- Extended is a Starknet-based perp DEX focused on speed, self-custody, and predictable trading fees.

- Traders get access to 80+ perpetual markets, including crypto, FX, commodities, and indices.

- Maker fees are 0.00%, taker fees are 0.05%, and all positions use USDC as collateral.

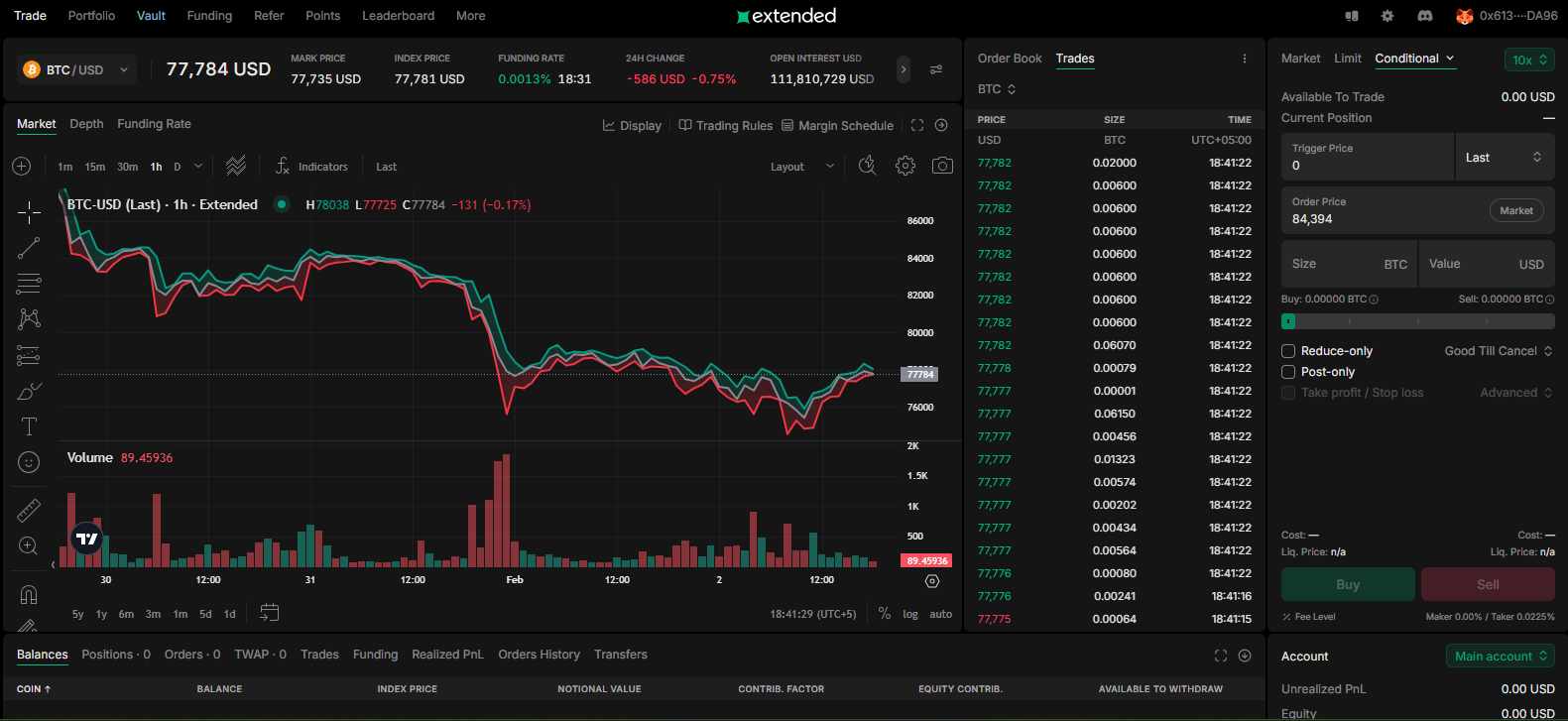

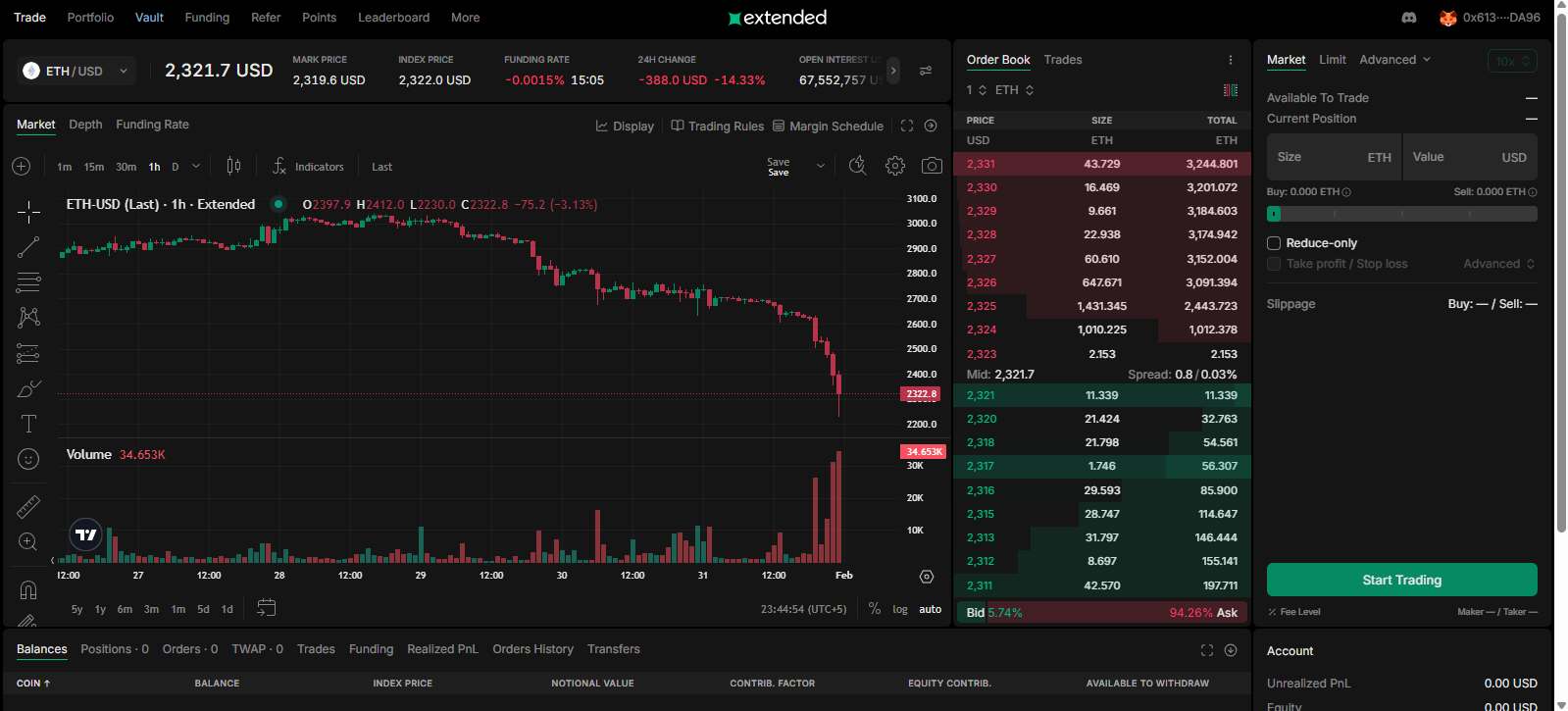

- The interface feels CEX-like, with TradingView charts and advanced order types available.

