- •Pacifica is a Solana-based perp DEX with 48+ markets and up to 50x leverage.

- •No KYC required, with wallet-based access and USDC-only deposits.

- •Off-chain CLOB delivers fast execution with on-chain settlement.

- •Built-in AI assistant offers trade ideas and risk insights.

- •Bridge audited by BlockSec, with built-in deBridge support.

- •Hot-cold fund architecture with multi-tier liquidation system.

The perp DEX space is expanding quickly, with platforms chasing CEX-level speed and DeFi security. Pacifica is one such platform that has climbed the rankings, now reporting over $830 million in daily perpetual trading volume, and it’s one of the few built on the Solana blockchain. In this Pacifica review, we’ll look at its features, fees, and overall user experience to answer the key question many traders have: is Pacifica safe to use?

| Stats | Pacifica |

|---|---|

| 🚀 Fondé | 2025 |

| 🌐 Siège social | Singapour |

| 🔎 Fondateur | Constance Wang |

| 👤 Utilisateurs actifs | 33K + |

| 🪙 Contrats à terme | 48 XNUMX |

| 🔁 Frais de futures (maker/taker) | 0.015% / 0.040% |

| 📈 Effet de levier maximum | 50x |

| 🕵️ Vérification KYC | Non requis |

| Application mobile | Non |

Pacifica Overview

Pacifica is a Solana-based perpetual DEX built for traders who want fast execution without giving up on-chain custody. Founded in 2025 and headquartered in Singapore, the exchange is led by Constance Wang and launched its closed beta in June 2025. Since then, it has grown to more than 33,000 active users, reporting over $830 million in daily perpetual volume and around $46 million in OI, quickly surpassing Jupiter to become Solana’s top perp DEX by volume.

The platform focuses purely on derivatives, offering 48+ perpetual contracts with up to 50x leverage. There’s no spot market or tokenized asset support, keeping the experience centered on high-speed futures trading. Orders are matched through an off-chain central limit order book (CLOB) designed for sub-10ms execution, while deposits, withdrawals, and custody remain on-chain. The bridge used for transfers has also been audited by BlockSec.

Pacifica charges 0.015% maker and 0.040% taker fees, does not require KYC, and currently operates without a mobile app. It also supports sub-accounts, allowing traders to manage separate balances, positions, and risk profiles under a single master account. The platform highlights AI-powered tools for personalized insights, built by a team with backgrounds in both crypto and traditional finance.

On the risk side, the platform uses a multi-tier liquidation system with market liquidation, backstop mechanisms, and auto-deleveraging to help keep the orderbook stable during volatile moves.

So how does Pacifica feel once you’re inside the platform? Let’s walk through its trading interface, funding options, and other key features next.

Pacifica Pros and Cons

| 👍 Pacifica Pros | 👎 Pacifica Cons |

|---|---|

| ✅ Sub-accounts for strategy separation | ❌ Pas de trading au comptant disponible |

| ✅ Built on Solana with fast, low-latency execution | ❌ No vaults or staking products |

| ✅ Built-in AI trading assistant | ❌ Limited asset coverage compared to larger perp DEXs |

| ✅ Fast execution with off-chain CLOB matching | ❌ No dedicated mobile app yet |

| ✅ Advanced order types and hotkeys | ❌ Support mainly through Discord, with slower responses at times |

