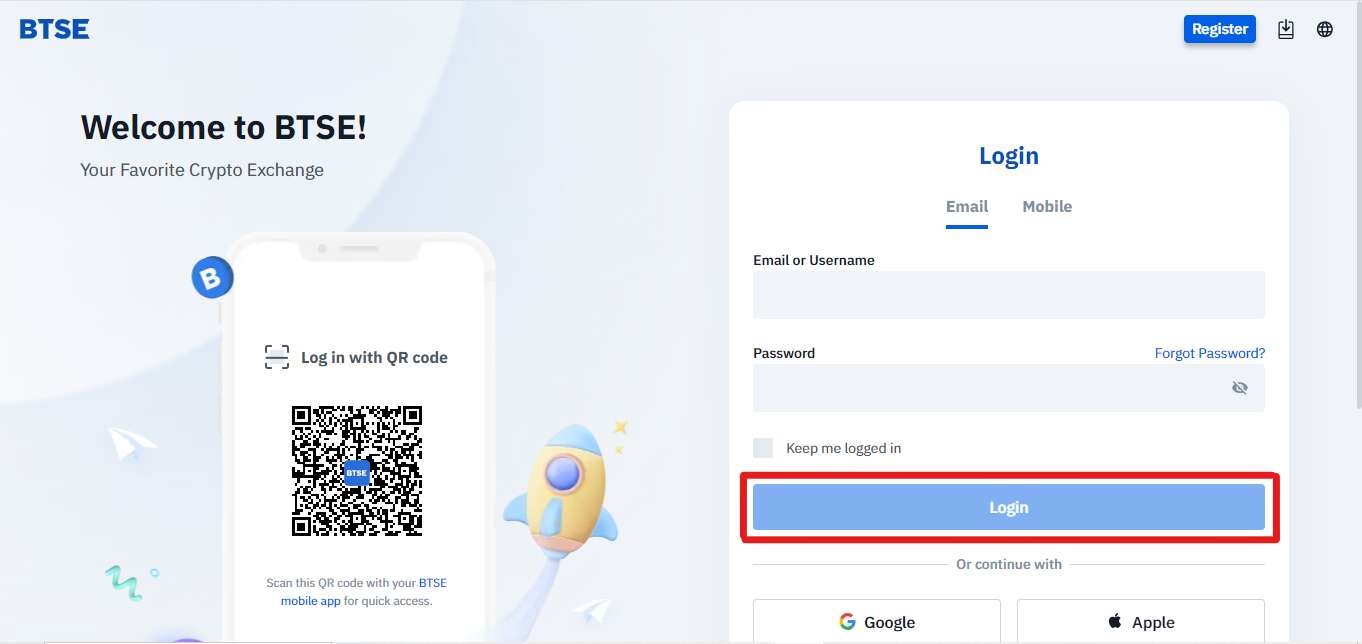

Step 1: Log into Your BTSE account

To access BTSE, enter your details on the login page, confirming a secure entry into your account.