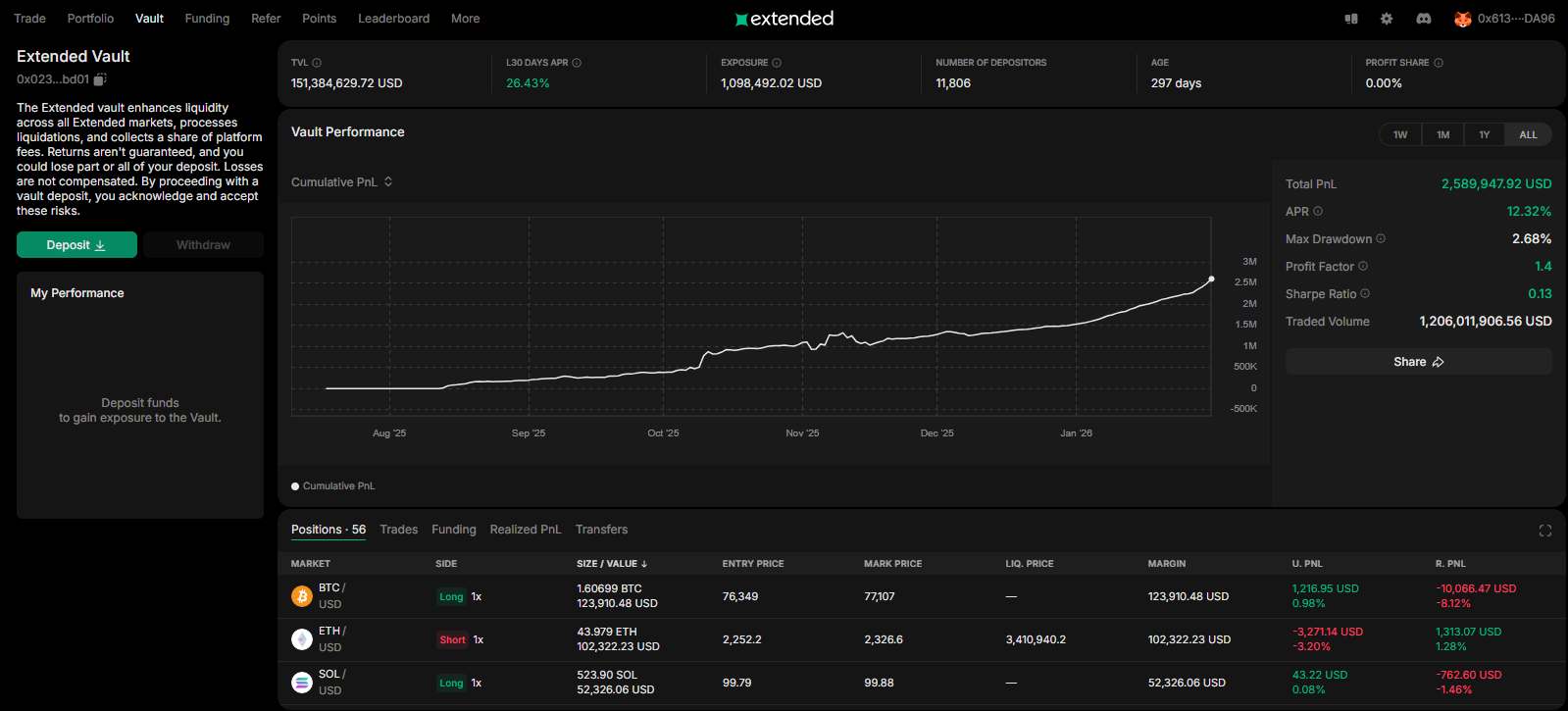

- Extended Vault allows users to earn yield while using vault shares as trading margin.

- The platform suits active traders, though feature depth may feel limited for some users.

The market has seen a clear shift in narrative, with high-volume traders increasingly prioritizing decentralized exchanges over centralized platforms, a trend largely led by Hyperliquid, which set the pace for on-chain perpetual trading. Close behind, Extended has emerged as a newer perp DEX that has climbed the rankings quickly, recording around $3.376 billion in 일일 거래량. For this Extended review, we used the platform hands-on and reviewed its documentation to focus only on what matters to traders, including execution quality, fees, supported networks, and the overall trading experience.