| ✅ Integrated cross-chain bridge |

Pacifica KYC and Sign-up

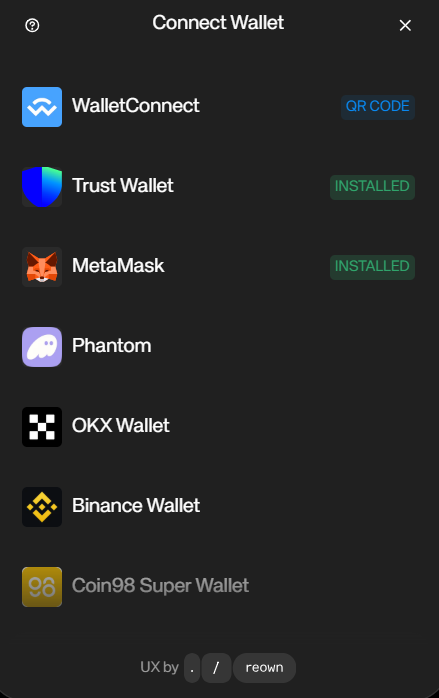

Since Pacifica is a decentralized exchange, there’s no KYC required by default. You don’t need to create an account or go through a registration process. Instead, you can simply connect your wallet and start trading within a few clicks.

Here’s how to get started on Pacifica:

Étape 1 : Open your browser and go to the official Pacifica website. Click the “Launch App " button to enter the trading platform.

