- Solana, ultra hızlı ve düşük maliyetli işlemler elde etmek için Proof of History ve paralel işlemeyi kullanır.

- Güçlü Rust tabanlı akıllı sözleşmeleri destekleyerek yüksek performanslı dApp'lerin geliştirilmesine olanak tanır.

- Solana ekosistemi milyonlarca kullanıcı ve önde gelen Solana projeleriyle güç kazanıyor.

İnsanlar kriptoda ölçeklenebilirlikten bahsettiğinde, Solana neredeyse her zaman konuşmanın bir parçasıdır ve bunun iyi bir nedeni vardır. Daha önceki blok zincirlerinin verim sınırlamalarını çözmek için sıfırdan oluşturulmuştur Bitcoin ve Ethereum ile birlikte Solana, günümüzün en geliştirici dostu ekosistemlerinden birinde hız, düşük ücretler ve yeniliği bir araya getiriyor.

Bu yazıda, Solana'yı farklı kılan özellikleri, bu hıza nasıl ulaştığını ve şu anda hangi gerçek dünya kullanım örneklerini desteklediğini ele alacağız.

Solana Nasıl Çalışır: Farklı Bir Blockchain Türü

Hisse Kanıtı + Tarih Kanıtı

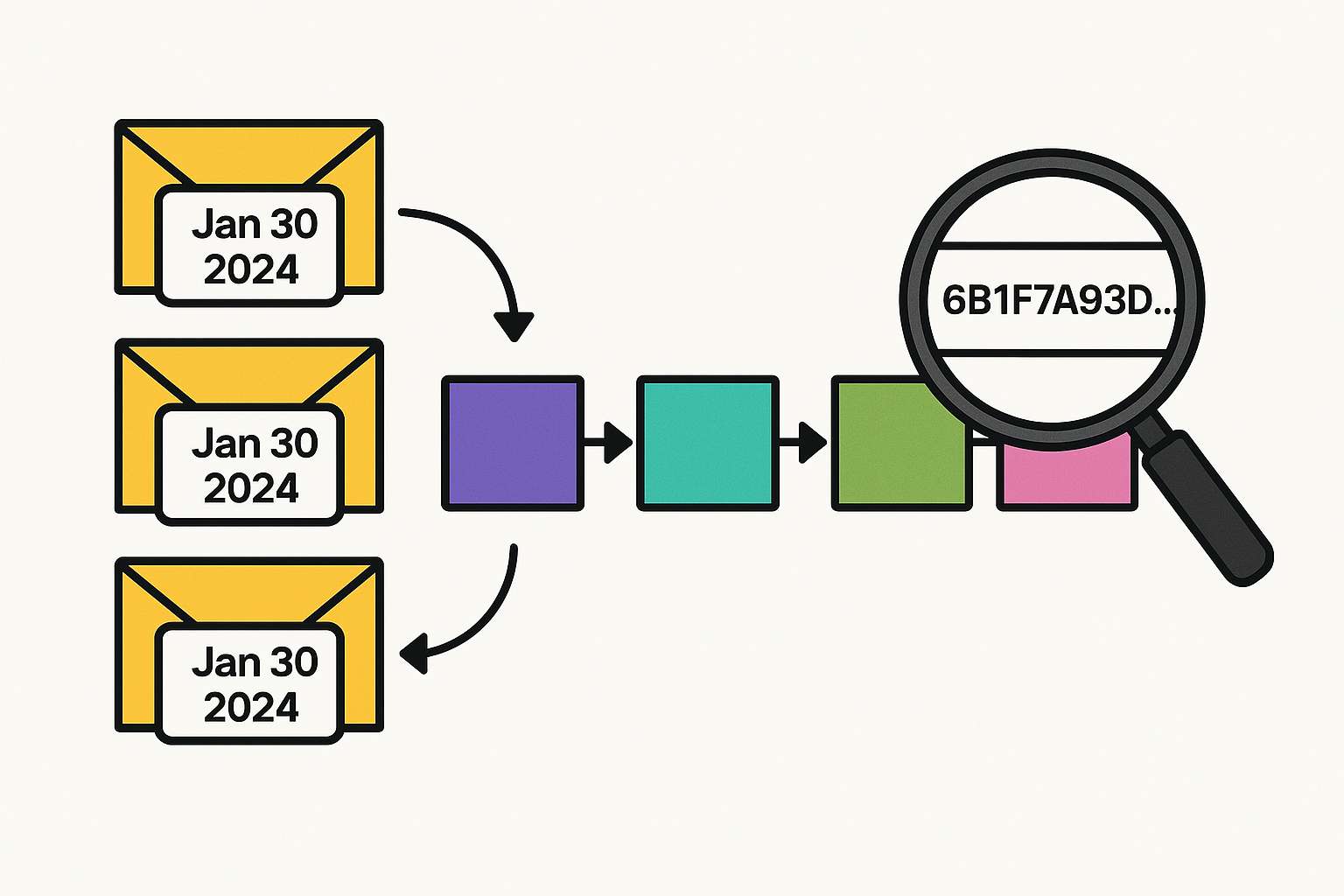

Solana özünde bir Bahis kuponu blockchain. Ama onu gerçekten farklı kılan şey Tarih Kanıtı (PoH), fikir birliğine varılmadan önce işlemleri doğrulanabilir bir sıraya koymak için kriptografik zaman damgalarını kullanan bir mekanizmadır.

Bunu, her mektubun kurcalanmaya dayanıklı bir zaman damgası içerdiği bir postalama sistemi gibi düşünün. Herkes bir mektubun ne zaman gönderildiği konusunda anlaşmak için sürekli saatine bakmak yerine, sadece zaman damgasını okur ve buna göre sıralar. Bu, düğümler arasındaki sürekli ileri geri hareketi ortadan kaldırır ve gecikmeyi önemli ölçüde azaltır.

Deniz Seviyesi ile Paralel Uygulama