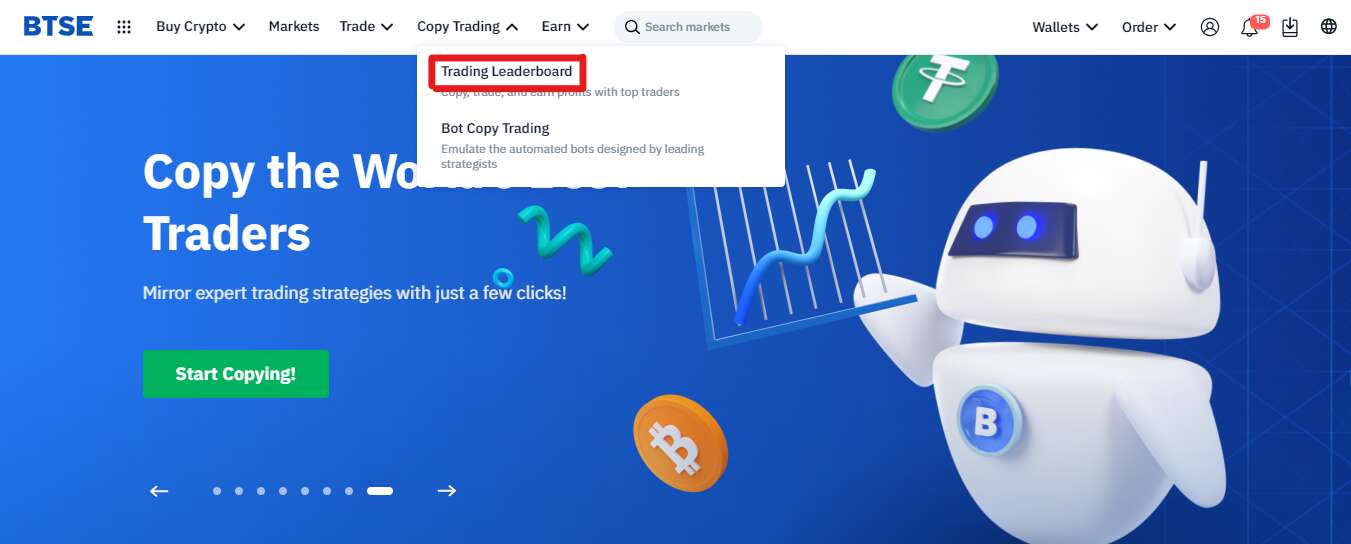

Step 2: Click on” Copy Trading”

Go to the BTSE platform and locate the “Copy Trading” section. This is typically found in the main menu or trading dashboard.

Step 3: Choose” Trading Leaderboard” Option

Once within the Copy Trading section, look for the “Trading Leaderboard” option. Click on it to access the list of successful traders on the platform.

Step 4: Scroll Down to the Middle

Scroll down through the Trading Leaderboard until you reach the middle section. Here, you’ll find traders with varying performance metrics.

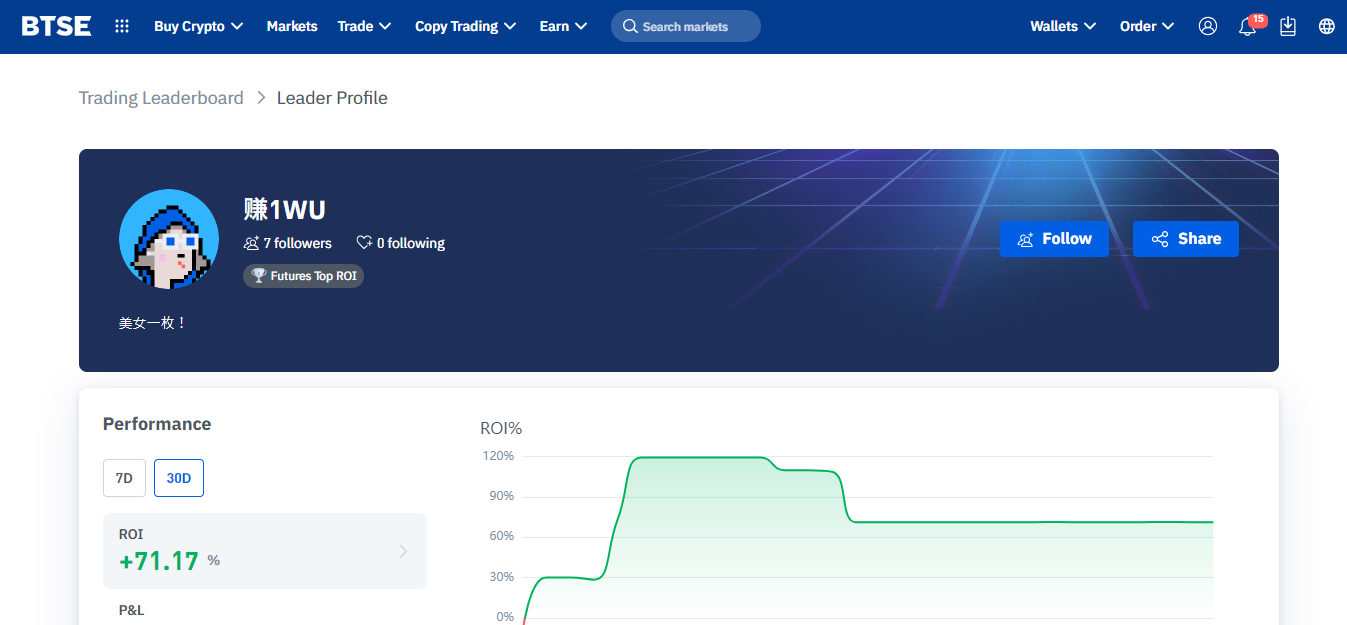

Step 5: Choose a Trader and Click on Their Profile

Evaluate the traders listed, considering their trading history, risk tolerance, and overall performance. Click on the profile of a trader you are interested in copying.

Step 6: Go Through Their Details

Within the selected trader’s profile, thoroughly review their trading details. This includes their trading strategy, historical performance, risk levels, and any other relevant information provided.

