- Solana usa Prova de Histórico e processamento paralelo para obter transações ultrarrápidas e de baixo custo.

- Ele suporta poderosos contratos inteligentes baseados em Rust, permitindo dApps de alto desempenho.

- O ecossistema Solana está prosperando, com milhões de usuários e os principais projetos Solana ganhando força.

Quando se fala em escalabilidade em criptomoedas, Solana quase sempre faz parte da conversa, e por um bom motivo. Construída do zero para solucionar as limitações de throughput de blockchains anteriores, como Bitcoin e Ethereum, Solana combina velocidade, taxas baixas e inovação em um dos ecossistemas mais amigáveis aos desenvolvedores da atualidade.

Neste artigo, vamos analisar o que torna o Solana diferente, como ele atinge essa velocidade e quais casos de uso do mundo real ele está potencializando atualmente.

Como Solana funciona: uma versão diferente de blockchain

Prova de Participação + Prova de Histórico

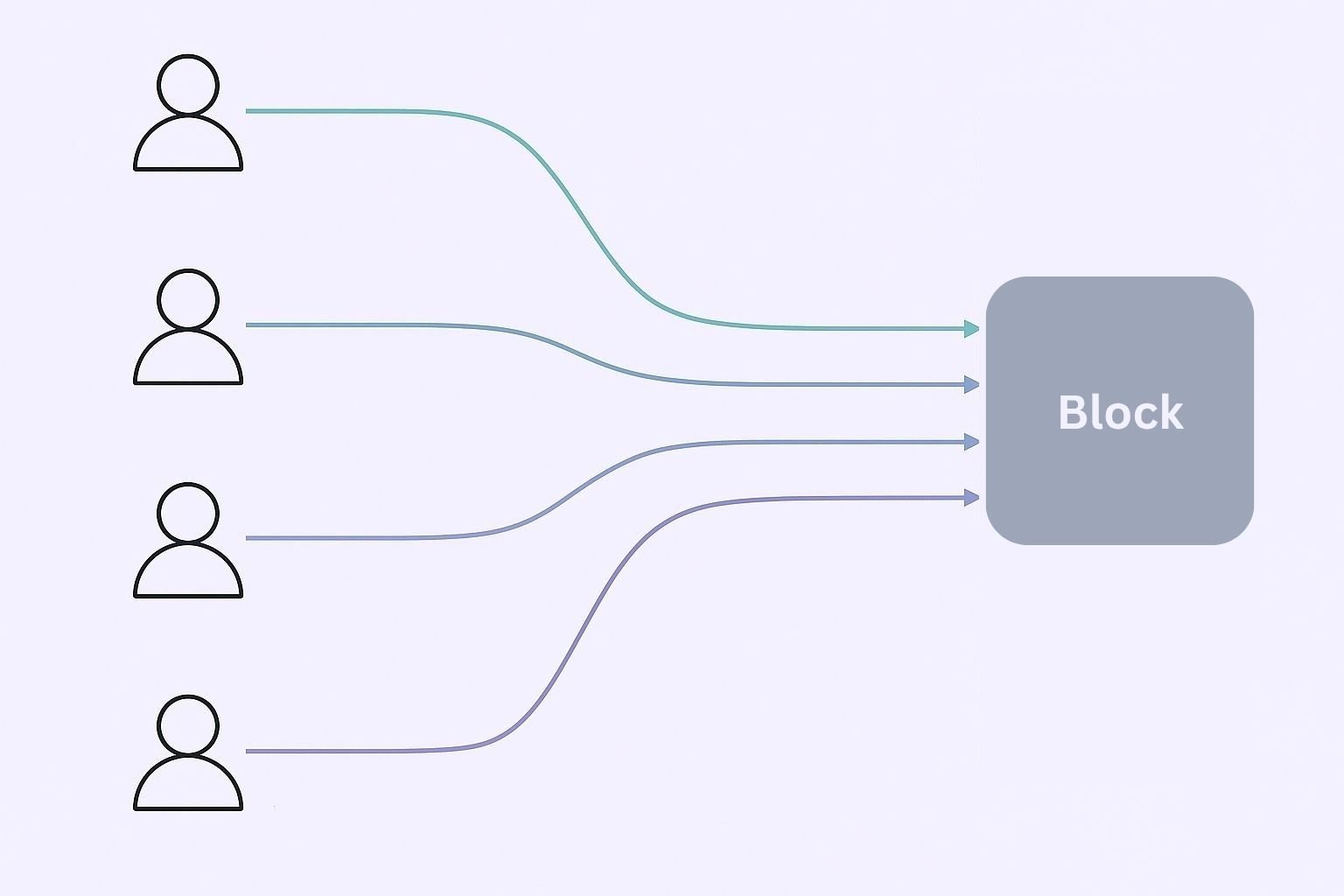

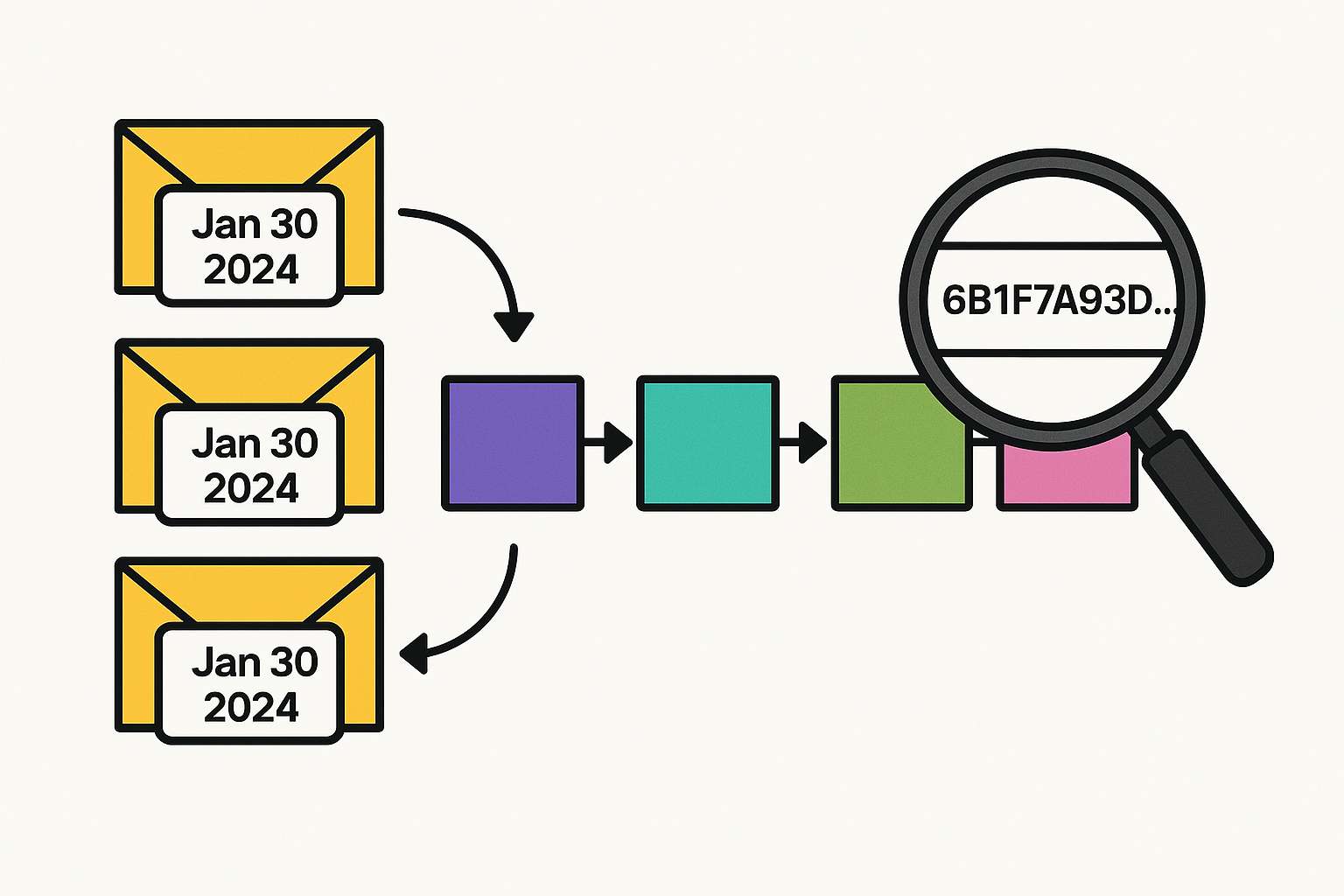

Em sua essência, Solana é uma Prova de participação blockchain. Mas o que realmente o diferencia é Prova de História (PoH), um mecanismo que usa registros de data e hora criptográficos para organizar transações em uma sequência verificável antes mesmo que o consenso seja alcançado.

Pense nisso como um sistema de correspondências onde cada carta inclui um carimbo de data e hora à prova de violação. Em vez de todos ficarem olhando o relógio para saber quando uma carta foi enviada, eles simplesmente leem o carimbo de data e hora e classificam de acordo. Isso elimina o vai e vem constante entre nós, o que reduz drasticamente a latência.

Execução paralela com o nível do mar

A Solana também introduziu a execução paralela, denominada "Sea Level". A maioria das blockchains processa transações uma a uma (em série). A Solana, no entanto, permite que validadores executem contratos inteligentes simultaneamente. O resultado? Uma rede que pode, em teoria, processar até 710,000 transações por segundo (embora os testes atuais atinjam um máximo de cerca de 50,000 TPS).

