Сегодня инвесторы хотят больше, чем просто криптоприбыль или дивиденды по акциям, они хотят и то, и другое, в идеале на одной платформе. На сегодняшнем рынке игнорировать криптовалюту больше нельзя. Она становится такой же важной для понимания, как и традиционные финансы. И вскоре инвестирование в акции может показаться неполным без гибкости и скорости, предлагаемых криптоплатформами.

В этой статье рассматриваются лучшие криптобиржи для торговли акциями, что дает вам четкую отправную точку, если вы хотите управлять обоими активами в одном месте. Мы сосредоточились на важных деталях: доступность акций, торговые сборы, удобство использования платформы, методы депозита, безопасность и получаете ли вы дивиденды или другие выгоды. Если вы готовы торговать Tesla и Bitcoin Этот список из той же панели управления является вашей отправной точкой.

Почему стоит выбрать криптовалютную биржу, поддерживающую акции?

Границы между классами активов быстро размываются. И поэтому оставаться неосведомленным о криптовалюте больше не вариант, и поскольку инвестирование в акции продолжает перемещаться в онлайн, платформы, которые поддерживают оба актива, предлагают более умный, более оптимизированный подход. Криптобиржи с торговлей акциями уже не просто новинка. Они превращаются в практичные, комплексные инструменты для современных инвесторов, которым нужна гибкость, эффективность и все в одном месте.

- Одна панель управления для всего

Биржи как eToro и Uphold позволит вам купить Bitcoin и акции Apple в одном приложении. Вместо жонглирования кошельками, брокерскими конторами и портфельными трекерами вы получаете единую, оптимизированную панель управления, которая обрабатывает обе стороны. Это просто, быстро и избавляет вас от необходимости переключаться между приложениями или вручную синхронизировать сделки.

- Наличие 24 / 7

В отличие от традиционных фондовых рынков, которые закрываются после закрытия, криптобиржи всегда открыты. Эта круглосуточная доступность позволяет вам торговать, когда бы ни двигался рынок, будь то криптовалюта или акции. Так что, если вы хотите торговать акциями после закрытия или корректировать свои криптопозиции в выходные? Легко. Эти платформы созданы для инвесторов, которым нужна гибкость и доступ к рынкам в любое время.

- Фиат не требуется (используйте криптовалюту в качестве маржи)

Вместо использования фиатных денег вы можете торговать акциями напрямую, используя криптовалюту. Криптовалютные биржи, такие как BTCC, позволяют пользователям торговать токенизированными акциями, используя криптовалютные стейблкоины, такие как USDT или USDC, в качестве обеспечения для торговли акциями.

4 лучших криптобиржи для торговли акциями

Исследуя, какие биржи для торговли криптовалютой и акциями заслуживают места в этом списке, мы не просто следовали рыночным тенденциям, мы сосредоточились на том, что действительно важно для пользователей. Это означает реальное удобство, надежную поддержку клиентов, простой в использовании интерфейс, разумные комиссии и приличный выбор акций для торговли. Из всех рассмотренных нами бирж только четыре криптобиржи соответствовали всем необходимым параметрам и выделялись как заслуживающие вашего внимания.

- BTCC: Лучшая биржа для токенизированных фьючерсов на акции

- Kraken: Лучше всего подходит для реальной торговли акциями США с дивидендами

- Crypto.com: Лучшее мобильное приложение для инвестирования в криптовалюту и акции

- Bybit: Лучше всего подходит для торговли CFD с доступом к криптовалютным и традиционным рынкам