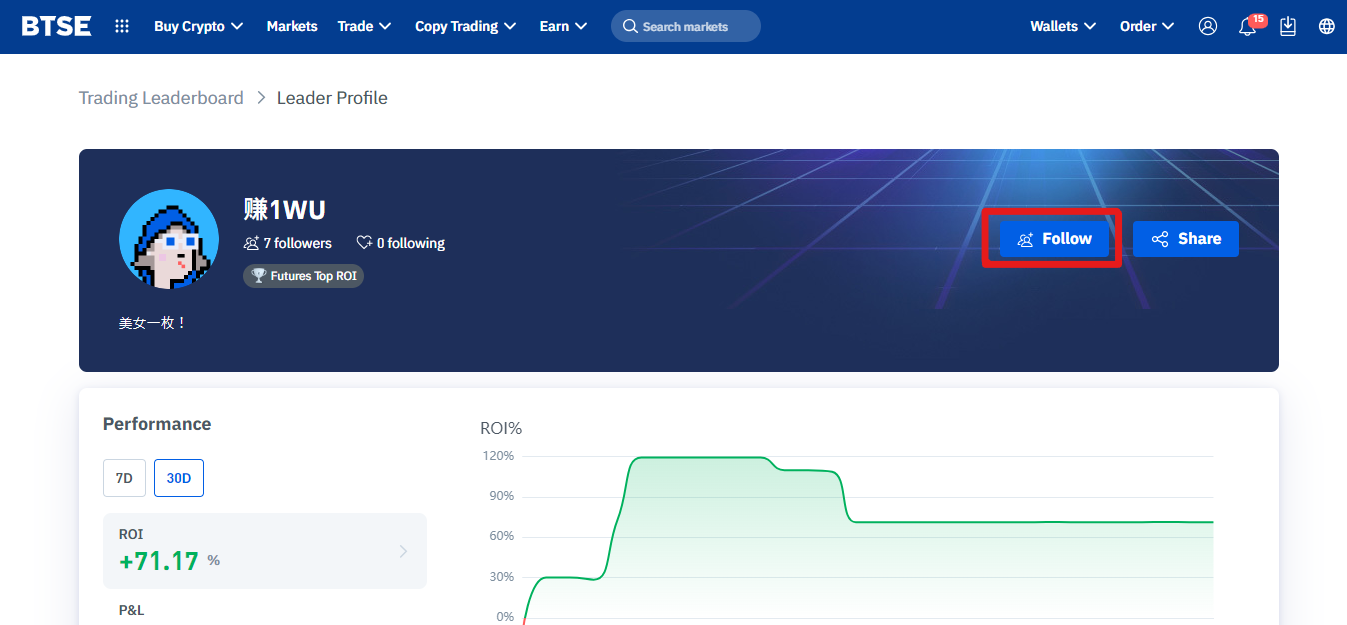

Step 7: Hit “Follow” Button

If you are satisfied with the trader’s details and wish to copy their trades, locate the “Follow” button on their profile page. Click on it to initiate the copying process.

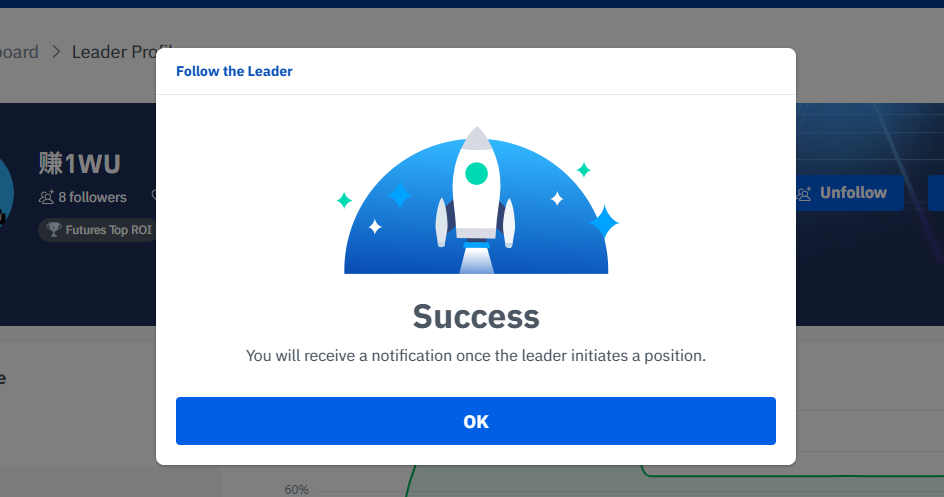

Step 8: Successfully Copied Button

Once you’ve clicked “Follow,” a confirmation statement should appear, indicating that you have successfully copied the chosen trader. From this point onward, your trades will mimic those of the selected trader.

