- •Paradex focuses primarily on perpetual futures, with 93+ contracts and up to 50x leverage.

- •Paradex charges 0% maker and 0% taker fees across spot and perpetual trading.

- •Spot trading is limited to ETH/USDC, keeping the platform derivatives-focused.

- •Trading data such as positions and PnL is hidden using ZK-based encryption.

- •Paradex supports 17+ networks for deposits and withdrawals.

- •Vault Traded Funds (VTFs) allow passive participation through managed strategies.

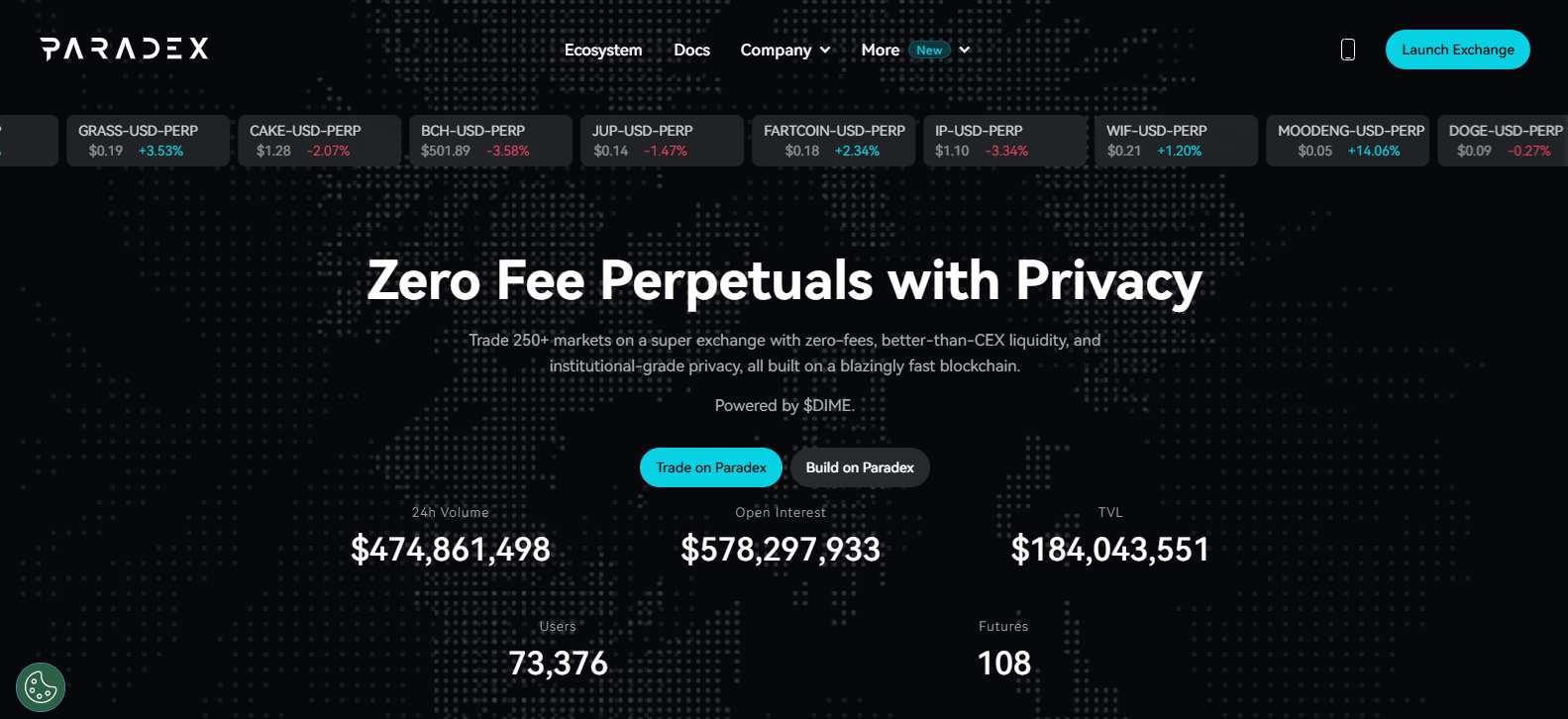

Fees compound, and public exposure creates risk in perpetual markets. Paradex, built as a Starknet appchain, was designed to reduce both by removing retail trading fees, encrypting positions, and introducing portfolio margin on-chain. With its primary focus on perpetual trading and limited spot exposure, Paradex is structured for advanced traders looking to move away from CEX platforms but still expecting a similar level of ease on a DEX. In this Paradex review, we focus on what Paradex actually delivers to traders, while also examining practical factors like slippage, funding mechanics, liquidity depth, and overall execution to see how it compares with other perpetual DEXs.

| 統計 | パラデックス |

|---|---|

| 🚀 設立 | 2024 |

| 🔎創設者 | アナンドゴメス |

| 👤 アクティブユーザー | 73 + |

| 🪙 スポット暗号 | 1+ |

| 🪙 先物契約 | 93+ |

| 🔁 スポット料金 (メーカー/テイカー) | 0.00の%/ 0.00% |

| 🔁 先物手数料(メーカー/テイカー) | 0.00の%/ 0.00% |

| 📈 最大レバレッジ | 50x |

| 🕵️ KYC検証 | 必須ではありません |

| 📱モバイルアプリ | あり |

| ⭐評価 | 無し |

Paradex Overview

パラデックス was founded in 2024 by Anand Gomes and built as a dedicated perpetual futures exchange running as an appchain on Starknet. From the start, the focus has been derivatives. It is not trying to compete as a broad spot marketplace. Instead, the structure is clearly centered around perpetual contracts. The platform reports 73K+ users and more than $27B+ in 月間取引高, with most of that activity coming from perps, and it plans to introduce a native token, DIME, which has not yet been launched.