| Обмен | Тип | Акции | Сборы | Дивиденды | Безопасность. | KYC |

|---|---|---|---|---|---|---|

| BTCC | токенизированному | 6 | 0.020% / 0.045% | Нет | Средняя | Нет |

| Kraken | Real | 11000 | 0% | Да | Высокий | Да |

| Crypto.com | Real | 5000 | 0% | Да | Высокий | Да |

| Bybit | CFD | 78 | 0.03%. | Нет | Высокий | Да |

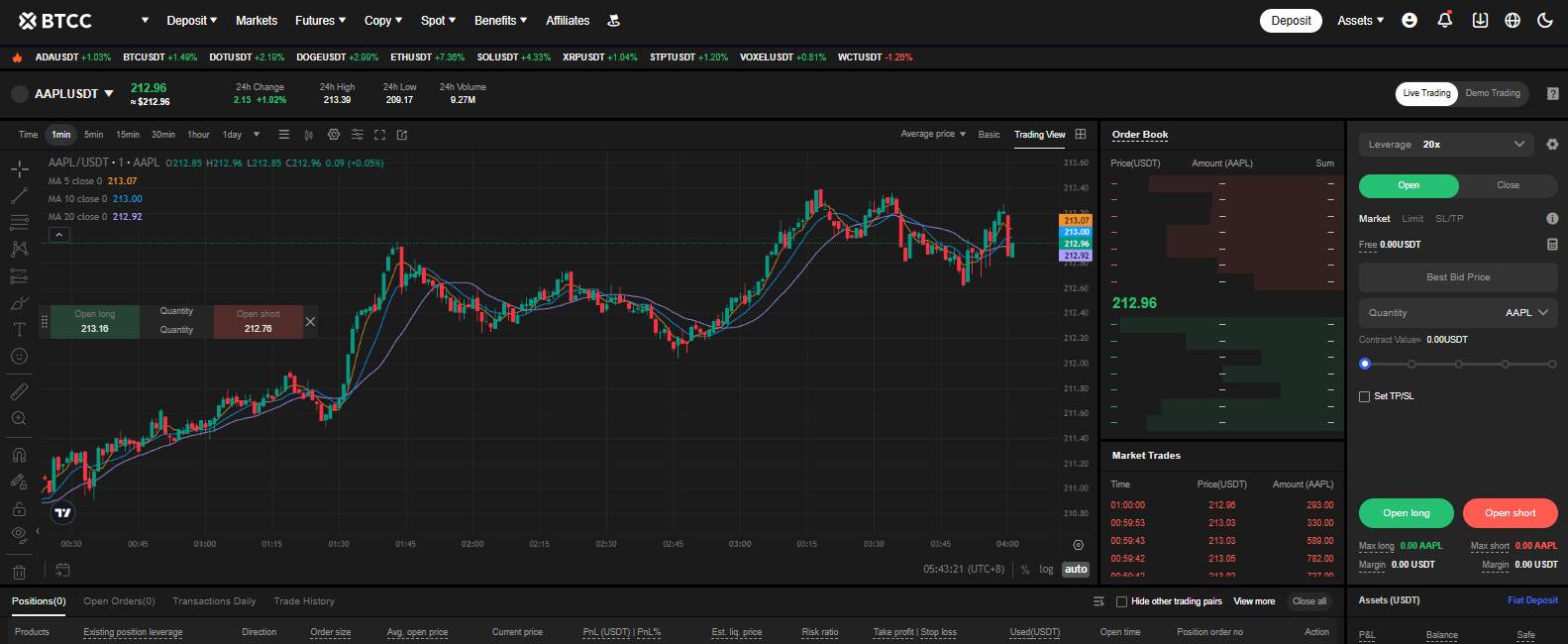

1. BTCC

Основанная в 2011 году и заслужившая доверие более трех миллионов пользователей по всему миру, BTCC превратилась из биржи чисто криптовалютных деривативов в универсальную платформу, которая позволяет вам торговать как цифровыми активами, так и токенизированными акциями США в одном месте. Через его стандартный интерфейс фьючерсов, дополненный графиками в реальном времени, книгой заказов и кредитным плечом до 50×, вы можете получить доступ к фьючерсным контрактам, привязанным 1:1 к шести ведущим компаниям США (Apple, Amazon, Coca-Cola, Microsoft, Netflix и Tesla). Эти контракты следуют точным движениям цен базовых акций без фактического предоставления права собственности или дивидендов, и они имеют ту же структуру комиссий мейкера и тейкера; 0.020% для мейкера и 0.045% для тейкера, без дополнительных комиссий или сборов, специфичных для акций.

Безопасность на BTCC оценивается как умеренная, вы можете начать торговать без проверки KYC, хотя последующее прохождение верификации дает вам более высокие лимиты на депозиты и снятие средств. Помимо токенизированных акций, биржа предлагает товарные фьючерсы (Gold/USDT и Silver/USDT), широкий спектр крипто-бессрочных контрактов и такие функции, как копи-трейдинг и демо-режим для совершенствования ваших стратегий без риска.

Говоря о том, как пополнить счет, процесс прост — пользователи имеют несколько вариантов депозита, включая мгновенные криптовалютные переводы или использование Visa и Mastercard для депозита в USD, EUR, KRW или TWD. Объединяя оба класса активов в одной чистой, удобной панели управления в веб-сайте и на мобильном устройстве, BTCC оптимизирует ваш торговый рабочий процесс и предлагает гибкость, которую требуют современные инвесторы.