Futures Grid Trading

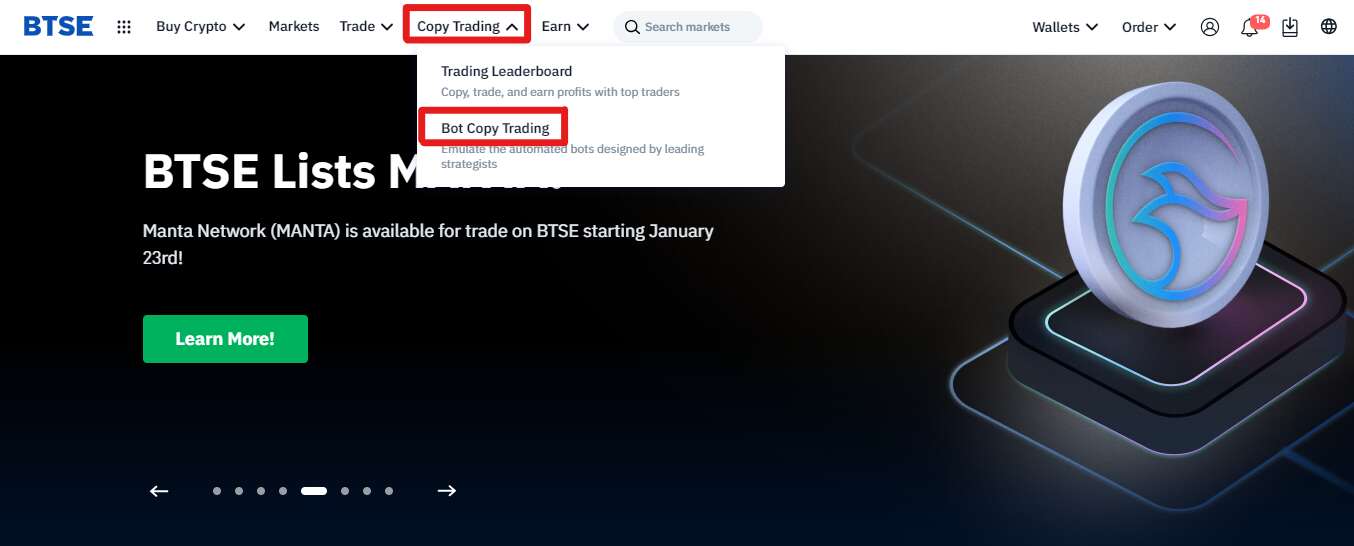

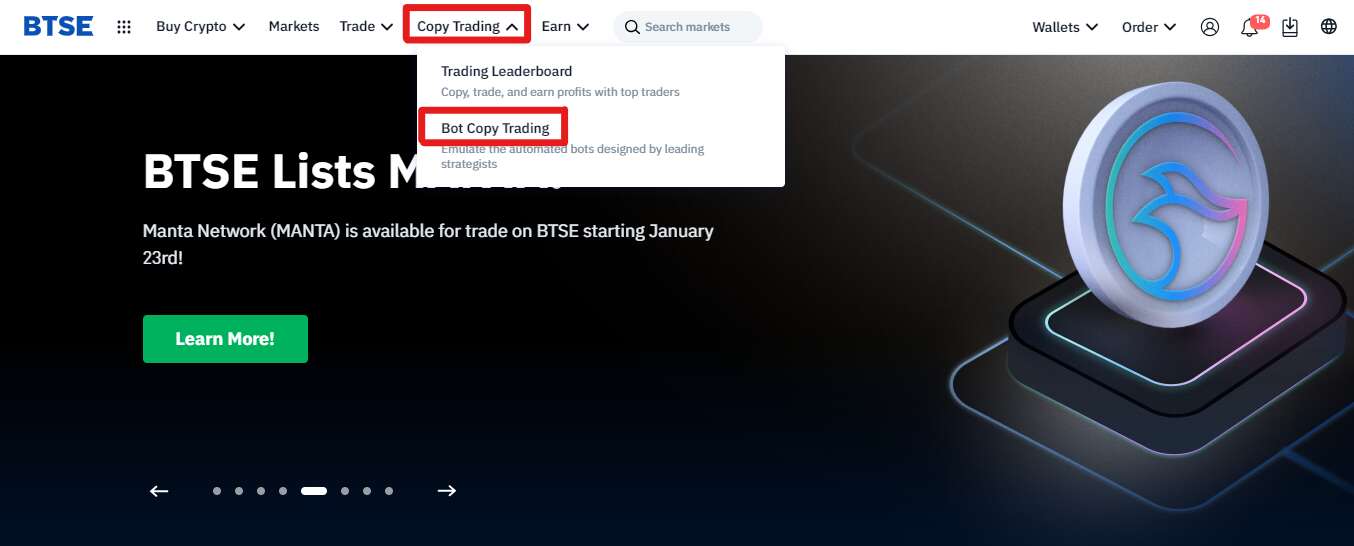

Step 1: Click on” Copy Trading”

Go to the BTSE platform and locate the “Copy Trading” option in the menu. Click on it to access the copy trading features.