In terms of markets, Paradex currently lists 93+ perpetual contracts with leverage up to 50x. Retail traders do not pay maker or taker fees through the UI, which changes cost dynamics compared to many other venues. Spot exposure exists, but it is limited to ETH/USDC, so the design remains perp focused. Trading begins with USDC deposits.

On the infrastructure side, Paradex supports 17+ networks including Ethereum, other EVM compatible chains, and Starknet. Users can move funds through the native Paradex bridge, or use integrations such as Orbiter Finance, Hyperlane, and Rhino.fi.

Structurally, the exchange uses off-chain order matching for speed, while settlement happens on-chain via ZK-STARK proofs. Accounts are ZK encrypted, so positions, liquidation levels, and PnL are not publicly visible. Funding runs continuously rather than in fixed intervals, auto deleveraging is not used, and portfolio margin allows offsetting positions under one margin system. Core contracts and the bridge have undergone external audits, and the API and web infrastructure have been penetration tested, which together outline the current security framework behind the platform.

Paradex Pros and Cons

| 👍 Paradex Pros | 👎 Paradex Cons |

|---|---|

| ✅ 0% maker and taker fees on spot and perpetual trading | ❌ Spot market limited to ETH/USDC |

| ✅ ZK-based encryption hides positions and PnL | ❌ One-way mode only, no hedge mode |

| ✅ Portfolio margin under a unified account structure | ❌ No sub-accounts for strategy separation |

| ✅ 93+ perpetual contracts with up to 50x leverage | ❌ Past operational incident in January 2026 |

| ✅ 17+ supported networks for deposits and withdrawals | ❌ Blockchain rollback raised decentralization concerns |

