Bitcoin, the pioneer of cryptocurrencies, has captured the imagination of individuals and investors worldwide. In recent years, the cryptocurrency market has experienced unprecedented growth, with Bitcoin at the forefront of this financial revolution.

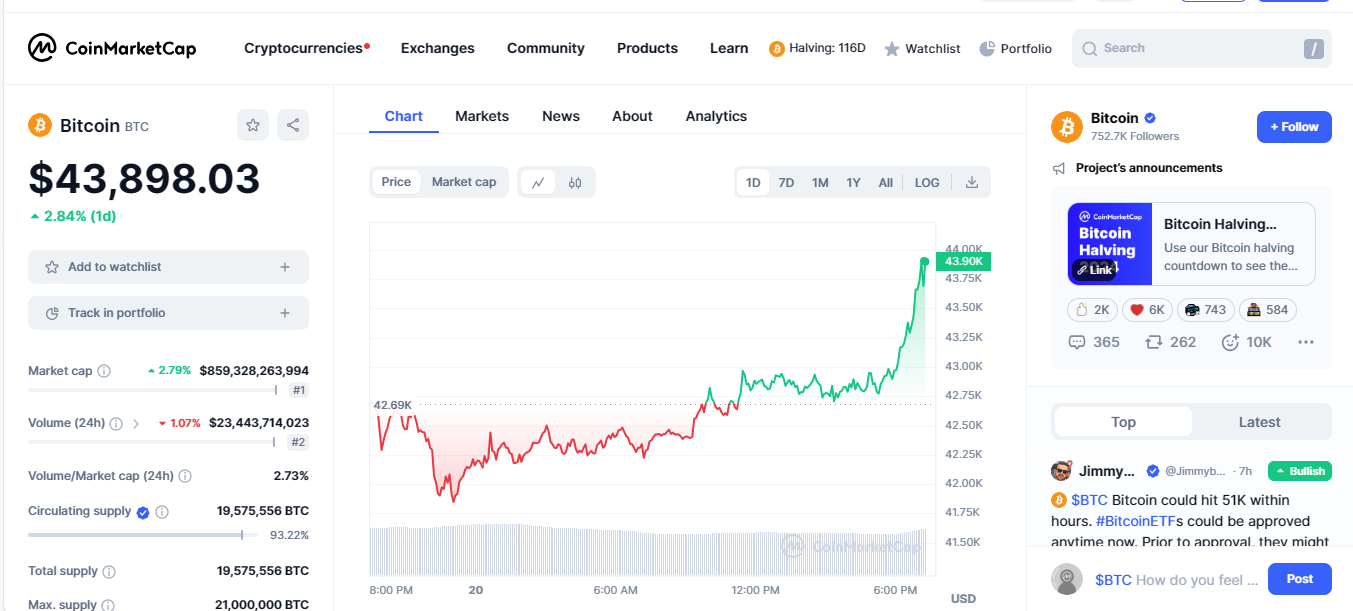

Due to the decentralized nature of cryptocurrencies, pinpointing an exact figure is impossible; however, it is trading above $43,000, as per CoinMarketCap‘s recent data.

To help you gauge a fair idea about the numeral usage of Bitcoin, in this blog post, we will delve into Bitcoin ownership, explore the crypto market, and shed light on the growing number of users and wallets.

People Who Own, Use & Hold Bitcoin

The number of Bitcoin users has experienced significant growth in recent years. As a decentralized digital currency, Bitcoin has attracted individuals seeking alternatives to traditional financial systems.

The decentralized nature of Bitcoin allows users to have control over their finances without reliance on a central authority. This feature has appealed to those who value financial autonomy and privacy. There is no actual way to determine Bitcoin use and hold, but a few methods are stated below.

Method 1: Research Studies on Bitcoin Adoption

Various research studies delve into Bitcoin adoption, employing surveys and analytics to gauge user participation. These studies examine demographic factors, geographical distribution, and user motivations, shedding light on Bitcoin users globally.

Quantifying the ownership of Bitcoin differs from traditional securities like stocks due to its decentralized nature. Unlike regulated markets, Bitcoin doesn’t trade through centralized exchanges, making it challenging to accurately ascertain the number of Bitcoin owners.

While the blockchain publicly records all transactions and wallet addresses, these details remain detached from real-world identities.

