- ApeX Omni combines perps, spot swaps, RWAs, and prediction markets in one interface

- Trading feels similar to centralized exchanges while remaining fully non-custodial

- Perpetual markets offer 94+ contracts with leverage up to 100x

- Spot trading works through multichain spot swaps, not a traditional order book

- Fees remain competitive with low futures costs and simple spot pricing

- Vaults, grid bots, and staking support both active and passive strategies

- Security relies on self-custody, ZK proofs, and Ethereum-based settlement

Perpetual DEXs continue to evolve, with updates and upgrades becoming increasingly visible across the market, both in newly launched perp DEXs and in older platforms that are being reworked. One example is ApeX Pro, which was previously constrained by chain fragmentation and has now transitioned into ApeX Omni, an aggregated multichain liquidity platform designed as a single interface for perps, spot trading, prediction markets, and RWAs. This ApeX Omni review examines how the platform has changed after the architectural shift, with a focus on fees, services, and security.

| 统计数据 | ApeX Omni |

|---|---|

| 🚀 成立 | 2024 |

| 🌐总部 | 纽约,美国 |

| 🔎创始人 | 戴夫·迈尔斯 |

| 👤 活跃用户 | 545K + |

| ♾️ 支持的犯罪分子 | 94+ |

| 🔁 现货费用(制造商/接受者) | 0.5% |

| 🔁 期货费用(制造商/接受者) | 0.02%/ 0.05% |

| ⚙️ 网络支持 | 5+ |

| 📈 最大杠杆 | 100x |

| 🕵️ KYC 验证 | 不需要 |

| 📱 移动应用程序 | 是 |

| ⭐ 评分 | 4.5/5 |

| 💰 奖金 | 5% 交易费折扣 (现在宣称) |

ApeX Omni Overview

ApeX Omni is the main trading interface of ApeX Protocol and represents a clear step away from how its earlier version operated. Launched in 2024, the platform was rebuilt to remove chain fragmentation and to support trading across multiple networks through a single account flow. Instead of forcing users to bridge assets manually, ApeX Omni aggregates liquidity across several chains and abstracts most of that complexity away at the interface level.

From a usage perspective, the platform feels closer to a centralized exchange than a typical DEX. The interface is mobile-first, clean, and responsive, with no mandatory KYC and fully non-custodial account control.

For spot trading, ApeX Omni supports over 20 cryptocurrencies. Spot trades are executed with a 0.00% maker fee and a 0.05% taker fee, which keeps costs predictable for both passive and active traders.

On the futures side, the platform offers access to more than 94 perpetual contracts with leverage of up to 100x. Futures trading follows a 0.02% maker fee and a 0.05% taker fee, with 每日交易量 reaching as high as $1.45B+. Beyond standard crypto pairs, futures markets also include tokenized real-world assets such as stocks, gold, and silver, along with leveraged prediction markets, giving traders exposure beyond purely crypto-native instruments.

ApeX Omni also includes vaults and copy trading mechanics, allowing users to follow strategies or deploy capital into protocol-managed vaults. On the infrastructure side, the protocol uses zero-knowledge proofs to keep individual positions private while maintaining verifiable balances and withdrawals. Security monitoring is public, with ongoing oversight and audit reports available through ApeX Protocol’s repositories.

ApeX Omni Pros and Cons

| 👍 ApeX Omni Pros | 👎 ApeX Omni Cons |

|---|---|

| ✅ Up to 100x leverage on major pairs | ❌ Prediction markets still developing |

| ✅ Cross-collateral improves capital efficiency | ❌ Some audit details not fully consolidated |

| ✅ Zero gas fees on perpetual trades | |

| ✅ Broad product suite including tokenized stocks, FX and prediction markets | |

| ✅ Multichain trading without manual bridging | |

| ✅ Grid bots and automation tools available | |

| ✅ Vaults support passive and copy trading | |

| ✅ Mobile access available on both iOS and Android |

ApeX Omni KYC and Sign-up

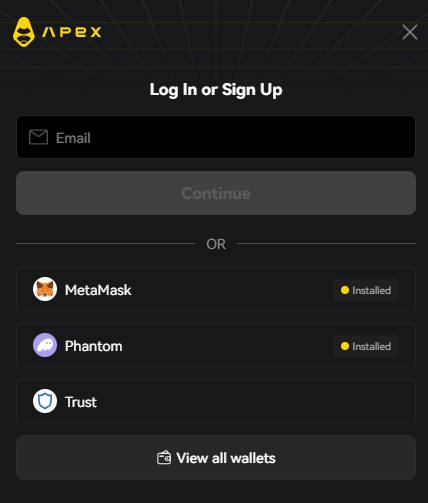

To create an account on ApeX Omni, users need an EVM-compatible Web3 wallet such as MetaMask or 拉比钱包. The setup does not involve account registration or KYC. You simply connect your wallet and approve access to ApeX Omni to begin.

The process is straightforward and takes only a few minutes. Below is a step-by-step breakdown showing how you can connect your wallet and start trading on ApeX Omni.