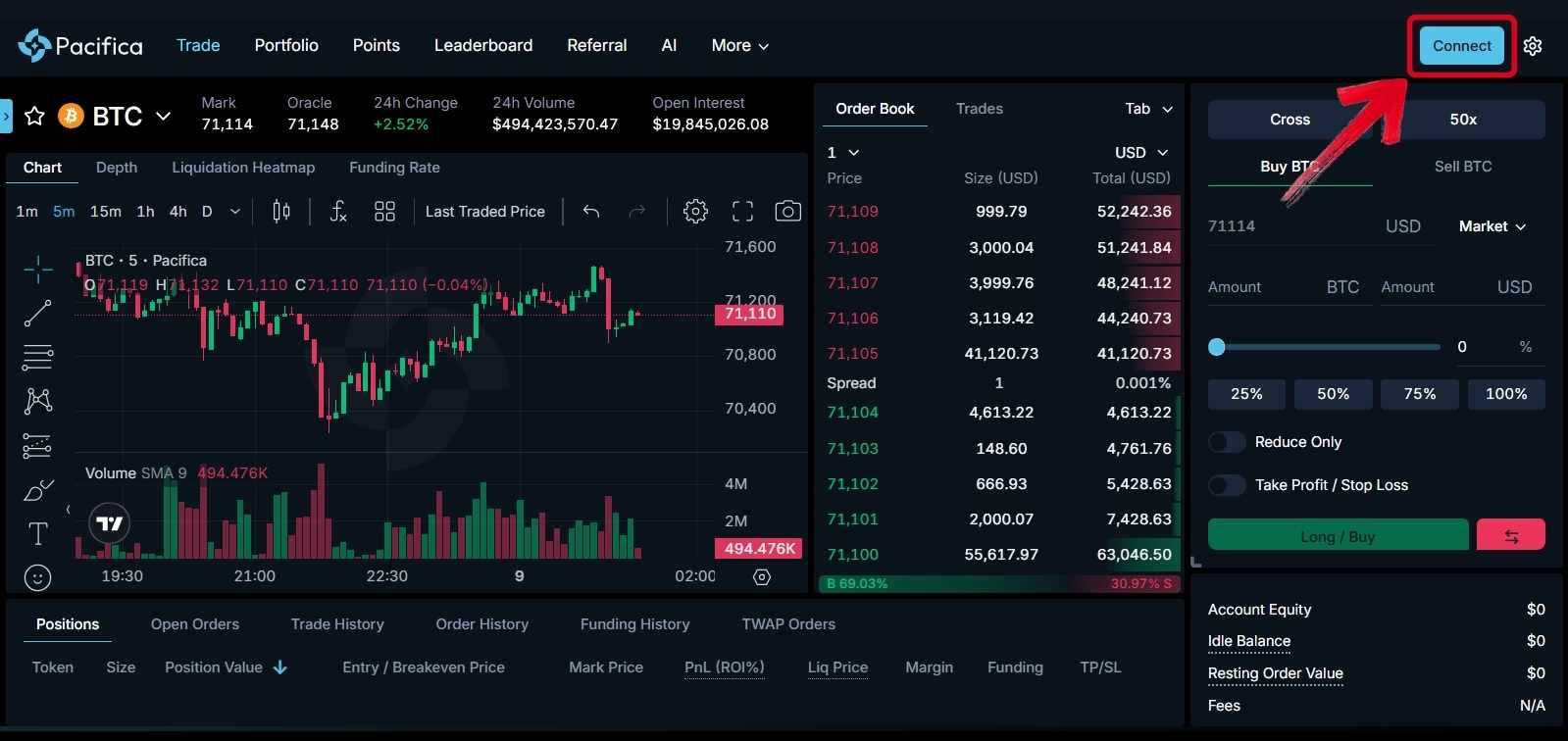

Étape 2 : Once the app loads, click the "Connect" bouton dans le coin en haut à droite de l'écran.

Étape 3 : A pop-up will appear showing the list of supported wallets. Select the wallet you want to use.

Étape 4 : Your wallet will send a connection and signature request. Approve it to connect your wallet to Pacifica and start trading.

Pacifica is available worldwide, with no region-based restrictions, unlike many CEX platform, that limit access based on local regulations.

Réseaux pris en charge

Pacifica is built on the Solana blockchain and currently operates only on the Solana network. All deposits, withdrawals, and trading activity take place on Solana.

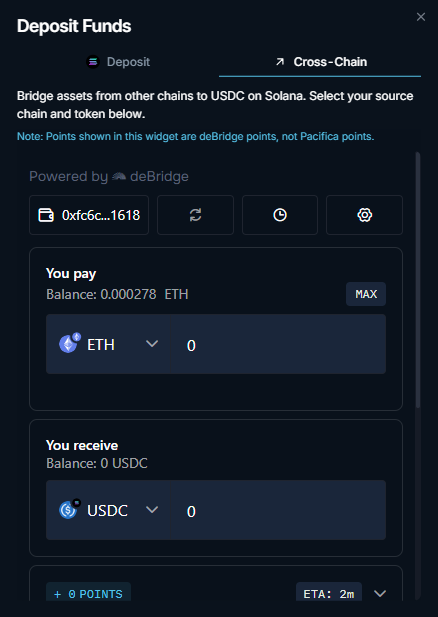

To make funding easier, Pacifica includes a built-in bridge integrated with dePont. This lets users transfer assets from other networks, including Ethereum, BNB Chain, and 5+ additional chains, directly into the platform. Once bridged to Solana, the funds can be used for trading on Pacifica.

