- Grvt is a perp-only DEX built to feel similar to centralized exchanges.

- Supports over 76 perpetual contracts with leverage up to 50x.

- Maker rebate starts at -0.0001%, with a 0.045% taker fee.

- Users can earn yield through earn-on-equity and GLP vault strategies.

- Deposits and withdrawals use USDT and USDC across six networks.

- Native mobile apps are available for both Android and iOS.

- The platform is crypto-only, with no spot or traditional asset markets.

Perp DEXs have built a very strong hold in the crypto space, with users moving away from centralized exchanges for several reasons, mainly privacy and centralization. As more projects enter this sector, Grvt is one of the more recent platforms to appear, positioning itself as more than just a perp DEX. It is moving toward the idea of an on-chain private bank through its earn-on-equity offering. This Grvt review focuses on details that matter while trading and using the exchange, such as fees, supported assets, networks, and more.

| Stats | Grvt |

|---|---|

| 🚀 Fondé | 2024 |

| 🌐 Siège social | Singapour |

| 🔎 Fondateur | Hong Gyu Yea |

| 👤 Utilisateurs actifs | 90K + |

| ♾️ Les auteurs de crimes soutenus | 76+ |

| 🔁 Frais de futures (maker/taker) | -0.0001% / 0.045% |

| ⚙️ Réseau pris en charge | 6+ |

| 📈 Effet de levier maximum | 50x |

| 🕵️ Vérification KYC | Non requis |

| Application mobile | Oui |

| ⭐ Évaluation | 4.5/5 |

Grvt Overview

Grvt is a hybrid decentralized perpetual futures exchange launched in 2024 and based in Singapore, founded by Hong Gyu Yea. It is built on zkSync’s ZK Stack using a Validium architecture, which allows the platform to deliver fast execution while keeping custody and settlement on-chain. In day-to-day use, Grvt feels closer to a centralized exchange in terms of speed and interface, but it operates without taking control of user funds and does not require KYC.

The platform focuses exclusively on perpetual futures trading. It supports over 76 perpetual contracts with leverage of up to 50x and reports daily trading volume of around $1.6 billion, with more than 90K+ users. Trading fees are clearly defined. Makers receive a rebate of -0.0001%, while taker fees are set at 0.045%. Grvt also supports trading across 6 networks through a unified liquidity setup, which helps keep order books deep across supported markets.

Beyond active trading, Grvt includes account-level yield features. Users can earn on idle equity directly within their trading account through options like the GLP Vault and delta-neutral strategies, designed to generate passive returns without requiring constant position management. Grvt remains crypto-only, with no support for assets such as forex or tokenized stocks, and also offers mobile app available for both android and iOS. The platform’s contracts and infrastructure have been audited by Spearbit DAO, NCC Group, and teams associated with the zkSync foundation.

Grvt Pros and Cons

| 👍 Grvt Pros | 👎 Grvt Cons |

|---|---|

| ✅ CEX-style interface with fast execution | ❌ Perpetual futures only, no spot trading |

| ✅ Negative maker fees reward liquidity providers | ❌ Limited number of trading pairs |

| ✅ Earn yield on equity while trading | ❌ Daily withdrawal limit of 50,000 USDT |

| ✅ GLP vault and managed strategies available | ❌ Order types remain fairly basic |

| ✅ Demo trading for risk-free practice | ❌ Email required during signup despite wallet-based access |