| 통계 | 확장 |

|---|---|

| 🚀 설립됨 | 2024 |

| 🌐 본사 | 런던, 영국 |

| 🔎 창립자 | Ruslan Fakhrutdinov (CEO) |

| 👤 활성 사용자 | 43K + |

| ♾️ 가해자를 지원함 | 80+ |

| 🔁 선물 수수료(메이커/테이커) | 0.00의 % / 0.05의 % |

| ⚙️ 네트워크 지원 | 7+ |

| 📈 최대 레버리지 | SR 50x |

| 🕵️ KYC 인증 | 필요하지 않음 |

| 📱 모바일 앱 | 아니 |

| 💰 보너스 | 거래 수수료 10 % 할인 (지금 청구하세요) |

Extended Overview

확장 is a decentralized perpetual futures exchange that launched in 2024 and operates on Starknet, an Ethereum Layer 2 built using ZK-STARK technology. The platform focuses on delivering fast, reliable perp trading while keeping user funds fully self-custodied through Starknet smart contracts. Trades settle on-chain, while order matching happens off-chain, allowing Extended to maintain low latency without sacrificing transparency.

While most markets focus on major crypto assets, trading is not limited to cryptocurrencies alone. Through its TradFi section, Extended also offers a selection of FX pairs, commodities, and index-based contracts, allowing you to take leveraged positions across multiple market types from a single platform. Fees remain straightforward at 0.00% for makers and 0.05% for takers. All positions use USDC as collateral, and trades are gas-free for users. The protocol has surpassed 잠긴 총 가치 156만 달러 and reports more than 43,000 active users.

Security is handled through a hybrid design that combines off-chain speed with on-chain validation, supported by oracle-based pricing and an insurance fund. The core Starknet perpetual contracts have also undergone a competitive audit through Code4rena.

This overview sets the foundation. Next, we’ll break down how Extended performs in real trading conditions, covering liquidity, order execution, risk controls, and where the platform fits among other perp DEXs.

Extended Pros and Cons

| 👍 Extended Pros | 👎 Extended Cons |

|---|---|

| ✅ CEX-like interface with full self-custody | ❌ No mobile app available |

| ✅ Fast execution with one-click trading | ❌ Order matching happens off-chain |

| ✅ Zero maker fees, 0.05% taker fees | |

| ✅ 80+ perpetual markets across crypto and TradFi | |

| ✅ Advanced order types included | |

| ✅ Vault allows earning while trading | |

| ✅ Gas-free trading on Starknet |

Extended KYC and Sign-up

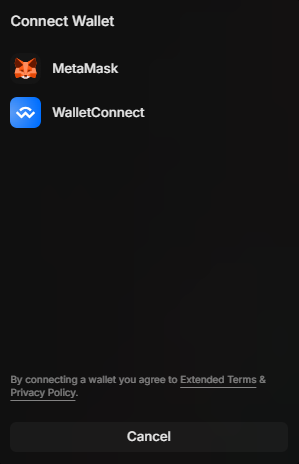

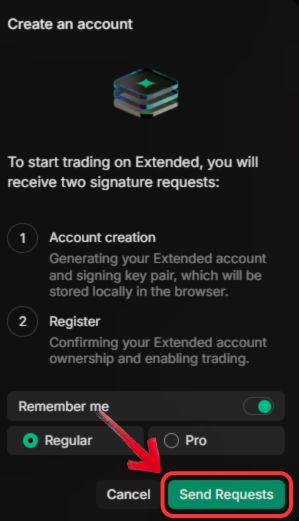

Signing up on Extended is quick and straightforward. You need an EVM-compatible Web3 wallet to get started. At the moment, Extended supports MetaMask directly, along with WalletConnect for connecting other supported wallets. Once your wallet is ready, the steps to start trading on Extended are simple and easy to follow.

1 단계 : 브라우저를 열고 공식 웹사이트를 방문하세요. 확장 웹사이트를 클릭하고 “거래 시작” to launch the Extended platform.