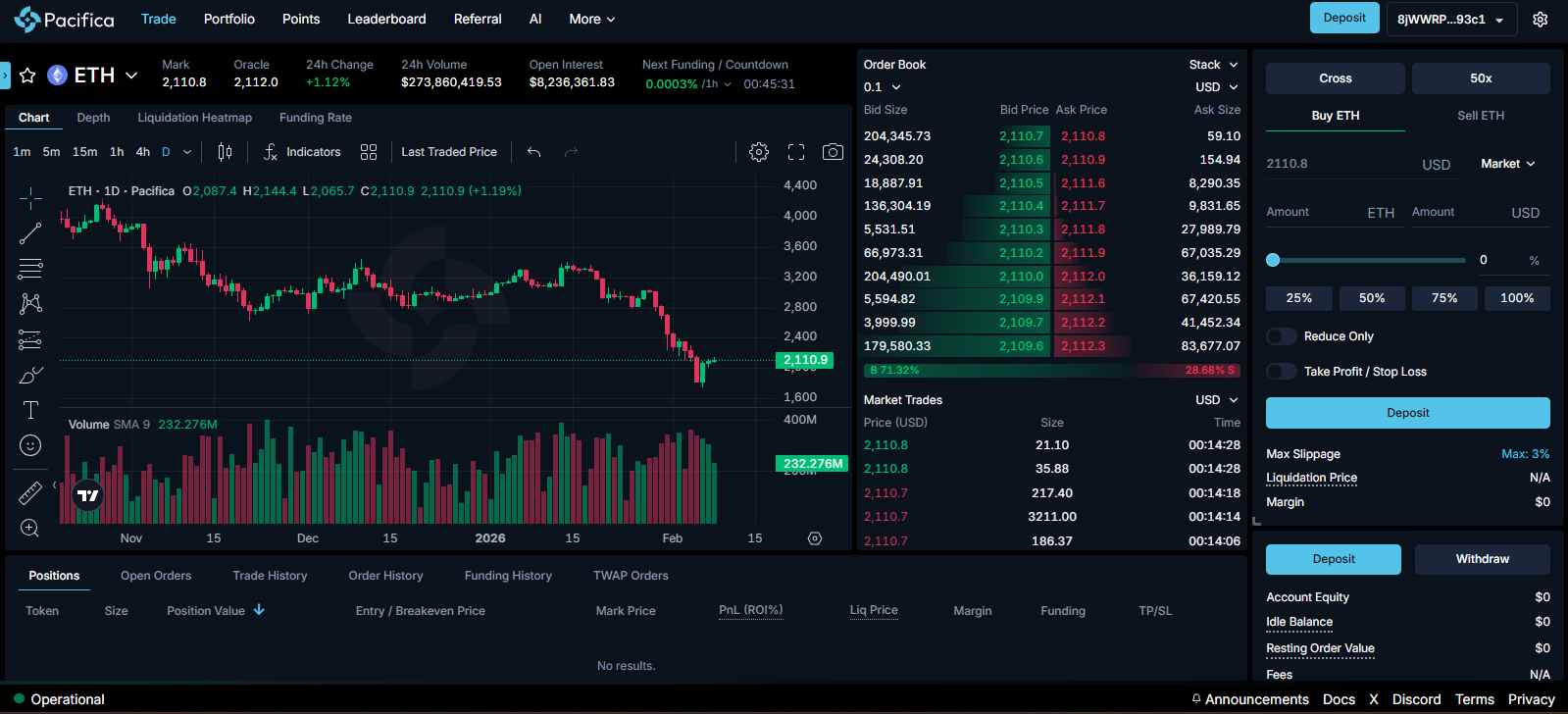

Pacifica Trading

Pacifica features a modern trading interface, though the available markets are limited to derivatives only. The platform currently offers 48+ perpetual markets, with leverage of up to 50x depending on the asset. The main trading screen includes a TradingView-powered chart, giving users access to indicators and charting tools. Orders are matched through an off-chain central limit order book (CLOB), similar to what traders are used to on centralized exchanges, with the order panel and position tools placed on the right side of the interface.

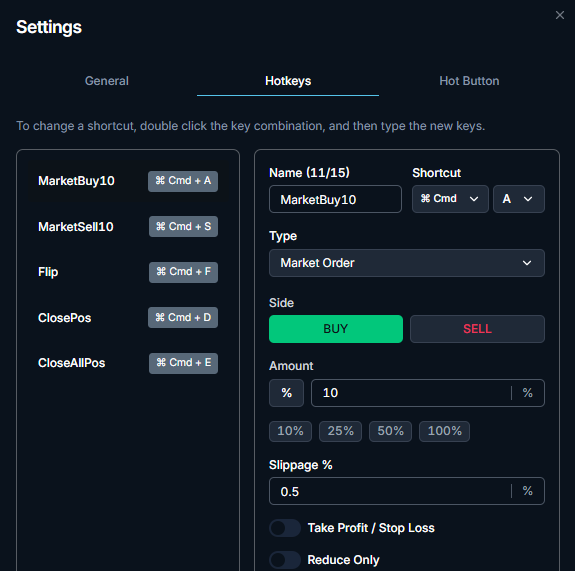

In terms of order types, Pacifica offers a solid range of options. Along with basic Market and Limit orders, users can also place advanced orders such as Stop Market, Stop Limit, TWAP, and Scaled orders to manage entries more precisely. The platform also supports sub-accounts, allowing traders to run different strategies in parallel with separate balances, positions, and risk profiles. Another practical feature is Hotkeys, which lets users assign keyboard shortcuts for faster trade execution.