Solana ayrıca "Sea Level" olarak adlandırılan paralel yürütmeyi tanıttı. Çoğu blok zinciri işlemleri tek tek (seri olarak) işler. Ancak Solana, doğrulayıcıların akıllı sözleşmeleri eş zamanlı olarak çalıştırmalarına izin verir. Sonuç? Teoride saniyede 710,000'e kadar işlemi işleyebilen bir ağ (ancak mevcut testler yaklaşık 50,000 TPS'ye kadar çıkıyor).

Bu, onu hız gerektiren uygulamalar için ideal hale getiriyor: DeFi, oyun, NFT pazar yerleri ve daha fazlasını düşünün.

Geliştiriciler Neden Solana Üzerinde İnşa Etmeyi Seviyor

Rust'ta Akıllı Sözleşmeler

Ethereum'un Solidity tabanlı akıllı sözleşmelerinin aksine Solana, Rust, daha fazla güç ve esneklik sunan düşük seviyeli bir programlama dili. Karşılığı? Daha yüksek karmaşıklık ve daha dik bir öğrenme eğrisi. Geliştiriciler Ethereum'dan kopyalayıp yapıştıramazlar; sıfırdan inşa etmeleri gerekir, ancak karşılığında daha fazla kontrol elde ederler.

Katman-2'ye gerek yok

Solana, harici ölçekleme çözümlerine dayanmaması bakımından benzersizdir. Iyimserlik veya Arbitrum. Mimarisi, kullanıcı deneyimini ve geliştirici uygulamasını basitleştiren Katman-1'deki hacmi işlemek için oluşturulmuştur.

Solana Ekosistemi: Aktif, Çeşitli ve Genişleyen

MKS Solana ekosistemi sadece bir sürü vaat değil, gerçek bir çekişle tam hızda ilerliyor:

- 2 milyondan fazla aylık aktif cüzdan

- 83,000'den fazla günlük aktif hesap

- 2,132 doğrulayıcı

- 32 milyondan fazla NFT basıldı

Ve evet, Helium, Marinade, Tensor gibi en iyi Solana projelerinden bazıları jito DeFi, staking ve Web3 altyapısı hakkında düşünme şeklimizi yeniden tanımlıyoruz.

