Unleashing the secrets behind extraordinary success and immense wealth is always a captivating journey. Today, we delve into the life and accomplishments of one such individual who has left an indelible mark on the financial world – Su Zhu.

With his determination, Su Zhu has amassed a net worth during the 2021 bullrun that would leave most people in awe, but at the same time, he did things that would leave most people in shock.

In this article, we will explore how he made his fortune, lost it all, got into jail, where his company stands today, and what Su Zhu is up to now.

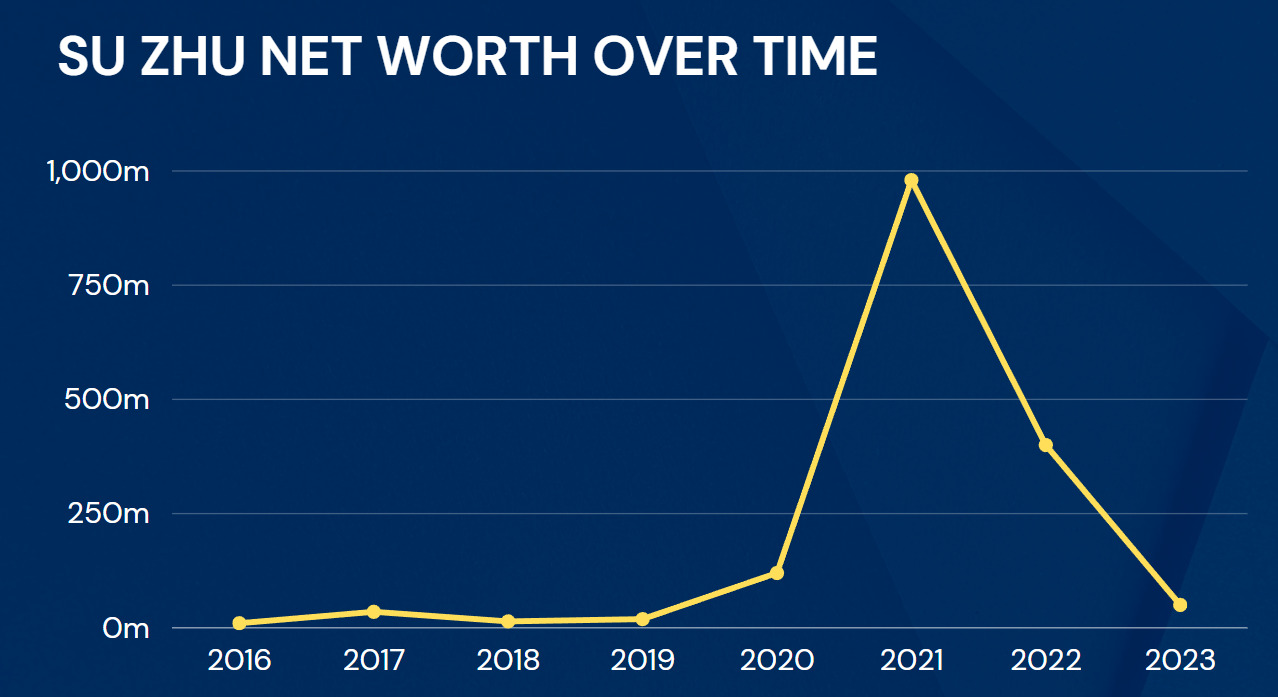

Su Zhu Net Worth

Su Zhu’s net worth could have been a testament to his remarkable achievements in the financial industry – but it is not as it seems. As an esteemed hedge fund manager and entrepreneur, Su Zhu has built an empire that surpasses the expectations of many. It is widely known that his net worth was over $1 billion before 3AC went bust. However, his net worth is now estimated to be around $50 million. A large portion of his net worth comes from his private investments and his involvement in the crypto exchange OPNX (Open Exchange).