Прочитайте больше: Полный обзор BTCC

Плюсы и минусы BTCC

| 👍 Плюсы BTCC | 👎 Минусы BTCC |

|---|---|

| ✅ Торгуйте 6 основными акциями США как токенизированными фьючерсами | ❌ Относительно высокие торговые комиссии: 0.020%/0.045% |

| ✅ 420+ цифровых активов | ❌ Никаких дивидендов или выгод от корпоративных действий |

| ✅ Высокое кредитное плечо (до 50×) | ❌ Нормативные вопросы |

| ✅ Самая глубокая ликвидность | ❌ Ограниченный выбор акций |

| ✅ Нет KYC |

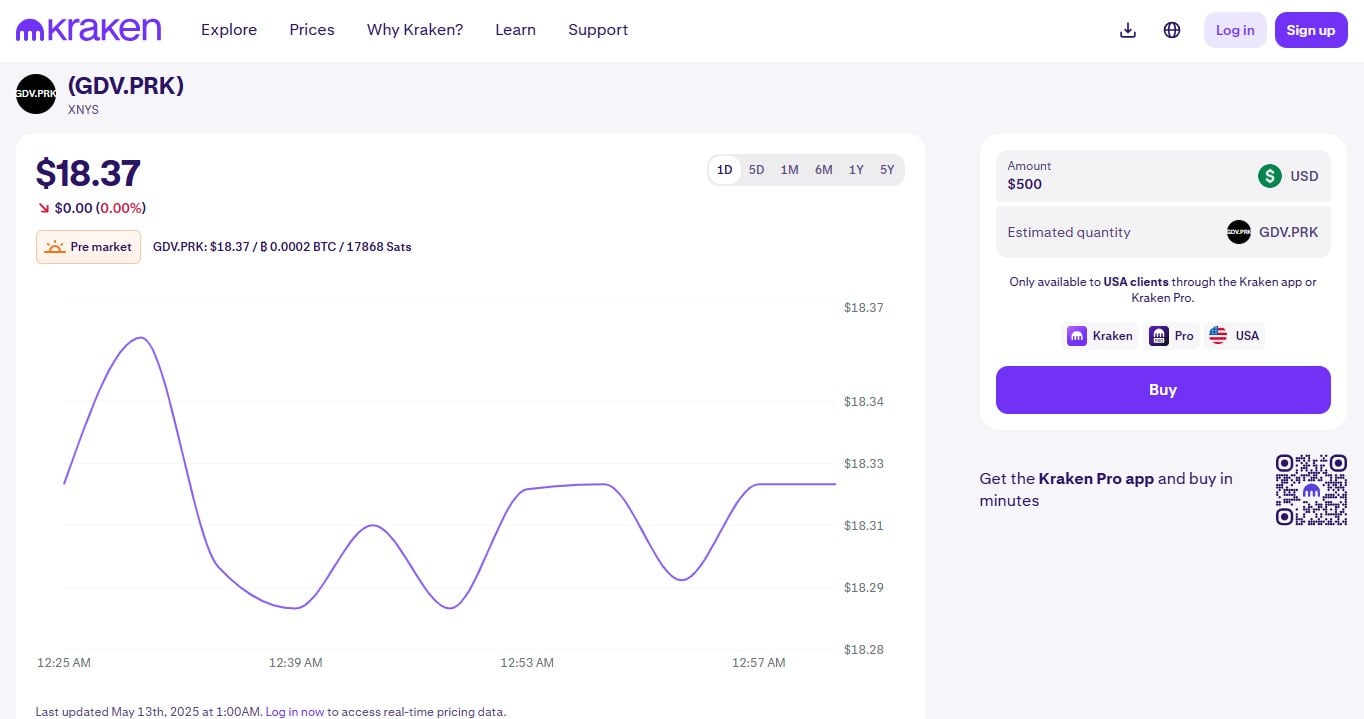

2. Kraken

Kraken, одна из самых известных криптобирж с более чем 15 миллионами пользователей, недавно вышла на рынок торговли акциями, начав с реальных акций США и ETF для пользователей в Соединенных Штатах. Это не токенизированная торговля; вы получаете доступ к более чем 11,000 XNUMX публично котируемых акций на NYSE, NASDAQ и AMEX, реальных акций с реальным владением и реальными дивидендами. Когда компании выплачивают дивиденды, они автоматически зачисляются на ваш счет Kraken счет на дату выплаты, как и у традиционных брокеров. В отличие от предложений на основе фьючерсов, эти активы поставляются с корпоративными правами, и да, также поддерживается торговля дробными акциями.