| ✅ Vault Traded Funds (VTFs) for passive strategies | |

| ✅ CEX-like performance and UX |

Paradex KYC and Sign-up

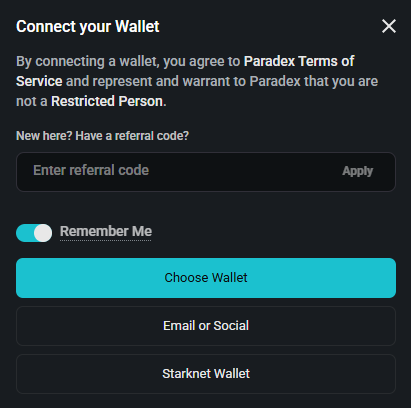

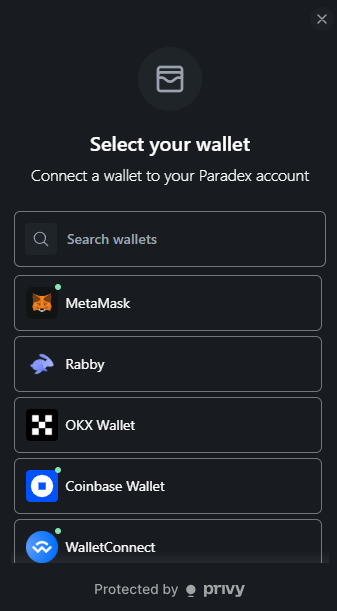

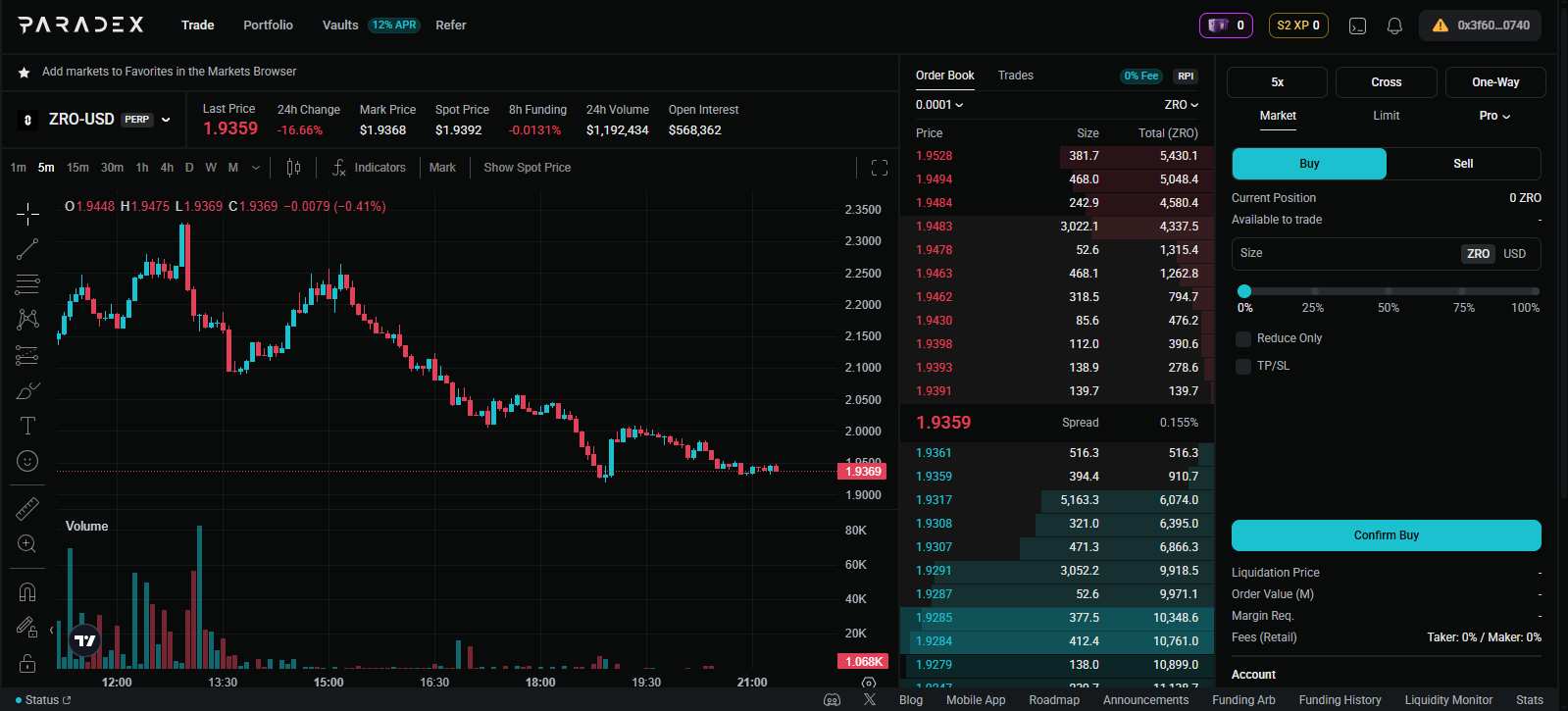

Paradex works like most modern dApps. There is no traditional account creation flow with documents or manual approval. You get started by connecting a Web3 wallet. It supports EVM wallets such as MetaMask and ラビーウォレット, along with Starknet wallets like Braavos. You can also choose email or social login if you prefer that route. Here are the steps to set up your Paradex account.

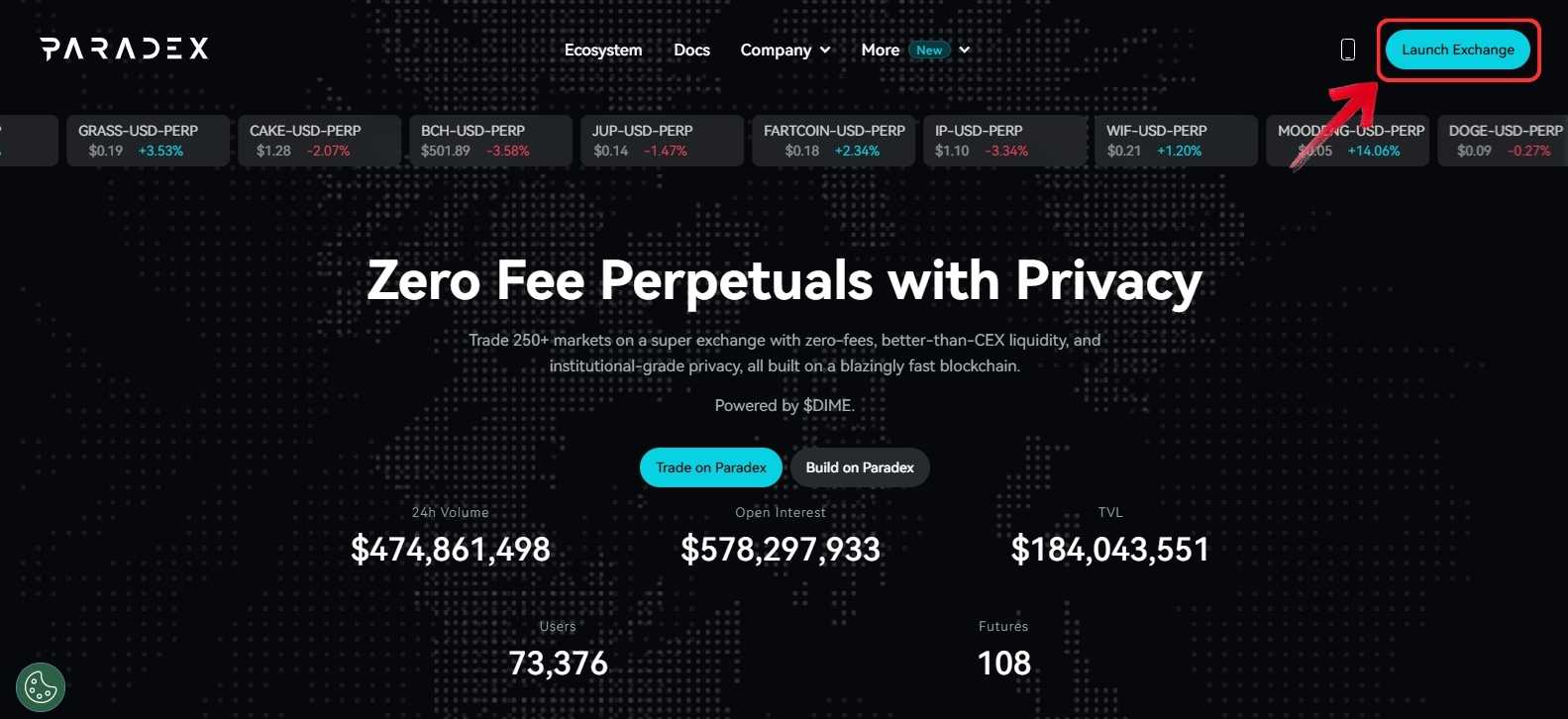

ステップ1: Video Cloud Studioで パラデックス ウェブサイトをクリックして “Launch Exchange”

ステップ2: Once inside the interface, click on "ログインする" 右上隅にあります。

ステップ3: You will see connection options. Choose between an EVM wallet, a Starknet wallet, or email/social login, depending on what you are using.