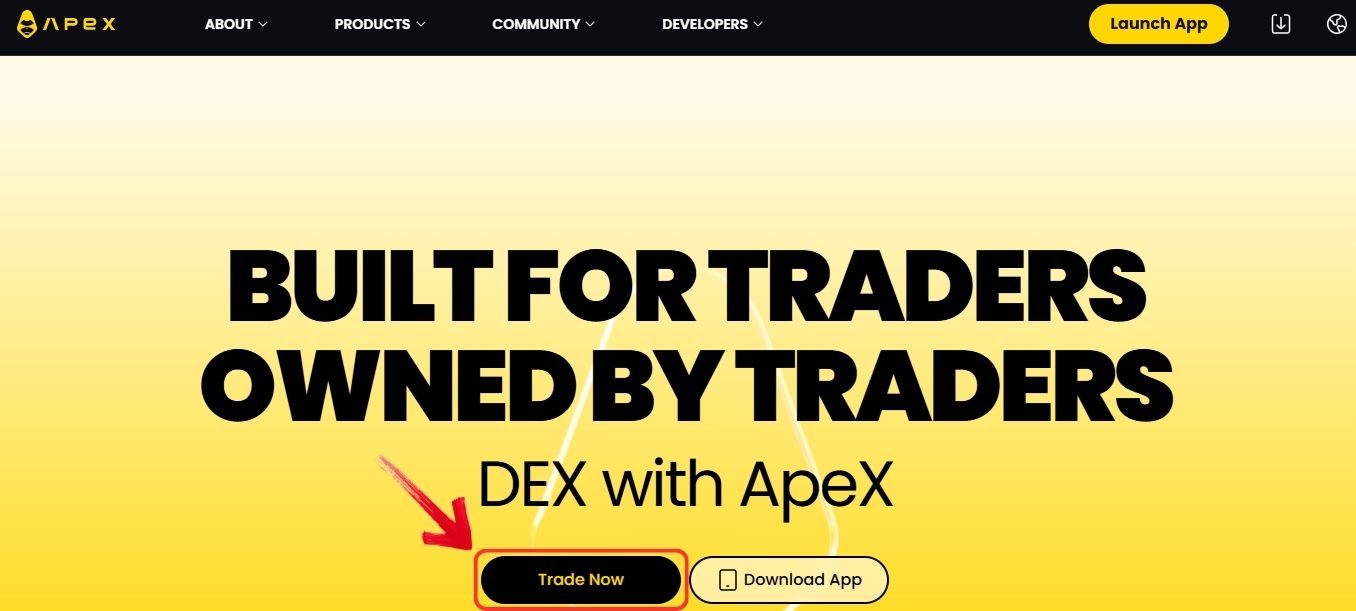

步骤1: 打开浏览器访问官方 ApeX 协议 platform. Click “立即交易” to launch the ApeX Omni interface.