Что отличает Kraken Отличие в том, как он соединяет оба мира. Та же панель управления, которая показывает ваши криптовалютные сделки, теперь позволяет вам торговать акциями. Используете ли вы Kraken Pro на десктопе или в мобильном приложении, все унифицировано, заказы на акции и криптовалюты находятся рядом с интегрированными графиками, книгами заказов и полными торговыми инструментами, такими как лимитные и рыночные заказы. Для инвесторов, привыкших к крипто-среде, интерфейс кажется интуитивно понятным, предлагая при этом традиционные финансовые функции.

Что касается финансирования, Kraken дает вам большую гибкость. Вы можете вносить фиатные валюты, такие как USD, EUR или GBP, используя банковские переводы (ACH, SEPA, SWIFT) или использовать кредитные и дебетовые карты через партнерские платежные шлюзы. Криптовалютные депозиты также поддерживаются, и пользователи могут конвертировать свои активы в фиатные валюты в приложении для покупки акций. Kraken рекомендует использовать фиатный счет для более плавной торговли акциями, но криптовалютное финансирование также хорошо подходит для тех, кто хочет объединить эти два варианта.

Что касается сборов, KrakenТорговля акциями осуществляется без комиссии. Нет никаких комиссий за сделку; только стандартные регулирующие сборы (например, надбавки SEC и FINRA), которые являются номинальными. Все сделки с акциями осуществляются через Kraken Securities, LLC — брокер-дилер, зарегистрированный в FINRA, и член SEC, гарантирующий полное соблюдение нормативных требований и душевное спокойствие.

Прочитайте больше: Kraken Полный обзор

Плюсы и минусы Kraken

| 👍 Плюсы Kraken | 👎 Минусы Kraken |

|---|---|

| ✅ Предлагает более 11,000 XNUMX реальных акций и ETF США | ❌ Торговля акциями доступна только для пользователей из США |

| ✅ Торговля акциями без комиссии | ❌ Функция реинвестирования ограничена ручным реинвестированием |

| ✅ Дивиденды, выплачиваемые по соответствующим акциям, зачисляются автоматически | ❌ Требуется KYC |

| ✅ Полная интеграция с криптовалютной торговлей; единая панель управления | |

| ✅ Поддерживает дробное инвестирование акций |

3. Crypto.com

Crypto.com, всемирно признанная криптобиржа, запущенная в 2016 году, выросла до обслуживания более 80 миллионов пользователей. Хотя она наиболее известна своими криптосервисами, она также предлагает доступ к более чем 5,000 реальных акций и ETF США через своего зарегистрированного брокерско-дилерского партнера Foris Capital. Поскольку это реальные акции, а не синтетические продукты, инвесторы могут получать дивиденды, которые автоматически зачисляются на их баланс в долларах США «Stocks Cash».

Торговля акциями происходит прямо внутри Crypto.com Мобильное приложение, предлагающее понятный, интуитивно понятный интерфейс с поддержкой как рыночных, так и лимитных ордеров. Вы также можете начать с малого, дробное инвестирование в акции доступно всего от 1 доллара, что открывает розничным пользователям возможность инвестировать в дорогостоящие акции. Комиссия за торговлю акциями составляет 0%, поэтому вы концентрируетесь только на цене акций, а не на скрытых сборах.

Одной из уникальных особенностей является кредитование ценными бумагами, где соответствующие акции в вашем портфеле могут быть сданы в кредит для получения пассивного дохода, добавляя немного больше полезности вашим акционерным владениям. В целом, это надежное расширение Crypto.comэкосистема, позволяющая пользователям исследовать мир криптовалют, оставаясь в рамках одного приложения.

Прочитайте больше: Crypto.com Полный обзор

Crypto.com Плюсы и минусы

| ???? Crypto.com Плюсы | ???? Crypto.com Минусы |

|---|---|

| ✅ Доступ к более чем 5,000 реальных акций и ETF США через зарегистрированного брокера | ❌ Доступно только через мобильное приложение — нет доступа с настольного компьютера |

| ✅ 0% комиссии на биржевые сделки | ❌ Нет расширенных торговых инструментов или аналитики для биржевых трейдеров |

| ✅ Поддерживаются дробные акции (от 1 доллара) | ❌ Ограничено только для рынков США |

| ✅ Дивиденды выплачиваются прямо на ваш счет | |

| ✅ Функция кредитования ценными бумагами добавляет потенциал пассивного дохода |