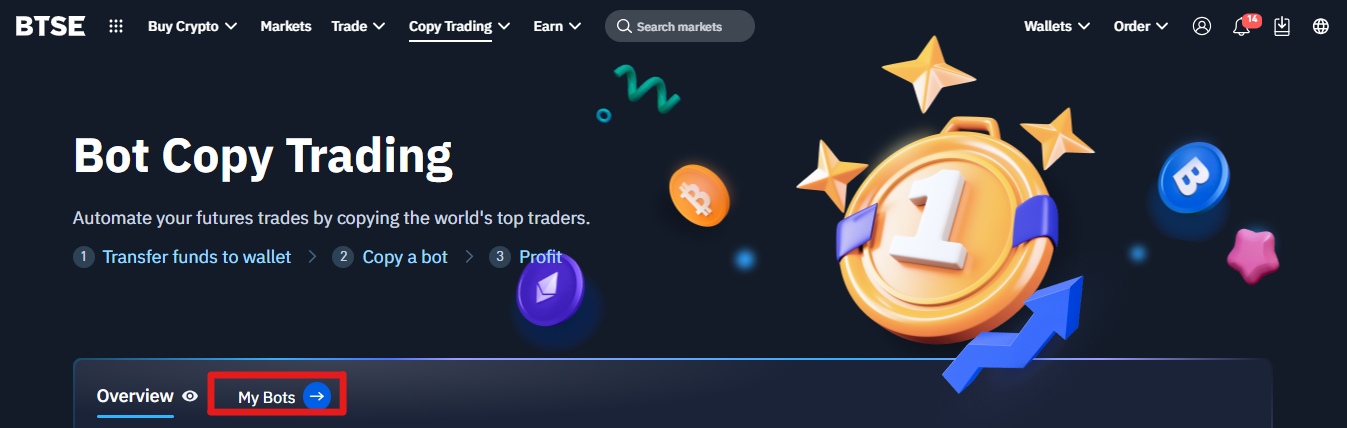

Step 2: Choose” Bot Copy Trading” Option

Select the “Bot Copy Trading” option within the copy trading section. This choice leads you to the interface for configuring trading bots.

Step 3: Scroll Down to the Middle

Scroll down on the page until you reach the middle section, where you’ll find the available bot options.

