Cardano (ADA) emerges as a significant contender, bragging for a substantial market capitalization of $25.5 billion. As interest in this cryptocurrency mounts, a fundamental inquiry arises: just how many individuals possess Cardano? This blog investigates Cardano ownership, looking into different methodologies and insights to crack the figures.

Join us as we disclose Cardano’s user base, offering valuable insights into the Cardano user base.

Let’s start exploring.

Research-Driven Facts About How Many People Own Cardano

Cardano (ADA), a cryptocurrency often compared to Ethereum, operates within a decentralized network, posing challenges in accurately determining its user base. Ownership of ADA is spread among various entities, complicating precise quantification. Despite this complexity, there are methodologies to estimate the number of ADA holders.

Let’s explore some of these approaches to gain insights into Cardano’s user base.

Method 1: Researched Data from Reliable Sources

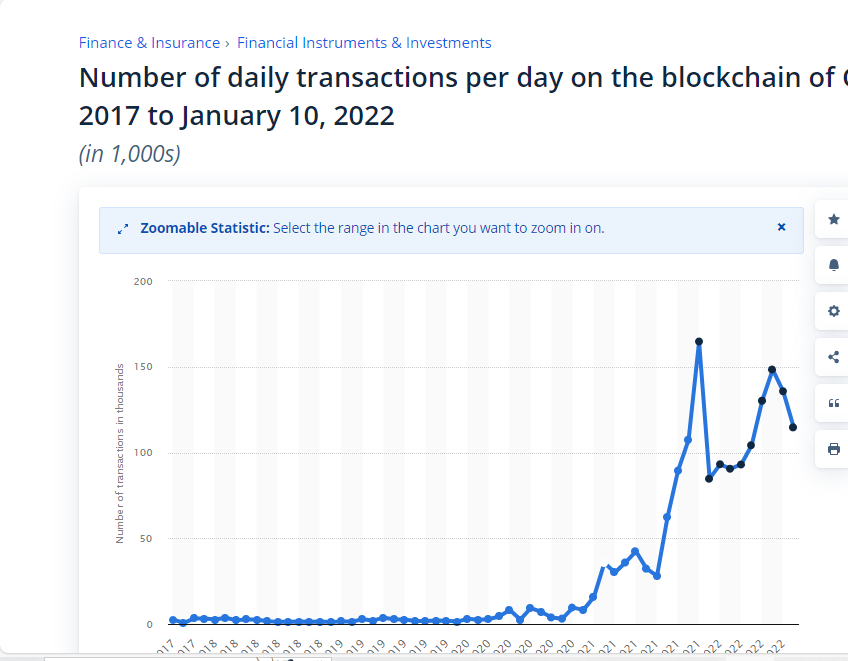

According to Statista reports in November 2021, the active addresses involved in Cardano transactions surged, surpassing the 5 million mark. This exponential growth underscores ADA’s rising popularity, positioning it as a viable alternative to Ethereum within the blockchain ecosystem.

The surge in Cardano’s active addresses reflects its appeal to users seeking cost-effective and efficient solutions for decentralized finance (DeFi) applications.

According to Coinmarketcap recent on-chain data reveals a notable uptick in active addresses within the Cardano network, surpassing last year’s peak. This surge in monthly active addresses underscores growing acceptance and hints at substantial forthcoming advancements.

According to Danogo, the count of active addresses over the past 30 days surged to 596,915 on March 11, marking the highest figure since May 2023. Such momentum signals increasing engagement and potential for significant developments within the Cardano ecosystem.

Method 2: Cardano Transactional Activity

In February 2021, Cardano (ADA) experienced a surge in blockchain activity as investor interest intensified, mirroring its counterpart Ethereum. This period marked ADA’s prominence among the most actively traded cryptocurrencies. Notably, ADA shares close ties with Ethereum, bragging about an open-source structure and a co-founder in common.

The day’s transaction volume reached a remarkable 164,670 transactions, reflecting growing engagement with the ADA blockchain. The sustained expansion in transactional volume highlights Cardano’s resilience and capacity for deeper disruption within the conventional financial sector.

Who Owns the Most Cardano?

Explore the distribution of ADA holdings by coincarp report with this table showcasing the top ten holders, shedding light on Cardano’s user base.