| ✅ Non-custodial with on-chain settlement | |

| ✅ Native mobile apps on Android and iOS |

Grvt KYC and Sign-up

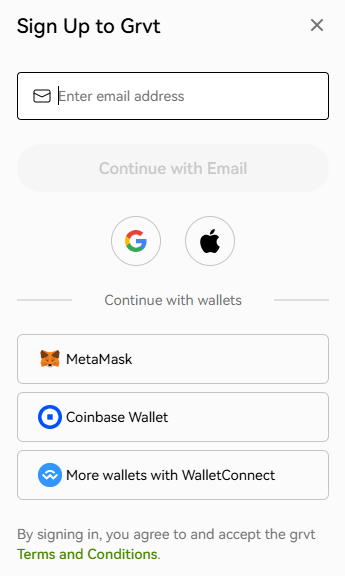

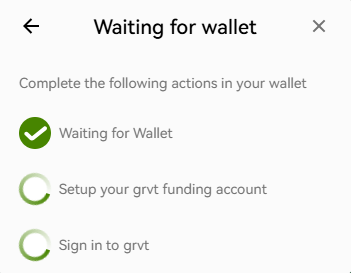

To sign up on Grvt, you will need a Web3 wallet and a valid email address, since it operates as a decentralized platform. When connecting a wallet, Grvt currently shows two direct options: Coinbase Wallet and MetaMask. Users who prefer another EVM-compatible wallet can still connect using WalletConnect.

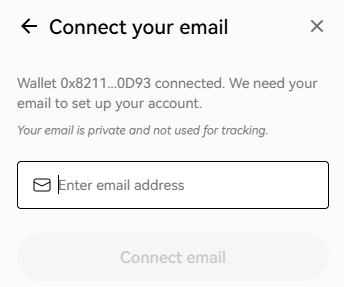

Unlike most perp DEXs, where an email is usually not required, Grvt includes an email step during signup to complete account setup and enable trading access. Once these requirements are in place, you can get started on Grvt by following the steps below.

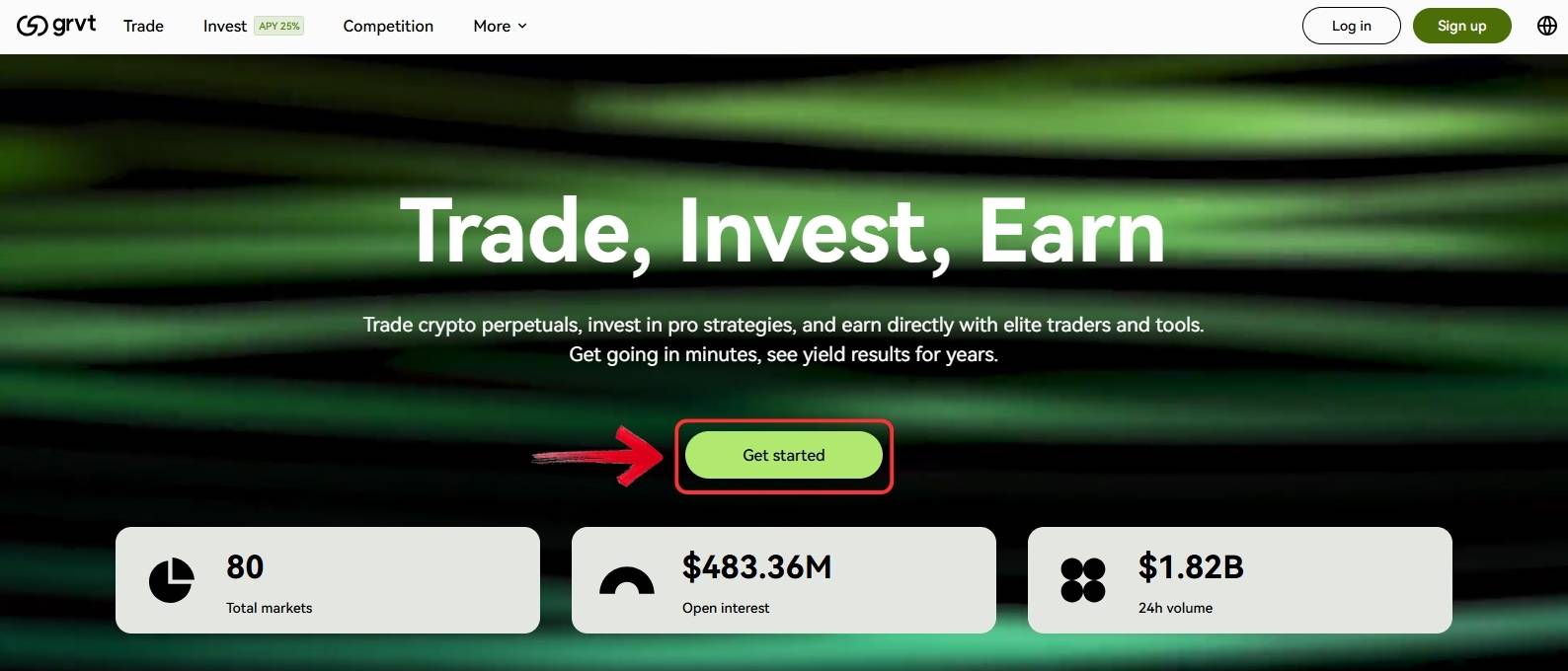

Étape 1 : Open your browser, visit the official Grvt platform, and click the "Commencer" .