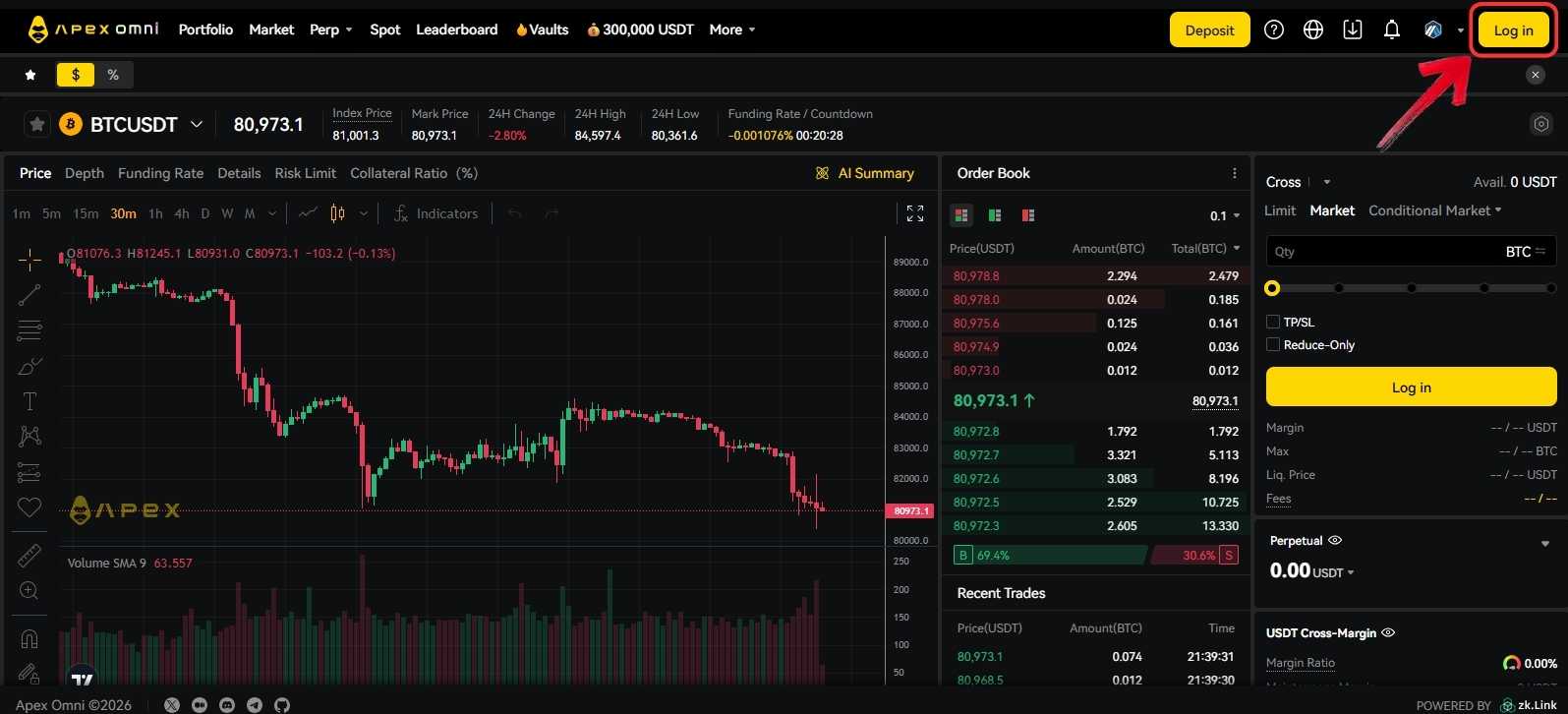

步骤2: On the ApeX Omni screen, click “登录” in the top-right corner. You can connect using an email address or a supported Web3 wallet.

步骤3: Choose a wallet from the available list to connect with ApeX Omni.

步骤4: After selecting a wallet, a connection request will appear in your wallet. Approve the request to link your wallet with ApeX Omni.

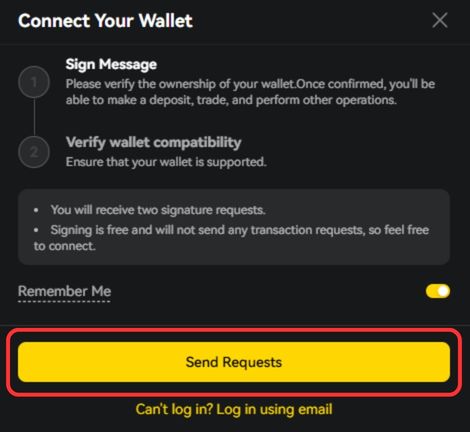

步骤5: A popup will appear asking for permission. Click “Send Requests” to allow ApeX Omni to request signatures and verify wallet compatibility.

步骤6: Once the requests are approved, accept the Terms and Conditions by checking the box, then click “创建帐号”.

After your account is created, you can start using ApeX Omni features, including perpetual trading, spot markets, prediction markets, real-world assets, and grid bot tools.

支持的网络

ApeX Omni supports 5 networks including Arbitrum, Base, BNB Chain, Ethereum, and Mantle. Since all of these are EVM-compatible, you can use a standard EVM wallet without any extra setup. This makes an EVM-compatible wallet the easiest way to access ApeX Omni, manage funds, and trade across all supported markets from one interface.