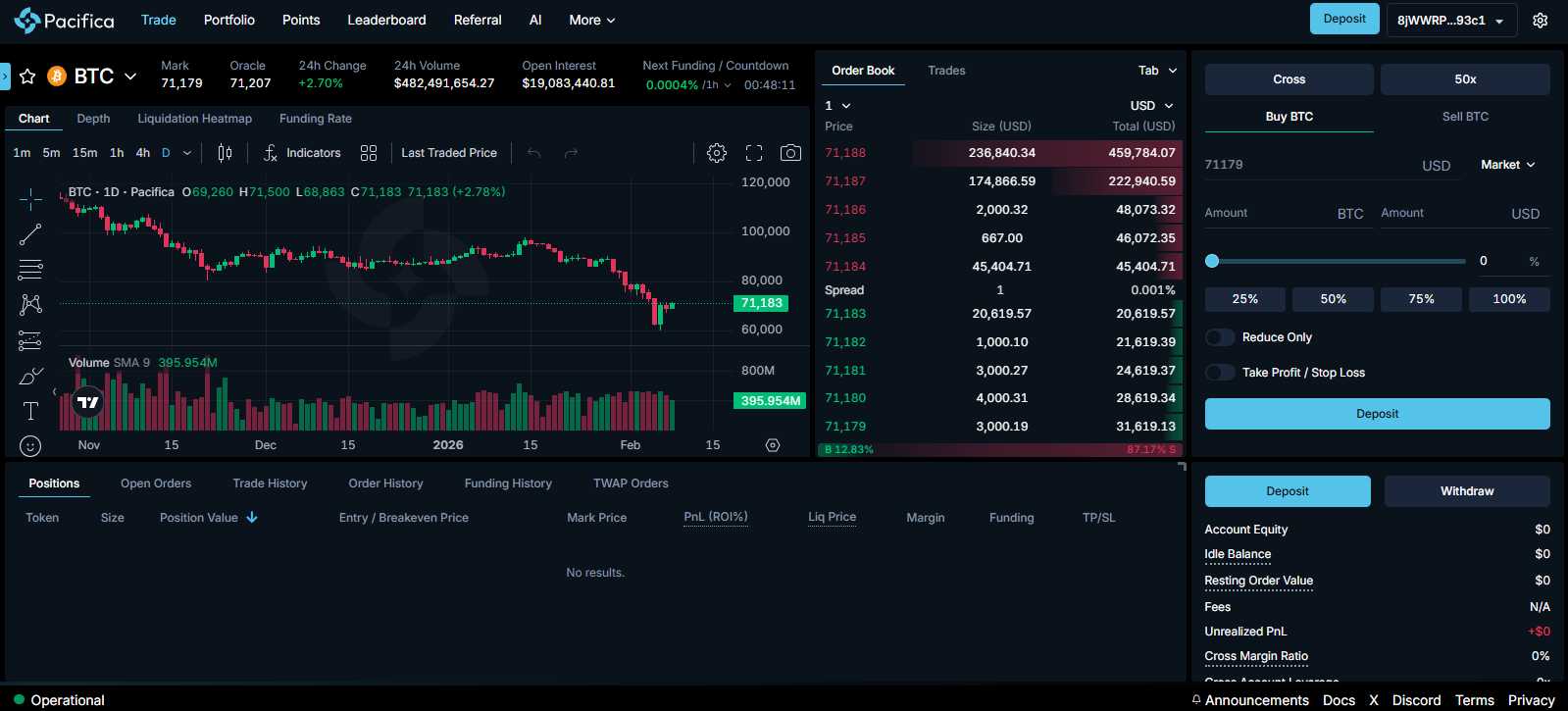

Méthodes de dépôt et de retrait

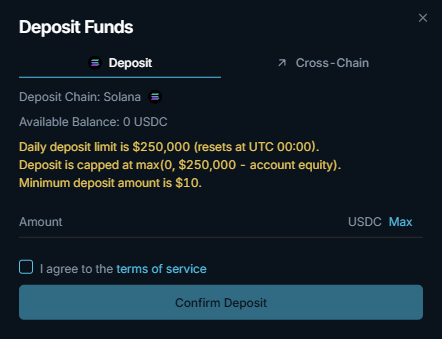

Pacifica is built on Solana and currently supports deposits only through the Solana network, allowing users to fund their accounts with USDC from a Solana-compatible wallet.

If you don’t already have funds on Solana, you can use the built-in bridge powered by deBridge to move assets from other networks. The bridge currently supports chains like Ethereum, BNB Chain, Base, Arbitrum, Polygon, Optimism, and Avalanche, letting you transfer funds to Solana before trading on Pacifica. The minimum deposit amount is $10, while the daily limit is set at $250,000 per account.

Pacifica Fees

Let’s take a quick look at how Pacifica’s fees are structured for trading, deposits, and withdrawals.

Frais de négociation

Pacifica follows a tiered fee model, with the base level starting at 0.015% for makers and 0.040% for takers. Fees are reduced as your 14-day rolling trading volume increases, placing you into higher VIP tiers.

At the VIP 3 level, where the 14-day rolling volume exceeds $500 million, fees can drop as low as 0.000% for makers and 0.028% for takers. This structure rewards higher-volume traders with lower costs over time.

Frais à terme

0.015 % Fabricant

0.040% Preneur

Dépôts et retraits

Deposits on Pacifica are free, with no platform fees, so you only pay the standard Solana network gas fee when sending funds to your account. Withdrawals, on the other hand, carry a flat $1 processing fee charged by the platform.

If you’re depositing through the built-in deBridge integration, Pacifica does not charge any additional fees for the bridge itself. However, this method involves external costs, such as the deBridge platform fee and the source network’s gas fees.

Pacifica Products and Services

Next, let’s take a closer look at Pacifica’s products and services to see what it actually offers traders.

Pacifica Trading

Pacifica focuses entirely on perpetual futures, offering up to 50x leverage across its listed markets. The interface feels fast and responsive, thanks to its off-chain CLOB matching system, which delivers sub-10ms execution and orderbook updates around every 100ms, while settlements still happen on-chain.

Traders get a full set of order types, including Market, Limit, Stop Market, Stop Limit, TWAP, and Scaled orders, making it easier to manage entries and exits. Users can also adjust their slippage settings to better control how their orders are executed in fast-moving markets. The platform also supports sub-accounts, so you can run multiple strategies at the same time with separate balances and risk exposure.

The interface itself is clean, dark-mode friendly, and built for active trading. Features like hotkeys and turbo mode help with fast scalping, while the built-in AI tools provide personalized trading insights based on your activity.