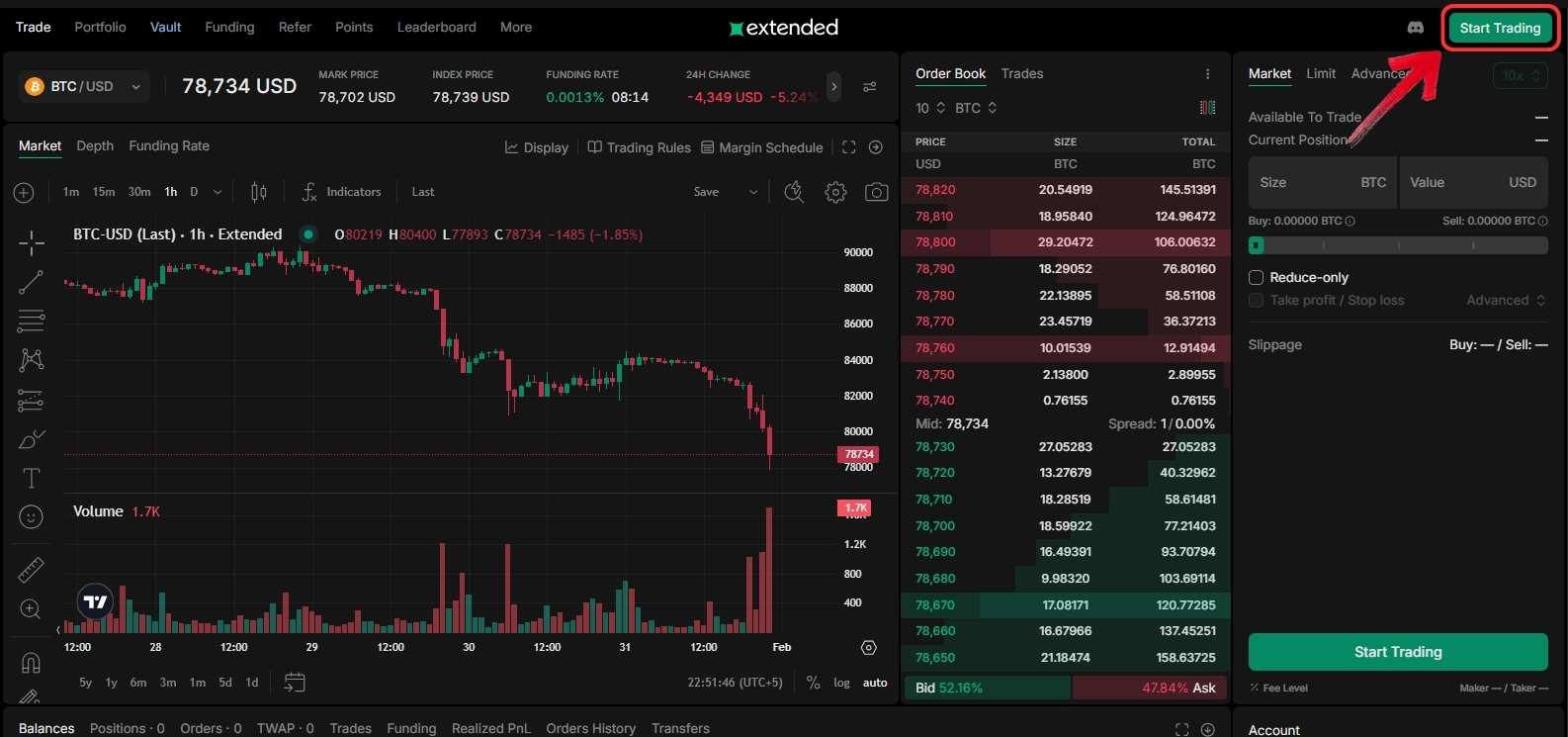

2 단계 : Once the platform loads, click “거래 시작” again in the top-right corner to view the available wallet options.

3 단계 : Select a Web3 wallet to connect with Extended.

4 단계 : After selecting a wallet, a connection request will appear in your Web3 wallet. Approve the request to proceed.

5 단계 : Extended will then ask for permission to send a signature request and create your account. Click “Send Request” and approve the signature in your wallet to complete account creation.

Once your wallet is connected, you can start trading on Extended right away. If you want to access vault features, you will need to switch to Extended Pro, which requires an additional approval to use Extended Vaults.