ApeX Omni Trading

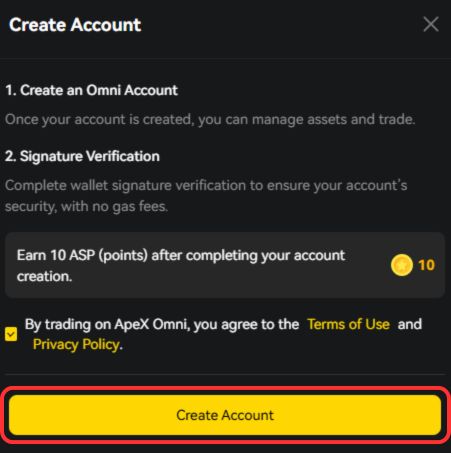

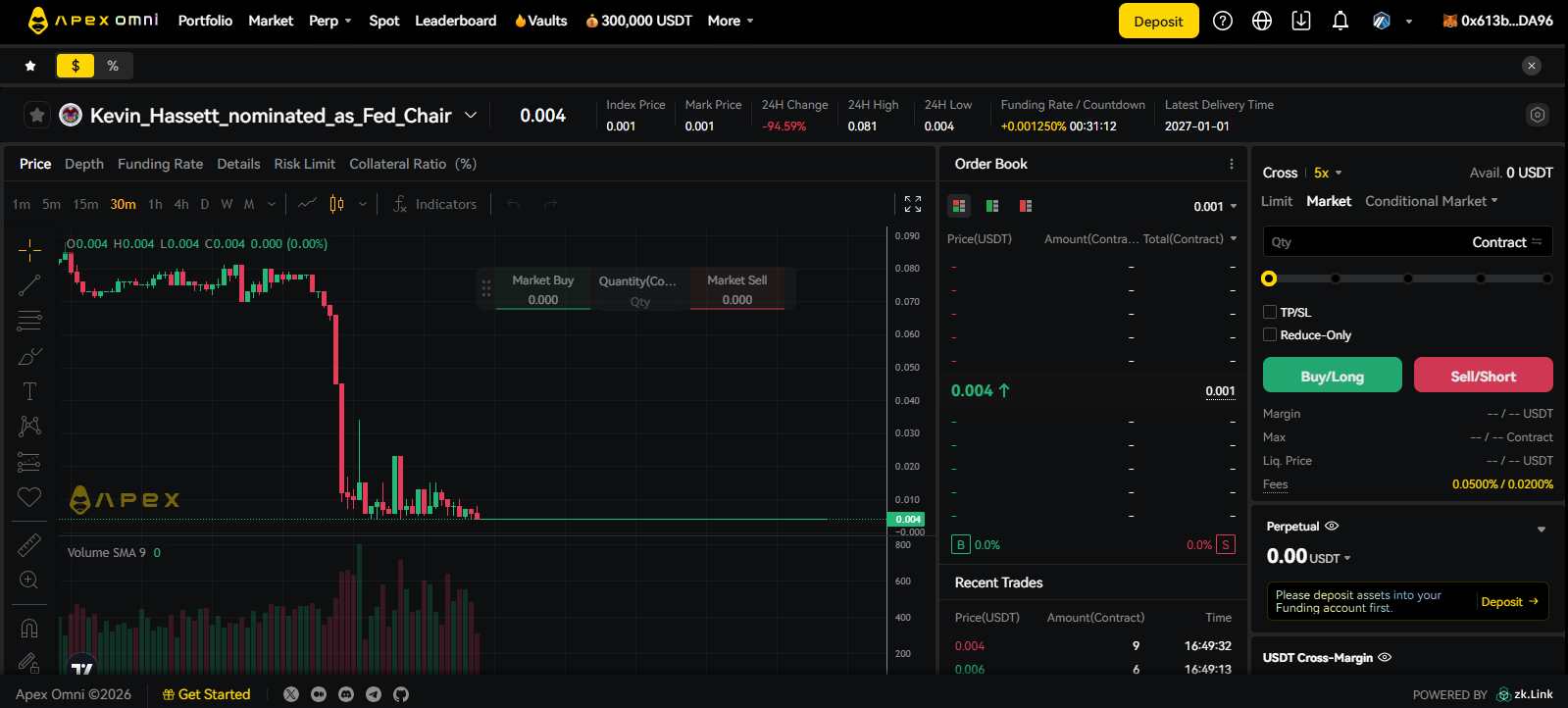

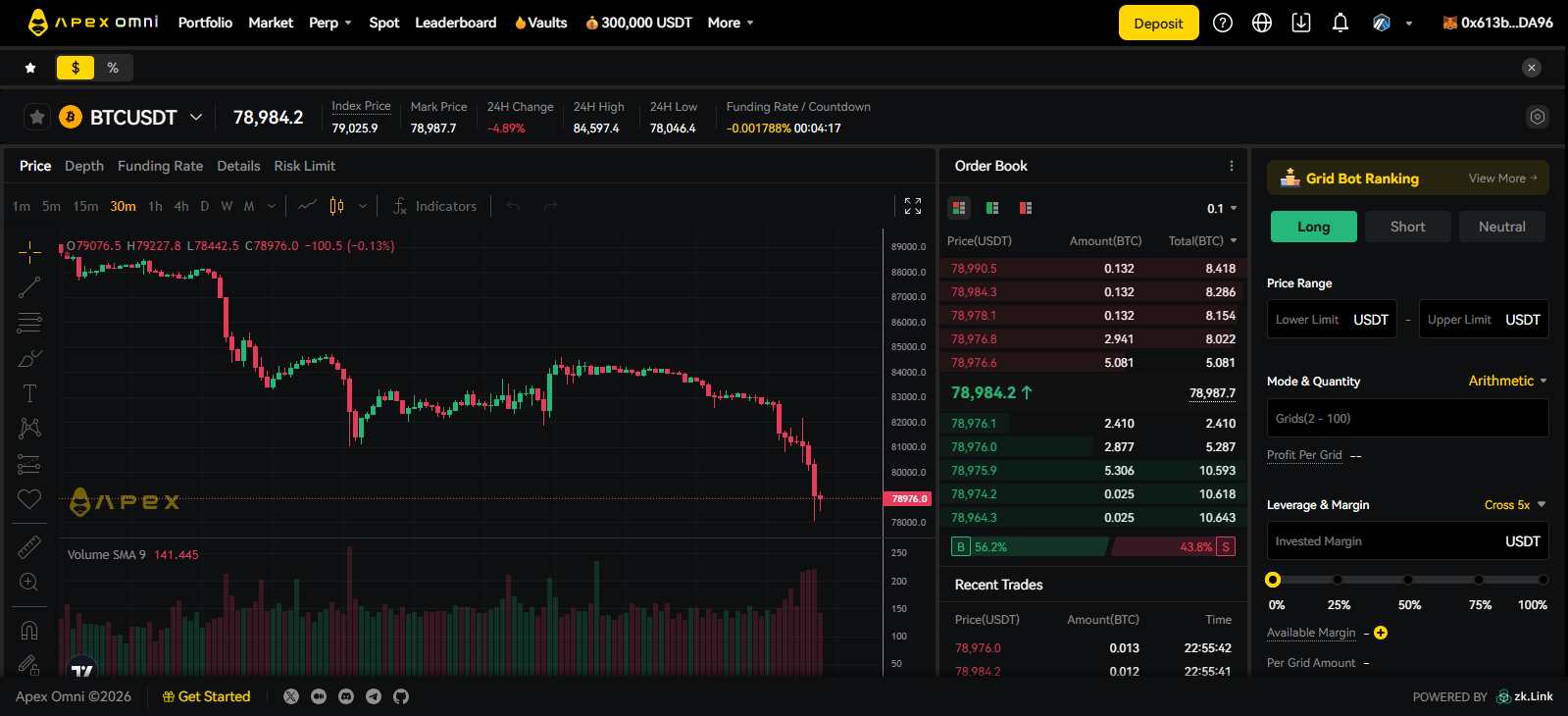

ApeX Omni’s trading interface will feel familiar if you have used centralized exchanges, especially Bybit. The layout closely mirrors a CEX-style setup, so there is very little learning curve if you are coming from centralized trading platforms.