With a background in computer science and economics, Su Zhu combined his analytical skills with a deep understanding of market trends to create strategies that consistently generated impressive returns. His expertise led him to co-found Three Arrows Capital, which quickly became renowned for its success in cryptocurrency trading, but is now insolvent.

It’s important to note that Su Zhu’s net worth extends far beyond monetary value. His influence on the crypto space goes beyond just wealth accumulation – he has played a pivotal role in shaping investment strategies and pushing boundaries within this rapidly evolving industry.

While some may attribute Su Zhu’s success solely to luck, those who have closely followed his career understand that it was his dedication and tireless work ethic that propelled him forward. With each triumph, he solidifies his position as one of the most influential figures in finance today. However, the more successful he became, the further grew his overconfidence; A truly dangerous trait that would lead Su Zhu to a path of destruction later on.

Stay tuned as we dive deeper into how Su Zhu made his fortune and uncover what cost him everything as a once visionary entrepreneur.

How did Su Zhu Make (and lose) His Fortune

As a highly educated individual with a strong background in mathematics and computer science, Su Zhu had the perfect foundation for entering the financial industry. He began his career as a trader at Goldman Sachs, where he gained invaluable experience and skills.

However, it was after leaving Goldman Sachs that Su Zhu truly made his mark. He co-founded Three Arrows Capital (3AC), an investment firm focused on digital assets like cryptocurrencies. This move proved to be incredibly lucrative as the cryptocurrency market boomed in 2021, making Su Zhu a crypto billionaire.

It is evident that Su Zhu’s determination, knowledge, and knack for spotting opportunities have played pivotal roles in building his fortune. His story serves as an inspiration for aspiring investors looking to make their mark in today’s dynamic financial landscape.

But what made him lose his fortune? Su Zhu and Kyle Davies were prominent promoters of the so-called “Super Cycle”, which assumes that the usual 4-year cycle of Bitcoin is breaking and we will go into an up-only mode. As the price continued to dump, Su Zhu kept his confidence and called it “Bullish Selling”. If that was the case, the liquidation of 3AC must have been the most bullish selling in crypto history. Great.

There is a full interview with Su Zhu on the “UpOnly” podcast, which you should definitely watch to understand more about Su Zhu’s idea of the super cycle: Su Zhu interview on UpOnly.

What is Su Zhu Now Doing?

After 3AC was insolvent, Su Zhu had to change his approach. Su Zhu is currently serving as the CEO and co-founder of a prominent cryptocurrency exchange, OPENX. Under his leadership, the company is slowly growing and Zhu continues to be a major player in the digital asset space.

In addition to his role at Three Arrows Capital, Su Zhu also shares his expertise through various platforms. He frequently appears on financial news networks like CNBC and Bloomberg, where he provides insights into market trends and offers valuable advice for investors.

Furthermore, Su Zhu is highly active on social media channels such as Twitter. With a significant following, he uses these platforms to share his thoughts on current events in finance and cryptocurrencies. His tweets are often regarded as influential within the crypto community.

As an entrepreneur with a keen eye for innovative opportunities, Su Zhu has also ventured into other ventures beyond just managing funds. He has invested in numerous successful startups within blockchain technology and emerging markets.

In September 2023, Su Zhu was imprisoned in Singapore due to mismanaging customer funds.

In conclusion

Su Zhu’s entrepreneurial journey from working at Wall Street firms like Goldman Sachs and Credit Suisse to co-founding one of Asia’s most successful cryptocurrency investment firms to losing billions of customer funds to going to jail is truly mindblowing. Through strategic investments coupled with delusional decision-making skills honed over time, Su Zhu managed to blow up a 100:0 lead. Whenever someone talks about the Dunning Kruger effect, this might be the perfect story to keep in mind. The confidence of 3AC about the “Super Cycle” was what cost many people their life savings.

Today, while focusing on growing OPENX, rebuilding Three Arrows Capital, and exploring new opportunities, Su Zhu continues to be a prominent figure in the crypto space in Singaporean Jail.