Even when Bitcoin holders invest with fiat money, though KYC documents may be required, exchanges do not disclose this information publicly. A common approach to estimating ownership is considering the count of Bitcoin wallet addresses.

The research conducted by Crypto.com reported a slightly elevated number, reaching 425 million. However, Crypto.com clarifies that within this total, 219 million individuals, accounting for 51%, are Bitcoin owners—a slight increase compared to the prevailing Bitcoin dominance ratio.

Chainalysis reports that the creation of Bitcoin addresses has surpassed 460 million, indicating significant engagement within the Bitcoin ecosystem.

A study by Triple-A revealed that around 420 million people own cryptocurrencies globally. However, the study doesn’t provide specific details about how many of them specifically hold Bitcoin.

Determining the actual number of people using Bitcoin isn’t straightforward. People can create many addresses, and someone might have several wallet addresses on different crypto platforms. Plus, many Bitcoin addresses are empty or not in use.

Method 2: Bitcoin Wallet Activity Analysis

Estimating the exact number of Bitcoin users is challenging due to the changing nature of the cryptocurrency. However, one method involves analyzing blockchain data to identify unique wallet addresses.

Wallet activity, measured by transactions and holdings, provides insights into user engagement. Tracking distinct addresses can estimate active users, though some users may have multiple addresses.

According to BitInfoCharts, there are over 40 million wallet addresses with Bitcoin holdings ranging from $1 to $100. Additionally, more than 139309 addresses hold between 10 BTC and 100 BTC, while over 13931 addresses have a value between 100 and 1000 BTC. This shows that a large majority of Bitcoin users have relatively small investments.

| Balance, BTC | Addresses |

|---|---|

| (0 – 0.00001) | 3914060 |

| [10 – 100) | 139309 |

| (100 – 1,000) | 13931 |

Method 3: Trading-Related Data in the Bitcoin Ecosystem

Analyzing trading data on cryptocurrency exchanges reveals patterns of user behavior. Volume, frequency of trades, and market trends provide a glimpse into the dynamics of the Bitcoin market.

Metrics such as trading volume and liquidity contribute to understanding user involvement in buying, selling, and exchanging Bitcoin within the broader financial ecosystem. Nevertheless, it’s worth noting that daily trading volumes exhibit significant volatility. For example

according to CoinMarketCap data, on June 30, 2023, Bitcoin trading exceeded $26 billion, yet it plummeted to a mere $13 billion the day before.

As per Reuters, Bitcoin recorded its highest daily trading volume ever, reaching $68.3 billion. This milestone occurred on January 5th, 2021, coinciding with Bitcoin’s then-all-time high of nearly $35,000.