지원되는 네트워크

Extended supports seven networks: Arbitrum, Base, BNB Chain, Ethereum, Avalanche, Polygon, and Starknet. Most of these networks are EVM-compatible, which makes an EVM-compatible wallet the most practical option for the majority of users. If you are trading on Starknet, you will need a Starknet-supported wallet such as Braavos, as EVM wallets do not work on Starknet-based accounts.

Extended Trading

When trading on Extended, you get access to perpetual contracts across more than 80 markets, with leverage going up to 50x. These markets are not limited to crypto assets only. Alongside major crypto pairs, Extended also lists a small selection of FX pairs, commodities, and indices under its TradFi section, allowing you to take leveraged positions beyond crypto. Fees stay consistent across all perpetual contracts, set at 0.00% for makers and 0.05% for takers.

The trading interface should feel familiar if you have used centralized exchanges before. Even though everything runs fully decentralized on Starknet with self-custody and on-chain settlement, the layout remains clean and functional. You get TradingView-powered charts with access to indicators and charting tools, while the order book and trading panel sit on the right, making execution straightforward.

Leverage limits are tied directly to margin requirements, which you can view easily from the trading interface. These requirements are predefined but can adjust based on market conditions and available liquidity on Extended.

On the order side, you are not limited to basic Market and Limit orders. Extended also supports Conditional, Scaled, and TWAP orders, giving you more control over how you enter and exit positions.

예금 및 인출 방법

On Extended, deposits and withdrawals are handled entirely through crypto networks, with no fiat options available. The platform supports seven networks: Arbitrum, Base, BNB Chain, Ethereum, Avalanche, Polygon, and Starknet. Since most of these are EVM-compatible, an EVM wallet is the most practical choice for most users, while Starknet activity requires a supported Starknet wallet.

Deposits are made directly from your connected wallet on the selected network. You simply need to ensure your wallet is funded on the same chain you plan to use.

For withdrawals, Extended offers two options: fast and slow. Fast withdrawals are available on Arbitrum and Ethereum, with a limit of $50,000 every 12 hours. These are designed for quicker settlement when speed matters. Slow withdrawals follow the standard on-chain process and take longer, but do not carry the same speed-related conditions.

Extended Fees

Next, we look at the fee structure set up by Extended.

거래 수수료

Trading fees on Extended are kept fixed across all perpetual markets. Makers pay 0.00%, while takers are charged 0.05% per trade. The fee structure does not change based on asset type, market conditions, or account size, keeping costs predictable for traders.

선물 수수료

0.00 % 메이커

0.0225% 테이커

입금 및 출금 수수료

Extended does not charge deposit fees. For withdrawals, standard network gas fees apply, and fast withdrawals include an additional 0.1x 보수 on top of the current gas cost. This extra charge is used to account for gas price fluctuations and ensure timely settlement on supported networks.

Extended Products and Services

Extended offers a small set of products focused on trading and account-level returns. Here is a quick look at what is available on the platform.

Extended Trading

Extended Trading is where you spend most of your time on the platform. From a single interface, you can trade perpetual contracts across major crypto assets as well as selected FX pairs, commodities, and indices. The layout is clean and familiar, so placing trades feels intuitive even if you are coming from a centralized exchange. Execution is fast, leverage goes up to 50x, and you have access to both basic and advanced order types to manage entries, exits, and risk more precisely.

Extended Vault

Extended Vault is where trading and yield come together on the platform. You deposit USDC into the vault and receive XVS, which represents your share. These vault shares earn yield and can also be used as trading margin, so your capital stays active while you trade. Funds can be withdrawn 24 hours after deposit. The vault holds around $156,431,298.50 in TVL, with reported APRs exceeding 25 percent, though returns can vary with market conditions and risk.

확장된 보안

Security on Extended is based on a self-custody and on-chain settlement model. Your funds and open positions are held in Starknet smart contracts, meaning the platform itself cannot access, move, or control user assets. Order matching happens off-chain for speed, but every trade, margin update, and liquidation is validated and settled on-chain through Starknet.

Risk controls include clearly defined margin requirements, partial liquidations, and an insurance fund designed to manage losses during volatile market conditions. Pricing relies on external oracles to reduce manipulation risk.