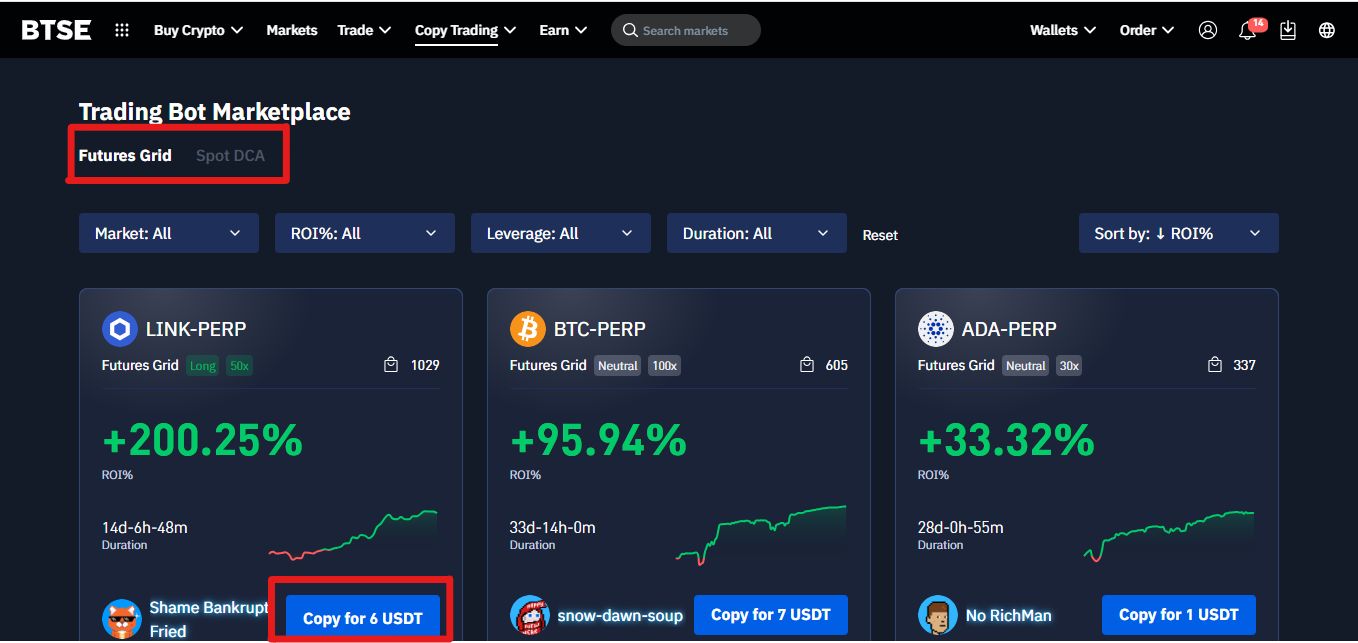

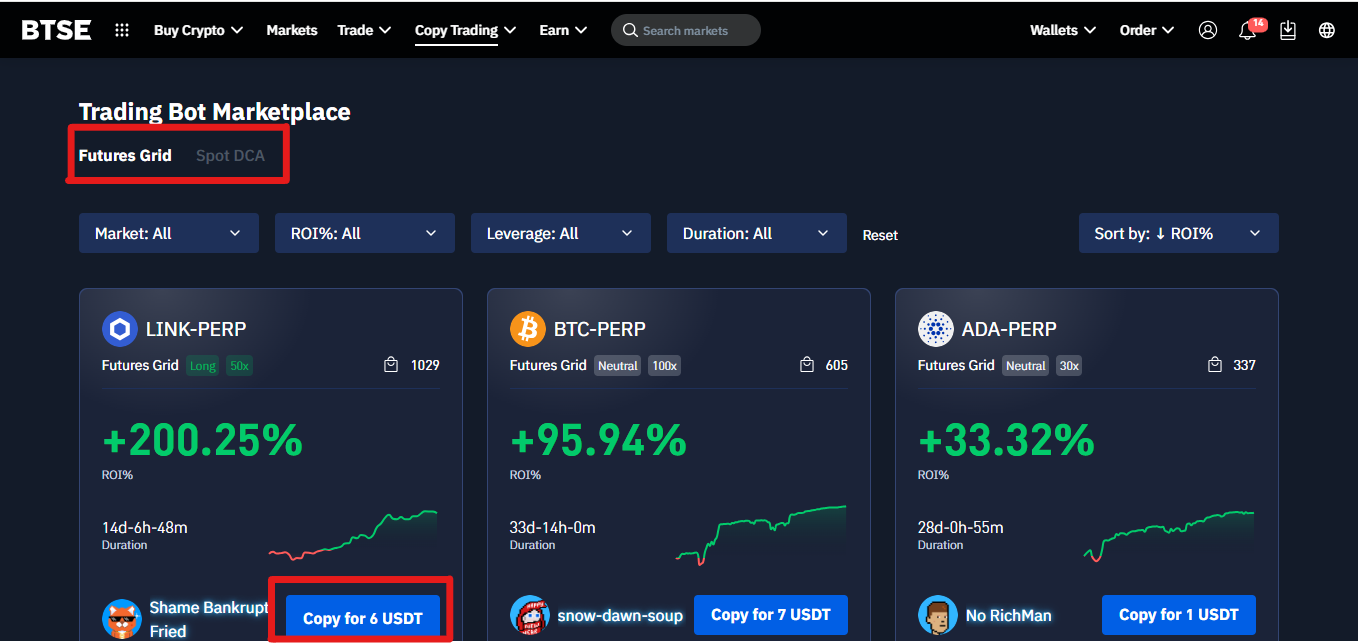

Step 4: Choose Futures Grid

At this point, choose the “Future Grid” option and click on it.

Step 5: Choose a Bot and Hit the Copy Button

Once you’ve clicked on Future Grid, select a specific bot that aligns with your trading goals. Click on the “Copy” button associated with the chosen bot.