The Count of Individuals Engaging with Bitcoin on a Daily Basis

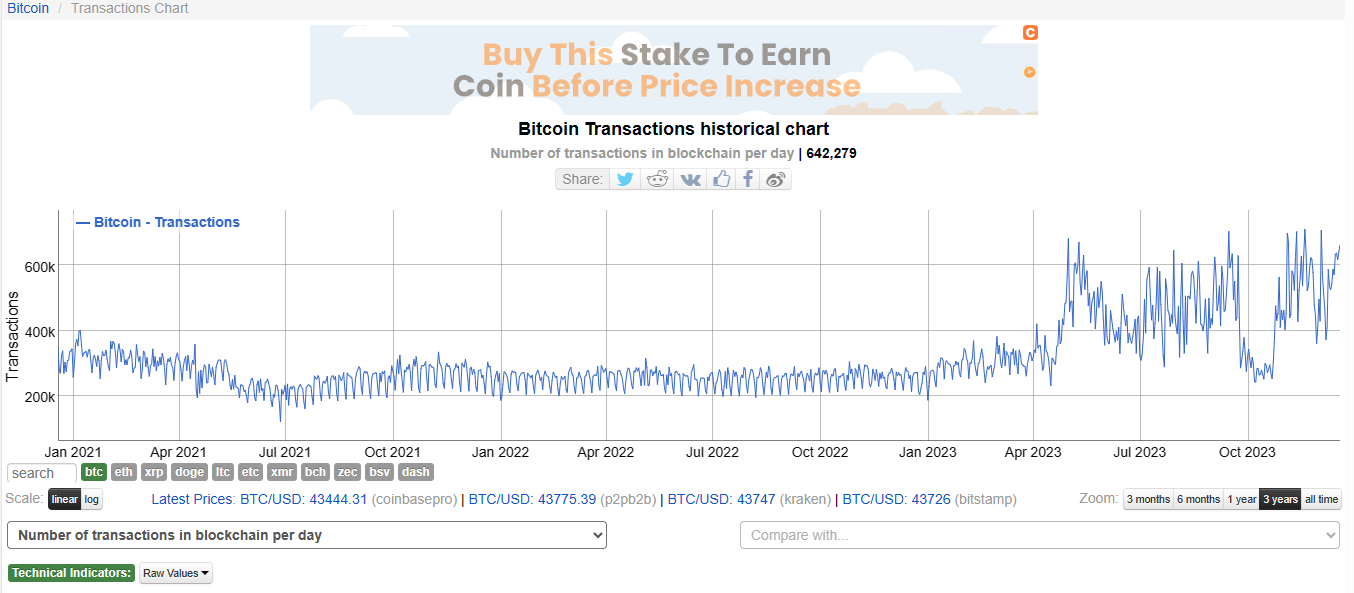

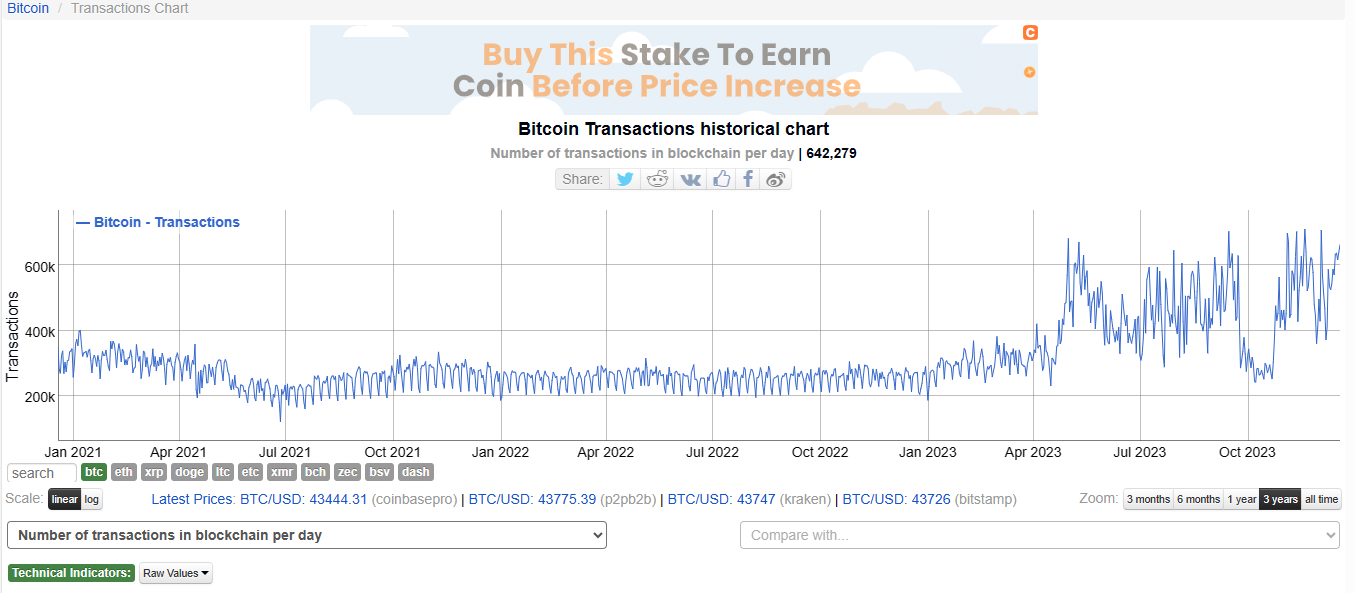

Let’s delve into the daily usage of Bitcoin. A useful metric to begin with is the count of Bitcoin transactions. As previously mentioned, there were 642,279 Bitcoin transactions recorded in the last 24 hours, according to BitInfoCharts. This figure contrasts with the 630,099 transactions on May 1, 2023.

Notably, this marks the peak in daily Bitcoin transactions observed in the past three years. This might suggest an increasing trend of individuals utilizing Bitcoin for daily transactions. Additionally, it could signify a growing influx of participants into the market, albeit with smaller investment amounts.