Étape 2 : From the available options, select a Web3 wallet to connect with Grvt.

Étape 3 : After connecting your wallet, Grvt will ask for your email address to complete account setup. Enter your email and verify it by pasting the confirmation code sent to your inbox.

Étape 4 : Once the email is verified, Grvt will prompt a wallet signature request to finalize account creation.

After completing these steps and funding your account, you can start using the Grvt platform right away.

Réseaux pris en charge

Grvt supports deposits and withdrawals across six blockchain networks: Ethereum, Arbitrum, Base, BNB Chain, Kaia, and Tron. These supported networks allow users to fund their Grvt accounts directly from on-chain wallets or move assets out without relying on a centralized exchange. Network selection mainly affects how funds are deposited and withdrawn, while trading itself remains unified on the platform through Grvt’s internal account system.

Grvt Trading

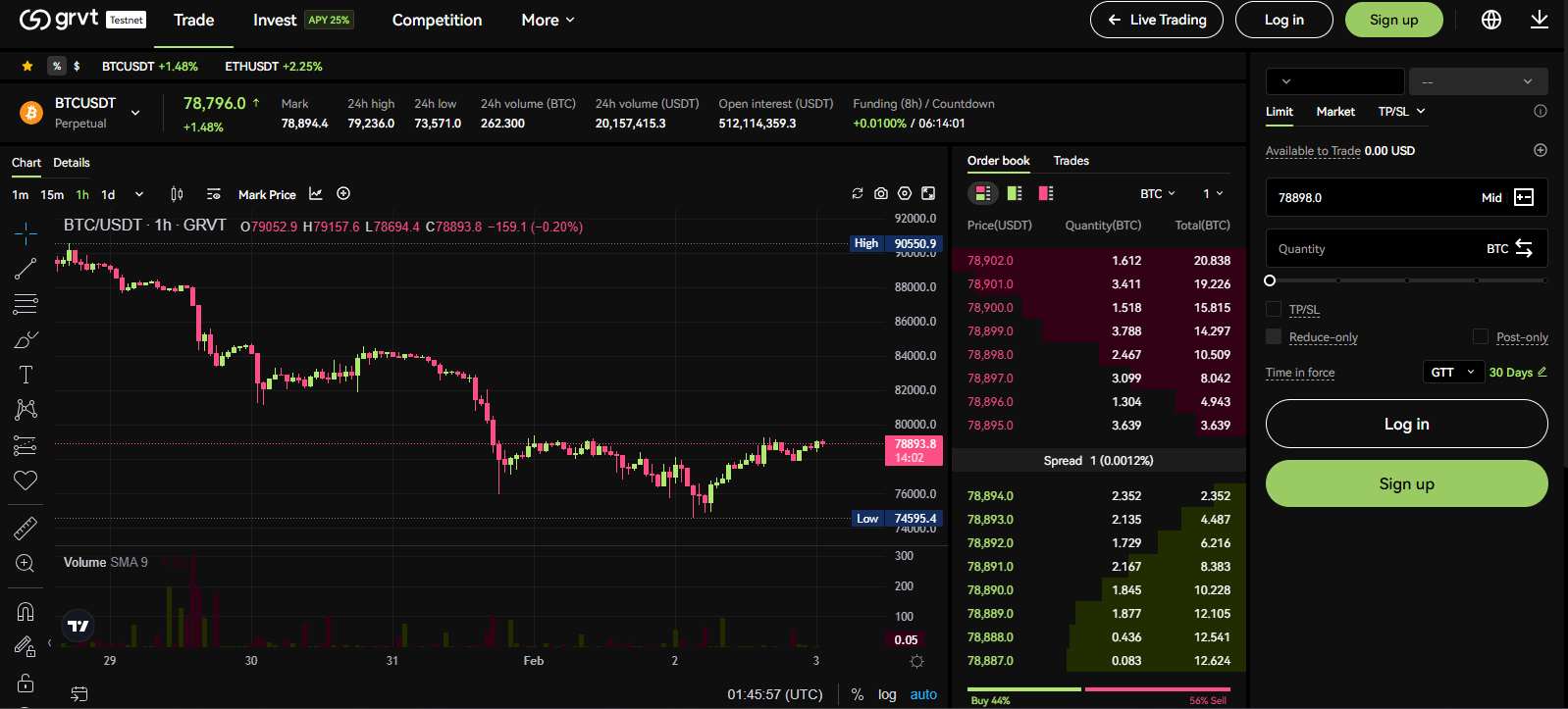

Grvt is limited strictly to perpetual futures trading. It offers access to 76+ perpetual contracts, all crypto-only, with leverage going up to 50x. There are no other asset classes available on the platform.