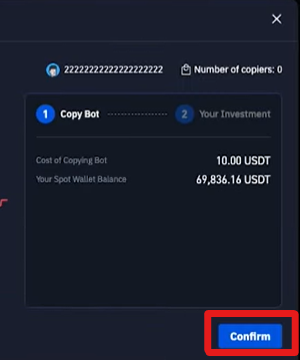

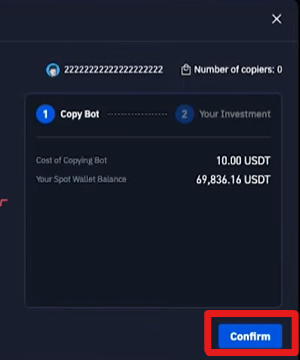

Step 6: Click on “Confirm” Button

After clicking “Copy,” the platform will prompt you to confirm your selection. Verify the details and hit the “Confirm” button to proceed.

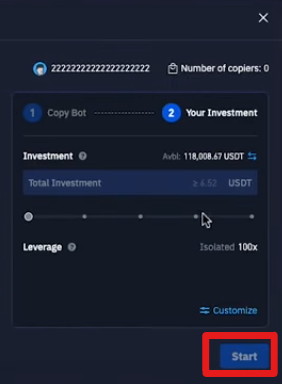

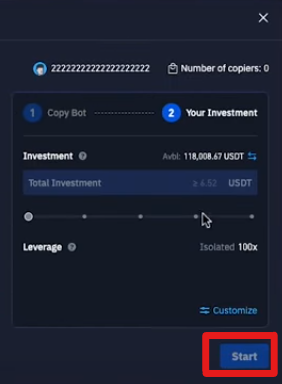

Step 7: Enter an Investment Amount

Specify the amount you want to invest in the copied bot. Enter this investment amount in the designated field.

Step 8: Click on “Start” Button

Initiate the copied bot by clicking on the “Start” button. This action activates the bot and begins executing trades based on its predefined strategy.

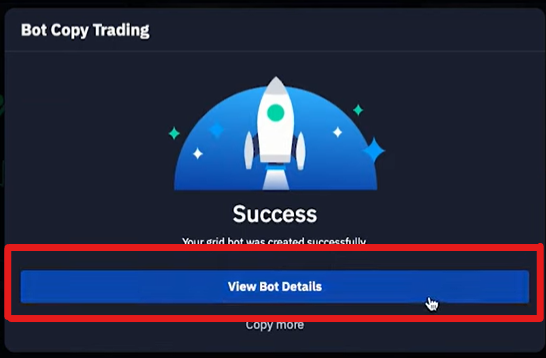

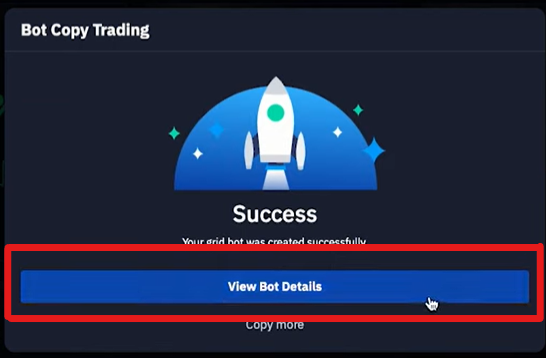

Step 9: Click on the “View Details ” Option to See Bot Details

For a deeper understanding of the bot’s settings and strategy, click on “View Details.” This allows you to review and comprehend the specifics of the chosen bot.

Spot DCA

Step 1: Click on” Copy Trading”

Go to the Copy Trading section on the BTSE platform.

Step 2: Select” Bot Trading” Option

Within the Copy Trading section, select the Bot Copy Trading option.

Step 3: Scroll Down to the Middle

Scroll down to the middle of the page where various bot options are displayed.

Step 4: Choose the “Spot DCA” Option

Among the available bot types, opt for Spot DCA (Dollar-Cost Averaging) based on your trading preferences

Step 5: Select a Bot and Hit the Copy Button

Choose a specific bot that aligns with your trading strategy, and click on the Copy button to initiate the copying process

Step 6: Hit “Confirm” Button

Confirm your selection to proceed with copying the chosen bot

Step 7: Enter Your preferred investment Amount

Specify the desired investment amount you wish to allocate to the copied bot.

Step 8: Hit “Start” Button

After entering the investment amount, click on the Start button to initiate the bot’s trading activities.

Step 9: Click on “View Details” to See Bot Details

To gain insights into the specifics of the copied bot, click on View Details to access comprehensive information about its trading parameters and performance

Step 10: Click on” My Bots” to See Your Bots

To monitor and manage your active bots, go to the “My Bot” section within the platform. Here, you can check the performance and status of your copied bots.

By following these steps, you can seamlessly engage in Copy Trading on BTSE, leveraging the expertise of experienced traders to enhance your trading strategies. Always ensure thorough research when choosing a trader to follow, as this decision significantly impacts your trading outcomes.

Is Copy Trading on BTSE Good?