| Ranks | ADA Holdings | Percentage of the Total Supply | Address |

|---|---|---|---|

| 1 | 1,650,684,174 | 3.67% | Ae2tdPwUPEYwFx4dmJheyNPPYXtvHbJLeCaA96o6Y2iiUL18cAt7AizN2zG |

| 2 | 777,944,704 | 1.73% | addr1q9cp6hfrsvqc0jn9eeskdtk3l7usqaa35lm925f7usqtzhnsr4wj8qcpsl9xtnnpv6hdrlaeqpmmrflk24gnaeqqk90qjgx |

| 3 | 452,300,055 | 1.01% | addr1q8hsff3uwtphx7dtya7unjwjwug52e5jvqp09je6pwqx8k4jvuxrw2x5rr7e258a33yzkrhhlrrc5ezvd2z7qtdq0gasme4 |

| 4 | 298,164,638 | 0.66% | addr1q88ysqegp378eag7fauv5zyjvvuy8mca3dc0925hv0nzl8qp0jwyns8qwzf5dqtdlwkv7qt5upzcyfmd5yl43s89txvse89 |

| 5 | 168,032,153 | 0.37% | Ae2tdPwUPEZFSi1cTyL1ZL6bgixhc2vSy5heg6Zg9uP7PpumkAJ82Qprt8b |

| 6 | 165,748,001 | 0.37% | addr1v804tgee0m3ww7z93zh64wr9flqh9psdhnxg6cykfudgulg6f633p |

| 7 | 159,600,418 | 0.35% | addr1q99j4v4tplxmxt4md3r6chjwt0sfeq23z740s3zk5cdhccl7xy874vgy876lvf7r6nagq59pmrd4wdy6mc0jv0zfdfhsqne |

| 8 | 139,111,134 | 0.31% | Ae2tdPwUPEZLXq3gxpmnnnKQD2mWQokQfKwrWqks8to3zarvhbxsPABmD68 |

| 9 | 130,983,949 | 0.29% | addr1q9y8tu07chm4g5djr33tye2ckvdnl2cm7s6u7p5mqjs8wfalpcf5mc8ncefe92rj4gz6kwlzxrj54wy25c7c44vvdl9qeys |

| 10 | 102,875,473 | 0.23% | – |

This table displays Cardano’s primary addresses holding significant portions, showcasing its impact on ADA’s distribution.

Our Key Findings About Cardano Usage

| Key Findings | Values |

|---|---|

| Cardano’s Active Addresses Surge | Surpassed 5 million in November 2021, highlighting growing popularity as an Ethereum alternative for DeFi apps. |

| Reflects appeal to users seeking cost-effective and efficient DeFi solutions. | |

| Notable Uptick in Active Addresses | Recent surge to 596,915 on March 11, 2024, hinting at forthcoming advancements. |

| Signaling increasing engagement and potential developments within the Cardano ecosystem. | |

| Transactional Activity Surge | Heightened activity in February 2021, mirroring the Ethereum trend, with 164,670 transactions. |

| ADA is positioned among the most actively traded cryptocurrencies. | |

| Market Performance and Long-Term Holder Confidence | recently surged to $0.566 on Feb. 11, 2024, fueled by momentum, showcasing a 7% weekly gain. |

| Long-term ADA holders constituting 23% display confidence in the project’s potential, signaling a positive momentum. |

The Future of Cardano

According to binance reports “Cardano (ADA), ranked eighth by market capitalization, recently surged to a six-day peak of $0.566 on Feb. 11, driven by bullish momentum. Despite a subsequent pullback, ADA remains up 7% weekly, currently trading at $0.536 amid broader market declines. Long-term ADA holders exhibit confidence in the project’s potential, with 23% holding for over five years, showcasing steadfast support. Analysts anticipate ADA may encounter resistance around $0.54 to $0.56, potentially signaling a revolution towards $0.68.

According to Statista reports, the Cardano network is experiencing a surge in active addresses, reaching the highest monthly count since last year. Data reveals widespread acceptance and potential for future growth. On March 11, active addresses soared to 596,915, nearly double the lowest count recorded in September 2023. This uptick underscores increased adoption and transaction capacity on the Cardano blockchain, hinting at promising developments ahead.