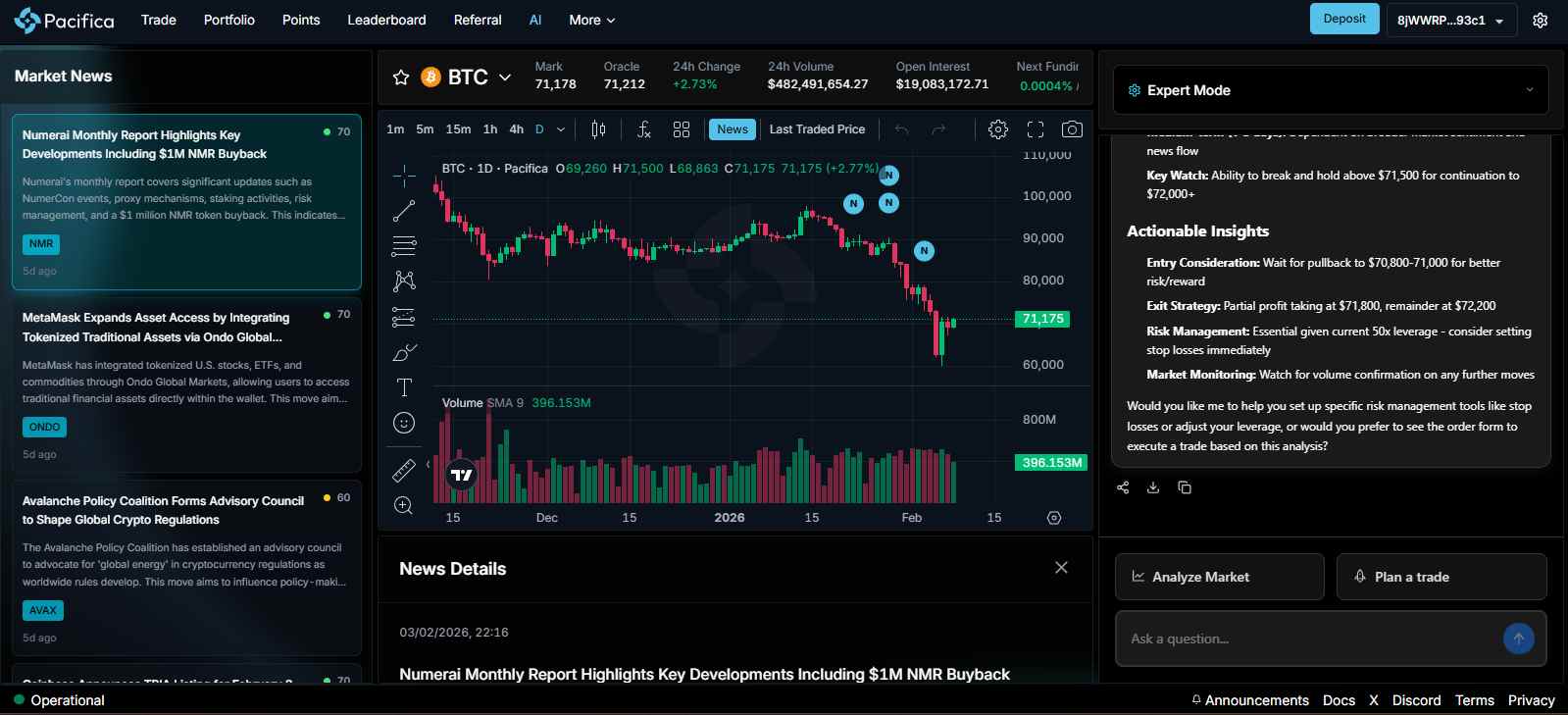

Pacifica AI

Pacifica AI is built directly into the platform as a trading assistant rather than a separate tool. It analyzes market conditions, reviews your open positions, and suggests trade ideas based on your activity and risk profile. You can also use it to plan entries, set stop-loss and take-profit levels, or check liquidation risks. The experience feels similar to a chat interface, where you ask for analysis or setups, and the AI responds with structured suggestions that you can review before placing trades.

Pacifica Security

Since Pacifica is a self-custodial DEX, you connect using your own wallet, which means the safety of your funds also depends on how securely you manage your private keys and wallet access.

On the infrastructure side, the platform’s deposit and withdrawal bridge has been audited by BlockSec. At the platform level, Pacifica uses a hot-cold hybrid fund protection model, where a limited hot wallet handles day-to-day withdrawals while the majority of user funds remain in a multi-signature cold vault governed by distributed signers. This setup is designed to limit exposure even if operational systems are compromised.

