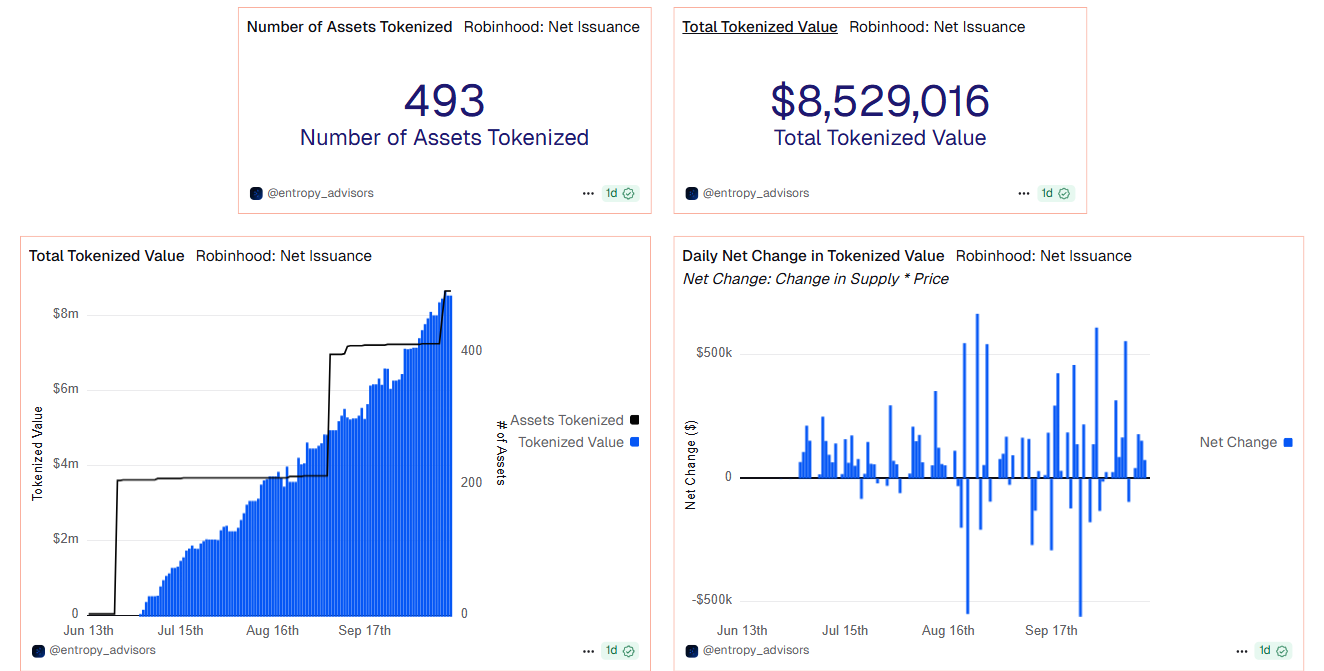

- •Robinhood’s tokenization on Arbitrum now includes nearly 500 US stocks and ETFs worth about $8.5M.

- •The tokens operate as MiFID II-regulated derivatives with low fees and a €1 entry point for EU users.

- •Lithuania’s regulator has requested structural clarity as Robinhood expands its RWA program.

Robinhood’s tokenization program on the Arbitrum blockchain has reached a new milestone, covering nearly 500 US stocks and ETFs for its European users. The latest data from Dune Analytics reveals that the initiative’s on-chain value now exceeds $8.5 million, showing strong traction since the feature launched earlier this year.

Dune Data Reveals Steady Growth Across 493 Assets

As of mid-October, Robinhood has tokenized 493 assets, including leading US equities, ETFs, and a few commodities. Stocks make up nearly 70% of the total supply, while ETFs represent around 24%. The cumulative minting volume has reached $19.3 million, offset by $11.5 million in token burning, suggesting consistent trading and redemption activity.

New listings include Galaxy (GLXY), Webull (BULL), and Synopsys (SNPS). Among the most traded are blue-chip names like NVIDIA (NVDA), Amazon (AMZN), Tesla (TSLA), and Alphabet (GOOGL). Even Robinhood’s own shares (HOOD) appear on-chain, with 2,669 tokenized units worth about $370,000.

How Robinhood’s On-Chain Stocks Operate

The Robinhood tokenization of US stocks uses Arbitrum, a Layer-2 blockchain built for speed and low transaction costs. Each token mirrors the live price of a listed stock or ETF but doesn’t grant ownership of the underlying asset. These are structured as blockchain-based derivatives compliant with MiFID II regulations in the EU.

Robinhood offers 24-hour weekday trading with no hidden fees beyond a 0.1% FX charge. Investors can start with as little as €1. However, tokenized assets remain within Robinhood’s internal ecosystem for now, transfers to external wallets are not yet supported.

Related read: Morgan Stanley Drops Crypto Fund Restrictions for Wealth Clients

Lithuania Seeks Clarity as Robinhood Engages Regulators

The Bank of Lithuania, which oversees Robinhood’s EU operations, has requested more details about how these tokenized products are structured and monitored. CEO Vlad Tenev said the company welcomes the review, viewing it as an opportunity to build trust and transparency around tokenized financial instruments.

On-chain metrics show healthy activity: cumulative issuance stands at about $30.8 million, while gas costs remain minimal at just 0.033 ETH (around $127). The figures highlight both operational efficiency and continued user participation.

Expansion Aligns with Robinhood’s Global Crypto Push

This milestone follows a broader expansion in Robinhood’s digital asset roadmap. The company recently introduced micro futures for Bitcoin, XRP, and Solana and completed a $179 million acquisition of WonderFi in Canada. It has also submitted a proposal to the US Securities and Exchange Commission calling for a standardized national framework for real-world asset tokenization.

Looking Ahead

The Robinhood tokenization of US stocks has now scaled to nearly 500 tokenized equities and ETFs on Arbitrum, underscoring how blockchain is reshaping market access. While these products function as regulated derivatives, they mark a practical step toward integrating traditional finance with on-chain infrastructure. As oversight evolves, Robinhood’s expanding portfolio could serve as a template for compliant RWA adoption across Europe.

- Dune Analytics – Robinhood: Stock Token Tracker by Entropy Advisors – (Updated Oct 17, 2025)