ステップ4: A wallet selection window will appear. Select your 優先財布 利用可能なリストから選択します。

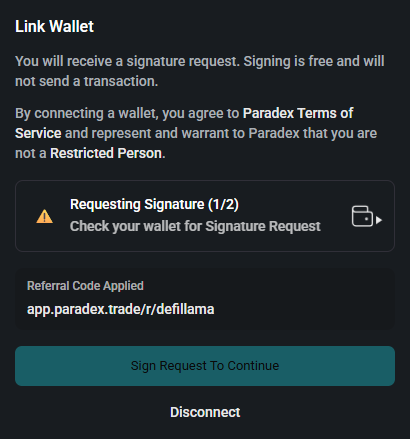

ステップ5: Paradex will send a signature request to your wallet. Approve the signature. This does not move funds; it only verifies ownership of the wallet.

ステップ6: After the wallet is connected, you will be asked to set a ユーザ名. Once that is done, you can deposit USDC through the supported networks and begin trading.

サポートされているネットワーク

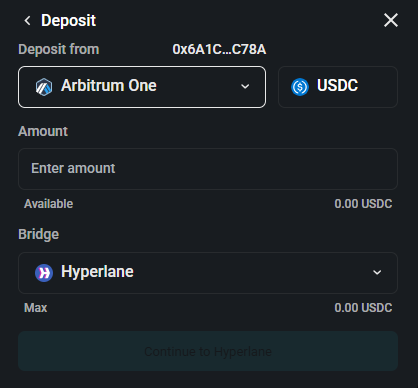

Paradex currently allows users to deposit and withdraw funds across 17+ supported networks. Most of these are EVM compatible chains such as Ethereum, Mantle, Arbitrum, Optimism, and Base.

In addition to EVM networks, Paradex also supports non-EVM chains including Solana and Starknet, giving users multiple routes to move USDC and access the platform.

EVM

Ethereum

アービトラムワン

ベース(Base)

スクロール

雪崩

ベラチェイン

BNBスマートチェーン

リネアメインネット

Manta Pacific Mainnet

マントル

モード メインネット

OPメインネット

ポリゴン

ソニック

Taiko Mainnet

ZKsync時代

非EVM

スタークネット

サンルーム

Paradex Trading

Paradex offers both spot and derivatives, but the spot side is extremely limited. At the moment, users can only trade ETH on the spot market, and both maker and taker fees remain at 0%. So while spot exists, it is not the core focus of the platform.

The main activity happens in derivatives. Once funds are deposited, users can trade over 93+ perpetual contracts with leverage of up to 50x. Retail traders do not pay maker or taker fees here either. Trading is limited to crypto contracts for now, with no tokenized equities or traditional asset markets live, although those expansions appear in the longer-term roadmap.

A structural difference appears in how account data is handled. Trade details such as open positions, entry and exit levels, liquidation prices, and unrealized PnL are not publicly visible. The platform uses ZK-based account encryption, which means other participants cannot monitor or track large positions directly on-chain.

On the technical side, Paradex runs on a Starknet appchain architecture with off-chain order matching and on-chain settlement. Execution is designed to remain fast even during higher activity. Funding does not operate on fixed 8-hour cycles like many perpetual platforms. Instead, it runs on a continuous mechanism, which smooths funding adjustments over time. The platform also does not use auto deleveraging. In the event of system losses, a socialized loss model applies instead of forcibly closing opposing trader positions.

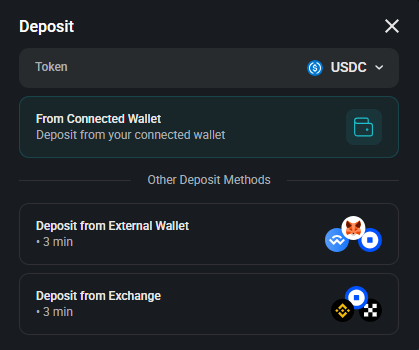

Paradex Deposit and Withdrawal Methods

For deposits and withdrawals, Paradex supports 17+ networks. Although trading itself runs on Starknet since it operates as an appchain, users are not limited to funding directly from Starknet. USDC can be deposited from multiple supported networks, with bridging handled inside the interface. This includes the native Paradex bridge, which currently supports Ethereum, along with integrations such as Hyperlane, Orbiter Finance, and Rhino.fi. As a result, users do not need to manually bridge assets elsewhere before transferring them to Paradex.

Deposits can also be made directly from external wallet addresses or centralized exchanges. The process is straightforward: select the preferred network inside Paradex, copy the generated deposit address, and transfer USDC from the chosen source. Once confirmed on-chain and bridged internally, the balance becomes available for trading within the app.

Paradex Fees

Next, let’s take a closer look at the cost structure on Paradex, including trading fees as well as any charges associated with deposits and withdrawals when using the platform.

取引手数料

Paradex separates traders into 2つのプロファイル: Retail (UI users) and Pro (API traders). The fee structure and trading limits depend on which profile you fall under.

Retail traders using the interface trade perpetual futures with 0% maker and 0% taker fees. There are no trading fees charged under the retail profile. However, retail accounts are subject to a speed bump. Order submission carries a 500ms delay, and order cancellations have a 300ms delay. If a retail account exceeds the allowed activity thresholds, it automatically switches to the Pro profile and loses access to RPI liquidity.