Engaging in Copy Trading on BTSE offers a wealth of benefits. Novice traders access professional knowledge, cutting the need for extensive expertise. It’s time-efficient, removing the requirement for in-depth market analysis.

On BTSE, trading is simplified by copying useful strategies, serving as a learning opportunity for beginners and providing skilled traders with a route to monetize their expertise. BTSE’s Leaderboard highlights top-performing traders, enhancing transparency.

The Futures Grid and Spot DCA bots also offer precise automation, allowing users control over market trends and customizable strategies for handling crypto market volatility efficiently.

BTSE Copy Trading Checklist

- Assess Performance Metrics on BTSE: Examine the overall Return on Investment (ROI) on BTSE and compare it with the 7-day ROI for consistent evaluation. Focus on consistency rather than occasional high gains, aiming to align with traders displaying steady and reliable performance to minimize potential risks.

- Investigate Performance History on BTSE: Before replicating a trader on BTSE, delve into their performance history. Analyze trends in profit and loss over time to gauge the trader’s consistency and overall success in the cryptocurrency market.

- Give Priority to P and L Ratio on BTSE: Highlight the trader’s Profit and Loss (PNL) ratio over win rates on BTSE, as a higher PNL ratio indicates superior investment profitability. Prioritizing this metric offers a more insightful perspective on the trader’s effectiveness in generating returns.

- Consider the Trader’s Following on BTSE: Take into account the number of followers a trader has on BTSE. A substantial following may signify credibility and proficiency in their trading strategies, providing an additional layer of confidence in the trader’s capabilities.

BTSE Copy Trading Tips

- Expand Your Portfolio on BTSE: Distribute your investment across multiple traders on BTSE to minimize risk. Expanding your portfolio helps minimize the impact of poor performance from any single trader. Explore copying traders with varied strategies for a well-rounded portfolio.

- Conduct Thorough Trader Research on BTSE: Before copying a trader on BTSE, engage in comprehensive research. Examine their trading history, risk management practices, and overall performance to make informed decisions about whom to emulate.

- Regularly Monitor and Adjust on BTSE: Keep a vigilant eye on your copied traders’ performance on BTSE. Periodically review their results and assess if they still align with your expectations. If a trader’s performance falters or their strategy shifts, consider adjusting your portfolio accordingly.

- Set Realistic Outlooks on BTSE: Establish pragmatic expectations for returns and comprehend the inherent risks of copy trading on BTSE. Recognize that markets fluctuate, and past performance does not guarantee future results.

- Embrace Losses as Learning Opportunities on BTSE: Losses are inherent in trading; on BTSE, view them as opportunities to learn and refine your strategy. Instead of fearing losses, use them as valuable insights to enhance your overall trading approach.

Summary

This step-by-step guide to BTSE Copy Trading offers a comprehensive overview for both novice and experienced traders. From diversifying portfolios to assessing performance metrics, users gain valuable insights to operate the platform effectively.

With user-friendly features and a variety of traders, BTSE’s Copy Trading emerges as an accessible and strategic tool in the cryptocurrency field.

FAQs

1-How does Copy Trading work on BTSE, and what benefits does it offer to users?

Copy Trading on BTSE involves users replicating the trades of successful traders. This allows participants to capitalize on market expertise, observe trading strategies, and potentially achieve profitable outcomes without extensive market knowledge.

2-Can you elaborate on the risk management features within BTSE’s Copy Trading platform and how they contribute to a safer trading environment?

BTSE’s Copy Trading platform incorporates risk management tools like stop-loss mechanisms and configurable investment parameters. These features enhance user control, enabling them to mitigate potential losses and manage risk effectively, fostering a safer trading environment.

3-What types of traders can users choose to copy on BTSE, and how does the Leaderboard function aid in selecting reliable traders?

Users on BTSE can choose from a pool of traders, including both professional and community traders. The Leaderboard showcases top-performing traders, offering insights into their historical performance and success rates. This aids users in selecting reliable traders to emulate.

4-How user-friendly is the interface for setting up and managing Copy Trading on BTSE?

BTSE provides an intuitive and user-friendly interface for setting up and managing Copy Trading. With straightforward options to choose traders, allocate investment amounts, and monitor performance, even users new to cryptocurrency trading can manage the platform with ease.

5-In what ways does BTSE address the challenges associated with potential losses in Copy Trading, and what strategies can users employ to maximize their chances of success?

BTSE addresses potential losses in Copy Trading by offering risk management features in trading options. Users can minimize risks by spreading their portfolio, setting appropriate stop-loss levels, and staying informed about market conditions, providing a strategic approach to maximize their chances of success.