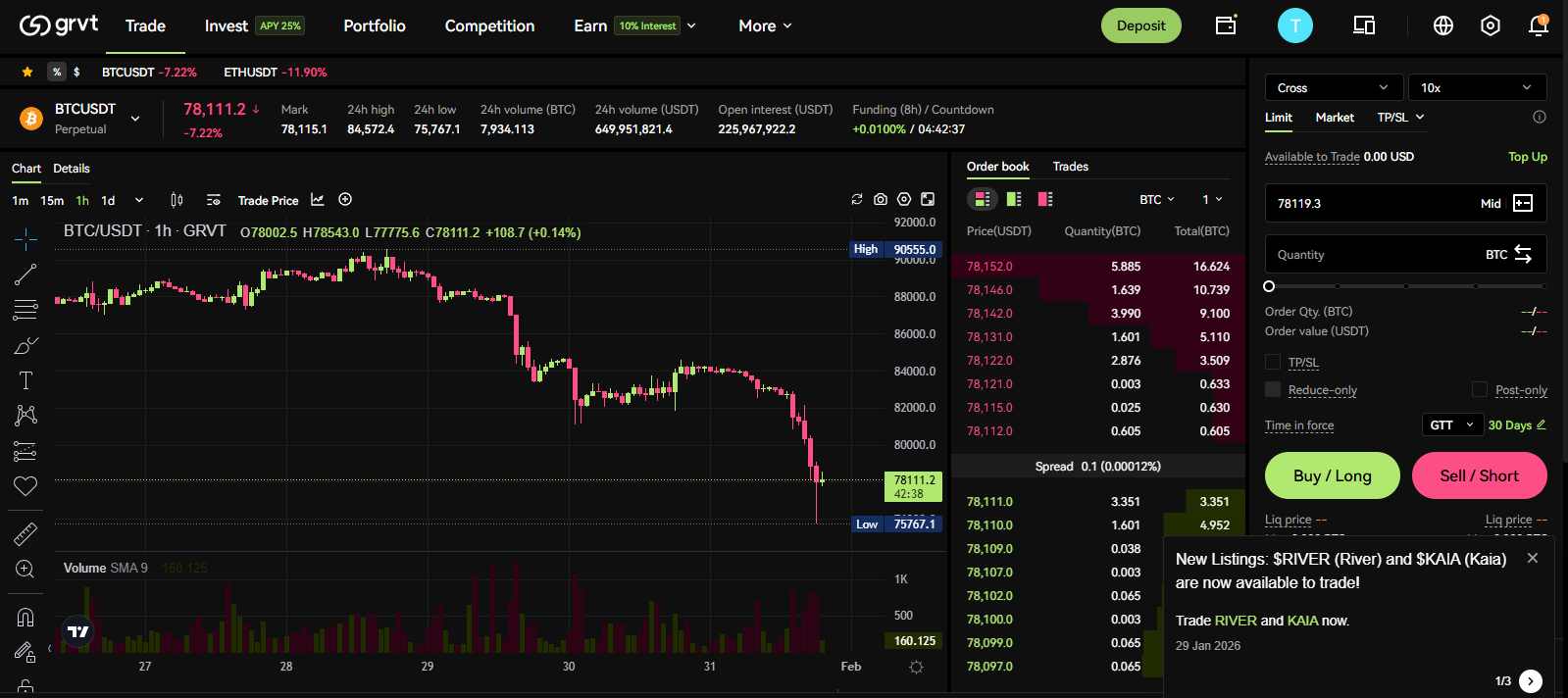

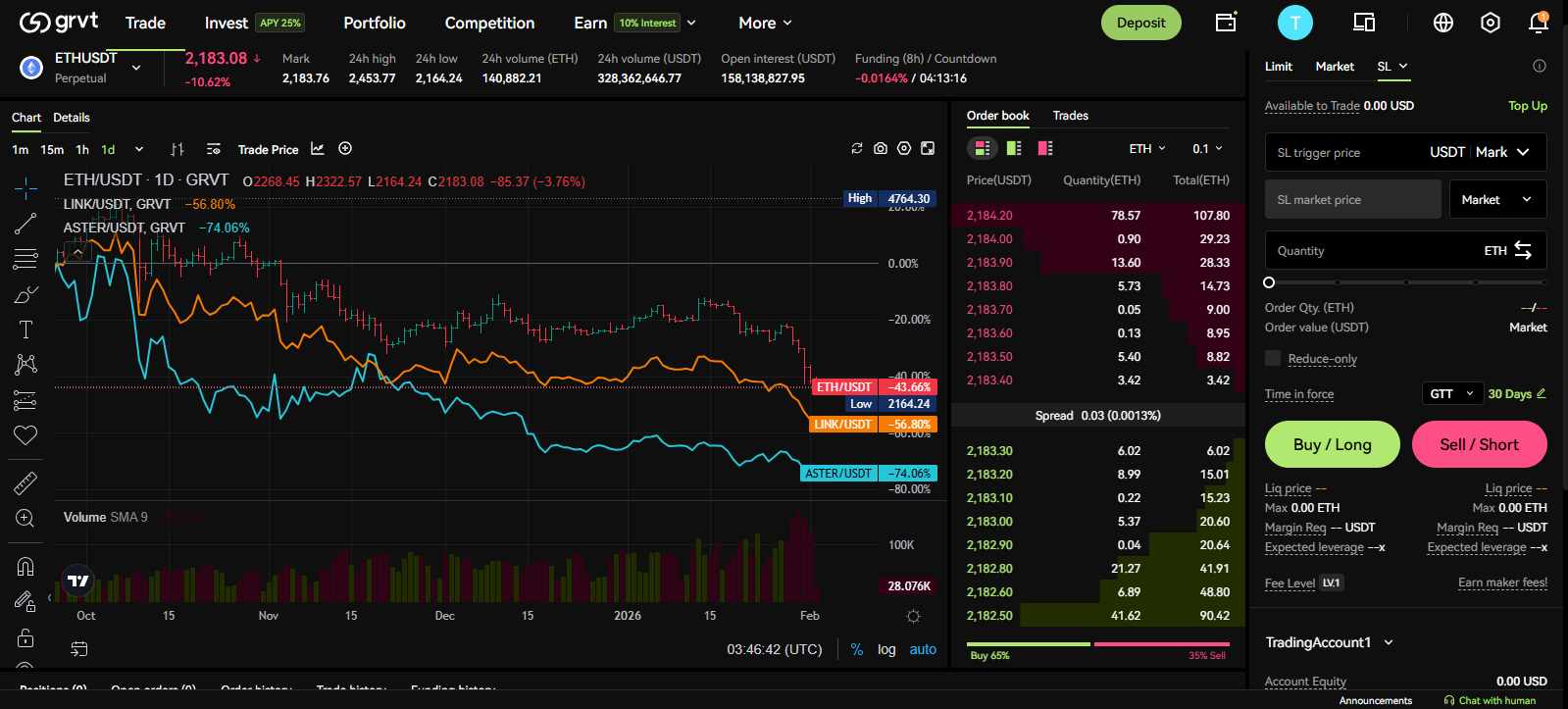

The trading interface is designed to feel familiar to anyone who has used centralized exchanges. The layout follows a standard structure, with TradingView-powered charts at the center, giving access to common indicators and charting tools. The order book, trading panel, and position details are all visible on the same screen, while trade history is placed just below for quick reference.