Pro traders, typically those accessing through API, operate without speed bumps and with significantly higher rate limits. The fee structure for Pro traders on perpetual futures is 0.003% maker and 0.02% taker. When a Pro taker order matches against retail flow, a FastFills mechanism applies and reduces the taker fee by 75%, bringing it down to 0.005%.

スポット料金

0.00% メーカー

0.00% テイカー

将来の料金

0.00% メーカー

0.00% テイカー

入金および出金手数料

Deposit and withdrawal fees depend on the network and bridge provider used. While Paradex itself does not charge a separate platform fee for deposits, users still pay standard network gas fees and any applicable bridge charges. These bridge costs vary by provider and source chain, and in some cases can be noticeably higher depending on network congestion and current conditions.

Paradex Products and Services

Next, let’s take a look at the products and features offered by Paradex, and what users actually get beyond basic perpetual trading.

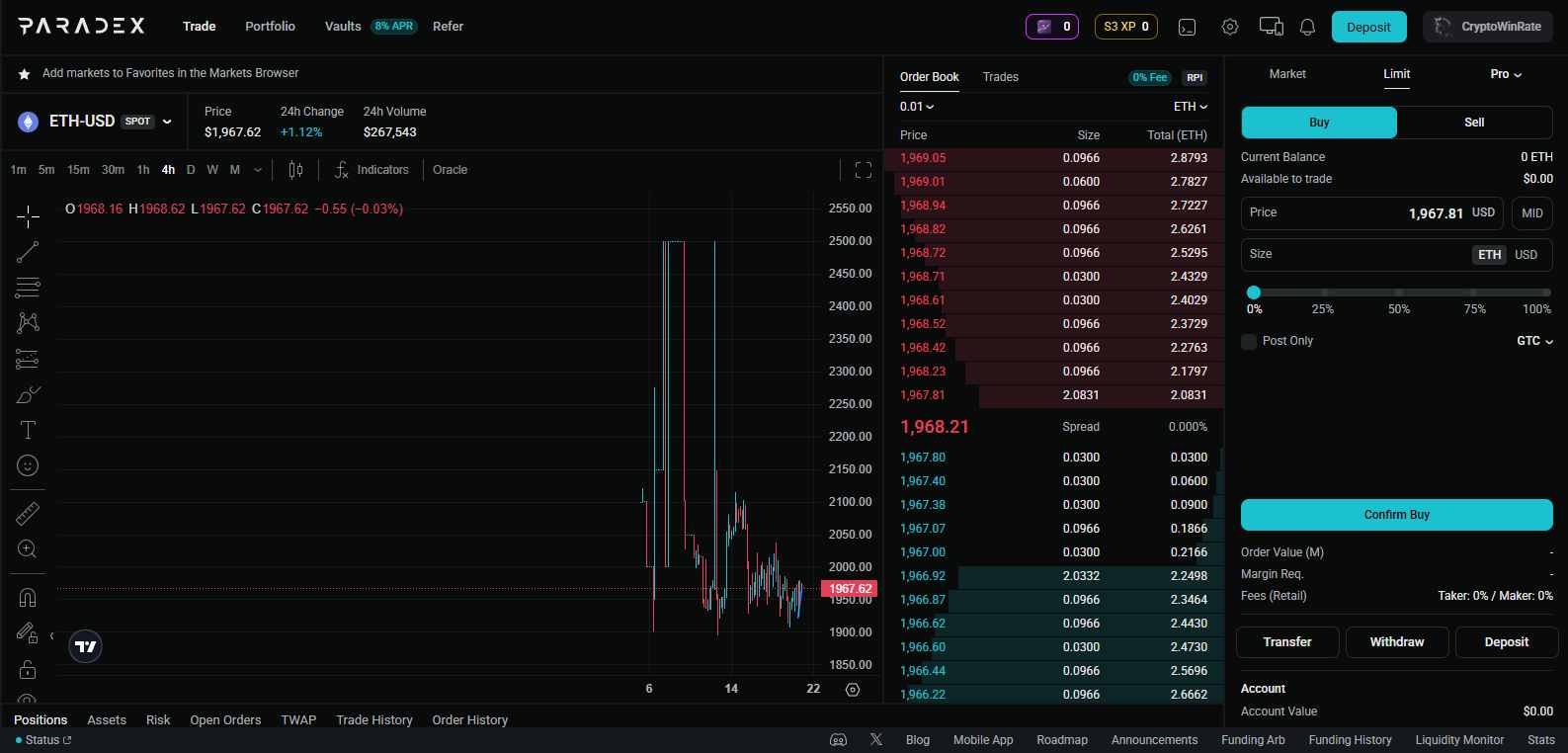

Paradex Trading Interface

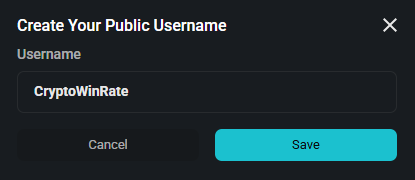

The trading interface on Paradex feels familiar if you have used centralized exchanges before. The layout is clean and straightforward, without too much clutter, although users do not get layout customization options. What you see is largely fixed.

Charts are powered by TradingView, so traders have access to a full set of indicators, drawing tools, and timeframes. That makes it easier to structure entries and exits without needing external charting platforms. For most users, the charting setup will feel standard and sufficient for strategy work.

In terms of order types, the basics are covered. Users can place limit and market orders directly from the main panel. Under the Pro dropdown, additional order types are available, including TWAP, scaled orders, and stop limit or stop market orders. This gives more flexibility for traders who want to manage execution more precisely rather than entering a full position at once.