How Many Bitcoin Wallets Are There?

The previously mentioned Chainalysis study reveals the existence of more than 460 million Bitcoin addresses. However, this data doesn’t provide insight into the number of individuals engaging in Bitcoin transactions.

Creating a Bitcoin wallet is open to everyone, making it challenging to determine user numbers accurately. Some investors opt to generate several Bitcoin addresses for balance separation, while others may maintain addresses across various trading platforms.

The problem is most wallet addresses don’t contain Bitcoin. It’s better to focus on addresses with a balance to get accurate data. BitInfoCharts is a helpful source for this.

For instance, we can exclude the 3913974 wallets holding less than 0 – 0.00001 BTC. At today’s BTC/USD rates, these wallets are worth $0.31 or less.

| Balance, BTC | Addresses |

|---|---|

| (0 – 0.00001) | 3914060 |

| [10 – 100) | 139309 |

| (100 – 1,000) | 13931 |

Our Key Finding About Bitcoin Usage

| Stats | Findings | Our Sources |

|---|---|---|

| Bitcoin Wallets | 460 Million | https://blog.chainalysis.com/reports/bitcoin-addresses/ |

| No. Bitcoin Wallets With an Active Balance | Around 67 Million | https://bitinfocharts.com/top-100-richest-bitcoin-addresses.html |

| Bitcoin Transactions in the Prior 24 Hours | 642,482 | https://bitinfocharts.com/comparison/bitcoin-transactions.html#3y |

| How many people know about Bitcoin? | 88% | https://www.pewresearch.org/short-reads/2023/04/10/majority-of-americans-arent-confident-in-the-safety-and-reliability-of-cryptocurrency/ |

How Many People Will Use Bitcoin in the Future?

To gauge future Bitcoin adoption, analyzing historical data is paramount. Examining the number of daily Bitcoin transactions is particularly enlightening.

According to BitInfoCharts, within the first 12 months post-Bitcoin’s January 2009 launch, daily transactions ranged from 1 to 10. By early 2012, this surged to over 6,000 transactions. In January 2014, the daily average skyrocketed tenfold to surpass 60,000. As of the start of 2017, the Bitcoin network was processing over 300,000 transactions daily.

Remarkably, on May 1st, 2023, a peak of 630,099 daily transactions occurred. These statistics underscore a discernible pattern—Bitcoin usage is consistently escalating annually. Notably, this growth persists despite Bitcoin enduring a bear market since late 2021. According to BitInfoCharts, in the past 24 hours, 642,279 Bitcoin transactions were made.

The numbers above tell us something important – more and more people are using Bitcoin each year. Even better, this trend is continuing, even though Bitcoin hasn’t been doing so well in the market since late 2021.

This is great news for people who plan to invest in Bitcoin for a long time. This consistent growth makes it one of the top cryptocurrencies to consider buying.

Influence of Celebrity Endorsements on Bitcoin

The influence of famous people supporting Bitcoin is significant, not just on a personal level but also when big companies back it. Take Microsoft, for example; they started accepting Bitcoin in 2014, and AT&T joined in 2019. Many other businesses now also welcome Bitcoin.

An influential figure in the cryptocurrency world is Elon Musk, Tesla’s CEO. In early 2021, Tesla invested $1.5 billion in Bitcoin, and Musk often praised Dogecoin on Twitter during the same time.

Although another report suggests Tesla later sold 75% of its Bitcoin, citing cash flow issues in a BBC report, the increasing involvement of celebrities and major brands in cryptocurrencies is a positive sign for Bitcoin’s future.

Top 10 Famous Cryptocurrency Owners According to Forbes

For 2021, Forbes included 10 individuals in its annual World’s Billionaires list, recognizing them as “crypto billionaires.” This marked an increase of four individuals compared to the preceding year. The notable high-earners in this category include:

- Sam Bankman-Fried: An MIT graduate in his twenties, he founded FTX, a derivatives exchange, and Alameda Research, a quantitative trading firm. His total wealth stands at $8.7 billion.

- Brian Armstrong: As co-founder and CEO of Coinbase, he boasts a net worth of $8.9 billion.

