- •MENA ICON 2025 in Abu Dhabi gathered 400+ global finance and policy leaders.

- •Turkey led MENA’s crypto activity with nearly $200 billion in annual trading volume.

- •The event reinforced Abu Dhabi’s position as a regional hub for financial innovation.

The event known as MENA ICON 2025 in Abu Dhabi concluded this month after two intensive days of discussions, networking and strategic insight. Held in Abu Dhabi and hosted by CFA Society Emirates, it drew more than 400 investment professionals, policymakers and industry leaders from the region and abroad. This edition was noted as the largest to date for the congress.

In parallel, new data on the broader Middle East and North Africa (MENA) crypto-market presented a striking backdrop, with one country’s volume standing out region-wide. The main keyword appears here naturally in the preface to maintain consistency with the article’s focus.

Investment Leaders Converge at MENA ICON 2025

At MENA ICON 2025 in Abu Dhabi, the programme featured a broad array of topics, including artificial intelligence, innovation, private capital and global macro-economics. Among the key sessions, a recorded address by Hamad Al Mazrouei, chairman of the ADGM Academy and Under-Secretary of the Abu Dhabi Department of Economic Development, emphasised Abu Dhabi’s increasing role in building a talent-driven and innovation-oriented financial ecosystem.

The closing highlight of the event included a fireside chat with Ray Dalio of Bridgewater Associates, covering global economic cycles and long-term investing themes. In all, the gathering underlines how the region is seeking to deepen its integration into global financial trends and position itself as a locus of investment dialogue.

Related read: Dubai and Peaq Machine Economy Collaboration Takes Shape

Crypto Volume Insights Frame Regional Context

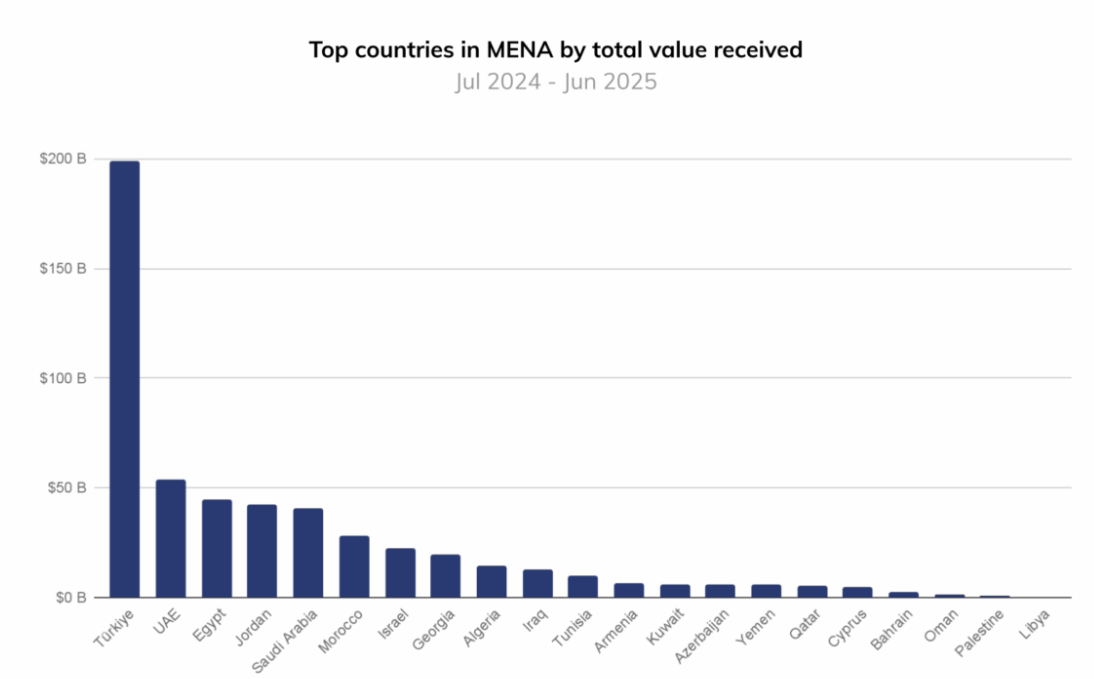

While the congress addressed capital markets broadly, recent research from Chainalysis offers a snapshot of digital-asset trends in the MENA region. According to the firm’s October 2025 report, one country, Turkey, recorded nearly $200 billion in annual cryptocurrency transactions, making it the largest market in the region.

The report notes that much of this figure was driven by speculative trading rather than broad-based retail adoption. So while the volume is significant, it also illustrates caution about how sustainable the behaviour may be. For comparison, the United Arab Emirates recorded around $53 billion in crypto volume in the same period.

The broader MENA region posted about 33 per cent year-over-year growth in crypto activity, which trails other regions like Asia-Pacific and Latin America. These findings provide a backdrop for discussions at MENA ICON 2025 in Abu Dhabi, where digital-asset themes intersected with broader finance, private capital and innovation tracks.

Also read: JPMorgan Upgrades Coinbase Stock Amid Rising Optimism

Nod to Future Pathways

In closing, the outcomes of MENA ICON 2025 in Abu Dhabi underline how the region is intensifying its engagement with global investment practices and emerging technology themes, including digital assets. The congress reinforced that regional centres such as Abu Dhabi are positioning themselves as forums for thought leadership and dialogue.

Meanwhile, the crypto data from Chainalysis show that while volume levels in MENA may be reaching new highs, the nature of market participation varies widely and may call for deeper structural development. Together these strands point to a future in which traditional capital-markets activity and crypto-ecosystem dynamics increasingly intersect in the region.