At the same time, it is worth noting that Paradex currently operates in one-way mode only. You cannot open simultaneous long and short positions on the same contract within a single account, and sub-accounts are not available for separating strategies. That means traders looking to run hedge positions internally may need to manage exposure differently.

As for liquidity, major perpetual pairs generally maintain tight bid-ask スプレッド. Order books appear deep on high-volume contracts.

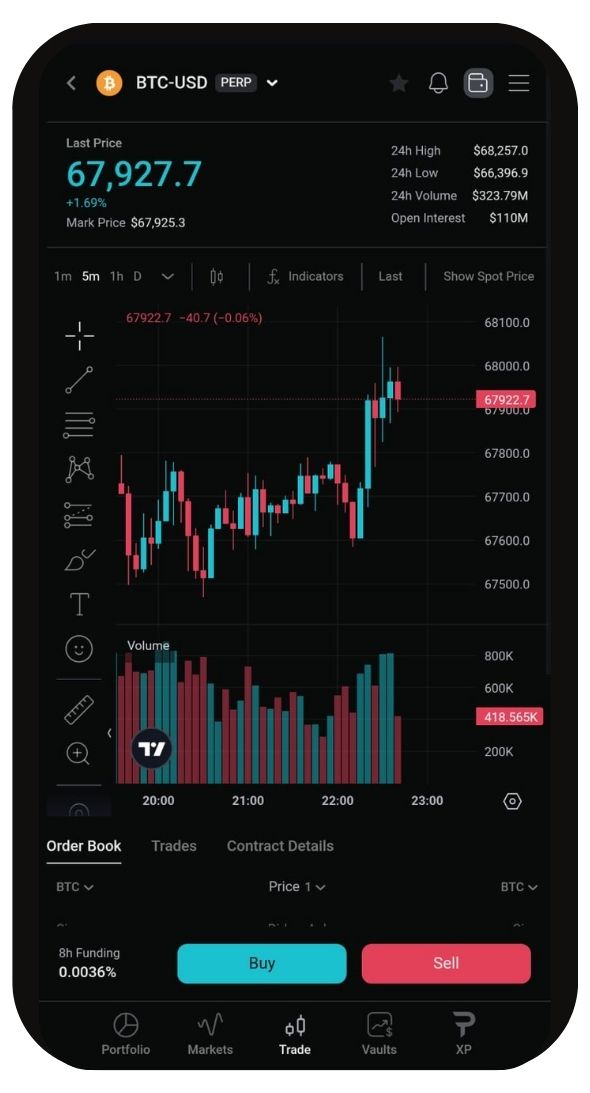

モバイルアプリ

Paradex offers a native mobile app available on both iOS and Android, giving users access to the same trading environment as the web platform. From the app, traders can open and manage perpetual positions, place advanced order types such as stop limit, scaled, and TWAP orders, and monitor their full portfolio in real time. Vault access is integrated directly within the app, allowing users to allocate funds without switching devices. The app also supports more than 20 languages. For wallet-based accounts, a compatible mobile wallet is required for non-custodial login.