- Chris Larsen: The chairman and co-founder of Ripple, a real-time currency exchange, and gross settlement system, holds a net worth of $3.4 billion.

- Cameron Winklevoss and Tyler Winklevoss: Renowned twin brothers and former Olympic rowers, they initiated their Bitcoin investments in 2012 and currently share an approximate net worth of $3 billion each.

- Michael Saylor: As the CEO of software firm MicroStrategy, his net worth has reached approximately $2.3 billion, largely influenced by Bitcoin investments.

- Jed McCaleb: A co-founder of Ripple, his net worth is around $2 billion.

- Fred Ehrsam: Originally a co-founder of Coinbase alongside Armstrong, Ehrsam now heads Paradigm, a cryptocurrency-focused investment firm with a net worth of $1.9 billion.

- Changpeng Zhao: The founder of Binance, a prominent cryptocurrency exchange, holds a net worth of $1.9 billion.

- Matthew Roszak: As the chairman of Bloq, a blockchain infrastructure company, he invested in Bitcoin around 2011 and currently possesses a net worth of about $1.5 billion.

- Tim Draper: In 2014, following the closure of the Silk Road cryptocurrency black market by the U.S. Marshals, this Silicon Valley venture capitalist invested $18.7 million in Bitcoin, now valued at $1.5 billion.

Which Nations Have Embraced Bitcoin as Legal Payment?

The future of Bitcoin also depends on its global acceptance. For instance, a few countries have banned Bitcoin, and some big names have made it legal. Here are some names.

- In the United States, Bitcoin is categorized as a “money services business,” requiring registration and record-keeping under the Bank Secrecy Act. The IRS treats it as property for tax purposes.

- Australia designates Bitcoin as an asset for capital gains tax, not considering it as currency.

- The European Union regards buying and selling digital currencies as a “supply of services” exempt from value-added tax. Still, individual countries, like the United Kingdom, have specific Bitcoin tax rules.

- Canada sees Bitcoin as money services, not currency, categorizing transactions as “barter transactions,” with any generated income considered business income.

Which Nations Prohibit Bitcoin Usage?

Because Bitcoin lacks government oversight, several countries have banned or cautioned Bitcoin account holders. These countries include:

- Ecuador: In 2014, Ecuador’s National Assembly banned Bitcoin and other cryptocurrencies but established guidelines for its “electronic money.”

- Russia: While there is no existing law against cryptocurrency, the Russian government has warned about the potential misuse of “virtual currencies” for terrorist financing and money laundering.

- Vietnam: Vietnam’s government and state banks do not regulate Bitcoin as an investment, and Bitcoin is not recognized as a legitimate payment method.

- Bolivia: Bolivia’s central bank has prohibited using cryptocurrencies, including Bitcoin.

- China: Cryptocurrency exchanges are banned in China, and banks and financial institutions are forbidden from trading in Bitcoin.

- Colombia: Bitcoin investments or usage are not allowed in this country.

Even though some countries have made Bitcoin illegal worldwide, we cannot deny it’s popularity.

What Affects the Bitcoin User Base?

Like other tradable assets, Bitcoin’s price is dictated by market dynamics. The interplay between Bitcoin’s demand and supply dictates its valuation. Now, let’s explore crucial metrics that can impact the value of Bitcoin, consequently influencing the volume of its users.

Market Trends

The value of Bitcoin is intricately tied to overall market trends, undergoing extended cycles of bullish and bearish markets. The rise prompts more participants to join the market during upward trends, driven by FOMO (fear of missing out).

Conversely, in downtrends, the opposite occurs, with investors succumbing to FUD (fear, uncertainty, and doubt), leading to the selling of Bitcoin holdings and further price decline.

Bitcoin is gaining momentum. Its value was just over $20,000 a year ago, and today it’s trading above $43,000, reflecting a substantial 12-month gain.

Some Other Major Issues that Affect Bitcoin Usage are mentioned below.

- Significant Economic Events: Significant economic occurrences like recessions or booms can sway Bitcoin user numbers. During downturns, users may seek alternative assets, including Bitcoin, as a store of value. Conversely, economic prosperity might drive interest away from cryptocurrencies.

- Market Volatility: The number of Bitcoin users can be influenced by market volatility. When Bitcoin experiences significant price fluctuations, it may attract or deter users seeking stable investments. High volatility can entice traders looking for profit opportunities but may also discourage those seeking a store of value.