One useful feature is the Compare tool. It allows users to select another token and overlay its price line on the same chart, instead of opening multiple charts in separate windows. For deeper analysis, individual charts can also be opened in separate panes, with support for comparing up to ten tokens within a single chart view.

Key token information is placed at the top of the interface, including funding rates and trading volume, so important metrics remain visible while placing and managing trades. Order types on Grvt are limited. Along with basic limit and market orders, the platform also supports trigger orders under advanced options.

Méthodes de dépôt et de retrait

Grvt supports deposits and withdrawals through the same 6 blockchain networks discussed earlier, including Ethereum, Arbitrum, Base, BNB Chain, Kaia, and Tron. Users can move funds in and out directly using these networks, without relying on any centralized custody layer.

For funding the account, Grvt currently accepts deposits in USDT and USDC only. Once the on-chain transaction is confirmed on the selected network, USDT or USDC is credited to the user’s trading balance. Withdrawals work the same way, with funds sent back to the connected wallet through the chosen supported network. Each individual account has a daily withdrawal limit of 50,000 USDT.

When it comes to security, withdrawals are gated by a few required steps. Users must complete 2FA and sign with their SecureKey before adding a withdrawal address. Every address needs to be approved and saved in the Address Book under Settings before any funds can be withdrawn.

Grvt Fees

Let’s take a quick look at how Grvt structures its fees across trading activity and account funding, focusing on what users actually pay while placing trades and moving funds in or out of the platform

Frais de négociation

Most exchanges, whether DEX or CEX, charge fees to both makers and takers. Grvt follows a more traditional structure where makers receive a rebate for providing liquidity. Under its nine-tier fee model, perpetual trading fees start at -0.0001% for makers and 0.045% for takers. These fees decrease as users move up the tiers, which are determined by 30-day trading volume and the total asset value held in the Grvt trading account.

Frais à terme

-0.0001% Maker

0.045% Preneur

Frais de dépôt et de retrait

Grvt does not charge any deposit fees from the exchange side. However, when depositing funds, users still pay the standard network gas fee on the source chain. These costs are usually lower when using Layer 2 networks like BNB Chain or Arbitrum, while deposits made through Ethereum can incur higher gas fees due to mainnet congestion.

For withdrawals, Grvt applies a flat fee to cover on-chain settlement and bridging costs. Ethereum withdrawals are charged at 15 USDT. For other supported networks including Arbitrum One, Base, BNB Smart Chain, Tron, KAIA, and Solana, the withdrawal fee is 1 USDT plus the network gas fee, which is processed through rhino.fi.

Grvt Products and Services

Below is a breakdown of the main products and services available on Grvt, covering both active trading tools and account-level strategies offered on the platform.

Grvt Trading

Grvt Trading is the main product on the platform and centers entirely around perpetual futures. When using it, the interface feels familiar, especially if you have traded on centralized exchanges before. Charts, order placement, positions, and account details are all accessible from a single screen, which keeps the workflow smooth during active trading. The platform supports over 76 crypto perpetual markets with up to 50x leverage, and trading runs on a central limit order book, giving fast execution without taking custody of user funds.

Grvt Mobile App

Grvt offers native mobile apps on both Android and iOS, alongside a solid mobile web version. The mobile experience mirrors the desktop closely, letting users trade perps, check positions, and manage balances on the go without losing key functionality or control over funds.