The platform also includes self-trade prevention, automatically cancelling orders that would match against positions from the same account. For risk management, Pacifica runs a three-tier liquidation system, starting with market liquidations, followed by a backstop liquidator, and auto-deleveraging if losses exceed available collateral. This layered approach helps keep the orderbook stable during extreme market moves.

Pacifica Customer Support

As a DeFi platform, Pacifica relies mainly on community and direct team channels for support, with most assistance handled through its official Discord server. Response times can sometimes be slow, especially during busy periods, but questions and issues are generally acknowledged and addressed by the team or community moderators.

Pacifica Alternatives

Pacifica is still a relatively new entrant in the perp DEX space, and some features may be missing compared to more established platforms. There’s no spot trading, no vault-based staking, and limited asset coverage, especially when it comes to tokenized stocks or precious metal products. That said, there are several strong alternatives in the market, each offering different features depending on what you’re looking for.

1. Hyperliquide : For deeper markets, Hyperliquide offers perps, tokenized stocks, and vaults for passive strategies.

2. Briquet : For zero-fee trading, Briquet focuses on perps while offering vaults for automated strategies.

| Fonctionnalité | Pacifica | Hyperliquide | Briquet |

|---|---|---|---|

| Établi | 2025 | 2024 | 2024 |

| Frais spot (créateur/preneur) | N/D | 0.04% / 0.07% | 0.00% / 0.00% |

| Frais à terme (fabricant/preneur) | 0.015% / 0.040% | 0.015% / 0.045% | 0.00% / 0.00% |

| levier Max | 50x | 50x | 50x |

| KYC requis | Non | Non | Non |

| Cryptos prises en charge (Spot) | N/D | 238 XNUMX | 1+ |

| Contrats à terme | 48 XNUMX | 173 XNUMX | 117 XNUMX |

| Volume des contrats à terme sur 24 heures | 830M + $ | 1.84 milliards de dollars et plus | 2.51 milliards de dollars et plus |

| Fonctionnalités clés | • Solana-based perps • Built-in AI assistant |

• L1 personnalisé • Zéro gaz |

• ZK rollup • Vente au détail sans frais |

| S'inscrire | S'inscrire | S'inscrire | S'inscrire |

Conclusion

Pacifica has been gaining traction as perp volumes rise, offering a simple interface and a Solana-based trading environment that may appeal to users already active in that ecosystem. The addition of built-in AI tools also brings a new angle to the perp DEX space. However, this Pacifica review shows that the platform is still limited, with no spot markets, vaults, or broader asset coverage. If those features matter to you, it may be worth continuing your search by reading our guide on the DEX du meilleur criminel les plates-formes.

FAQ

1. Is Pacifica safe to use?

Pacifica uses a self-custodial model, a hot-cold fund architecture, and a three-tier liquidation system. However, wallet security still depends on the user.

2. What assets can I trade on Pacifica?

Pacifica currently offers 48+ perpetual futures markets. There is no spot trading at the moment.

3. Is Pacifica built on Solana?

Yes. Pacifica is a Solana-based perp DEX, and all deposits, withdrawals, and trading activity take place on the Solana network.

4. Can you use Pacifica without a Solana wallet?

You need a Solana-compatible wallet to trade. If your funds are on another network, you can bridge them using the built-in deBridge tool.

5. Does Pacifica have a mobile app?

Yes. Pacifica offers native iOS and Android apps, along with a mobile-optimized web app.

6. What is the Pacifica AI Trading Agent?

It’s a built-in assistant that provides market analysis, trade ideas, and risk checks through a chat-style interface.

7. What are the Pacifica withdrawal limits and process?

Pacifica withdrawals are capped at around $100,000 per account every 24 hours during beta. Funds are sent in USDC to your Solana wallet, with standard network gas fees.

8. Is my money safe on Pacifica? Is it custodial?

Pacifica is non-custodial, meaning you keep control of your wallet and private keys. Trades settle on-chain, but you should still follow basic DeFi safety practices.