You see TradingView charts, the order book, and the trading panel on a single screen. Token details and market data sit at the top, while your open positions and order history are placed at the bottom. The interface also lets you use drag-and-drop features to personalize your trading setup, making it easier to arrange panels the way you prefer and manage trades without switching views.

Beyond order placement, you also get quick access to funding rate history and risk limit information through dedicated tabs. Since risk limits are directly linked to the maximum leverage you can use, having this data visible helps you size positions more carefully and make more informed entries while trading.

现货交易

ApeX Omni offers what it calls spot trading, but in practice this works as spot swaps rather than a traditional spot order book. Instead of placing limit or market orders against other traders, you are swapping tokens directly through a multichain spot DEX layer. The key point here is that you are not dealing with the usual friction that comes with cross-chain swaps. Spot trading fees are fixed at 0.5% on ApeX Omni.

You can swap tokens across multiple blockchains without manually bridging assets, juggling different wallets, or worrying about holding native gas tokens on every chain. Execution happens in real time, with built-in anti-MEV protection, and liquidity is pulled from multiple sources across supported networks to improve pricing and depth compared to single-chain DEXs.

From a user perspective, the process is simple. You add the token contract you want to swap, select the source and destination chains, and execute the trade in one flow. ApeX Omni supports swaps across major networks such as Ethereum, BNB Chain, Base, and Solana, allowing you to move between ecosystems without leaving the platform. This setup makes spot activity on ApeX Omni more about efficient token conversion than traditional spot market trading.

衍生品交易

ApeX Omni’s perpetual markets are one of its stronger areas, with relatively tight bid-ask spreads on major pairs and a broader range of markets than many perp DEXs. You can trade on more than 94 perpetual contracts, covering not only cryptocurrencies but also prediction markets, tokenized stocks, indices, and precious metals. Perpetual trading fees are set at 0.02% for makers and 0.05% for takers, which keeps costs in line with other high-volume derivatives platforms.

Maximum leverage goes up to 100x, though the actual leverage available depends on your position size. As trade size increases, allowed leverage decreases, and both initial and maintenance margin requirements rise. This structure encourages more controlled risk-taking on larger positions.

存款和提款方式

ApeX Omni handles deposits and withdrawals entirely on-chain through its supported networks, including Arbitrum, Base, BNB Chain, Ethereum, and Mantle. You can deposit and withdraw funds directly using supported assets such as USDT, USDC, and WETH, without relying on any centralized custody layer.

In addition to direct transfers, ApeX Omni also offers a built-in multichain swap feature. This allows you to swap tokens held in your wallet into USDT or USDC across supported networks, making it easier to fund your trading balance without leaving the platform.

ApeX Omni Fees

Fee structure matters when using a perp DEX, and it goes beyond trading fees. Costs tied to deposits, withdrawals, and swaps also play a direct role in your overall trading experience and results.

交易费用

Trading fees on ApeX Omni are split between spot and futures, and the structure is fairly straightforward once you look at them separately.

For spot trading, fees are fixed at 0.5%, so there is no tiering or volume-based adjustment on spot swaps.

Futures trading follows a tiered fee structure. Base fees start at 0.02% for maker orders and 0.05% for taker orders. As your activity increases, these rates can come down depending on your VIP tier.

VIP tiers are based on either your trading volume or your APEX and esAPEX staking balance. You do not need to meet both requirements. Meeting just one is enough to move to the next tier and access lower futures fees.

现货费用

0.05%

期货费用

0.02% 庄家

0.05% 接受者

存取款费用

ApeX Omni does not charge any deposit fees. When you deposit funds, the only cost you pay is the network gas fee for the chain you are using.

For withdrawals, you get two options. Normal withdrawals come with no platform fee. You just need to cover the network gas, and the funds to pay for that gas must already be in your Omni account. These withdrawals are not instant and can take up to four hours to complete.

If you want speed, fast withdrawals are available and are processed almost instantly, but they do include a fee. On non-Ethereum networks, the fee is a flat 2 USDT. On Ethereum, the fee is not fixed and is calculated based on current gas prices, the gas limit used for the withdrawal, and the ETH price. Because of this, fast withdrawal costs on Ethereum can change depending on network congestion and market conditions.

ApeX Omni Products and Services

Below are the core ApeX Omni products and services users interact with on a day-to-day basis.

ApeX Omni Trading

ApeX Omni brings all of its trading features into a single, easy-to-use interface. You can trade spot swaps, perpetual futures, prediction markets, and tokenized RWAs without jumping between different sections. Perpetual markets support high leverage with cross-collateral, while spot swaps handle multichain token conversions smoothly. Order execution is fast, spreads on major pairs stay tight, and the overall setup makes active trading feel familiar even if you are coming from centralized platforms.