Stratégies Grvt

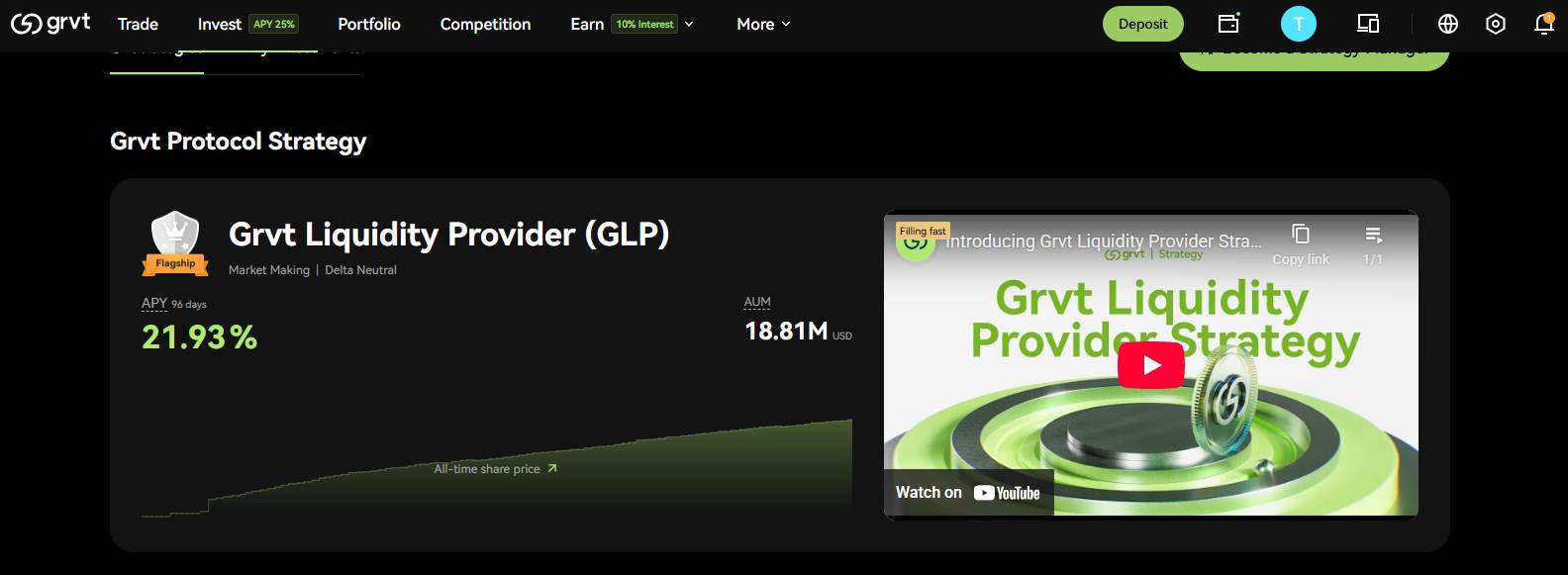

Grvt Strategies is where the platform moves beyond manual trading. Users can browse on-chain strategies created by professional traders and funds, review performance metrics, and allocate capital directly while keeping funds non-custodial. A key option here is the Grvt Liquidity Provider Vault (GLP), which allows users to invest USDT into a delta-neutral setup. During favorable market conditions, the GLP vault has shown APYs above 20%, making it appealing for users looking for more passive exposure alongside active trading.

Grvt Earn

Grvt Earn focuses on keeping capital productive. Your account equity can earn a yield of up to 10% even while you trade, rather than sitting idle. This includes earn-on-equity rewards, maker rebates, and access to vault-style products. Everything is integrated into the trading account, so there’s no separate staking or lock-up process.

Trading démo

Demo Trading lets users explore Grvt without real risk. You get a separate demo account with simulated funds and access to the same interface, leverage, and order types as live trading. It’s useful for learning the platform, testing strategies, or understanding liquidation mechanics before committing real capital.

Grvt Security

Grvt uses a hybrid security model that combines self-custody, zero-knowledge technology, and on-chain settlement. User funds are not held by the platform. Assets remain under user control, and trades are settled through smart contracts on zkSync. Order matching happens off-chain for efficiency, while final settlement is verified with zero-knowledge proofs anchored to Ethereum, which helps limit front-running and MEV exposure.

Wallet access relies on non-custodial key management with multi-factor authentication and SecureKey signing. On the trading side, Grvt includes isolated and cross-margin options and a liquidation system designed to manage risk during volatile conditions.

The platform has undergone third-party audits by Spearbit DAO and security testing by NCC Group. It also benefits from the audited zkSync infrastructure. To date, no major security incidents have been reported.