Özellikle heyecan verici gelişmelerden biri de yürütülebilir NFT'lerin (xNFT'ler) piyasaya sürülmesidir; yalnızca görüntüleri depolamakla kalmayıp kod çalıştırabilen NFT'ler. Bunlar halihazırda Coral ve Backpack gibi uygulamalarda kullanılıyor.

Ayrıca okuyun: Solana'ya Nasıl Köprü Kurulur

Tokenomics: SOL Token Nasıl Çalışır?

Solana'nın yerel simgesi, SOL, staking, işlem ücretleri ödeme ve akıllı sözleşmelerle etkileşim için kullanılır. Bitcoin, SOL arzında kesin bir sınır yoktur. Bunun yerine, Solana deflasyonist-enflasyonist bir hibrit modeli takip eder:

- Enflasyon %8 civarında başlar ve her yıl %1.5'e kadar kademeli olarak azalır

- Tüm işlem ücretlerinin %50'si yakılarak arz baskısı azaltılıyor

Şu anda token'ların yaklaşık %39'u topluluk girişimlerine tahsis edilmiş durumda ve geri kalanı erken yatırımcılar ve Solana Vakfı'nın elinde bulunuyor.

Ayrıca Oku: Solana ($SOL) Nasıl Satın Alınır

Gerçek Dünya Faydası: Sadece Teoriden Daha Fazlası

Solana'nın yüksek verimi ve asgari işlem ücretleri gerçek Web3 benimsenmesine yol açtı. Merkezi olmayan borsalardan Hivemapper gibi haritalama protokollerine ve hatta zincir üstü varlık sahipliğine sahip oyunlara kadar her şeye güç veriyor.

Ve belki de en etkileyici olanı, Solana'nın tüm bunları merkeziyetsizlik ölçümlerinden ödün vermeden başarması ve farklı coğrafyalarda ve donanımlarda 2,000'den fazla doğrulayıcıyı korumasıdır.

Bottom Line

Solana, hız, ölçeklenebilirlik ve gelişen bir ekosistemi bir araya getirerek Layer-1 alanında meşru bir rakip olduğunu kanıtladı. İster geliştirici, ister yatırımcı olun veya sadece Solana'nın en iyi projeleri, Solana'nın 2026'te izlenmeye değer olduğu tartışılmaz.

Gerçek dünyadaki faydası, teknik yeniliği ve artan benimsenmesi, onu bu hale getiren şeydir. Solana sadece bir blockchain moda sözcüğünden daha fazlası.

SSS

1. Proof of History nedir ve Proof of Stake'ten farkı nedir?

Proof of History (PoH), Proof of Stake (PoS)'un yerine geçmez, Solana'nın işlemleri verimli bir şekilde sipariş etmesine yardımcı olan bir eklentidir. PoH'u genel bir zaman damgası kaydı gibi düşünün. Ağın, doğrulayıcılar birbirleriyle konuşmadan önce işlemleri önceden sıralamasına izin verir, bu da her şeyi hızlandırır. Diğer zincirler saatleri senkronize ederek zaman kaybeder; Solana bu adımın tamamını atlar.

2. Solana bu kadar hızlı olmasına rağmen gerçekten merkeziyetsiz mi?

Evet, Solana'nın durumunda hız merkezileşme anlamına gelmiyor. 2,000'den fazla doğrulayıcı, sağlıklı bir Nakamoto katsayısı ve Jump Crypto'nun Firedancer'ı gibi birden fazla bağımsız doğrulayıcı istemcisi bulunuyor. Aslında, yüksek verimi geniş bir doğrulayıcı setiyle dengeleyen birkaç blok zincirinden biri, ancak eleştirmenler hala donanım maliyetleri ve hisse konsantrasyonu konusunda endişelerini dile getiriyor.

3. Ethereum dApp'leri neden Solana'ya taşınamıyor?

Çünkü Solana, Solidity yerine Rust adında farklı bir programlama dili konuşuyor. Bu, geliştiricilerin Ethereum'dan kodu kopyalayıp yapıştıramayacağı anlamına geliyor. Bu bir dezavantaj gibi görünse de aslında daha güçlü, özel uygulamalara olanak sağlıyor. Daha zor bir iş ama sonuç daha iyi performans ve akıllı sözleşme davranışı üzerinde daha fazla kontrol.