Isso o torna ideal para aplicações que exigem velocidade: pense em DeFi, jogos, mercados de NFT e muito mais.

Por que os desenvolvedores adoram construir em Solana

Contratos Inteligentes em Rust

Ao contrário dos contratos inteligentes baseados em Solidity da Ethereum, Solana usa Ferrugem, uma linguagem de programação de baixo nível que oferece mais poder e flexibilidade. A desvantagem? Maior complexidade e uma curva de aprendizado mais acentuada. Os desenvolvedores não podem simplesmente copiar e colar do Ethereum; eles precisam construir do zero, mas, em troca, obtêm mais controle.

Não é necessária camada 2

Solana é único porque não depende de soluções de dimensionamento externas como Otimismo ou Arbitrum. Sua arquitetura foi criada para lidar com volume na Camada 1, o que simplifica a experiência do usuário e a implementação para desenvolvedores.

O ecossistema de Solana: ativo, diverso e em expansão

O método da Ecossistema Solana não é apenas um monte de promessas, está correndo a todo vapor com tração real:

- Mais de 2 milhões de carteiras ativas mensais

- Mais de 83,000 contas ativas diariamente

- Validadores 2,132

- Mais de 32 milhões de NFTs cunhados

E sim, alguns dos principais projetos de Solana como Helium, Marinade, Tensor e jito já estão redefinindo como pensamos sobre DeFi, staking e infraestrutura Web3.

Um desenvolvimento particularmente empolgante é o lançamento de NFTs executáveis (xNFTs); NFTs que podem executar código, não apenas armazenar imagens. Eles já estão sendo usados em aplicativos como Coral e Backpack.

Veja também: Como chegar a Solana

Tokenomics: Como funciona o token SOL

O símbolo nativo de Solana, SOL, é usado para staking, pagamento de taxas de transação e interação com contratos inteligentes. Ao contrário Bitcoin, não há um limite rígido para o fornecimento de SOL. Em vez disso, Solana segue um modelo híbrido deflacionário-inflacionário:

- A inflação começa em ~8% e diminui gradualmente para 1.5% ao ano

- 50% de todas as taxas de transação são queimadas, reduzindo a pressão de oferta

Atualmente, cerca de 39% dos tokens são alocados para iniciativas comunitárias, com os primeiros investidores e a Fundação Solana detendo o restante.

Leia também: Como comprar Solana ($SOL)

Utilidade no mundo real: mais do que apenas teoria

A alta taxa de transferência e as taxas de transação mínimas da Solana levaram à adoção efetiva da Web3. Ela impulsiona tudo, desde exchanges descentralizadas a protocolos de mapeamento como o Hivemapper, e até jogos com propriedade de ativos on-chain.

E talvez o mais impressionante seja que Solana consegue tudo isso sem comprometer suas métricas de descentralização, mantendo mais de 2,000 validadores em diversas regiões e hardwares.

ponto de partida

Solana provou ser uma concorrente legítima no espaço da Camada 1, combinando velocidade, escalabilidade e um ecossistema próspero. Seja você um desenvolvedor, investidor ou apenas explorando o principais projetos de Solana, Solana é inegavelmente digno de ser assistido em 2026.

Sua utilidade no mundo real, inovação técnica e crescente adoção são o que tornam Solana mais do que apenas mais um chavão do blockchain.

Perguntas

1. O que é Prova de Histórico e como ela é diferente de Prova de Participação?

A Prova de Histórico (PoH) não substitui a Prova de Participação (PoS), mas sim um complemento que ajuda a Solana a ordenar transações com eficiência. Pense na PoH como um registro público de registro de data e hora. Ela permite que a rede pré-sequencie as transações antes mesmo que os validadores se comuniquem, o que acelera tudo. Outras cadeias perdem tempo sincronizando relógios; a Solana ignora essa etapa inteira.

2. Solana é realmente descentralizada apesar de ser tão rápida?

Sim, velocidade não significa centralização no caso da Solana. Ela possui mais de 2,000 validadores, um coeficiente Nakamoto saudável e múltiplos clientes validadores independentes, como o Firedancer da Jump Crypto. Na verdade, é uma das poucas blockchains que equilibra alta taxa de transferência com um amplo conjunto de validadores, embora os críticos ainda levantem preocupações sobre custos de hardware e concentração de participação.

3. Por que os dApps do Ethereum não podem simplesmente migrar para Solana?

Como Solana usa uma linguagem de programação diferente, Rust em vez de Solidity, isso significa que os desenvolvedores não podem simplesmente copiar e colar o código do Ethereum. Embora isso possa parecer uma desvantagem, na verdade permite aplicativos personalizados mais poderosos. É um trabalho mais árduo, mas o resultado é melhor desempenho e mais controle sobre o comportamento dos contratos inteligentes.