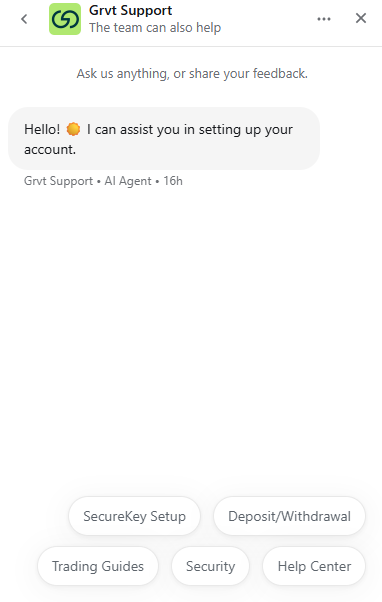

Grvt Customer Support

Grvt offers customer support mainly through self-service and ticket-based channels rather than a constant phone line. Most users start with the Help Center, which covers common topics like account setup, trading, deposits, withdrawals, and security. For account-specific or technical issues, support is handled through email and ticket submissions. Grvt also provides in-app customer chat support within the mobile app, making it easier to reach support while on the go. Community channels such as Discord and Telegram remain active for general questions and updates, with response times usually reasonable.

Grvt Alternatives

Grvt offers a solid setup for users moving into DEX trading, with a clean interface and a fairly complete set of features. That said, coverage across these features can feel limited for some users, and depending on trading needs or preferences, it may still make sense to look at alternative platforms before settling on one.

1. Hyperliquide : Known for deep liquidity and instant execution, Hyperliquide runs on its own L1 and removes network fees during trading.

2. Aster : With features like stock-linked perps and higher leverage, Aster adds asset variety that Grvt currently does not offer.

| Fonctionnalité | Aster | Hyperliquide | Grvt |

|---|---|---|---|

| Établi | 2025 | 2024 | 2024 |

| Frais spot (créateur/preneur) | 0.10% / 0.04% | 0.04% / 0.07% | N/D |

| Frais à terme (fabricant/preneur) | 0.010% / 0.035% | 0.015% / 0.045% | -0.0001% / 0.045% |

| levier Max | 1001x | 50x | 50x |

| KYC requis | Non | Non | Non |

| Cryptos prises en charge (Spot) | 8+ | 238+ | N/D |

| Contrats à terme | 93+ | 173+ | 76+ |

| Aucune limite de retrait KYC | Illimité | Illimité | 50,000 USDT / day |

| Volume des contrats à terme sur 24 heures | 6.38 milliards de dollars et plus | 8.29 milliards de dollars et plus | 2.13 milliards de dollars et plus |

| Fonctionnalités clés | • Effet de levier 1001x (BTC/ETH) • Trading en grille et application mobile |

• Chaîne L1 personnalisée • Zéro frais de gaz • Coffres-forts + jalonnement HYPE |

• zkSync Validium architecture • Earn on equity & GLP vault • CEX-style perp trading |

| S'inscrire | S'inscrire | S'inscrire | S'inscrire |

Conclusion

Grvt feels well put together for traders who want a perp-focused DEX that behaves closer to a centralized exchange, without giving up self-custody. The interface, fee structure, and yield features will make sense to some users, especially those trading perps regularly or looking to keep idle equity working. At the same time, its crypto-only scope and narrower product range may not fit everyone’s trading style. If certain features feel limiting, it can help to compare Grvt alongside other leading DEX perpétrés to see which setup aligns better with how you trade.

Questions fréquentes

1. Is Grvt fully non-custodial, or does it ever hold user funds?

Grvt is fully non-custodial. Users keep control of their funds at all times, and assets are settled on-chain through smart contracts rather than held by the platform.

2. Does Grvt support spot trading or only perpetual futures?

Grvt currently supports only perpetual futures trading. Spot markets and other asset types are not available at this time.

3. Is Grvt suitable for beginners?

Grvt can work for beginners in the sense that it offers a demo account and a familiar interface. That said, perpetual futures and leverage carry risk, so new users should take time to learn the platform and markets before trading with real capital.

4. Does Grvt offer yield on my funds?

Yes. Grvt includes built-in yield options such as earn-on-equity and vault-based strategies that let you generate returns on capital held in your account.

5. Is there a mobile app for Grvt?

Yes. Grvt offers native mobile apps for both Android and iOS, along with a mobile-friendly web version.