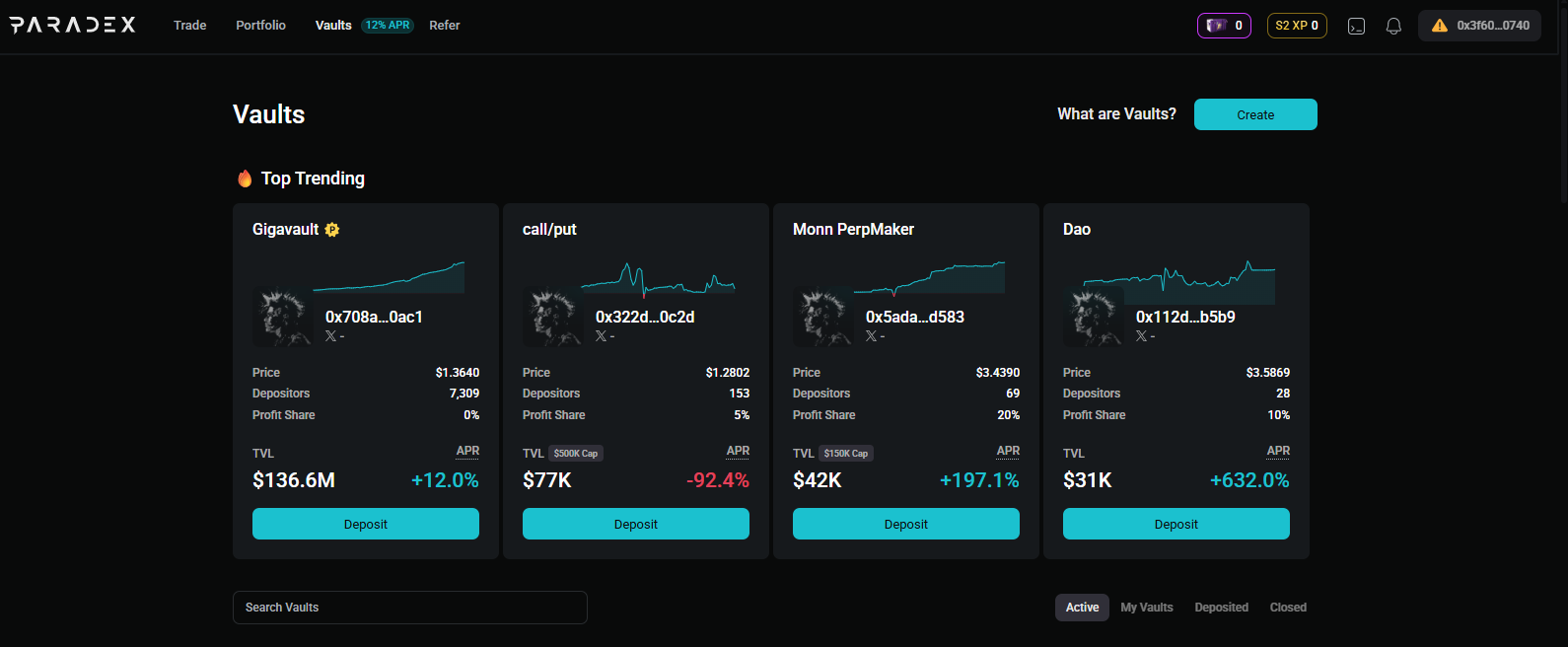

金庫

Paradex Vaults are smart contract-based pools where users deposit collateral, primarily USDC, and receive vault tokens representing their proportional share. The platform offers Protocol Vaults, such as the flagship liquidity-focused vaults that have historically shown minimum APR levels around 8%, along with User Vaults created and managed by independent operators. These are also referred to as Vault Traded Funds (VTFs), structured as tokenized multi-strategy portfolios.

Strategies typically deploy capital across perpetual markets, and sometimes spot or options. Returns depend on trading performance and are distributed after any operator profit share. While vaults allow passive participation without manual trading, users should still consider risks such as drawdowns, strategy underperformance, and smart contract exposure.

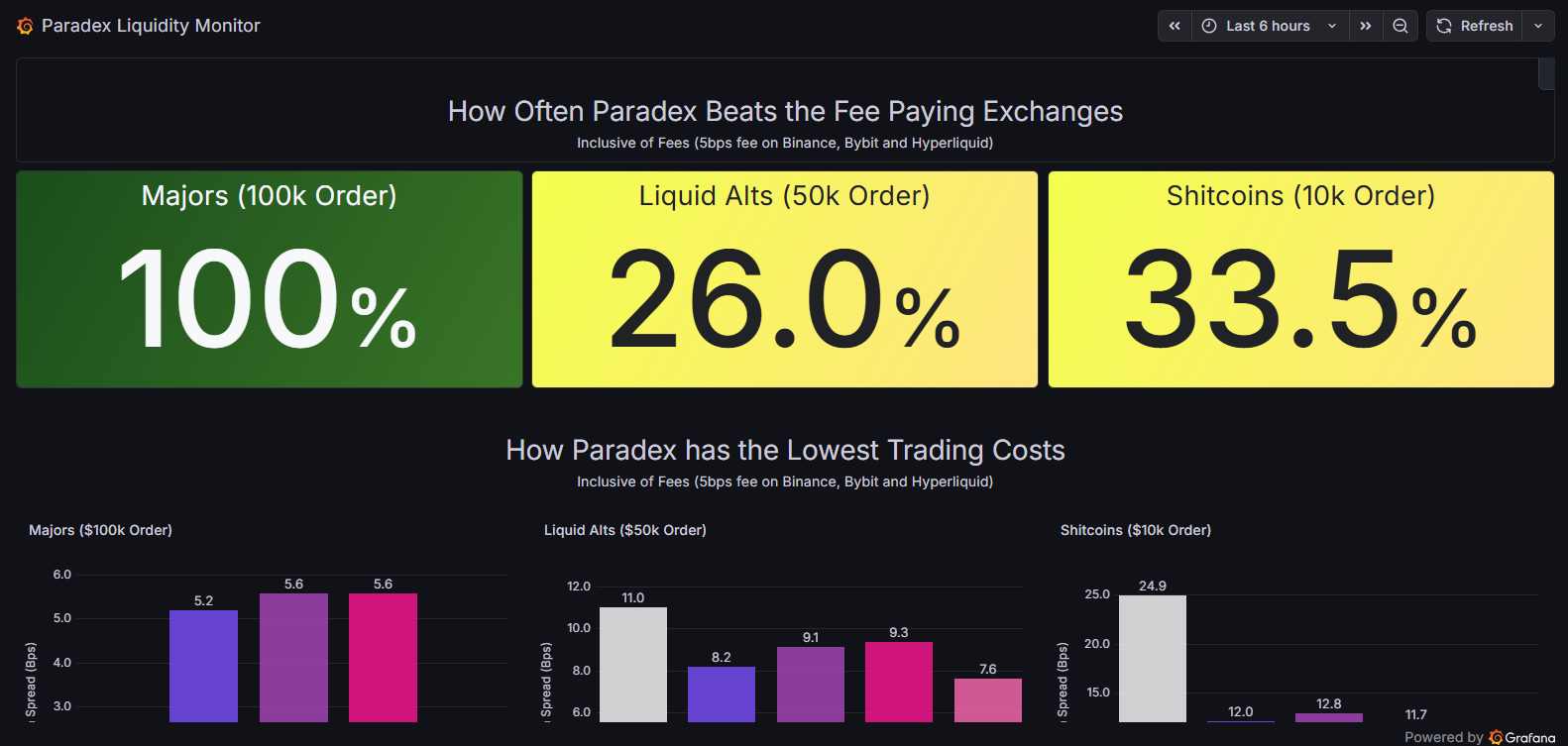

Paradex Liquidity Monitor

Paradex includes a Liquidity Monitor that gives you a clearer picture of how its order books compare in real time. Inside the platform, you can view order book depth, market depth charts, and slippage estimates before placing larger orders. The tool also tracks how often Paradex matches or beats fee-paying exchanges for different order sizes, including majors and smaller alt pairs. Since trading fees for retail users are zero, the comparison includes external exchange fees for context. For active traders, this helps evaluate execution quality rather than relying on spreads alone.