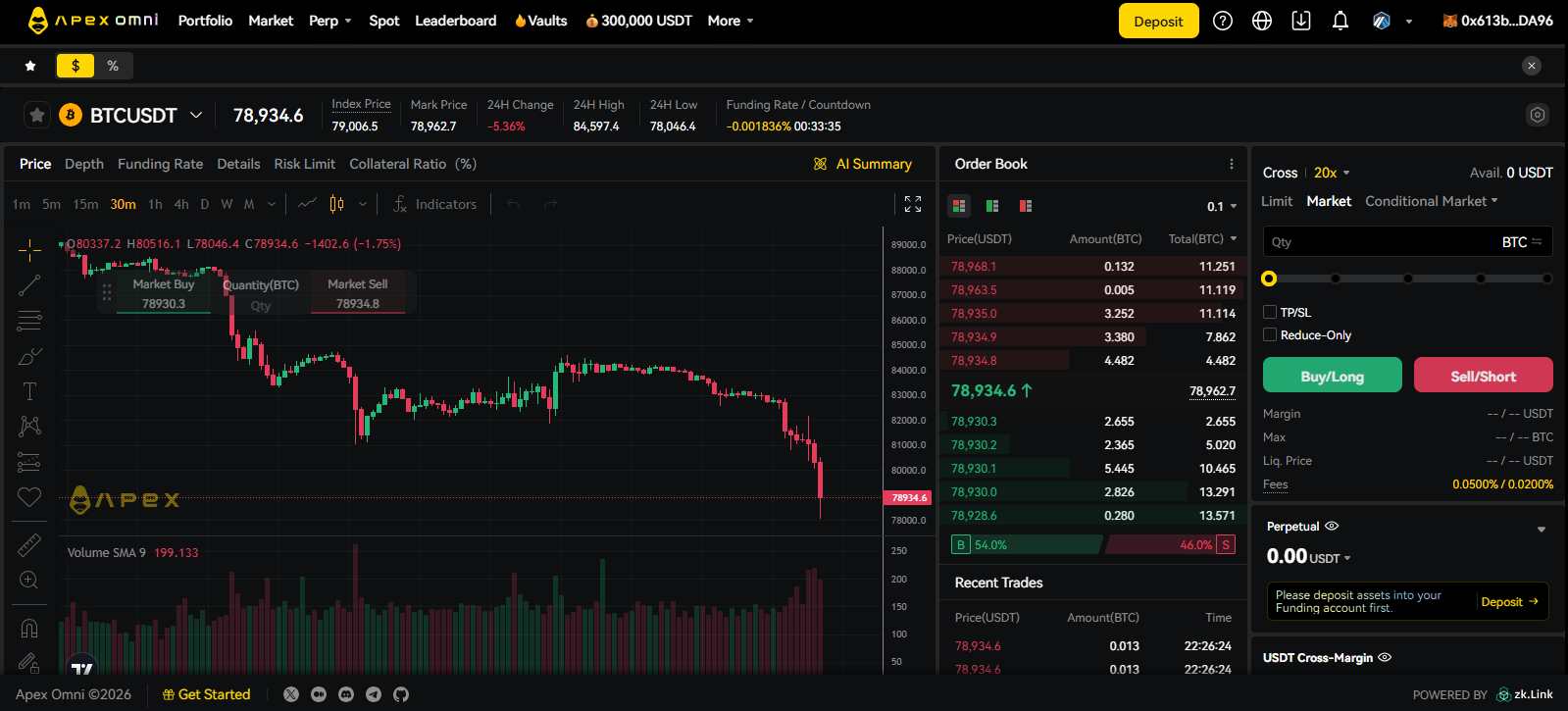

移动应用程序

ApeX Omni works well on mobile without forcing you into a separate app. You can trade directly through your mobile browser or wallet app with the same features as desktop. Perps, spot swaps, vaults, grid bots, and predictions all stay accessible, making it easy to manage positions or react to markets while on the move.

