- •S&P Global launches the S&P Digital Markets 50 Index, blending 15 cryptocurrencies and 35 crypto-linked equities into one unified benchmark.

- •The index, developed with Dinari, will be tokenized via dShares, giving investors onchain access to both digital assets and U.S. equities.

- •Designed to rebalance quarterly, the index aims to bring transparency, diversification, and institutional credibility to the crypto investment space.

S&P Global has officially announced the S&P Digital Markets 50 Index, a new benchmark combining 15 leading cryptocurrencies with 35 publicly traded companies connected to blockchain and digital finance. The index, revealed on October 7, 2025, by S&P Dow Jones Indices (S&P DJI), aims to give investors a transparent and diversified view of the evolving digital asset market.

The collaboration between S&P Global and Dinari, a platform known for tokenized U.S. public securities, marks a strategic effort to link traditional markets with decentralized finance. Dinari will issue a token that tracks the index, allowing investors to access both equities and digital assets through a single, onchain product.

Cameron Drinkwater, Chief Product & Operations Officer at S&P DJI, described the launch as a response to growing global demand for reliable benchmarks in digital finance. “Independent and transparent benchmarks are essential for building accessibility in this space”, Drinkwater said. The initiative reflects how institutional players are beginning to treat digital assets as part of a broader investment toolkit for diversification and growth.

Inside the S&P Digital Markets 50 Index

The S&P Digital Markets 50 Index serves as a hybrid benchmark representing both sides of the crypto ecosystem. It combines major cryptocurrencies, such as Bitcoin, Ethereum, Cardano, Polkadot, Aave, and Solana, with companies that have a direct role in the digital economy. These include well-known names like Coinbase, Nvidia, and Strategy (formerly MicroStrategy), firms that either hold crypto assets or provide infrastructure for blockchain and computing operations.

S&P Global stated that the index is market capitalization-weighted and will rebalance quarterly, ensuring relevance as the market evolves. This structure prevents any single cryptocurrency or company from dominating the overall performance.

The addition of tokenized tracking via Dinari’s dShares makes the index “investible”, giving investors a practical way to participate in both digital and traditional finance. Anna Wroblewska, Chief Business Officer at Dinari, emphasized that the initiative demonstrates how blockchain can modernize benchmark tracking. “For the first time, investors can access both U.S. equities and digital assets in a single, transparent product”, she noted.

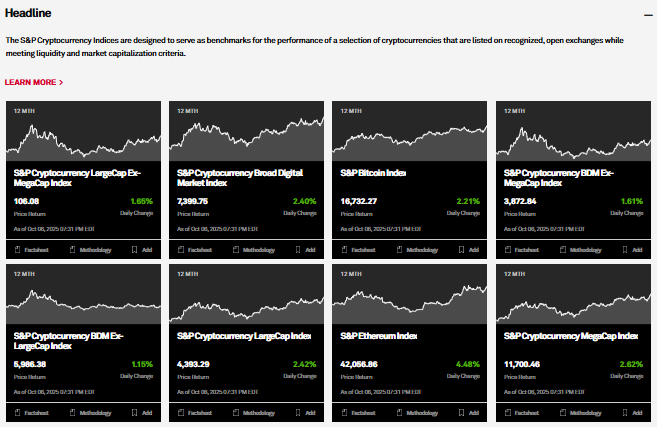

The index will join S&P DJI’s existing lineup of digital asset benchmarks, including the S&P Cryptocurrency Broad Digital Market Index, further solidifying the firm’s position in bridging regulated finance with decentralized innovation.

Why This Launch Matters for Crypto’s Future

The unveiling of the S&P Digital Markets 50 Index signals a pivotal moment in the ongoing integration between traditional finance and decentralized markets. It offers a structured entry point for institutions and retail participants who want exposure to the crypto sector without managing wallets or exchanges.

Analysts view this as a “major validation” for crypto as a legitimate asset class. By providing a consistent, rules-based framework, S&P Global introduces a level of credibility often missing in volatile markets. The move could pave the way for new financial products, such as ETFs or mutual funds based on the index, expanding crypto accessibility to mainstream portfolios.

For S&P Global, this initiative reinforces its broader role as a trusted provider of benchmarks across both conventional and alternative asset classes. And for investors, it represents a bridge between Wall Street’s reliability and the innovation driving blockchain economies.

Also read: Galaxy Launches GalaxyOne, Expanding Access to Institutional-Grade Finance

A New Benchmark for the Digital Era

The S&P Digital Markets 50 Index reflects how far the digital asset sector has come, from speculative beginnings to being formally recognized by one of the world’s most trusted index providers. By merging crypto assets and blockchain-linked equities into one transparent benchmark, S&P Global provides investors with a clearer, more structured way to approach the market.

As the boundaries between traditional and decentralized finance continue to blur, this index may well become a key reference point for the next wave of regulated crypto investment products, offering both confidence and accessibility to a maturing global ecosystem.