- Security Incidents: Large-Scale Hacks and Scams: Large-scale hacks and scams impact Bitcoin adoption. Security breaches erode user confidence, leading to hesitancy in adopting or continuing to use Bitcoin. Enhancing security measures is crucial for fostering trust within the cryptocurrency community.

- Institutional Adoption: Institutional interest is pivotal in shaping the Bitcoin user base. As more institutions explore and adopt Bitcoin, it gains credibility as a legitimate asset class. Institutional involvement can positively influence retail users, fostering widespread acceptance and integration into traditional financial systems.

- Inflation: Bitcoin, often dubbed “digital gold,” can attract users during times of inflation. Investors turn to it as a hedge against depreciating fiat currencies, aiming to preserve their wealth through the scarcity and deflationary nature of Bitcoin.

- Regulation: Government regulations heavily influence Bitcoin adoption. Clear and supportive regulations can foster trust, encouraging more users to enter the space. Conversely, stringent or uncertain regulations may hinder growth, causing potential users to hesitate.

- Interest Rates: Changes in interest rates impact Bitcoin adoption. Investors might seek higher returns in riskier assets like cryptocurrencies in a low-interest-rate environment. Higher interest rates, on the other hand, could draw funds away from Bitcoin into traditional interest-bearing investments.

- Political Policies: Government policies, especially those related to monetary and fiscal decisions, can shape Bitcoin user trends. Users may increase in response to policies perceived as destabilizing traditional financial systems or decrease if policies create a more stable economic environment, reducing the perceived need for alternative financial instruments.

In the end, it’s not clear if the economic events mentioned significantly affect Bitcoin’s value in the long run. Even though market reactions may happen due to important news, most of Bitcoin’s price movements are linked to broader trends

In a Nutshell

To accurately determine the actual number of Bitcoin users is challenging. Nonetheless, available data indicates a growing trend in the number of individuals purchasing, holding, and engaging in transactions with Bitcoin. In 2009, there were only 14 active Bitcoin wallet addresses, a number that has now exceeded 40 million.

FAQs

1. Who created Bitcoin?

Bitcoin was created by an individual or group using the pseudonym Satoshi Nakamoto in 2009. Despite intense speculation, Nakamoto’s true identity remains unknown. The invention of Bitcoin marked the beginning of decentralized digital currencies, revolutionizing the financial landscape with its blockchain technology.

2. What makes Bitcoin unique?

Bitcoin’s uniqueness lies in its decentralized nature, operating without a central authority. Its limited supply of 21 million coins ensures scarcity. Utilizing blockchain technology, Bitcoin enables transparent, secure, and pseudonymous transactions globally. This combination of decentralization, scarcity, and technological innovation distinguishes it from traditional currencies.

3. Can I find statistics on Bitcoin ownership by country?

Yes, you can find statistics on Bitcoin ownership by country from various sources. Several websites, research firms, and cryptocurrency analytics platforms provide data on the distribution of Bitcoin holdings globally, offering insights into regional adoption rates and the popularity of Bitcoin in different countries.

4. What factors influence Bitcoin adoption globally?

Regulatory policies, technological infrastructure, economic stability, public awareness, and financial trends influence Bitcoin adoption globally. Countries with clear regulations, robust technology, and economic uncertainty may see increased adoption. Public perception and awareness, shaped by media and education, also play a pivotal role.

5. How is Bitcoin ownership measured?

Bitcoin ownership is measured through blockchain addresses, each representing a unique wallet. However, this method has limitations, as one person can have multiple addresses. Analyzing on-chain data, researchers estimate ownership, but precise counts are challenging due to the pseudonymous nature of Bitcoin transactions.

6. Is Bitcoin legal?

Bitcoin’s legality varies globally. Many countries accept and regulate it, while others impose restrictions or outright bans. Before engaging in Bitcoin activities, researching and understanding your jurisdiction’s legal stance to ensure compliance with local regulations is crucial.

7. How do I acquire Bitcoin?

To acquire Bitcoin, you can use cryptocurrency exchanges like Coinbase or Binance, where you can buy Bitcoin using traditional currency. Alternatively, you can receive Bitcoin as payment, mine it (though mining has become complex), or participate in peer-to-peer transactions. Ensure secure storage in a digital wallet.