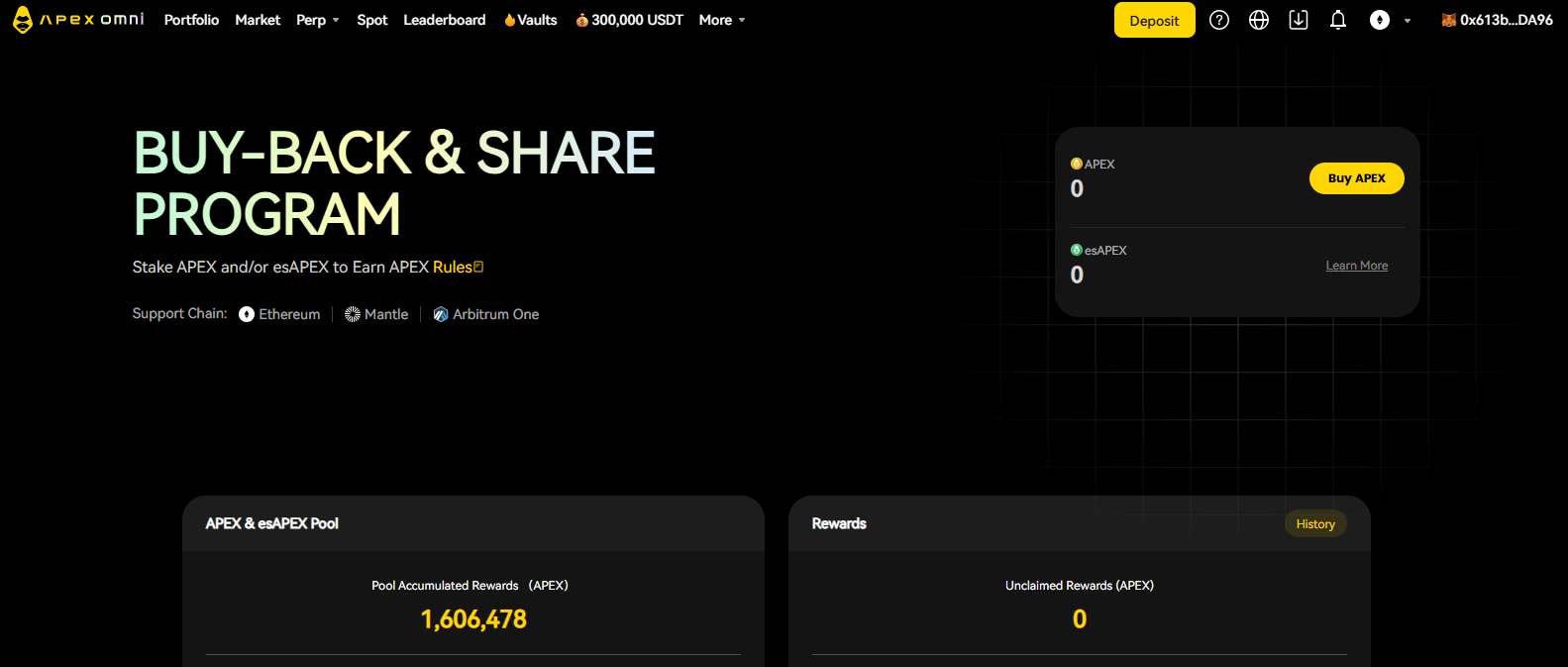

ApeX Token – $APEX

$APEX is the protocol’s utility and governance token. You use it mainly for staking, fee benefits, and ecosystem rewards. Stakers earn from protocol activity through buybacks, and holding $APEX can also unlock VIP perks and participation in platform programs. It ties regular users directly into how ApeX grows and distributes value.

Omni Prediction Markets

Omni Prediction Markets let you trade outcomes instead of prices. You place yes or no positions on real-world events like politics, macro data, or crypto milestones, with leverage applied. Pricing adjusts based on probabilities, settlement is oracle-based, and everything runs inside the same trading interface you already use for perps.

网格机器人

The grid bot is built for traders who want automation without complexity. You set a price range, choose long, short, or neutral mode, and the bot handles execution. It works best in sideways or choppy markets and can even earn maker rebates during promos. You track performance clearly and keep full control at all times.

Omni Staking

ApeX Omni staking is built around the $APEX token and a simple rewards loop. When you stake, rewards are paid in APEX rather than stablecoins, and the protocol uses a portion of its fee revenue to buy back APEX from the market and distribute it to stakers. The staking page also keeps things transparent by showing how many APEX tokens are distributed each week and the running total, so you can track rewards without guessing.