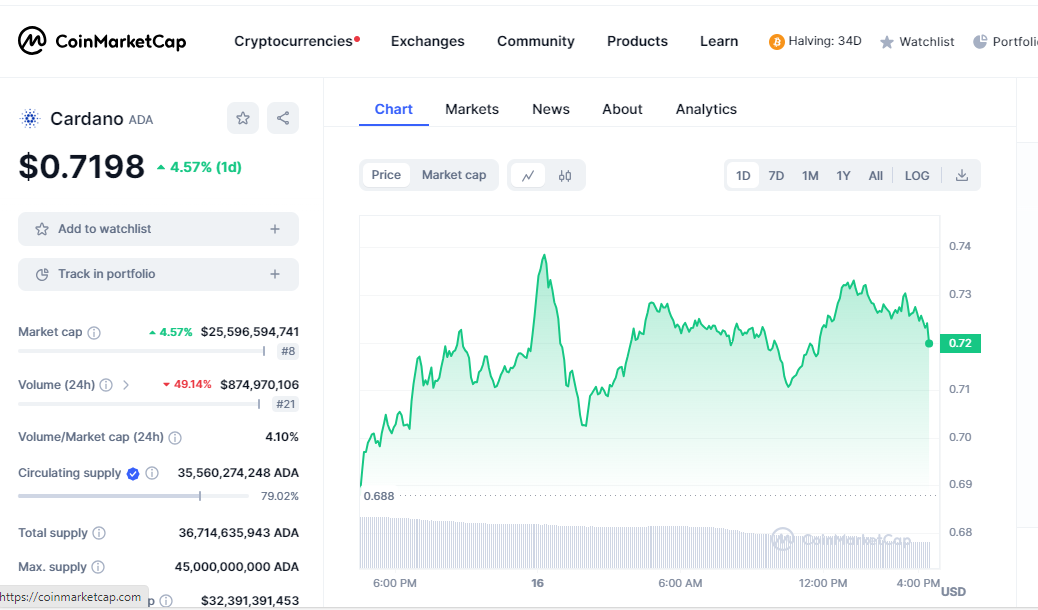

Cardano’s price reached $0.7198, showcasing its powerful market performance alongside a notable market capitalization of $25.5 billion. This significant market presence underscores its growing influence in the cryptocurrency domain, attracting investor attention and contributing to its status as a key player in the digital asset domain.

What Affects the Cardano User Base?

Here are some key factors that can affect Cardano’s future. Let’s have a look.

- Technological Developments: Advancements in Cardano’s technology, such as protocol upgrades or new features, can attract more users by improving usability and functionality.

- Regulatory Environment: Changes in regulations concerning cryptocurrencies can influence the adoption of ADA, either by fostering trust and legitimacy or by creating barriers to entry.

- Market Sentiment: Fluctuations in the cryptocurrency market, including changes in prices and investor sentiment, can impact user engagement with ADA.

- Partnerships and Integrations: Collaborations with businesses, governments, or other blockchain projects can expand ADA’s use cases and increase its user base.

- Security Concerns: Security breaches or vulnerabilities in the Cardano network can erode trust among users and discourage adoption.

- Scalability and Performance: Issues related to network scalability or transaction speed can affect user experience, potentially leading to dissatisfaction and decreased usage.

- Community Engagement: Active participation and support from the Cardano community, including developers, enthusiasts, and stakeholders, play a crucial role in attracting and retaining users.

- Competition: Competition from other blockchain platforms offering similar services or features may influence ADA’s user base, prompting Cardano to differentiate itself through innovation and strategic positioning.

The long-term valuation of Cardano is subject to uncertainties regarding its response to economic events. While noteworthy developments may trigger immediate market shifts, Cardano’s prices are mainly shaped by broader market trends, not isolated occurrences. A comprehensive grasp of these overarching trends is key in evaluating Cardano’s value in the future.

In a Nutshell

Pinpointing the exact number of individuals who own Cardano (ADA) remains challenging due to its decentralized nature and distributed ownership across various groups. However, the growing adoption and interest in Cardano signal a promising future for the cryptocurrency. As it continues to develop its technology, foster partnerships, and expand its ecosystem, Cardano is poised to attract even more users and solidify its position as a key player in the digital asset space.

FAQs

1 – Who is the founder of Cardano?

Charles Hoskinson, along with Jeremy Wood, is one of the co-founders of Cardano (ADA). Hoskinson, a prominent figure in the cryptocurrency space, was also involved in the founding of Ethereum. His vision for Cardano emphasizes scalability, interoperability, and sustainability, aiming to create a more inclusive and decentralized financial system through blockchain technology.

2 – Is the use of Cardano legal?

Yes, Cardano’s ADA cryptocurrency is legal in most jurisdictions where cryptocurrency ownership and trading are permitted. However, regulations regarding cryptocurrencies can vary from country to country, so it’s essential to consult legal experts or regulatory authorities in your region to ensure compliance with local laws and regulations regarding cryptocurrency usage and investment.

3 – Are there any public disclosures or reports indicating which exchanges or wallets hold the most Cardano ADA?

As of now, there aren’t comprehensive public disclosures or reports specifically detailing which exchanges or wallets hold the largest amounts of Cardano’s ADA cryptocurrency. However, some exchanges may occasionally disclose aggregate holdings, but detailed data on individual wallets is typically not publicly available due to privacy and security reasons.

4 – Is there any information available on the distribution of Cardano ADA among different geographical regions or demographics?

As of current data, information on the distribution of Cardano’s ADA among various geographical regions or demographics is limited. While some studies may offer insights based on wallet addresses or exchange data, comprehensive demographic breakdowns are often challenging due to the pseudonymous nature of cryptocurrency transactions and the lack of centralized reporting mechanisms.

5 – What factors might contribute to an individual or entity accumulating a substantial amount of Cardano (ADA)?

Several factors contribute to accumulating a substantial amount of Cardano (ADA). These include early adoption, strategic investments, belief in the project’s potential, long-term commitment to the ecosystem, active participation in staking or governance, and financial resources to acquire and hold ADA tokens. Additionally, involvement in development, partnerships, or community contributions can lead to increased holdings.