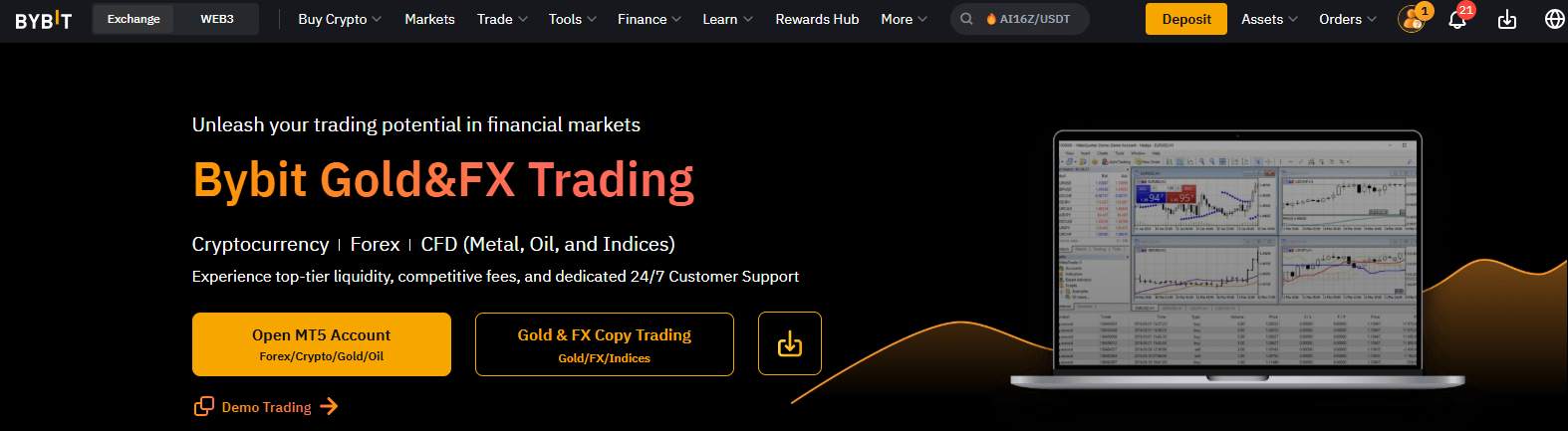

4. Bybit

Bybit, запущенная в 2018 году как биржа криптовалют, постоянно добавляла предложения CFD на индексы, товары и основные пары валют через свой интерфейс MetaTrader 5. На вкладке TradeFi, доступной непосредственно в мобильном приложении или через настольный клиент MT5 в сети, теперь вы можете спекулировать на 78 CFD на акции США, включая такие крупные имена, как Apple и Microsoft. Эти CFD на акции работают так же, как Bybitдругие продукты CFD: вы никогда не владеете базовыми акциями, но вы получаете прибыль или несете убытки в зависимости от разницы цен между вашим входом и выходом. Пользователи могут занимать позиции с кредитным плечом от 3.33 до 5X, при этом максимально допустимый размер лота установлен на уровне 80.

Помимо акций, Bybit также предлагает контрактов на других основных индексах, таких как NAS100, SP500, SPI200, UK100 и CHINA50. Вы также можете торговать по широкому спектру валютных пар, сырьевых товаров, драгоценных металлов и нефтяных рынков, все под одной крышей TradeFi. По пятницам взимается 3-дневный своп, о чем следует помнить, если вы удерживаете позиции на выходных.

Финансирование остается гибким: вы можете внести криптовалюту (USDT, BTC, ETH) с минимальными затратами или использовать фиатные рельсы, такие как дебетовые/кредитные карты, ACH и SEPA, где это поддерживается. Все позиции CFD рассчитываются в долларах США, поэтому ваш баланс USDT используется для маржинальных сделок. Торговые издержки различаются в зависимости от типа продукта; CFD на форекс, сырьевые товары и индексы имеют спред-основанные сборы в размере примерно от 0.10 до 6 долларов за лот, в то время как CFD на акции облагаются комиссией в размере 0.04 доллара за акцию с минимальной суммой в 5 долларов за заказ. Вкладка TradeFi объединяет все эти рынки в одном месте, позволяя вам легко переключаться между торговлей криптовалютой и традиционным рынком, не переходя между различными разделами платформы.