Extended’s core perpetual contracts have been audited by ChainSecurity and reviewed through a public competitive audit by Code4rena, focusing on custody, settlement, and validation logic. Since launch, no major security incidents or settlement failures have been reported.

확장된 고객 지원

Customer support on Extended follows a typical DeFi model rather than a traditional helpdesk setup. There is no live chat, email ticketing system, or phone support. Most support happens through the official Discord server, where team members, moderators, and community users actively respond to questions around trading, vaults, and technical issues. Documentation also plays a major role, with detailed guides covering most platform features and common problems. Response times can vary, but Discord is generally the fastest option for time-sensitive issues.

Extended Alternatives

Extended offers a unique mix of performance and decentralized trading, but it might not be the best fit for every trader. Some users may find feature limitations, network support gaps, or interface differences compared with other DEXs or hybrid platforms. If you want options beyond Extended, there are several alternatives worth considering:

1. 라이터: If zero-fee trading matters to you, 거룻배 stands out by pairing that model with a verifiable on-chain order book, something Extended does not currently offer.

2. ApeX Omni: For traders who want more built-in tools, ApeX 옴니 provides broader features like multi-chain access and copy trading beyond what Extended supports.

3. 아스터: Large order execution is handled differently on 과, where hidden orders allow you to trade size without showing intent in the public order book.

| 특색 | 과 | 확장 | 거룻배 | ApeX 옴니 |

|---|---|---|---|---|

| 설립 년도 | 2025 | 2024 | 2024 | 2024 |

| 현물 수수료 | 0.10% | N/A | 0.00% | 0.05% |

| 선물 수수료(메이커/테이커) | 0.010의 % / 0.035의 % | 0.00의 % / 0.05의 % | 0.00의 % / 0.00의 % | 0.02의 % / 0.05의 % |

| 최대 활용 | SR 1001x | SR 50x | SR 50x | SR 100x |

| KYC 필요 | 아니 | 아니 | 아니 | 아니 |

| 지원되는 암호화폐(스팟) | 8+ | N/A | 1+ | 20+ |

| 선물 계약 | 93+ | 80+ | 117+ | 94+ |

| KYC 출금 한도 없음 | 제한 없는 | 제한 없는 | 제한 없는 | 제한 없는 |

| 24시간 선물 거래량 | 6.38 억 달러 이상 | 3.37 억 달러 이상 | 4.09 억 달러 이상 | 1.44 억 달러 이상 |

| 주요 특징 | • 1001배 레버리지 • 그리드 트레이딩 • 모바일 앱 |

• Starknet-based • Gas-free trading |

• zk-rollup • Zero fees |

• Multichain perps • RWAs • Bots & vaults |

| 회원가입 | 회원가입 | 회원가입 | 회원가입 | 회원가입 |

히프 라인

Extended sits in an interesting spot among perp DEXs. If you value low fees, fast execution, self-custody, and access to both crypto and select TradFi-style markets, the platform covers those areas well. For some traders, the Starknet setup, vault mechanics, or limited product range may feel like a good fit. For others, those same choices might feel restrictive compared to more feature-heavy platforms. That is why it helps to look at Extended in context. If you are still weighing options, browsing our 최고 범죄자 DEX comparison can give you a clearer sense of how Extended stacks up against other alternatives.

자주 묻는 질문

1. Is Extended suitable for beginners, or is it more for active traders?

Extended is built with active traders in mind. The interface is clean, but features like leverage, margin rules, and advanced orders assume you already understand perp trading basics.

2. Can I trade non-crypto markets on Extended?

Yes. Alongside crypto perps, Extended lists selected FX pairs, commodities, and index-based contracts in its TradFi section, all traded as perpetuals.

3. Which wallet works best with Extended?

If you are using EVM networks, MetaMask is the most straightforward option. For Starknet trading, you will need a supported Starknet wallet such as Braavos.

4. Are there any limits on leverage for specific markets?

Yes. While maximum leverage goes up to 50x, individual markets can have lower leverage caps based on liquidity and risk conditions.

5. Is Extended available on mobile devices?

There is no dedicated mobile app at the moment. Extended is designed for desktop use through a web browser for a more stable trading experience.