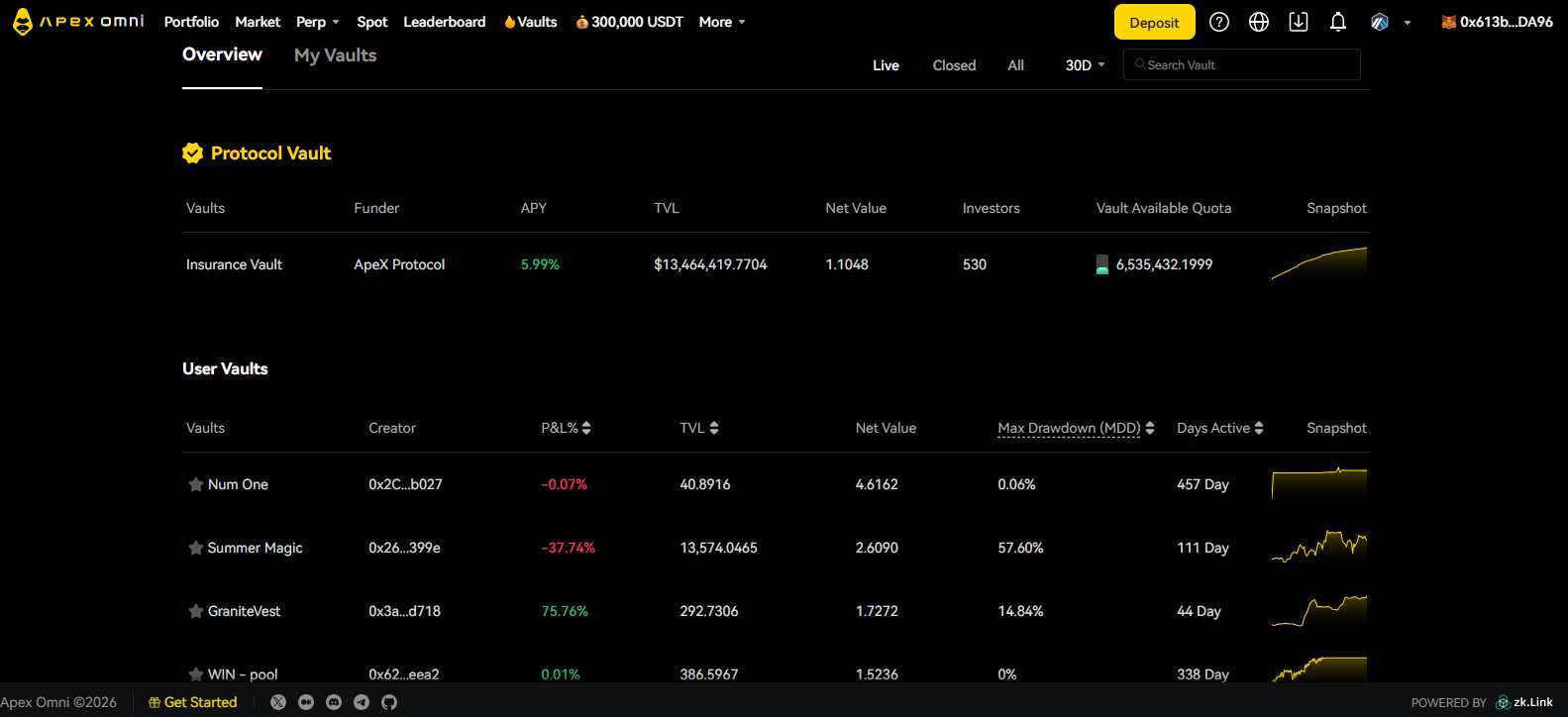

Omni Vaults

Omni Vaults are for passive participation or strategy scaling. Traders create vaults and run strategies without access to user funds, while followers automatically mirror those trades. Profits are split transparently, performance is visible, and smart contracts enforce rules. It is a clean way to follow skilled traders or deploy capital without micromanaging trades.

Alongside trader vaults, ApeX Omni also offers protocol vaults. These allow users to deposit USDT to provide liquidity to the platform and earn yield, with returns reaching up to 7.65%, depending on market conditions.

ApeX Omni Security

ApeX Omni is designed around self-custody and on-chain verification, which is standard across most perp DEXs. You stay in control of your funds and private keys at all times, and the platform never takes custody of user assets. Trades and positions rely on zero-knowledge proofs through zkLink, so individual activity stays private while balances and settlements can still be verified on-chain. Core contracts ultimately settle on Ethereum, meaning final custody benefits from Ethereum’s security model.

Risk management is handled through position-based leverage limits, dynamic margin requirements, and protections against common MEV behavior during execution. On the oversight side, ApeX Protocol is monitored by CertiK through its Skynet system, and audit reports are publicly available in the project’s repositories. There have been no publicly reported exploits affecting ApeX Omni so far.

ApeX Omni Customer Support

Customer support on ApeX Omni is available, but it is mostly community-driven rather than app-based. The main support channel is Discord, where you raise tickets for issues like wallet connections, deposits, withdrawals, or trading errors, and responses are usually timely. Telegram is also active, mainly for quick questions and updates, though detailed issues are often redirected to Discord. There is no live chat or support email, so Discord remains the most reliable option.

ApeX Omni Alternatives

If you want to compare ApeX Omni with other options in the perp DEX space, a couple of alternatives worth looking at:

1. 超流动性: Built around its own custom chain, 超流动性 prioritizes fast execution and deep liquidity, which suits traders who care about tight spreads and quick fills.

2. 紫菀: With a simpler layout and fewer moving parts, 翠菊 offers straightforward market access and supports hidden orders, which can help higher-volume traders reduce market impact.

| 专栏 | 翠菊 | 超流动性 | ApeX Omni |

|---|---|---|---|

| 建立 | 2025 | 2024 | 2024 |

| 现货费用 | 0.10% | 无 | 0.05% |

| 期货费用(挂单者/吃单者) | 0.010%/ 0.035% | 0.015%/ 0.045% | 0.02%/ 0.05% |

| 最大杠杆 | 1001x | 50x | 100x |

| 需要KYC | 没有 | 没有 | 没有 |

| 支持的加密货币(现货) | 8+ | 无 | 20+ |

| 期货合约 | 93+ | 173+ | 94+ |

| 无 KYC 提款限制 | 无限量的 | 无限量的 | 无限量的 |

| 24小时期货成交量 | $ 6.38B + | $ 8.29B + | $ 1.44B + |

| 主要功能 | • 1001 倍杠杆(BTC/ETH) • 网格交易和移动应用程序 |

• 定制 L1 链 • 零汽油费 • Vaults + staking |

• Multichain perps & spot swaps • Prediction markets & RWAs • Vaults, grid bots, staking |

| 注册 | 注册 | 注册 | 注册 |

底线

ApeX Omni brings together a lot of moving parts into a single platform, and how useful it feels really depends on what you are looking for. If you value multichain access, non-custodial trading, and a mix of perps, spot swaps, and newer products like prediction markets, the setup can make sense. At the same time, not every trader will need this level of complexity or feature depth. If some parts do not align with how you trade, it can be helpful to look through other top perp DEX options and compare what fits your workflow better.

常见问题解答

1. What assets can I trade on ApeX Omni?

You can trade perpetual futures, spot swaps, prediction markets, and tokenized real-world assets like stocks and precious metals, all from one interface.

2. Is ApeX Omni suitable for beginners?

The interface is easy to navigate, especially if you have used centralized exchanges before. However, features like leverage, perps, and prediction markets still require basic trading knowledge to use responsibly.

3. Is ApeX Omni safe?

ApeX Omni is non-custodial, settles on Ethereum, and uses zero-knowledge proofs for privacy. The protocol is monitored by CertiK, and no major exploits have been reported so far. Like any DeFi platform, smart contract risk still exists.

4. How does spot trading work on ApeX Omni?

Spot trading on ApeX Omni is handled through spot swaps rather than an order book. Instead of matching buy and sell orders, you swap tokens directly across supported chains. This approach removes the need for manual bridging and makes spot activity more about quick token conversion than traditional market trading.

5. Does ApeX Omni have a mobile app?

There isn’t a separate downloadable app in every case, but ApeX Omni works smoothly as a mobile-optimized web app and via wallet apps like MetaMask or Bybit Web3. You can access most features on your phone, including perps, spot swaps, vaults, grid bots, and predictions.