Paradex Portolfio

Paradex uses a unified account structure where spot, perpetual futures, options, and vault positions sit under one margin system. This enables portfolio margin, meaning risk is calculated across the entire account rather than per position. For example, offsetting positions such as long spot and short perps can significantly reduce required margin. Users can switch between isolated, cross, or portfolio margin modes. The dashboard provides visibility into positions, PnL, orders, and vault holdings within a single consolidated view.

Paradex Security

When it comes to security, the first thing you should understand is that Paradex is self-custodial, just like most perpetual DEXs. Your funds are not sitting with a central company. You connect through your own wallet, and you remain in control of your assets. That removes custodian risk, but it also means security is largely in your hands. If your wallet is compromised, there is no centralized recovery process. So private key management and wallet hygiene matter.

On the protocol side, Paradex does add a privacy layer. Your open positions, entry and exit levels, liquidation prices, and unrealized PnL are not publicly visible. Unlike many on-chain perpetual models where anyone can monitor large positions, this data is protected through ZK-based encryption. That changes how exposed your trading activity is.

In terms of audits, core contracts including Paraclear, Vault, Factory, Registry, and Oracle were reviewed in May 2025 by Cairo Security Clan. The L1 Bridge has earlier audits from Zellic and Trail of Bits. The API and web infrastructure also went through penetration testing in March 2025 via HackerOne. Full reports are publicly available.

It is also important to mention that in January 2026, a database migration issue briefly caused Bitcoin prices to display incorrectly, triggering liquidations. The team rolled back the state and refunded around $650,000 to affected users.

Paradex Customer Support

If you are expecting traditional live chat or ticket-based support inside the platform, that is not currently available. Paradex does not offer direct in-app chat support. Instead, users can reach out through the official Paradex Discord server, where community members and team representatives are active.

This setup works for general questions, technical clarifications, and platform updates, but response times can vary depending on activity levels. There is no dedicated 24/7 private support desk, so users relying on immediate assistance during volatile market conditions should keep that in mind.

Paradex Alternatives

Paradex still has gaps. Even though zero trading fees are attractive, it may not suit every trader. So it makes sense to look at a few alternatives depending on what you value more.

1. ハイパーリキッド: Currently one of the leading perpetual DEX, 超流動性 gives users more trading options and is not limited to cryptocurrencies only. Users can also trade tokenized stocks and commodities, which makes it more flexible compared to Paradex.

2. ライター: For users who prioritize low fees, ライター can be an alternative option. It follows a similar zero-fee structure for retail traders but offers a wider range of perpetual contracts. For traders focused mainly on perps with minimal fees, it can serve as a practical alternative.

| 機能 | パラデックス | 超流動性 | ライター |

|---|---|---|---|

| 設立 | 2024 | 2024 | 2024 |

| スポット手数料(メイカー/テイカー) | 0.00の%/ 0.00% | 0.04の%/ 0.07% | 0.00の%/ 0.00% |

| 先物手数料(メーカー/テイカー) | 0.00の%/ 0.00% | 0.015の%/ 0.045% | 0.00の%/ 0.00% |

| 最大レバレッジ | 50x | 50x | 50x |

| KYCが必要 | いいえ | いいえ | いいえ |

| サポートされている暗号通貨(スポット) | 1+ | 238+ | 1+ |

| 先物契約 | 93+ | 173+ | 117+ |

| KYC出金制限なし | 無制限 | 無制限 | 無制限 |

| 24時間先物出来高 | 408.22億ドル以上 | 1.84億ドル以上 | 2.51億ドル以上 |

| 他社とのちがい | • Zero retail trading fees • ZK-encrypted private accounts • Continuous funding |

• カスタムL1チェーン • ガス料金ゼロ • Vaults + HYPEステーキング |

• イーサリアム L2 (zk-rollup) • 証明可能な実行 • 手数料無料の小売取引 |

| 会員登録 | 会員登録 | 会員登録 | 会員登録 |

ボトムライン

If you are looking for a perpetual DEX with zero trading fees, Paradex is a practical option and competes closely with Lighter on cost alone. It also offers features like ZK-encrypted account privacy and Vault Traded Funds for passive strategies, which add another layer beyond basic perp trading. However, operational risk should not be ignored. The January 2026 pricing incident shows that platform-level errors can still happen. If long-term track record and stability matter more to you, it may be worth comparing other established 永久DEX 決める前に。

よくあるご質問

1. Does Paradex require KYC?

No, Paradex does not require KYC for trading or withdrawals. Users connect through a Web3 wallet.

2. What can you trade on Paradex?

Paradex currently focuses on perpetual futures with 93+ contracts. Spot trading is limited to ETH/USDC.

3. What is the maximum leverage on Paradex?

Paradex offers up to 50x leverage on perpetual contracts.

4. Is Paradex self-custodial?

Yes. Users retain control of their funds through connected wallets. The platform does not hold user assets.

5. How does Paradex protect trading privacy?

Positions, entry and exit prices, liquidation levels, and PnL are hidden using ZK-based encryption, meaning they are not publicly visible on-chain.

6. What networks does Paradex support for deposits?

Paradex supports 17+ networks including Ethereum, Arbitrum, Base, Mantle, Solana, and Starknet.