Прочитайте больше: Bybit Полный обзор

Bybit Плюсы и минусы

| 👍 Плюсы Bybit | 👎 Минусы Bybit |

|---|---|

| ✅ Одна вкладка TradeFi для криптовалют, 78 акций США, индексов, сырьевых товаров и форекс | ❌ CFD на акции не предоставляют фактического права собственности на акции, права голоса или прямых выплат дивидендов |

| ✅ Предлагает интерфейс MetaTrader 5 (MT5) для торговли индексами, валютой, золотом, нефтью через CFD | ❌ Никаких дивидендов по CFD |

| ✅ Функция копирования сделок позволяет пользователям копировать сделки профессиональных трейдеров на рынках MT5 | ❌ Платформа MT5 может показаться сложной для новичков |

| ✅ Комиссии: $0.10–$6/лот (FX/товары/индексы); $0.04/акция (мин. $5) по акциям | |

| ✅ Пополнение счета через USDT, BTC, ETH, карты, ACH или SEPA |

Резюме

Биржи, которые мы рассмотрели, не просто удобны, они на самом деле делают инвестирование гораздо более осуществимым. Если вы торгуете криптовалютой, покупаете акции или просто изучаете свои возможности, наличие всего в одном месте экономит время и стресс. Это особенно полезно, если вы живете в месте с ограниченным доступом к традиционным торговым приложениям. Криптобиржи с торговлей акциями предлагают гибкость, доступ и простоту, которые ищут многие современные инвесторы. Если вам нужен более плавный способ инвестирования, стоит рассмотреть эти универсальные платформы.

Часто задаваемые вопросы (FAQ)

1. Существуют ли регулируемые платформы, поддерживающие как криптовалютную, так и фондовую торговлю?

Да, такие платформы, как Kraken и Crypto.com регулируются в нескольких юрисдикциях и предлагают торговлю как криптовалютами, так и акциями, что делает их подходящими для пользователей, которым важны соблюдение правовых норм и безопасность.

2. Могу ли я получать дивиденды от инвестиций в акции на криптовалютных биржах?

Только если вы торгуете реальными акциями. На таких платформах, как Kraken и Crypto.com, соответствующие акции выплачивают дивиденды, которые автоматически зачисляются на ваш торговый счет. Но на BTCC или Bybit, где акции предлагаются в виде синтетических фьючерсов или CFD, вы не получите никаких дивидендов, а только потенциальную прибыль от движения цен.

3. Существуют ли регулируемые платформы, поддерживающие как криптовалютную, так и фондовую торговлю?

Да. Такие платформы, как Kraken (в США) и Crypto.com (глобально) регулируются и соответствуют требованиям финансовых органов, таких как SEC, FINRA и других национальных регуляторов. Они работают с лицензированными брокерами-дилерами, чтобы предлагать реальную торговлю акциями, в то время как их криптоуслуги часто регулируются в рамках бизнеса по обслуживанию денег (MSB). Эти платформы обеспечивают баланс между инновациями и безопасностью инвесторов.

4. В чем разница между синтетическими акциями и реальными акциями?

Синтетические или токенизированные акции, подобные тем, что предлагаются на BTCC, являются деривативами. Они отражают цену реальных акций, но не предоставляют права собственности, права голоса или дивиденды. По сути, вы делаете ставку на движение цен, как фьючерсы или CFD.

Реальные акции, предлагаемые Kraken и Crypto.com, являются реальными акциями, купленными через регулируемого брокера. Вы владеете частью компании и имеете право на дивиденды, корпоративные действия и даже льготы для акционеров, где это применимо.

5. Могу ли я покупать дробные доли акций на криптовалютных биржах?

Да, дробные акции стали стандартной функцией на современных многофункциональных торговых платформах. Такие биржи, как Crypto.com и Kraken позволяют пользователям приобретать доли дорогостоящих акций, таких как Amazon или Tesla, всего за 1 доллар.

6. Что следует знать о сроках размещения заказов при покупке акций или ETF на криптовалютных биржах?

При размещении ордера на покупку акций или ETF время может повлиять на то, как и когда будет выполнена ваша сделка. Если вы отправляете рыночный ордер в течение торговых часов (9:30 утра – 4:00 вечера по восточному времени), ваш ордер, как правило, будет выполнен немедленно по текущей рыночной цене.

Однако если вы разместите ордер вне обычных часов работы рынка, вы получите всплывающее уведомление о том, что ваш ордер будет поставлен в очередь и автоматически исполнен после открытия рынка в 9:30 утра по восточному времени.

Для лимитных ордеров ваша сделка будет исполнена только в том случае, если рынок достигнет указанной вами цены, либо во время работы рынка, либо после нее, в зависимости от поддержки платформы.